Summary:

- JPMorgan Chase & Co. and Capital One Financial Corporation appear to be among the best buying opportunities amid this banking industry mayhem.

- With many bank industry and bank-specific risks, investors should carefully evaluate liquidity and capital cushions.

- Valuations are now more interesting, but may worsen before improving.

- My preference is to own high quality companies, especially in banking, rather than speculating in distressed situations.

Gary Yeowell

The bank failures of Silvergate Capital Corporation (SI), SVB Financial Group (SIVB), and Signature Bank (SBNY) have created significant uncertainty in the industry. Why?

Deposit flight, investment portfolio losses, rising funding costs, looming credit/loan defaults, and contagion risks via derivative counterparty exposures.

How does one make sense of all the mayhem? In truth, it’s extremely difficult to analyze and predict what comes next. Industry watchers are unsure whether there will be more bank failures or if it’s contained. There are important questions that remain unanswered:

- If more failures are to come, then how many and over what time period?

- What happens to bank earnings estimates and industry valuations?

- How does this all play out in the context of a looming recession?

With this backdrop, there are industry overhangs and the outlook is negative. However, the significant sell off in the industry has also created pockets of opportunity for investors. In my view, a viable approach to investing in the banking industry’s distress is to own high-quality operators, such as JPMorgan Chase & Co. (NYSE:JPM) and Capital One Financial Corporation (NYSE:COF).

Recent Developments

Beyond the bank failures, we’ve seen numerous bank stocks sell off globally. According to a study posted on Social Science Research Network on U.S. banks, there’s evidence of significant bank fragility. Additionally, what started in the U.S., particularly among regional banks, has quickly spread to other areas of the world.

We have already seen significant developments with First Republic Bank (FRC) and Credit Suisse Group AG (CS), each of which have collapsed in market value and have received financial support. FRC has received $70 billion in unused funding from JP Morgan and the Fed along with large banks having injected $30 billion of deposits. Separately, Credit Suisse requested support from the Saudi National Bank (which was denied), so the Swiss National Bank stepped in to offer up to a $50+ billion lifeline to backfill liquidity. On March 19, UBS Group AG (UBS) was persuaded by Swiss authorities to buy out Credit Suisse, which has deal contingencies.

Prior to that, the Fed stepped in by creating its Bank Term Funding Program (BTFP) to help mitigate bank liquidity problems. This program enables U.S. banks to borrow from the Fed with pristine collateral, including U.S. treasuries, U.S. agency securities, and agency mortgage backed securities, which can be redeemed at par value. In effect, banks that would otherwise face liquidity problems from potential deposit outflows and investment mark-to-market losses to support such withdrawals can essentially swap those assets at par value. In a way, this significantly assuages near-term liquidity risk for banks, but doesn’t fully solve for other problems facing the industry, in my view.

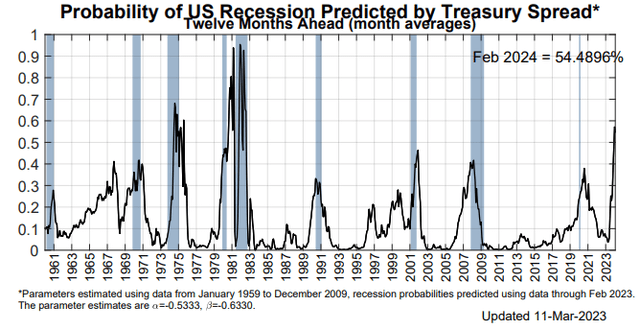

Note that all of these developments have occurred prior to the development of an official economic downturn. According to the NY Fed’s “Probability of US Recession Predicted by Treasury Spread” as of March 11, 2023, the U.S. is anticipated to fall into one:

Probability of US Recession Predicted by Treasury Spread (New York Fed (newyorkfed.org))

Identifying Safe Banks

Just to back up for a moment, I’m more inclined to buy banking stocks than to sell or short-sell them. Why? Admittedly yes, there could be more bank failures, which makes the case for shorting firms with the worst liquidity and capital positioning. However, shorting banks involves significant risk, particularly in the event of:

- private capital shoring up or recapitalizing such banks

- surprise actions of central bank intervention, i.e., rate cuts or QE.

These are not easily predicted events and shorting stocks in itself is much riskier than being long.

More importantly, bank industry valuations have already collapsed by 20% YTD and 35% year-over-year. Can industry valuations fall further? Absolutely, but I’d much rather be looking to go long here than short.

So what should investors look for? I think they can start by finding banks with the following characteristics:

- A staple deposit base with a relatively limited need for wholesale funding

- Hold to maturity and available for sale investment portfolios that have incurred minimal losses, especially relative to tangible book value (i.e. carry lower investment duration risk).

- Have good balance sheets and sound credit/loan underwriting that can withstand an increase of broader consumer/commercial defaults.

JP Morgan Asset Management provided an excellent research report detailing industry developments and how different U.S. banks have been affected.

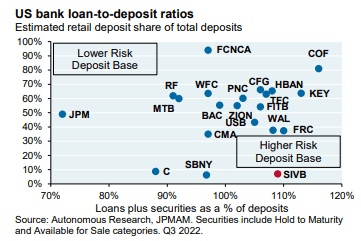

In terms of funding, banks need a diversified and sticky deposit base, which offers stable and inexpensive financing. If significant deposits exit the bank, they either need to raise deposit interest rates to mitigate future outflows or tap into more expensive wholesale funding. In brief, having a safe deposit base and strong balance sheet is critical. Clearly SIVB did not, as JP Morgan Asset Management explained:

SIVB was in a league of its own: a high level of loans plus securities as a percentage of deposits, and very low reliance on stickier retail deposits as a share of total deposits.”

So who are among the safest deposit banks? Based on Chart 1 (shown below), I think JPMorgan is the safest by having the lowest loan and securities relative to deposits plus an industry average retail deposit base. Otherwise, Capital One also has a high retail deposit base of 80+%, whereas most other banks are 70% or well below that threshold. Yes, other banks have safe deposit bases, however, we still need to consider capital cushion.

JP Morgan Asset Management: Bank Deposits (JP Morgan Asset Management Research)

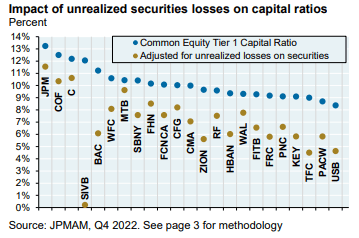

JP Morgan Asset Management also details how banks have absorbed rising interest rates and face losses on securities. Overall, certain banks still have very strong Tier 1 Capital Ratios adjusted for unrealized losses, i.e. JP Morgan Chase and Capital One.

JP Morgan Asset Management Research: Tier 1 Capital (JP Morgan Asset Management Research)

My view is that if you were to put all these banks into a matrix using the two charts above (U.S. bank loan-to-deposits ratios) and (impact of unrealized securities losses on capital ratios), JPM and COF rank the best.

Banks are under supervision by bank examiners, regulators, and the Fed via stress tests, and especially more so with these ongoing developments. In my view, having strong Tier 1 Capital Ratios when factoring in such losses will garner favorably. I think these “strongest banks” will also have the best capacity in maintaining capital return programs to shareholders, including buybacks and dividends. For context, if a bank doesn’t have adequate capital cushions, authorities can force management to reduce or suspend capital return programs until certain thresholds are met. That usually leads to stock price underperformance.

Turning back to the investment portfolios, JPM and COF having incurred limited losses which is great news for the balance sheet and tangible book value, i.e., shareholder value has been protected despite the significant rise in interest rates. By comparison, shareholders of Bank of America (BAC) saw their Tier 1 Capital Ratio decline by 11% to about 6% (nearly cut in half) when adjusting for these unrealized securities losses. Sure, BAC’s liquidity and solvency are fine, but those are real losses that fall onto the shareholder!

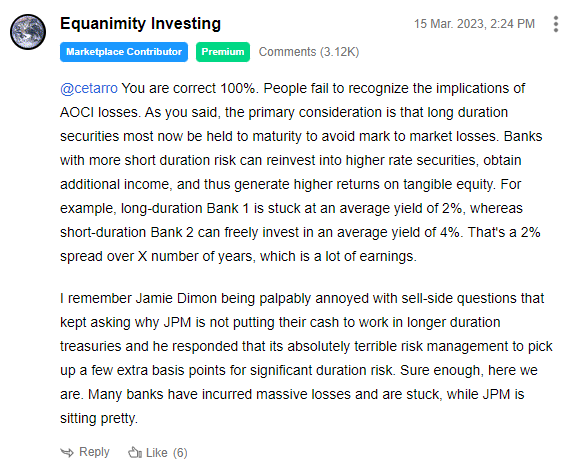

In another SA article, I explained that even if a bank doesn’t have to realize the losses on its investment portfolio by holding them to maturity, they are still forgoing incremental income that can be obtained with prevailing interest rates, which are higher today than they were in previous years:

Equanimity Research Comment (Author)

Conversely, JPM and COF have incurred minimal losses with their Tier 1 Capital Ratios only falling a couple percentage points, and still having among the strongest capital positioning among the listed banks.

Performance & Valuations

From a valuation perspective, JPM and COF are two different animals, but both are starting to get interesting.

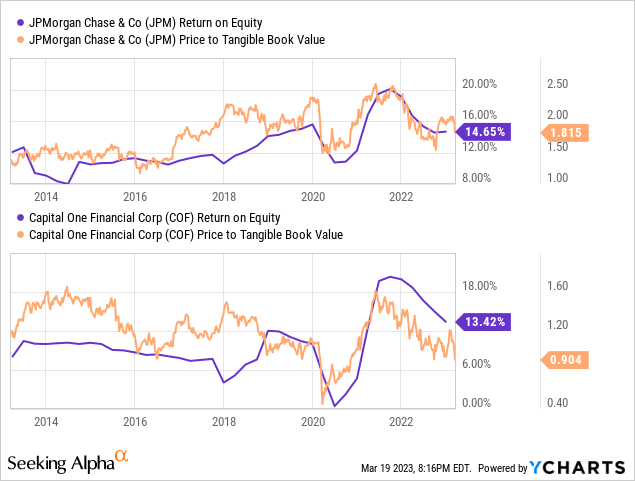

JPM has consistently produced superior returns on equity [ROE] relative to the industry, especially in recent years. However, that performance has led to premium market pricing with price-to-tangible book selling equal to or greater than 1.5x over the last 5+ years. In my view, anything close to 1.5x is a deal, which we saw in 2020 and late 2022.

COF has much more volatile ROEs, ranging from ~0% in 2020 up to 18+% in 2021. COF earnings and ROE volatility is inherently due to their business, however, such factors are reasonably well accounted for in the 0.9x price-to-tangible book value, or half of JPM’s valuation today.

Again, the differences on price-to-TBV between the two firms can be reconciled by the relative volatility in returns on equity. All that said, I think given that both are trading toward their historical average/median is interesting.

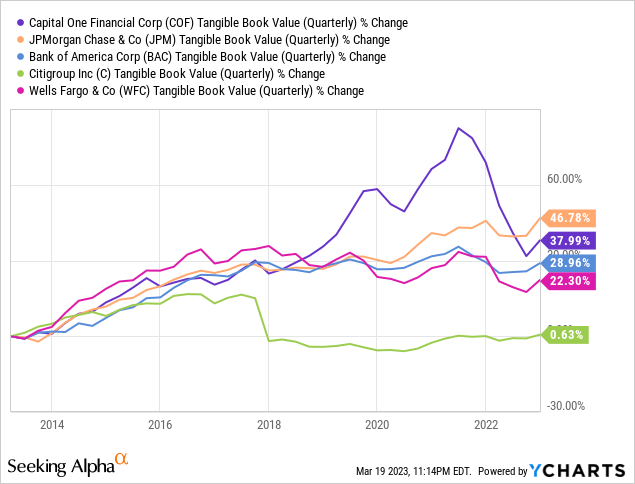

Another interesting comparison is how each of the five banks listed below has compounded their tangible book value over time. JPM and COF are standout winners on a 5-year and 10-year basis (shown below).

JPM’s tangible book has also more sustainably than COF on a 1-year, 3-year, 5-year and 10-year basis.

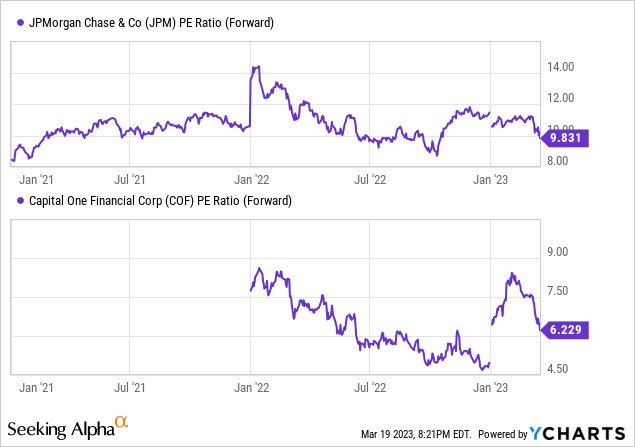

Moving onto earnings multiples, both banks also present relatively inexpensive price-to-earnings of 10x and 6x. Granted I think there will be more earnings volatility going forward, earnings should normalize eventually and accelerate over the next 3-5 years.

Another aspect about JPM and COF that’s highly valuable, in my opinion, is that both have put significant efforts and executed on technology. Like an extreme amount of execution and its only accelerating. Both have aggressively hired coders/programmers, expanding into the cloud, and are constantly reinvesting in AI and machine learning. JP Morgan has also been making significant investments in developing blockchain technology solutions, which I think will be another meaningful value-add for the company. Overall, I think these massive investments in technology and human capital will ultimately deliver significant revenue, operating leverage, and returns on equity. Moreover, I think this will provide a relative, long-term advantage over less efficient banks.

Other Risk Considerations

Specific to JPM and COF, I think there are less risks investors need to be concerned about relative to other banks. Deposit flight and portfolio losses are not a problem, in my view. So what are the primary risk considerations?

- Rising funding costs, i.e., having to raise deposit interest rates, could be a headwind to net interest margins. However, both are extremely profitable, particularly JP Morgan, so that’s a relatively lower risk.

- Looming credit/loan defaults. There are concerns about how consumers and commercial counterparties will handle the next recession. This risk could be material given the levels of consumer and corporate debt in the U.S. economy, particularly as corporate profit margins weaken. If commercial defaults meaningfully accelerate, unemployment will also rise and create a cascading effect. In truth, I think default and bankruptcy rates can only increase from here, so both JPM and COF will probably incur incrementally higher losses. That said, I think they both have a history of decent underwriting and my expectation is that will hold true into the future.

- Earnings volatility and negative investor sentiment in the banking industry. There’s a lot of uncertainty about bank stability and earnings may come under significant pressure, at least depending on the bank and their respective asset mix and funding base. I believe there will be more stock price volatility in the weeks and months to come, and valuations could decline significantly more before improving.

Specific to COF, SA author Harrison Schwartz outlined a compelling argument detailing its exposure to rising credit default rates and higher borrowing costs. Overall, I agree with that assessment and that reflects in COF’s ROE volatility. However, I still consider COF to be an above-average bank and if purchased at a large enough of a discount, investors should generate good returns. Remember, COF was still profitable during COVID. Perhaps the next recession will be even worse, but I think COF has the ability to manage through economic adversity.

Bottom Line

Banks are under a lot of pressure and investors should not dismiss broader industry risks and bank-specific risks. My plan is to avoid the most distressed banks that appear subject to the most liquidity and solvency risks. Instead, I think it’s best to own the best quality operators that have the greatest chance of compounding shareholder value over the long term. Granted JPM and COF stock prices may decline further, I think they are among the best risk/reward skews in the banking industry. I plan to accumulate shares of each company in the future, especially if their share prices decline further. Let me know what you think in the comments section below. As always, thank you for reading.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in JPM, COF over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

If you enjoyed this article and want more direct access to my research and ideas as well as the chance to chat with me and review my two model portfolios (dividend and long-only total return stocks) and my overall investing strategy, please note that my Marketplace Service called Equanimity Research is now live. I am very excited to foster a community of like-minded investors. You can now sign up for a two-week free trial* and there is a considerable discount for early annual subscribers.

*Free trial only valid for first-time subscribers.