JPMorgan Chase & Co.: A Well-Oiled Financial Behemoth

Summary:

- JPMorgan Chase & Co. is a reliable and stable investment option in the financial sector.

- The company has experienced strong growth and consistently raised dividends.

- JPMorgan’s acquisition of First Republic has significantly boosted its net income and stock performance.

Michael M. Santiago

Introduction

JPMorgan Chase & Co. (NYSE:JPM) is a behemoth in the financial sector that a lot of investors have relied heavily on to get a strong return on capital from investments of buying shares or using some of the services that the company provides. When the banking industry is facing difficulties, one of the first companies that a lot of people turn to for guidance and outlooks is JPM. Their status in the market is unquestionable and their current price is also offering a great entry point in my opinion. Stability and consistent dividend growth are some of the attributes I see JPM having.

The company has had a last few good 12 months as the share price has appreciated nearly 30% already. But I don’t think this necessarily makes JPM overvalued, especially when taking note of the 20% ROE and 25% ROTCE the company has managed to achieve in the last quarter, showcasing a strong improvement YoY. I am bullish on the outlooks for JPM and will be rating it a buy as such.

Company Structure

JPMorgan Chase & Co. functions as a global financial services corporation, operating across various segments: Consumer and Community Banking (CCB), Corporate & Investment Bank (CIB), Commercial Banking (CB), and Asset & Wealth Management (AWM). The company has grown into a very large player in the financial sector and like I said in the beginning, is one that people turn to for guidance on the economic landscape.

The services that the company provides are extremely broad and the branches within JPM could almost be their separate business in a sense, that’s how large JPM has become. Nonetheless, they focus on keeping a strong balance sheet and leveraging higher deposits and a growing lending portfolio into better ROE which is then turned into dividend increase and buybacks.

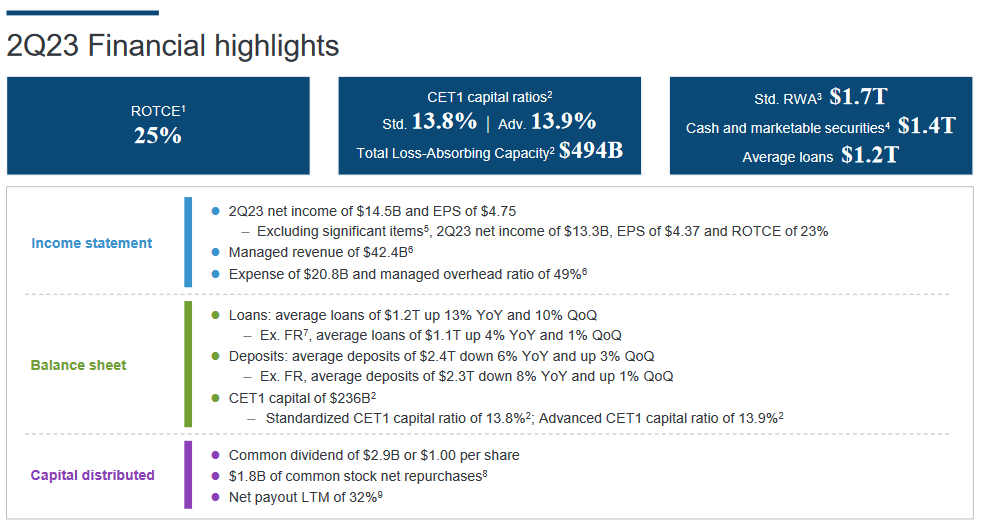

Q2 Highlights (Earnings Presentation)

In the last quarter alone, the company distributed dividends worth nearly $3 billion in total and bought back shares for $1.8 billion. Over the years JPM has done a very good job of consistently raising the dividend and I don’t think the future will hold anything else.

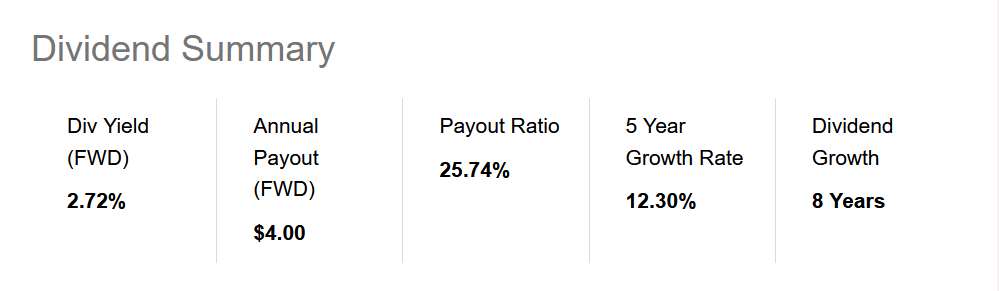

Dividend Summary (Seeking Alpha)

The payout ratio is under 30% which I think is a very healthy position to be in, and with the 5-year growth rate being over 12% I think it speaks volumes about the capabilities that JPM has in terms of delivering a strong return to shareholders. Looking at the estimates for the dividend, the market is expecting to see it go to $4.7 per share in 2025 which would represent a 3.2% yield. With a strong bottom line growth in the last few quarters, I think that JPM can average an EPS growth of at least 7 – 8% over the next decade annually. In the last 10 years, it has been over 10% CAGR for the company. Together with the dividend, I think that JPM can deliver a market-beating return and that is the reason I have them as a buy currently.

Earnings Transcript

From the earnings call back in July Jeremy Barnum, the CFO of JPM had some comments to include here that touch upon the recent performance and the outlook they have for the markets.

-

“the firm reported net income of $14.5 billion, EPS of $4.75 on revenue of $42.4 billion and delivered an ROTCE of 25%. These results included the First Republic bargain purchase gain of $2.7 billion and credit reserve build for the First Republic lending portfolio $1.2 billion as well as $900 million of net investment securities losses in Corporate. Touching on a few highlights, CCB Client investment assets were up 18% year-on-year, we had record long-term inflows in AWM and we ranked number one in IB Fee wallet share”.

When the implosion of two of the major regional banks happened earlier this year, JPM was faced with the opportunity of acquiring First Republic and including that into its portfolio and molding it into the framework of JPM. It seems that the progress on transforming the First Republic and integrating it into JPM has been on time so far. The addition of the lending portfolio of First Republic was significant and has helped JPM raise the bottom line quickly in the span of a few quarters. In fact, for the last quarter alone, First Republic added $2.4 billion in net income to the results. In terms of the contribution to the overall net income, that represents a share of around 16%. This result has rallied the stock the last few months and for good reasons, I think. As long as the interest rates remain elevated, JPM will continue to be able to post similar strong results as the last quarter, I think.

-

“In terms of the second-half outlook, we have seen encouraging signs of activity in capital markets, and July should be a good indicator for the remainder of the year. However, year-to-date announced M&A is down significantly, which will be a headwind”.

I don’t think the capital markets will recover fully to where they were in 2021 when rates were lower and the economic activity very high, but seeing some positive signs even while rates remain elevated I think will play out very well for JPM. In the coming years, I think they will be able to very well grow their asset base and once rates increase again, deliver a strong ROE. This will translate to stronger dividend payouts and buybacks, and with practices like that it’s really what makes JPM such a strong long-term addition to a portfolio I think.

Valuation & Comparison

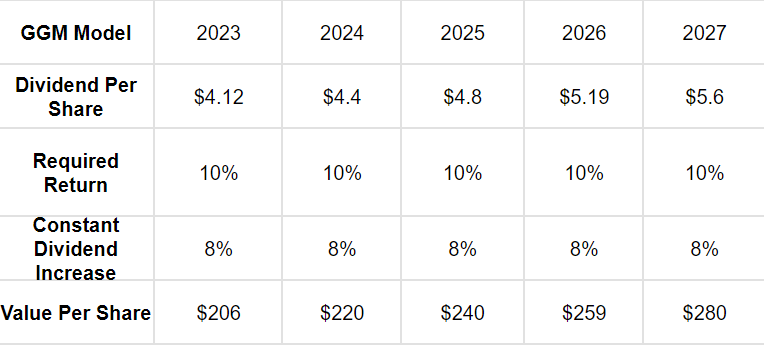

GGM Model (Author)

Playing with the idea that JPM can maintain the current growth rate of the dividend, we land at a pretty high target price of $206. This indicates an upside potential of nearly 40% and I don’t think we will see such a move upward in the short term. But I think it highlights very well the type of business you are getting with JPM. They have a strong commitment to growing the dividend. I think this is a reason for the high p/b that the company is trading at, which right now is at 1.4 and the p/e is at 9.2 on a forward basis. I think that when you have a company like JPM which is such a behemoth in the sector, then paying a premium for the stability it provides is justified. For that reason, I don’t mind the 1.4 p/b, because it’s also supported by the GGM model which as I said highlights that JPM could be significantly undervalued based on the prospects of its dividend growth.

Risk Associated

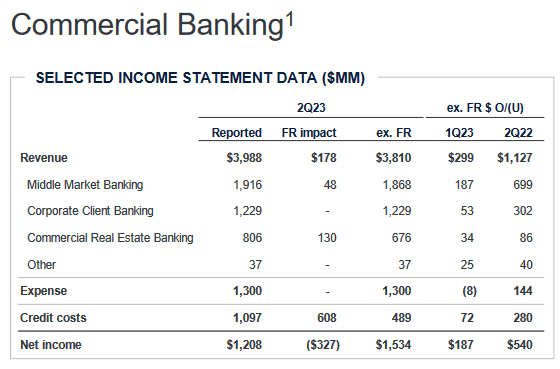

Recent reports indicate that the commercial property loans market is experiencing a notable downturn, prompting lenders, including financial giants like JPM, to explore options for selling debt associated with office buildings, hotels, and apartment complexes. This shift in the market landscape has been primarily attributed to the recent uptick in interest rates, which has cast a shadow over the commercial real estate sector.

Commercial Banking (Investor Presentation)

One of the key concerns looming over this situation is the uncertainty surrounding property prices. With a paucity of transactions and insufficient sales data, accurately gauging the market value of these loans has become a formidable challenge. This particular aspect represents a substantial risk not only to the financial institutions involved, including JPM but also to the broader commercial real estate lending sector.

Investor Takeaway

JPM has been in the news quite frequently as after the banking crisis this year they absorbed the First Republic into their framework and it seems like the addition has been a massive net income boost opportunity as it added $2.1 billion. Based on a GGM model, it seems like JPM is also trading quite low by the target prices if JPM maintains the current dividend growth rate. I am a fan of the business and think investors will do very well over the long term by investing in the company right now. I am rating it a buy as such.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.