Summary:

- JPMorgan closed FY 2022 with approximately $46.2 billion of pre-tax earnings, which is the second highest income for the bank in over a decade.

- On the backdrop of a likely rebound in investment banking activity, paired with a strong net interest rate margin, I am bullish for JPM’s FY 2023.

- Personally, I update my EPS expectations for the largest US bank through 2025; and I now calculate a fair implied share price equal to $219.25.

jetcityimage

Thesis

I have previously argued that JPMorgan Chase (NYSE:JPM) stock is a buy. And given the bank’s exceptionally strong 2022 performance, I am confident to reiterate my bullish thesis. Investors should consider that in 2022, JPMorgan has accumulated approximately $46.2 billion of pre-tax earnings–the second highest income for the bank in over a decade. Moreover, reflecting on an interest rate sensitive balance sheet, with over $1.6 trillion of total investments and $1.12 trillion of net loans, JPM is well positioned for another year of strong profitability.

Personally, I update my EPS expectations for the largest US bank through 2025; and I now calculate a fair implied share price equal to $219.25.

For reference, JPM stock is trading in line with the market: shares are down approximately 8.5% for the past twelve months, as compared to a loss of about 8.5% for the S&P 500 (SPY).

Seeking Alpha

JPMorgan’s Q422 Quarter

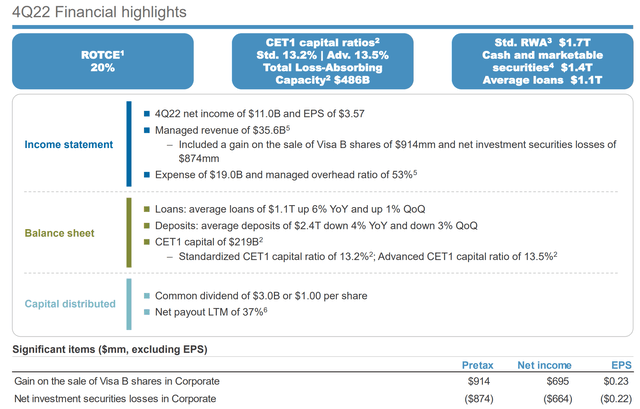

JPMorgan closed the FY 2022 with exceptionally strong Q4 results, beating analyst consensus estimates with regards to both revenues and earnings. During the period from September to the end of December, JPM generated about $34.6 billion of group revenues, which compares to about $34.3 billion as expected by analyst consensus estimates ($320 million beat). Quarterly profit before taxes was came in at $13.2 billion, viruses $12.7 billion for the same period one year earlier (4% year over year growth). Net income was recorded at $11 billion, or $3.57/share, topping consensus estimates by 47 cents. Although JPM’s Q4 profitability was supported by a $914 pre-tax income relating to sales of Visa B shares, the gain was almost completely offset by a $874 million loss from writing down the value of investment securities.

In context of a challenging macro environment in Q4 2022, JPM performed strongly across all operating units.

- The Consumer & Community Banking unit generated net income of $4.6 billion, up 10% YoY.

- The Corporate & Investment Bank lost profitability of about 27% as compared the same period in 2021, generating net income of $3.3 billion. Needless to say, the YoY contraction is attributable to lower investment banking fees.

-

Net income from Commercial Banking jumped 15% YoY, to $1.4 billion — driven by a 14% YoY loan growth paired with expanding net interest margin as compared to deposit expenses.

-

The Asset & Wealth Management franchise generated $1.1 billion of earnings, up 1% YoY.

For the full year 2022, JPM’s revenues grew to $122.3 billion and the bank’s profitability remained close to the highest level for over a decade: For FY 2022, JPM’s accumulated $46.2 billion of pre-tax earnings tax.

JPM Q4 Reporting

Bullish Going Into 2023

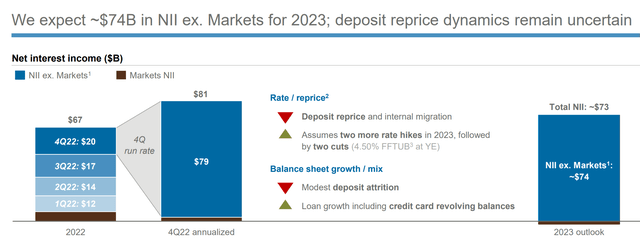

Like banks across the world, in 2023 JPMorgan is likely to continue to benefit from a strong net interest rate margin, which can be defined as the rates difference of what a bank earns from writing loans as compared to what the bank pays for deposits. With that frame of reference, investors should consider that there are some analysts that expect the Fed funds rate to peak at 6%, if not 8%. And the ECB has voiced commitment to raise to marginal lending facility rate to a level of 4%. Notably, even without additional rate increases, JPMorgan has estimated 2023 net interest income at about $81 billion (Q4 reference annualized), as compared to $67 billion in 2022.

Moreover, it would arguably not be unreasonable to expect that at some point in 2023 deal making activity picks up again, and JPM’s Corporate & Investment Bank delivers stronger results as compared to 2022.

JPM Q4 Reporting

Target Price: Raise To $219.25

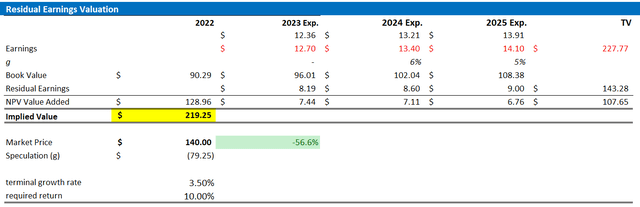

Reflecting on a higher yield environment for all asset classes, I upgrade my EPS expectations for JPM through 2025. I now estimate that DB’s EPS in 2023 will likely expand to somewhere between $12.6 and $12.8. Moreover, I also raise my EPS expectations for 2024 and 2025, to $13.4 and $14.1, respectively.

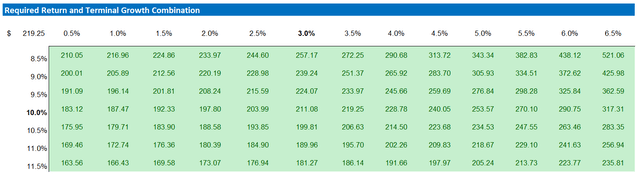

I continue to anchor on a 3.5% terminal growth rate (approximately in line with nominal global GDP growth to reflect conservatism), as well as on a 10% cost of equity, which I deem a conservative estimate.

Given the EPS update as highlighted below, I now calculate a fair implied share price of $219.25.

Analyst Consensus; Author’s Calculation

Below is also the updated sensitivity table.

Analyst Consensus; Author’s Calculation

Risks

In my opinion, bank investments are safer than perceived, but there remains an elevated tail risk, that could lead to JPMorgan approaching bankruptcy in extreme financial distress situations. The banking industry is still recovering from the financial crisis, and many big financial institutions have not yet regained pre-crisis levels. Despite this, JPMorgan’s strong CET1 ratio of 13.2% should provide protection in the most challenging scenarios.

Conclusion

JPMorgan closed FY 2022 with approximately $46.2 billion of pre-tax earnings, which is the second highest income for the bank in over a decade. On the backdrop of a likely rebound in investment banking activity, paired with a strong net interest rate margin, I am bullish for JPM’s FY 2023. Personally, I update my EPS expectations for the largest US bank through 2025; and I now calculate a fair implied share price equal to $219.25.

Disclosure: I/we have a beneficial long position in the shares of JPM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Not financial advice.