JPMorgan Chase: Don’t Rule Out The Impact Of A Severe Recession

Summary:

- JPMorgan’s Q3 earnings saw a further boost to its net interest income from the Fed’s rate hikes. However, the bank also cautioned that the tailwind is transitory.

- Investors must focus on whether the bank can navigate worsening economic headwinds well when the Fed’s tailwind fizzles out. Management is confident of its execution.

- We discuss why JPM’s valuation has likely factored in a mild-to-moderate recession but not a severe one.

- Given the sharp post-earnings surge, investors should wait for a pullback before adding more to their positions.

winhorse/iStock Unreleased via Getty Images

Thesis

JPMorgan Chase’s (NYSE:JPM) Q3 earnings release didn’t surprise us. Its net interest income benefited from the Fed’s interest rate hikes, lifting its earnings. However, the bank also cautioned that Fed’s tailwind is transitory, and investors need to expect some normalization in 2023.

Our analysis suggests that JPM’s valuations remain reasonable (relative to historical metrics). However, worsening economic headwinds, coupled with the normalization of its interest tailwinds, could impede its earnings growth momentum in 2023.

We gleaned that the market has likely priced in these challenges. Notwithstanding, the recent post-earnings surge led to a re-test against its near-term resistance. Hence, we deduce it’s more appropriate for investors to consider waiting for a pullback first before adding more positions.

Accordingly, we revise our rating on JPM from Buy to Hold.

Worsening Macro Headwinds Could Pressure JPM’s Earnings

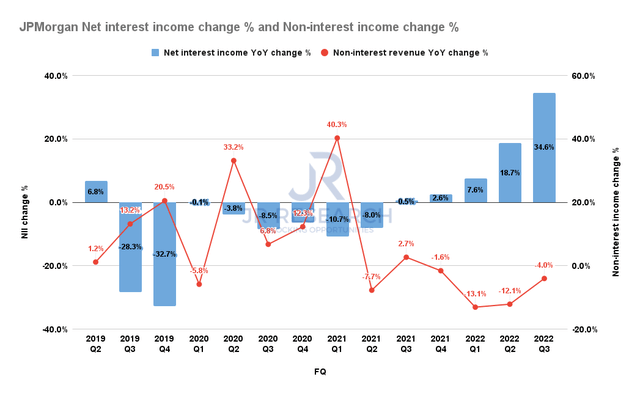

JPMorgan Net interest income change % and Non-interest revenue change % (Company filings)

As seen above, the bank benefited tremendously from the Fed’s aggressive rate hikes, as its net interest income increased by 34.8%, above Q2’s 18.7%. JPMorgan’s guidance for Q4 suggests that it sees another 40% YoY growth.

However, management also cautioned that investors should expect a marked normalization from 2023, given the surge in FY22. We believe the guidance is sensible, as the Fed could be nearing the end of its rapid hikes before taking a pause (as of now, the market has priced in a terminal rate of about 5%). Therefore, the Fed could be done with its rate hikes by early 2023 before pausing.

As a result, we believe the market is likely looking ahead and assessing the impact of a recession on JPMorgan’s earnings visibility.

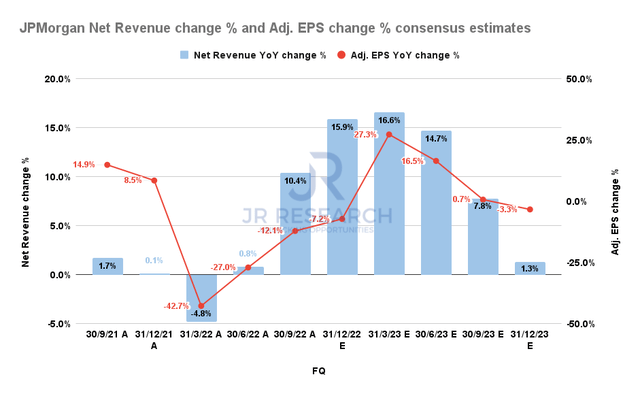

JPMorgan Net revenue change % and Adjusted EPS change % (S&P Cap IQ)

The consensus estimates (bullish) suggest that JPMorgan’s earnings growth could weaken in H2’23, given the net interest income tailwinds that bolstered its topline in H2’22.

Also, the bank included a reserve build of $808M but does not expect to see a significant recession currently. CEO Jamie Dimon articulated:

We’re just getting closer to what you and I might consider bad events. I’ve been very consistent. There is still, for example, a possibility of a soft wind. We can debate. There’s a possibility of a mild recession. Consumers are in very good shape, and companies are in a very good shape. And there’s possibility of something worse, mostly because of the war in Ukraine and oil price and all things like that. (JPMorgan FQ3’22 earnings call)

Therefore, we cannot rule out the possibility of a severe recession. But JPMorgan is confident that it can manage it well. However, we need to assess whether the valuations make sense at this level in case the market anticipates worse-than-expected recessionary headwinds.

JPM’s Valuations Are Reasonable

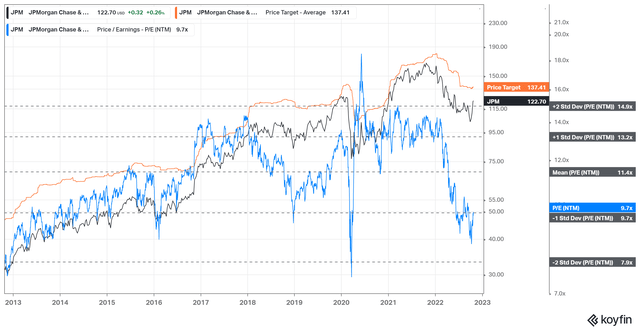

JPM NTM normalized P/E valuation trend (koyfin)

JPM’s NTM earnings multiple of 9.7x has likely reflected a mild-to-moderate recession. However, a more significant recession could force it down further to the two standard deviation zone (7.9x) under its 10Y mean.

Therefore, we urge investors to be mindful of a worse-than-expected recession that could impact its valuation further. Coupled with the tapering of its net interest income tailwind from H2’23, JPMorgan would have less of an earnings driver to mitigate the impact of the recession.

Is JPM Stock A Buy, Sell, Or Hold?

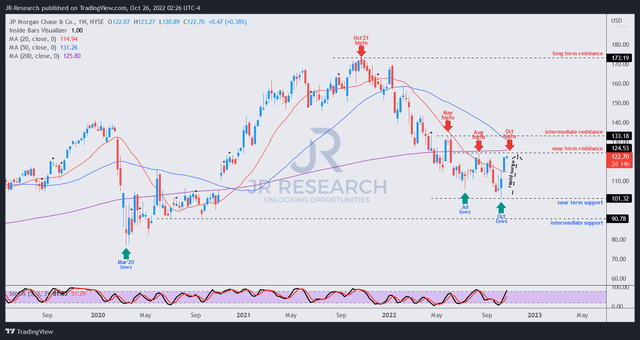

JPM price chart (weekly) (TradingView)

JPM rallied sharply into its near-term resistance post-earnings. However, we gleaned that the sharp surge met stiff resistance that denied further upside in August.

Therefore, we believe the near-term upside has been reflected accordingly. As such, investors should consider waiting for a pullback first with constructive basing action before adding more to positions.

As such, we revise our rating on JPM from Buy to Hold.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Do you want to buy only at the right entry points for your growth stocks?

We help you to pick lower-risk entry points, ensuring you are able to capitalize on them with a higher probability of success and profit on their next wave up. Your membership also includes:

-

24/7 access to our model portfolios

-

Daily Tactical Market Analysis to sharpen your market awareness and avoid the emotional rollercoaster

-

Access to all our top stocks and earnings ideas

-

Access to all our charts with specific entry points

-

Real-time chatroom support

-

Real-time buy/sell/hedge alerts

Sign up now for a Risk-Free 14-Day free trial!