Summary:

- JPMorgan Chase & Co.’s new fair price estimate is $222.86, 13% above the current stock price of $197.30, with projected annual returns of 7.6% through 2029.

- The bank reported an EPS of $4.63, beating consensus by 12%, and revenue of $41.93 billion, exceeding expectations by 0.5%.

- JPMorgan aims to open 500 new branches by 2027, focusing on low-income and rural areas, potentially adding $9.11 billion in revenue.

- JPMorgan is the best-capitalized among major banks, holding 12.86% of total US deposits, more than Bank of America and Wells Fargo.

- The fair price estimate has been adjusted due to financial changes and market conditions, with key risks including inflation, consumer financial health, and regulatory challenges.

photobyphm/iStock Editorial via Getty Images

Thesis

In my previous article on JPMorgan Chase & Co. (NYSE:JPM), released on March 29, I rated the stock as a “strong buy”, because according to my model, the estimated present fair price stood at $237.41, which was a potential 20.7% upside from the stock price at that time of $196.6. The model also suggested that the stock could deliver 17.8% annual returns throughout 2029.

JPMorgan reported Q1 2924 earnings on April 12. For that quarter, JPMorgan reported a quarterly EPS of $4.63, which beat the consensus by 12% ($0.50), and reported a revenue of $41.93B, which beat the consensus by 0.5% ($250M)

After updating my model with the newly available data from FQ1 2024, I arrived at a new fair price estimate of $222.86, which is 13% above the current stock price of $197.30, and a future stock price for 2029 of $287.24, which translates into annual returns of 7.6% throughout 2024-2029.

Overview

Growth Plan

JPMorgan announced on February 6 of this year their intentions to open 500 new branches by 2027, which is 125 new branches annually. These branches will be targeted at low-income areas and rural communities to capture their deposits.

According to my calculations, JPMorgan would be generating around $14.92M per branch in its consumer banking segment, and $3.30M per branch in its commercial banking segment. This means that the addition of 500 new branches could potentially generate around $9.11B in additional revenue, aside from the fact that existing deposits will continue to increase naturally as the economy grows. More on this will be developed in the valuation section.

However, has JPMorgan grown more after it expanded to the US? The answer is yes, actually, JPMorgan offers retail banking services in the UK through Chase online bank and plans to expand to Germany. Chase Online UK does not generate profit but it aims to do so by 2025.

How does JPMorgan Compare Against Peers?

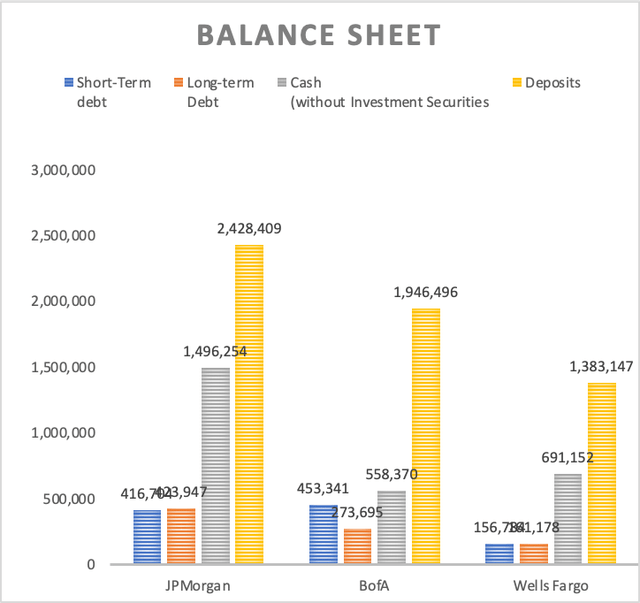

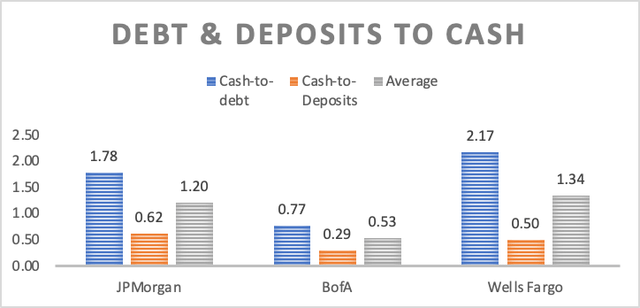

JPMorgan’s most prominent peers include giants such as Bank of America Corporation (BAC) and Wells Fargo & Co. (WFC). When comparing JPMorgan to the other two, we will observe that it’s the best-capitalized bank, since it has cash reserves of $1.49T excluding investment securities (which includes the debt securities held until maturity), which covers around 62% of its $2.42T deposits base.

Bank of America and Wells Fargo have 29% and 50% of deposits covered by their cash reserves (excluding investment securities) respectively. Furthermore, with its cash reserves, JPMorgan could pay 1.78 times its total debt, which is second to Wells Fargo with 2.14. Bank of America comes in last with 77% of its total debt covered by cash reserves.

Overall Wells Fargo comes ahead in scoring, however, that’s in part thanks to its little debt because it can’t expand as its two peers since it has an asset cap imposed by the FED due to its 2016 scandal where they opened deposit & credit accounts without its clients’ consent between 2011 and 2015.

Lastly, suppose we divided the total amount of deposits that JPMorgan holds by the total amount of deposits in the US, which at the end of 2023 totaled $18.81T. In that case, we will observe that JPMorgan is holding around 12.86% of deposits, followed by Bank of America with 10.34%, and Wells Fargo with 7.35%. Nevertheless, the US banking sector is well diversified, since 69.45% of deposits are held by other institutions.

All three banks lost market share compared to the previous quarter, where each bank held 13.8’%, 11.06%, and 7.51% respectively.

Industry Outlook

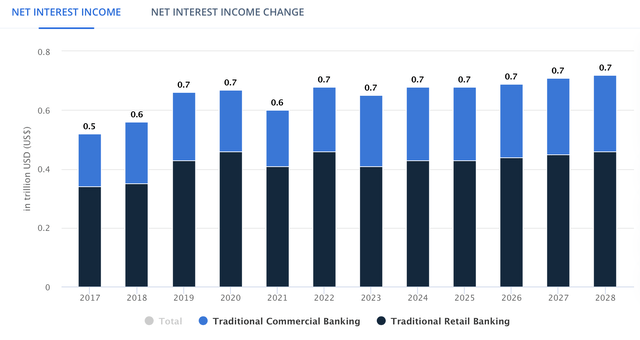

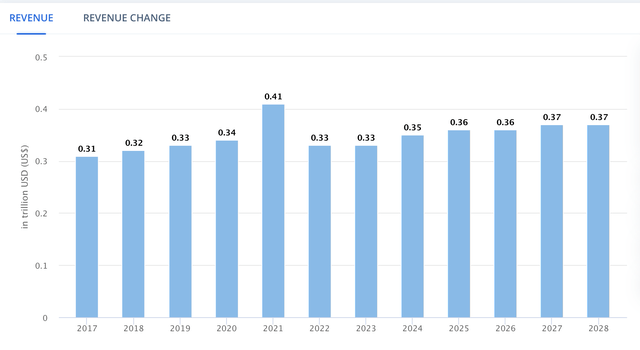

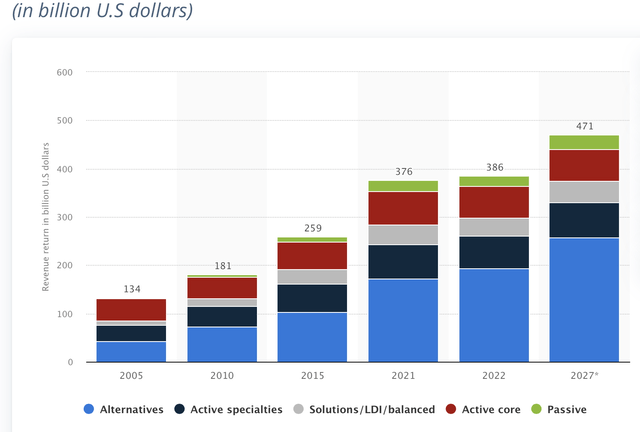

JPMorgan has an addressable revenue of $1.42T when summing the 2023 market volume of the US Traditional banking Market (which is estimated to grow at a 1.44% CAGR throughout 2028), the global investment banking market (with a projected 1.4% CAGR throughout 2024-2028), and worldwide asset management market (expected to grow at a much faster 4.40% throughout 2027. For the year 2028, the total addressable revenue in these three should ascend to $1.6T.

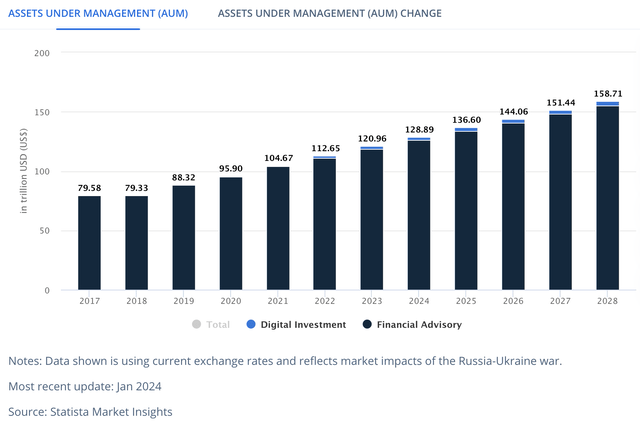

Lastly, with worldwide wealth management, it’s necessary to do a little more math. In 2023, the total AUM of the global wealth management market was $120.96T. JPMorgan charges on average 0.5% annually of total AUM to their wealth management clients. This means that the total addressable revenue would stand at $604.48B. For the year 2028, the total AUM of the worldwide wealth management market is expected to increase to $158.71T, which is multiplied by the average fee that JPMorgan Wealth Management charges meaning $793.55B total addressable revenue for 2028.

Overall, the current addressable market for JPMorgan as of 2023 stands at a staggering $2T, and for 2028, this number should increase to $2.39T, showcasing a 3.9% annual expansion in JPMorgan’s TAM.

Valuation

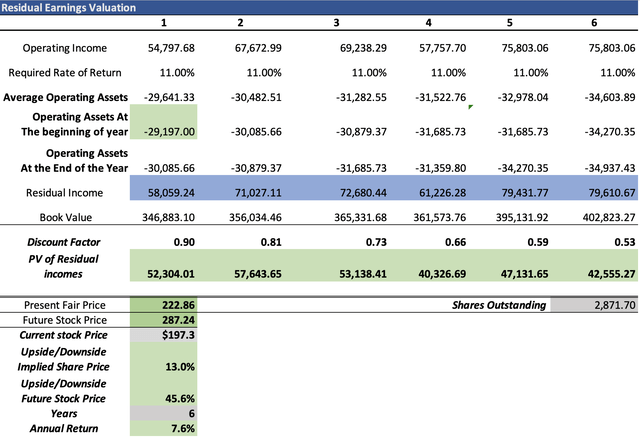

I will value JPMorgan through a Residual Earnings Model. The first step is calculating the Required Rate of Return, which I did through a CAPM model. The Beta of the stock is from MarketWatch. The result of the calculation was a discount rate of 11.03%.

| CAPM | |

| Risk-Free Rate | 4.301% |

| Beta | 1.09 |

| Market Risk Premium | 6.149% |

| Required Rate of Return |

11.003% |

Operating assets currently stand at -$29.19B. This was calculated by subtracting total deposits and total cash reserves from total assets. Then book value was calculated by subtracting total liabilities from total assets. Then I calculated margins tied to revenue, which came at -19.46% and 224.42% respectively. I will maintain these margins throughout the projection to calculate operating assets and book value for each year.

| Operating Assets | -29,197.0 |

| Book value | 336,637.0 |

| Operating Assets / Revenue | -19.46% |

| Book Value / Revenue | 224.42% |

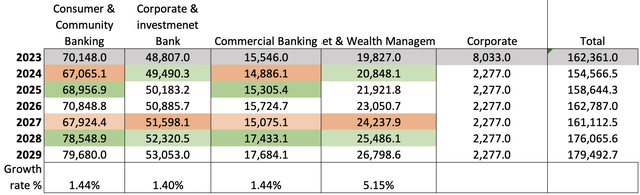

Then the next step is to calculate revenue. The first thing to do is to know how much those 125 yearly new branch openings will generate in revenue. This will mostly be for the consumer and commercial banking segments. When dividing the 2023 consumer (community banking revenue of $70.14B and the commercial banking revenue of $15.54B by the 4,700 branches that JPMorgan Chase has, I get each branch is generating approximately $14.92M and $3.30M in revenue respectively. Then each segment will grow at the growth rate of the respective market in which they operate.

The next thing to notice is that when there are interest rate changes, JPMorgan’s revenue tends to decrease. If interest rates are increased, then lower consumer demand will affect JPMorgan. On the other hand, if they decrease, then JPMorgan will earn less per loan.

Concerning Corporate & Investment Banking, and Asset & Wealth Management, the effect is the opposite. If interest rates are decreased, then valuations go up and therefore JPMorgan earns more in fees since the total value of portfolios has increased (because most wealth managers charge a management fee for the total value of assets under management). Meanwhile, if interest rates are increased, valuations tend to decrease, as well as M&A activities, and IPOs, this causes investment banks to earn less money.

The average revenue decrease was 6.76% and the average revenue increase was 14%. Therefore, since interest rates are more likely to be cut by November-December 2024 or by the first three months of 2025, I will imply that 2024 revenue will fall by 6.76%, and then it will recover by 14% as reduced interest rates will spur consumption. Then by 2027/2028, interest rates may be hiked again, therefore revenue for 2027 will fall 6.76% and then it will recover by 14% in 2028.

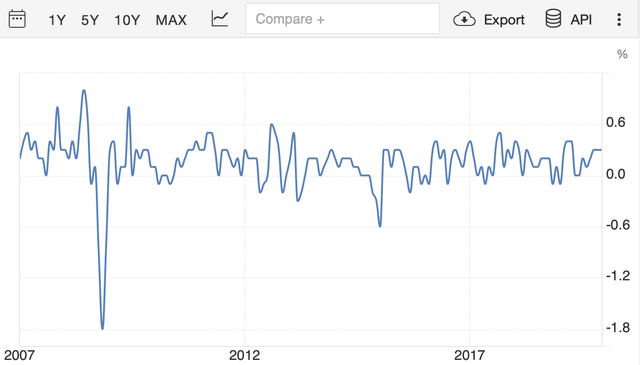

The reason for this is that we are not in the same situation as the 2008 crisis, which was so harsh that monthly YoY CPI change was -1.8%, and until December 31, 2019, monthly CPI change was less than 0.6%, and in many locations it was negative.

However, to have another period like that, interest rates would need to remain at the current 5.50% level for more time, or directly be hiked up to 7.50%. In the current circumstances, as soon as inflation hits 2.1%-2.6%, the FED will probably cut interest rates as the European Central Bank and the Swiss National Bank have done.

Monthly YoY CPI Change % 2007-2019 (Trading Economics)

Now, it’s time to calculate net income, which I will do through net income margins. The average net income margin contraction was 5.39% for 2018-2024TTM, and the average increase was 5.81%. Therefore, since in 2024 and 2027 I expect a change in interest rates (that as previously explained, had an immediate negative impact on JPMorgan’s income statement) net income margins will be at 28.59% (down from the current 33.57%) and 28.91% respectively. You can see the resulting net income margins in the table below:

| My Net income Margins % | |

| 2024 | 28.59% |

| 2025 | 34.40% |

| 2026 | 34.30% |

| 2027 | 28.91% |

| 2028 | 34.72% |

| 2029 | 34.72% |

The last step is to calculate the future stock price for the year 2029. To do that, I will use the undiscounted residual earnings that are highlighted in blue in the model below. Then I will sum the estimated book value for year 6 of the projection. Later, I divide by the total amount of shares outstanding.

As you can see, the estimated present fair price for JPMorgan Chase is $222.86, which is 13% above the current stock price of $197.3. The future stock price for the year 2029 came out at $287.24, which translates into low 7.6% annual returns throughout 2024-2029.

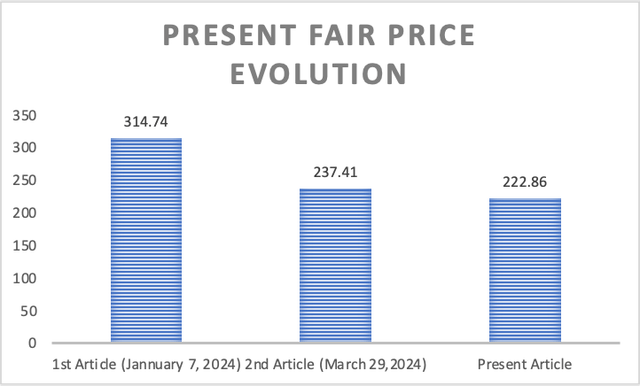

Present Fair Price Estimate Evolution

In my first article on JPMorgan, which was published on January 7, I assigned a present fair price to the stock of $314.74. In the second article, I assigned a fair price of $237.41, and in the present article, I readjusted my estimate to $222.86. From my second to my current article, my fair price estimate has gone down by 6.12%, mainly due to changes in JPMorgan’s financial condition, however, my model still indicates a possible upside.

Aside from this, I also changed the way I did my model so it could be closer to the real way banks behave in the stock market, and that is, following the trend of their book value.

Risks

The main risk is concerning inflation and the worsening financial condition of the American consumer. If the situation remains like this for too long, JPMorgan will be affected because of reduced consumption activity. A

Furthermore, JPMorgan’s expansion in foreign retail banking markets presents catalysts (such as the increased revenue) but also challenges, because a more complex corporate structure can pull down profitability margins. Furthermore, European markets are different than American ones in terms of risk-taking and the use of consumer loans and credit cards, which can make JPMorgan’s venture unprofitable.

Lastly, there is the risk of reducing expansion opportunities inside the US since banking is an old economy industry, it’s a saturated market, where different competitors have little to no differentiating factors. Furthermore, JPMorgan is already a giant, and the FDIC could put restrictions on it at the time of winning the auction of banks that fell into receivership. Additionally, it can also encounter opposition from regulators if it tries to acquire rivals the conventional way. Let’s remember that stock prices often reflect what investors are expecting for the future if what they are expecting is little growth, then the stock could remain flat.

Conclusion

In conclusion, JPMorgan continues to present a fair price adjustment opportunity. My estimated fair price stands at $222.86, which represents a 13% upside from the current stock price of $197.3.

The main factors that will help JPMorgan achieve this target are that the state of the US consumer is still good, and the inflation rate continues to be above the 3% level. Although I am assuming that the FED will cut interest rates by year-end, the current uncertainty could push that date further, which would let the current market optimism push JPMorgan to where I am suggesting it should arrive. Nevertheless, as the trend in JPMorgan’s income statement indicates, as soon as interest rates are cut, the most probable thing to happen is revenue and margins decline (and the same has occurred when interest rates are increased).

For these reasons, I reiterate my “strong-buy” rating on JPMorgan since I believe it has more room to go. In the next quarters, I think it’s important to monitor JPMorgan’s financial performance as well as the economic news that has a direct impact on the FED interest rates decision.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.