Summary:

- JPM continues to command depositors’ and market analysts’ confidence in deposit stability and forward execution.

- This sentiment is demonstrated by the “deluge of deposits” flowing into JPM, along with other banks, potentially helping boost its Net Interest Income beyond $73B in FY2023.

- Combined with Moody’s A1 credit rating and JPM’s excellent liquidity sources, the bank continues to reign supreme with a lower unrealized loss-to-equity ratio of 5.6%.

- Investors may consider adding here if it consequently reduces or matches their dollar cost averages. Otherwise, with the rapidly declining sentiments, we may see JPM testing the low $100s again.

Iana Miroshnichenko/iStock via Getty Images

This Is Why JPM Reigns Supreme In A Panic-Driven Market

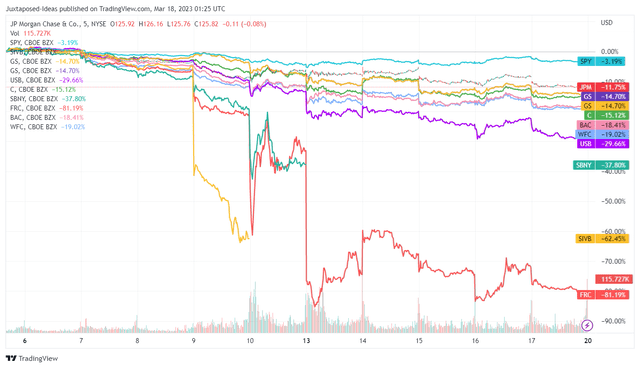

US Banking Stocks Over The Past Week

While the SVB Financial (NASDAQ:SIVB) debacle had impacted JPMorgan’s (NYSE:JPM) stock prices, it had also fared better than its peers, which recently recorded worse declines over the last week.

We shall explain why.

JPM was in no immediate danger of a similar SIVB bank run, since depositors ran their way seeking shelter instead. Bloomberg reported that the bank “raked in billions in new deposits,” with Bank of America (NYSE:BAC) similarly adding $15B of deposits over the past few days.

Particularly, many tech companies had also shifted their “key elements of payments infrastructure” to JPM, as done by Rippling, a back office-focused startup, on March 11, 2023. The flight response inherently demonstrated depositors’ trust in larger banks, suggesting tailwinds for the bank giant, considering the largest shift in market funds in over ten years, as highlighted by the Financial Times.

Another example was First Republic Bank (NYSE:FRC). The bank continued to suffer a vote of no confidence, with depositors steadily withdrawing funds. This was despite the improved liquidity from the Federal Reserve Bank and JPM’s funding, bringing its available liquidity to over $70B on March 12, 2023. This was on top of another $30B of deposits (for at least 120 days) injected by JPM and many big banks alike on March 16, 2023. Naturally, it remains to be seen how FRC may fare moving forward, given the talks of a potential sale.

Nonetheless, with JPM in a robust position to offer assistance to mid-sized banks such as FRC, the former’s prospects appear to be relatively solid, in our view. This was derived from the bank’s robust performance in FY2022, with total deposits of $2.04T (+5.1% YoY) in the US and $418B (+5.2% YoY) internationally, comprising 67.2% of its total assets of $3.66T (+17.6% YoY) by the latest quarter.

Furthermore, in an unfavorable scenario, the bank estimated that only $1.38T (-6.7% YoY) of its deposits were uninsured, comprising 56% (-7.2 points YoY) of its total sum, lower than SIVB’s 88% though higher than BAC’s 37.9% in FY2022. These numbers suggest the bank’s adequate capability to weather a potential bank run, significantly aided by its excellent liquidity and growing profitability thus far.

JPM had reported approximately $733B (inline YoY) of High-Quality Liquid Assets [HQLA] and $694B (-24.1% YoY) of unencumbered marketable securities, bringing its total liquidity sources to a total of $1.42T (-13.9% YoY) by the latest fiscal year. These naturally back its excellent Liquidity Coverage Ratio [LCR] of 112%, allowing the bank to sufficiently fund cash outflows “over a prospective 30 calendar-day period of significant stress.”

In addition, JPM’s Net Interest Income [NII] had grown tremendously to $66.71B (+27.5% YoY) in FY2022, with a stellar guidance of up to $73B (+9.4% YoY) guided for FY2023. This outperformance was naturally attributed to its higher loan growth and higher interest rates.

Given the notable inflow of deposits to the bank over the past few days, it is entirely possible that we may see an excellent upward revision of its FY2023 NII in our view.

On one hand, we understood some investors’ pessimism regarding JPM’s accelerating unrealized losses of $11.2B (+379.4% YoY) in available-for-sale [AFS] securities and $36.7B (+1055% YoY) in held-to-maturity [HTM] debt securities in FY2022.

On the other hand, it must be highlighted that these losses may not be realized after all, given the bank’s excellent liquidity sources, as discussed above. Furthermore, the bank boasted an improved unrealized loss-to-equity ratio of 5.6%, compared to BAC at 7.2%, Wells Fargo & Company (NYSE:WFC) at 6.9%, and Citigroup (NYSE:C) at 18.9%.

This was significantly aided by the Fed’s Bank Term Funding Program, reassuring the banking industry of an “easier one-year funding.” As a result, JPM was less likely to be under pressure to generate capital by realizing losses on securities, a challenge that had been faced by SIVB.

Combined with Moody’s credit rating of JPM at A1 (as of December 2022), long-term investors have nothing to fear, in our view.

So, Is JPM Stock A Buy, Sell, or Hold?

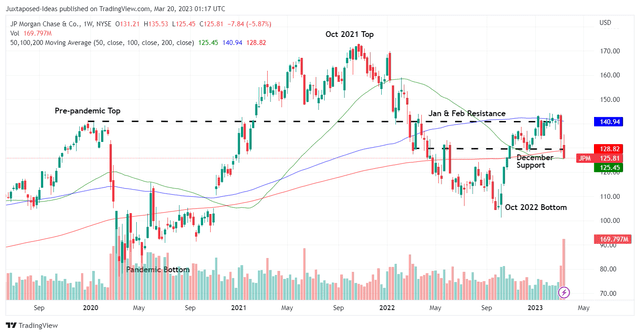

JPM 3Y Stock Price

In our view, JPM is trading at fair value now, returning to its normalized pre-pandemic levels, after the hyper-pandemic lows and heights. The stock’s valuations of NTM Price/Sales of 2.81x and NTM P/E of 10.52x are relatively in line with its 1Y mean as well, though lower than its 3Y pre-pandemic mean of 3.26x and 12.12x, respectively.

Particularly, we believe the recent banking failures have only demonstrated the bank’s stellar management and growing market confidence in its forward execution. However, we are already seeing the JPM stock breach its previous support at the December 2022 level in the $130s. Given the recent development with Credit Suisse (NYSE:CS) and FRC, we reckon that there may be more volatility in the short term.

Therefore, is it wise to add JPM here? We reckon interested investors may still do so, if it consequently reduces or matches their dollar cost averages. Particularly, market analysts expect the bank to pay out FY2023 dividends of $4.16 and FY2024 dividends of $4.45, suggesting excellent yields of 3.3% and 3.53%, respectively, based on its current stock prices of $125.81.

Otherwise, more patient investors may consider waiting a little longer before adding, ideally at its previous May 2022 support in the $110s, since the volatile banking situation may put further pressure on the stock’s prices thus far. Those levels may also offer improved forward yields of up to 4.04%, respectively, against its 4Y average of 2.90% and sector median of 3.03%.

Therefore, we are cautiously rating the JPM stock as a Buy here.

On one hand, investors that add here must size their portfolios since there may still be moderate volatility moving forward, attributed to the Fed’s tough battle in tamping down the rising inflation and overly robust labor market.

On the other hand, we reckon JPM may emerge stronger from these uncertainties, triggering its potential outperformance once the macroeconomic headwinds subside.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.