Summary:

- JPMorgan Chase saw its net income increase throughout 2022.

- The strong increase in net interest income in Q4 2022 mitigated the impact of higher loan loss provisions.

- The company only needs about 5% of its net income to cover the preferred dividends.

- The preferreds are attractive from a dividend and asset coverage level perspective, but I’m a little bit hesitant – mainly due to my personal tax situation as a foreign investor.

winhorse

Introduction

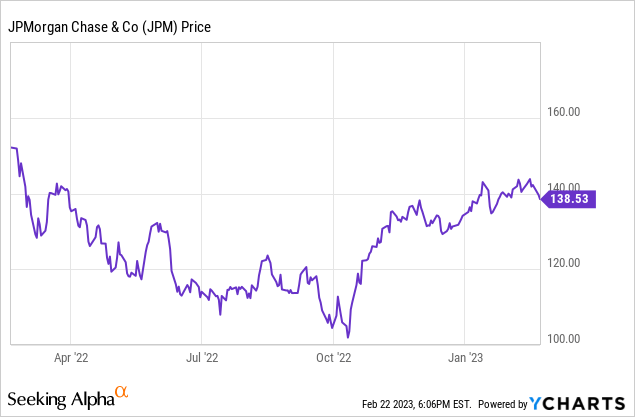

JPMorgan Chase (NYSE:JPM) doesn’t need a long introduction. As one of the most prominent financial institutions in the USA with a global reach, the company is one of the largest in the financial sector with a market cap of in excess of $400B. Although the preferred shares issued by JPMorgan are non-cumulative, they could be an interesting addition to an income portfolio as the dividend coverage ratio and asset coverage ratio are very strong.

JPMorgan ended 2022 on a strong note despite higher loan loss provisions

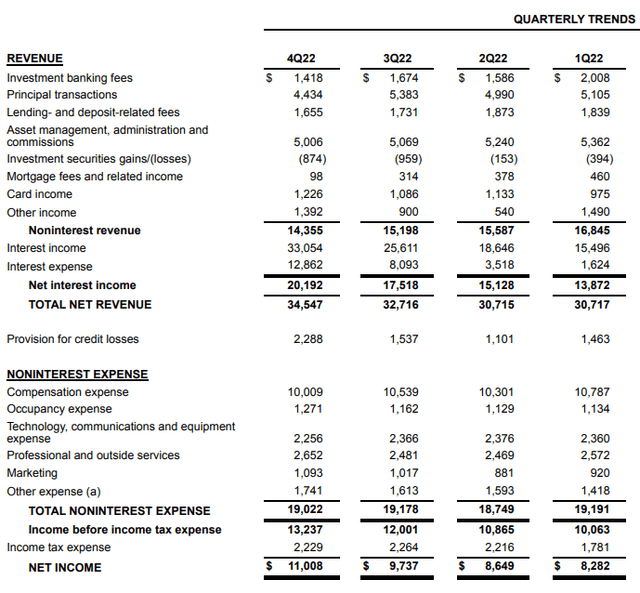

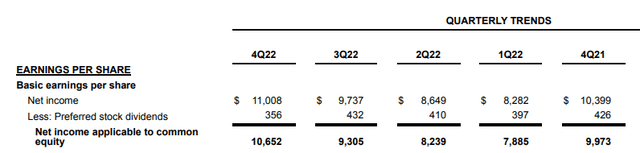

Before discussing the full-year results, it’s important to note the bank’s earnings accelerated throughout the year. Q1 2022 was the weakest quarter of the year with an EPS of $2.64, which subsequently increased to $2.77 in Q2, $3.13 in Q3, and $3.58 in the final quarter of 2022.

That’s good news, as the total amount of loan loss provisions booked by JPMorgan in the final quarter of the year was also much higher than the average in the preceding three quarters. As you can see below, the bank had to record almost $2.3B in loan loss provisions, which is almost as much as in the entire first semester.

This wasn’t an issue as JPMorgan’s financial performance improved tremendously. Although the net non-interest increased by almost 20% compared to the third quarter, the net interest income increased by more than $2.6B. And that was sufficient to report a higher pre-tax income despite the higher expenses and loan loss provisions. The pre-tax income came in at $13.2B while the reported net income for the final quarter of 2022 was $11B.

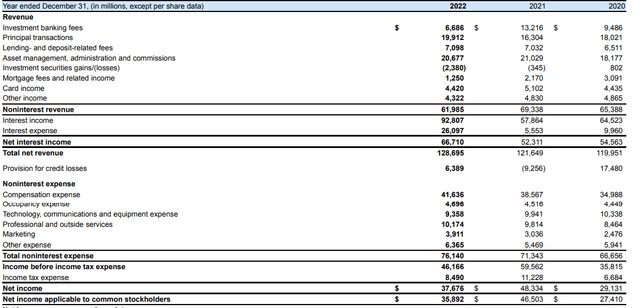

Looking at the full-year results, JPMorgan reported a net income of $37.7B, of which about $35.9B was attributable to the common shareholders.

A substantial portion of the net income that wasn’t attributable to the common shareholders is related to the preferred dividends. As you can see below, JPMorgan pays about $1.6B per year in preferred dividends.

From the perspective of a preferred shareholder, the dividend coverage is excellent. JPMorgan needed less than 5% of its net income to cover the preferred dividends so although they are all non-cumulative in nature, there’s no (financial) reason why JPMorgan shouldn’t continue to make the preferred dividend payments.

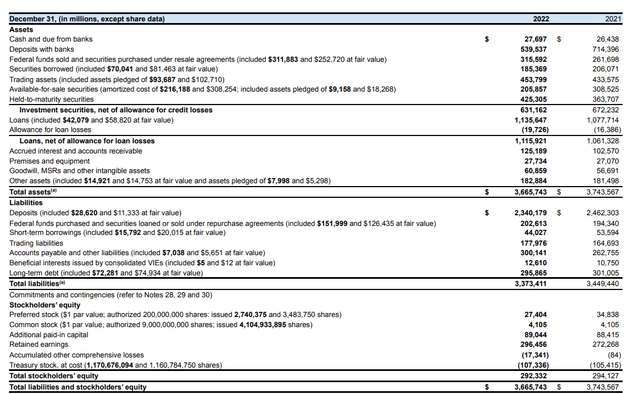

And looking at the balance sheet of JPMorgan, the total amount of preferred equity represents less than 10% of the total equity on the balance sheet.

This means the dividend coverage ratio and the asset coverage ratio are very strong and likely still getting stronger. JPMorgan isn’t issuing new preferred equity and I anticipate the earnings to increase thanks to the higher interest rates (which will improve the dividend coverage ratio even further) while JPMorgan still retains a portion of its earnings on its balance sheet (thus further increasing the amount of equity and the asset coverage ratio).

Revisiting the M-series of the preferred shares

The first time I had a look at the M-Series of JPMorgan’s preferred share category which are trading with (NYSE:JPM.PM) as ticker symbol, I was a little bit underwhelmed. While I liked JPMorgan as a bank and considering the low interest rates at that moment, the 4.2% yielding securities could be seen as ‘somewhat attractive’. I decided to pass as my ‘take home yield’ was less than 2.7% on an after-tax basis (this is a personal situation based on my personal fiscal requirements). And considering the preferred dividends are non-cumulative, it wasn’t a risk I was willing to take.

As a reminder and as I explained in the 2022 article: in the third quarter of 2021, JPMorgan issued 80 million units of its Series M preferred shares. The M-series is a non-cumulative preferred share with an annual preferred dividend of 4.20% per year, which results in $1.05 per share, paid in quarterly installments. The 80 million units have a total value of $2B, so this was a relatively sizeable issue by JPMorgan.

While the yield of 4.20% may be low and the fact the issue is a non-cumulative issue may be a deterrent for some investors, the dividend and asset coverage ratio is pretty strong, as explained above.

As interest rates increased, the share price of the preferred share decreased, and it closed at $18.81 per share on Wednesday. This means this series of the preferred shares is currently yielding approximately 5.6%. And that’s relatively attractive, especially if you expect the Fed will have to walk back its recent interest rate increases.

Investment thesis

I still don’t have a long position in any of JPMorgan’s preferred securities. I was considering it but haven’t made a final decision yet. A 5.6% yield is okay, but not exceptional. In a previous article, I gave the example of (OZKAP), the preferred shares issued by Bank OZK. While Bank OZK of course doesn’t play in the same league as JPMorgan, its preferred shares are offering a yield of 6.5%.

So for now, I am still on the sidelines and I have no position in JPMorgan and no position in its preferred shares. I am following the M-Series (and of course the other preferred issues by JPMorgan as well) closely, but I am in no rush to take any action.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Consider joining European Small-Cap Ideas to gain exclusive access to actionable research on appealing Europe-focused investment opportunities, and to the real-time chat function to discuss ideas with similar-minded investors!