Summary:

- JPMorgan Chase has demonstrated strong operating fundamentals amidst economic uncertainty.

- Management is prepared for a potential recession with sufficient capital to increase CECL reserve.

- With a below-average valuation and a well-covered dividend, JPM could provide investors with potentially strong long-term returns.

JayLazarin

JPMorgan Chase (NYSE:JPM) has done rather well since I last visited it in July. At the time, the stock had fallen out of favor with the market, trading at just $113. However, beauty is in the eye of the beholder, and it appears that my buy rating has done well, with the stock giving investors a 19% total return since then, performing far better than the 1% decline in the S&P 500 (SPY) over the same timeframe. With the stock still trading well off its 52-week high of $170, I highlight why JPM still has plenty to offer at current levels.

Why JPM?

JPMorgan Chase is one of the largest and most influential financial institutions, with a history dating back over two centuries. The company is a global leader in investment banking, financial services for consumers and small businesses, commercial banking, financial transaction processing, and asset management.

What differentiates JPM from the likes of Goldman Sachs (GS) and Morgan Stanley (MS) is its multi-cylinder business approach that’s not overly reliant on deal-making, transactions, and IPOs. This has worked out well for JPM, especially over the last year, as M&A and IPO activity has substantially declined due primarily to higher interest rates and economic uncertainty. JPM’s multifaceted strengths were highlighted by Morningstar in its recent analyst report:

JPMorgan now benefits from an unrivaled combination of scale and scope within the United States. The company has become the largest bank in the country. Within payments, depending on the metric, JPMorgan is generally the largest credit card issuer in the U.S. and roughly tied as the largest U.S. merchant acquirer.

The company’s investment bank is the leading global generator of fees, and JPMorgan’s FICC trading desk remains one of the top global players. The bank also has a national commercial banking platform and its own asset and wealth management operations.

This differentiator is reflected by JPM’s solid performance amidst a tough macroeconomic backdrop with revenue growing by 10% YoY during the third quarter. This was driven by higher interest rates, resulting in strong net interest income of $17.5 billion. Notably, management has guided for even higher NII of $19 billion for the fourth quarter, and JPM is generating solid return on tangible common equity of 18%, helping it to earn an A+ profitability rating in comparison to peers.

Importantly, JPM maintains an A- credit rating from S&P and carries a common equity tier 1 ratio of 12.5% as of the last reported quarter, up 30 basis points sequentially. This sits well above the 4.5% requirement by the Federal Reserve for large banks. It’s worth noting that management is targeting an even stronger CET1 ratio of 13% for the first quarter of 2023.

The strong operating fundamentals and balance sheet lends support to JPM’s 3% dividend yield, which is well-supported by a 34% payout ratio. The dividend also comes with 8 years of consecutive annual growth and an impressive 5-year CAGR of 14.4%. While JPM has kept the dividend the same for the past six quarters, I would expect to see a rise should recessionary concerns ease and a clearer direction from the Federal Reserve.

Risks to JPM include potential for higher loan losses due to a recession. However, management expressed the bank’s preparedness to add $5 to $6 billion to its CECL should the unemployment rate go to 5% to 6%, and that this would be easy to handle. This makes sense, as the additional reserve would just be a fraction of JPM’s quarterly NII.

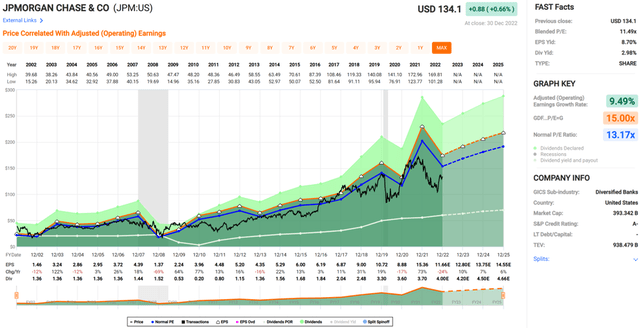

Lastly, a big part of whether a stock is a buy its valuation. At the current price of $134, JPM trades at a forward PE of just 11.6, sitting well below its normal PE of 13.2. I find the current valuation to be attractive, especially considering that analysts expect 9% EPS growth in 2023. Analysts also have a consensus Buy rating, with an average price target of $143.

JPM Valuation (FAST Graphs)

Investor Takeaway

JPM looks attractive at current levels, with the stock trading more than 20% below its 52-week high. Moreover, it has strong fundamentals and balance sheet, which should help it weather potential macroeconomic headwinds. With a well-covered dividend yield, track record of growth, and low valuation, JPM could give investors potentially strong long-term returns from present levels.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am not an investment advisor. This article is for informational purposes and does not constitute as financial advice. Readers are encouraged and expected to perform due diligence and draw their own conclusions prior to making any investment decisions.

Gen Alpha Teams Up With Income Builder

Gen Alpha has teamed up with Hoya Capital to launch the premier income-focused investing service on Seeking Alpha. Members receive complete early access to our articles along with exclusive income-focused model portfolios and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%.

Whether your focus is High Yield or Dividend Growth, we’ve got you covered with actionable investment research focusing on real income-producing asset classes that offer potential diversification, monthly income, capital appreciation, and inflation hedging. Start A Free 2-Week Trial Today!