Summary:

- Abbott Laboratories is back on track with a path to sustained, double-digit growth and the potential for double-digit annual returns.

- The company faced challenges post-pandemic but made strategic investments in R&D and diversified growth avenues.

- Recent earnings reports showed double-digit growth in segments like Nutrition and Medical Devices, with promising margins and positive 2024 guidance.

Kena Betancur

Introduction

Last year, I started covering Abbott Laboratories (NYSE:ABT), a company I should have started covering many, many years ago.

However, better late than never, I initiated bullish coverage on March 20 with the title “Abbott Laboratories: A Dividend King At A Discount.”

Since then, shares are up 18%, including its dividend. The S&P 500 (SP500) has risen 25% during this period, fueled by expectations that the Fed has beaten inflation, potentially allowing the central bank to cut rates no less than six times this year!

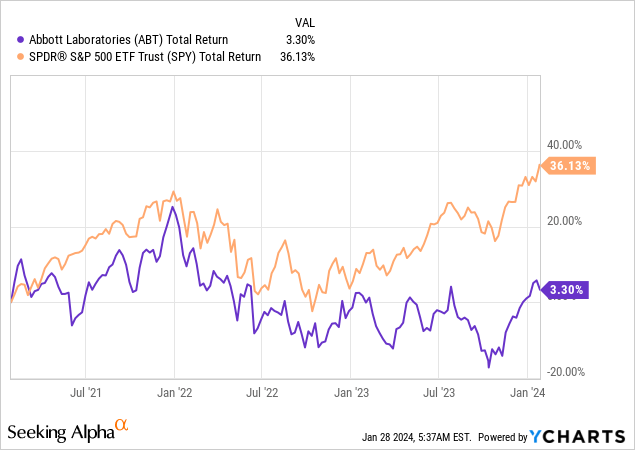

Over the past three years, ABT shares are up only 3%, lagging the S&P 500 by 33 points.

My most recent article was written on November 25, when I called the stock “One of the safest dividend stocks on the market.” Since then, shares are up 10%, beating the S&P 500 by 300 basis points.

One of the problems Abbott has faced is its poor post-pandemic performance, as the company – like many of its peers – was a major beneficiary of the pandemic. While it did very well during that period, tailwinds quickly faded after 2020.

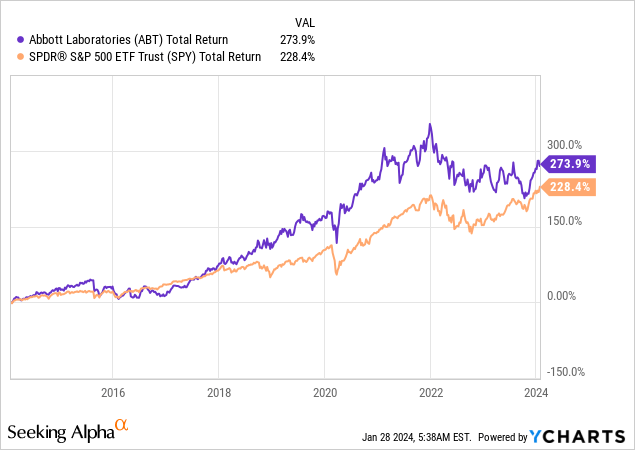

Nonetheless, over the past ten years, ABT shares have returned 273%, beating the S&P 500 by a significant margin.

Now, I believe ABT is back on track.

The company, which just released its quarterly earnings, is seeing a path back to sustained, double-digit growth, which could pave the way for double-digit annual returns, making ABT an attractive bet for dividend growth investors seeking healthcare exposure.

In this article, we’ll discuss all of that and more.

So, let’s get to it!

Abbott Is Back On Track

With regard to the pandemic, this challenging period underscored the resilience of Abbott’s diversified portfolio, with a significant emphasis on establishing a robust COVID testing business.

During the initial pandemic years, the company experienced disruptions, particularly in procedures-driven segments such as Medical Devices and Routine Diagnostic Testing.

Despite these challenges, the company’s Branded Generics Pharmaceutical business remained strong, and the Nutrition business experienced accelerated growth as individuals worldwide prioritized health protection.

Furthermore, back then, COVID-19 testing became a major aspect of the company’s portfolio, representing nearly 20% of sales in both 2021 and 2022.

As one can imagine, this unexpected shift in focus temporarily changed the company’s identity.

The headline from August 26, 2020, below, shows that Abbott was at the right place at the right time with the right product. Things could not have gone better for this company back then.

With that said, as we already discussed, once the pandemic faded, Abbott had to manage a massive transition, which resulted in poor stock price performance since then.

It also didn’t help that its stock had gotten way too expensive during the pandemic.

During its recent earnings call, the company noted that in order to manage this transition, investments were accelerated in various areas, most notably in the Research and Development pipeline.

The R&D strategy focused on diversifying growth opportunities, resulting in the announcement of over 25 new avenues for expansion.

These included the development of new products, exploration of new indications, and expansions into different geographic regions.

- Established Pharmaceuticals (“EPD”) agreements were reached to commercialize biosimilars in emerging markets.

- The Nutrition segment continued investing in science-based solutions, particularly targeting the fast-growing Adult Nutrition segment.

- In Diagnostics, approvals were secured for new tests, instruments, and a laboratory automation solution.

- Meanwhile, the Medical Devices segment saw the announcement of ten new product approvals, further enhancing the growth outlook.

These measures are now benefitting the company on its path to sustained post-pandemic growth.

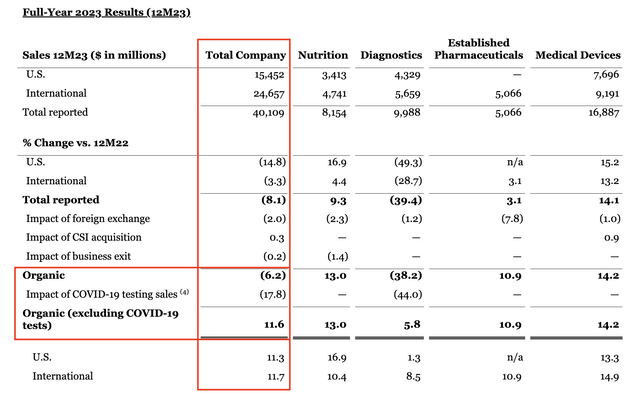

For example, in 2023, sales excluding COVID testing experienced double-digit growth every quarter and concluded the year 12% higher than the original high-single-digit growth guidance. I highlight this in the table below.

Adjusted earnings per share for the year reached $4.44, surpassing the midpoint of the original guidance range.

- The Nutrition segment witnessed a 14% increase in sales, driven by robust growth in Pediatric Nutrition and Adult Nutrition.

- In EPD, sales increased nearly 9% in the quarter and 11% for the full year, marking the third consecutive year of double-digit growth.

- Diagnostics, despite seasonality impacts, saw nearly 10% growth in Core Lab Diagnostics, driven by the success of the Alinity suite.

- Medical Devices, which may be my favorite segment, achieved sales growth of over 15% in the fourth quarter. The continuous glucose monitoring system, FreeStyle Libre, achieved major success, with sales surpassing $5.3 billion, establishing itself as the most successful medical device in history. Furthermore, growth was strong in various other Medical Device businesses, including Electrophysiology, Rhythm Management, Structural Heart, Heart Failure, and Neuromodulation.

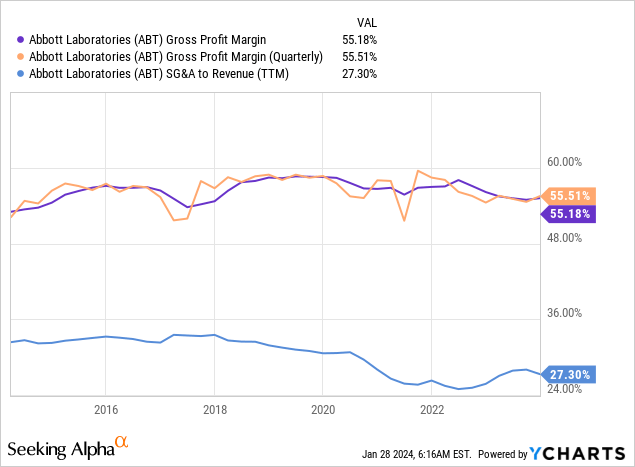

With regard to margins, the adjusted gross margin ratio was 55.9% of sales, while R&D spending came in at 6.1% of sales.

Adjusted Selling, General, and Administrative expenses (SG&A) were 26.3% of sales.

In general, margin developments are promising, especially because the company’s SG&A spending trend is encouraging.

However, there’s more work to be done to achieve pre-pandemic margins.

What’s Next?

Looking forward to 2024 from a financial perspective, the company issued guidance for full-year adjusted earnings per share in the range of $4.50 to $4.70.

This guidance included a first-quarter forecast of $0.93 to $0.97.

Total underlying base business organic sales growth, excluding COVID testing sales, is expected to be in the range of 8.0% to 10.0%.

This also bodes well for its dividend!

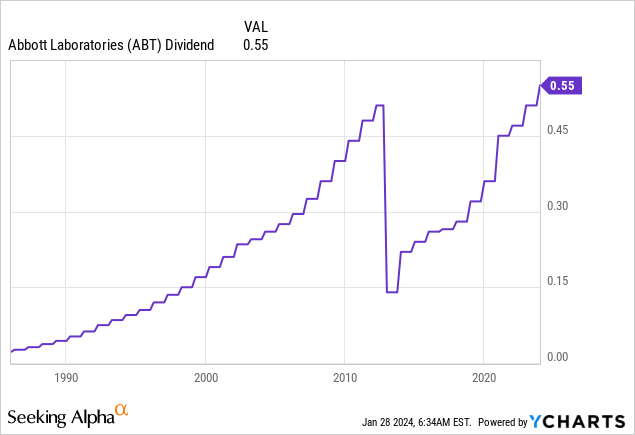

Abbott, which is a dividend king with more than 50 annual dividend hikes, hiked its dividend by 7.8% on December 15, 2023.

It currently yields 2.0%, based on a $0.55 per share per quarter dividend.

The five-year dividend CAGR is 12.4%, supported by a sub-50% payout ratio based on 2024 guidance.

Please note that the dividend “decline” in the chart below shows the AbbVie Inc. (ABBV) spinoff. Investors who held both did not suffer a decline in their dividends – especially not because both ABBV and ABT have hiked their dividends every year since then.

Furthermore, the company has a credit rating of AA-, which is one of the healthiest ratings on the market across all sectors.

Valuation-wise, we see that analysts expect the company to see accelerating EPS growth, which bodes well for its potential total return and dividend growth.

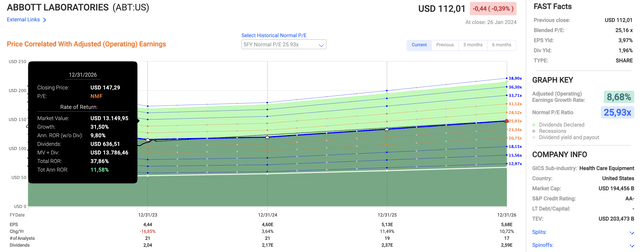

Using the data in the chart below:

- ABT is currently trading at a blended P/E ratio of 19.4x.

- The company’s five-year normalized multiple is 25.9x.

- This year, the company is expected to generate $4.60 in EPS, which means analysts agree with the company’s guidance midpoint. This implies a 3.6% EPS growth rate.

- Next year, EPS growth is expected to be 11.5%, potentially followed by 10.7% growth in 2026.

- As I believe that its five-year normalized earnings multiple is fair, the company could return more than 11% per year through 2026, which is based on the expected EPS growth trajectory, its dividend, and a 25.9x multiple.

Since 2004, ABT shares have returned 10% per year.

All things considered, I’m currently not long ABT, as I simply missed buying weakness last year – despite my bullish stance on the company.

I hope to add ABT to my portfolio this year, preferably on a correction.

Takeaway

Abbott Laboratories faced post-pandemic challenges, but strategic investments in R&D and diversified growth avenues are steering the company back on track.

The recent earnings report showed double-digit growth, especially in segments like Nutrition and Medical Devices.

Margins are promising, and 2024 guidance suggests continued financial strength.

Meanwhile, as a Dividend King, ABT’s recent 7.8% dividend hike, coupled with a solid credit rating and positive valuation outlook, makes it an appealing choice for investors seeking healthcare exposure.

Despite missing the buying opportunity last year, the potential for over 11% annual returns through 2026 makes ABT a compelling addition to my portfolio.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ABBV either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas’ FREE book.