Summary:

- KLA stands to benefit from an upcoming wave of demand for their inspection units compatible with the latest lithography technologies.

- A considerable portion of KLA’s installed base is transitioning from warranty to service contracts, promising a robust increase in service segment revenue.

- The company is well-positioned to capitalize on long-term secular tailwinds driven by the ever-growing demand for data in today’s digital world.

SweetBunFactory

Investment Thesis

KLA Corporation (NASDAQ:KLAC) is an important player in the Wafer Fabrication Equipment ‘WFE’ market, specializing in inspection and metrology tools crucial to quality controls. The company is positioned for growth as the industry braces for recovery, propelled by burgeoning technologies such as generative AI, autonomous driving, and IoT, which promise increased demand for data processing.

After a phase of intensive capacity expansion, semiconductor manufacturers are navigating a temporary capex contraction as supply-demand rebalances. Nonetheless, the industry is expected to bounce back, driven by escalating computing demands. With a market share of approximately 6-7% of global semiconductor capex (higher in the metrology and inspection equipment tools market), KLA is well-positioned to capitalize on these trends.

Investing Up The Supply Chain

KLA’s sales show a strong, direct correlation with the global semiconductor industry’s capex, a common trend among leaders in the WFE market. Notably, KLA’s sales are 93% correlated with global semiconductor capex, aligning closely with industry counterparts: Applied Materials, Inc. (AMAT) at 99%, Lam Research Corporation (LRCX) at 97%, and Tokyo Electron Limited (OTCPK:TOELF) at 90%. This high degree of correlation with a single variable is unusual in the financial world, reflecting the distinctive dynamics of the semiconductor industry.

First, a relatively small number of leading players in the WFE serve an equally small number of global customers. This global scope limits the impact of regional economic variations.

Secondly, each of the leading WFE companies has either found a niche market targeting one of the main fabrication processes (deposition, etching, lithography, implantation, and testing) or established relations with one or two leading manufacturers. For example, KLC found its niche in quality control testing, with its Series 295x Inline Defect Inspection device being the industry standard. ASM International NV (OTCQX:ASMIY) found its niche in the Atomic Layer Deposition market, where it commands a 55% market share; Tokyo Electron has a 100% market share in the Coater/Developer market, while ASML Holding N.V. (ASML) has a 100% share in the EUV lithography. This is not to say that competition doesn’t exist. Still, given that all these equipment and processes are part of the fabrication process, the correlation with global capex semiconductor spending is high.

Finally, KLA works closely with its customers to refine the wafer fabrication process, reducing the risk of strategic errors. The benefits of this approach shine when compared to the market dynamics of microchip design companies. For example, Intel Corporation’s (INTC) strategic mistakes culminated in a significant loss in market share.

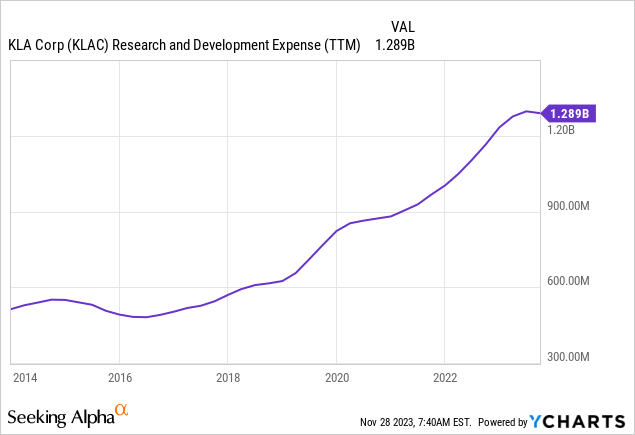

This touches on KLA’s R&D expenditures, which the company expects to rise. Working close to semiconductor manufacturers requires significant technological expertise, intellectual property, and financial resources, creating high barriers to entry. Smaller peers don’t have what it takes to buy a seat at the R&D meetings that KLA hosts with its clients.

Performance and Outlook

With a modest decline in the June quarter, KLA’s performance surpasses TOELF and LRCX’s 30% plummet and is comparable with AMAT’s 1.5% dip. However, it trails ASM’s 25% revenue boost inherent from its LPE acquisition. In the September quarter, KLA did relatively well (12% sales decline), again outperforming LAM and TOELF but underperforming AMAT.

Beyond these quarter-to-quarter short-term discrepancies, the sales correlation should return to normal. Tokyo Electron and Lam have sizable exposure to the memory market, which is sensitive to demand for consumer electronics. This segment has experienced a significant decline in the past few quarters, impacted by higher cost of living and interest rates. Now that sales have corrected, the broader industry trends are in effect.

KLA’s outlook for the December quarter points to a relatively moderate decline in sales between 12% – and 20%. The memory market is at historical lows, and there is no indication that customers plan to increase capacity soon.

However, KLA derives nearly a quarter of its revenue from services that depend on the installed instrument base size instead of equipment sales. This creates a cushion during downturns. The company expects revenue from the services segment to increase after a chunk of its installed units move from warranty to contract service.

Another catalyst is the technological advancements of its peer, ASML Holding N.V. (ASML). KLA anticipates a wave of new tool and system adoptions due to the technology transitions pioneered by ASML, manifested in the rollout of Extreme Ultraviolet ‘EUV’ lithography equipment used to draw electric circuits as small as 3 nanometres in width. 3nm semiconductors are now being used in Apple Inc.’s (AAPL) latest devices, iPhone 15 Pro and Pro Max, and are slowly becoming more popular in other applications reliant on high-performance computing.

Share Buybacks and Dividend Policy

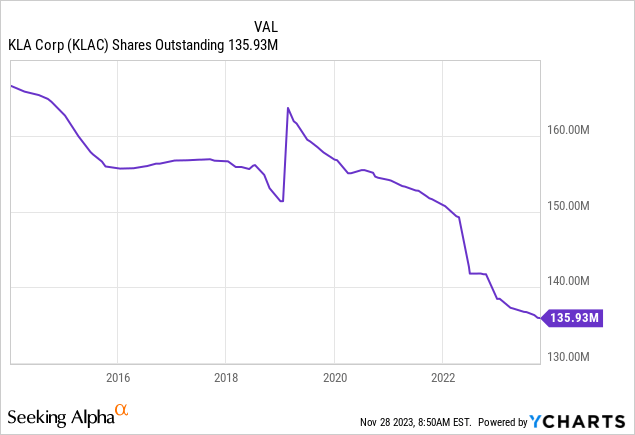

While not explicitly detailed, KLA’s share buyback initiative is a significant aspect of its shareholder value proposition. Over the past decade, KLA has reduced its shares outstanding by 18%.

The dividend policy is more detailed, with KLA committed to growing its dividends, which is evident in the September dividend hike, its 14th consecutive year of growth. Among its peers, KLA is one of the few committed to a dividend growth strategy, given the challenges arising from the sector’s cyclicality. Tokyo Electron’s policy is to distribute 50% of net income as dividends, which naturally translates to variable dividend distribution. Applied Materials is committed to stable dividends rather than dividend growth. ASM’s dividend policy is comparatively variable, adjusted each year depending on capex requirements and industry cycle. While each company has its own unique capital allocation policy, all share a focus on returning capital to shareholders during good times, assuaging the cyclical nature of the sector.

Valuation Risk

KLA is currently somewhat expensive, trading at a forward EV/EBITDA ratio of 19x and a forward Price/Sales ratio of 7.5x. These figures are on the higher end, particularly for a company in a cyclical industry. KLA stock has seen a substantial 45% increase this year, lending to a valuation surpassing the company’s typical range in prior years. However, in the context of its industry, KLA’s valuation appears more justified, as it falls within the lower spectrum of its peers’ average valuations.

| Fwd EV/EBITDA | Sales Growth (5-year avg.) | |

| KLA | 19x | 22% |

| ASMI | 26x | 30% |

| AMAT | 16x | 11% |

| LRCX | 21x | 13% |

| ASML | 26x | 21% |

| TOELF | 23x | 13% |

Moreover, KLA’s valuation gains a more favorable perspective when its growth trajectory is considered. Over the past five years, KLA has demonstrated robust growth, with a 22% average annual increase, ranking second in its peer group, only behind ASMI, whose growth has been significantly driven by acquisitions. This impressive growth rate, particularly compared to its peers, helps rationalize KLA’s current market valuation despite its seemingly high price metrics.

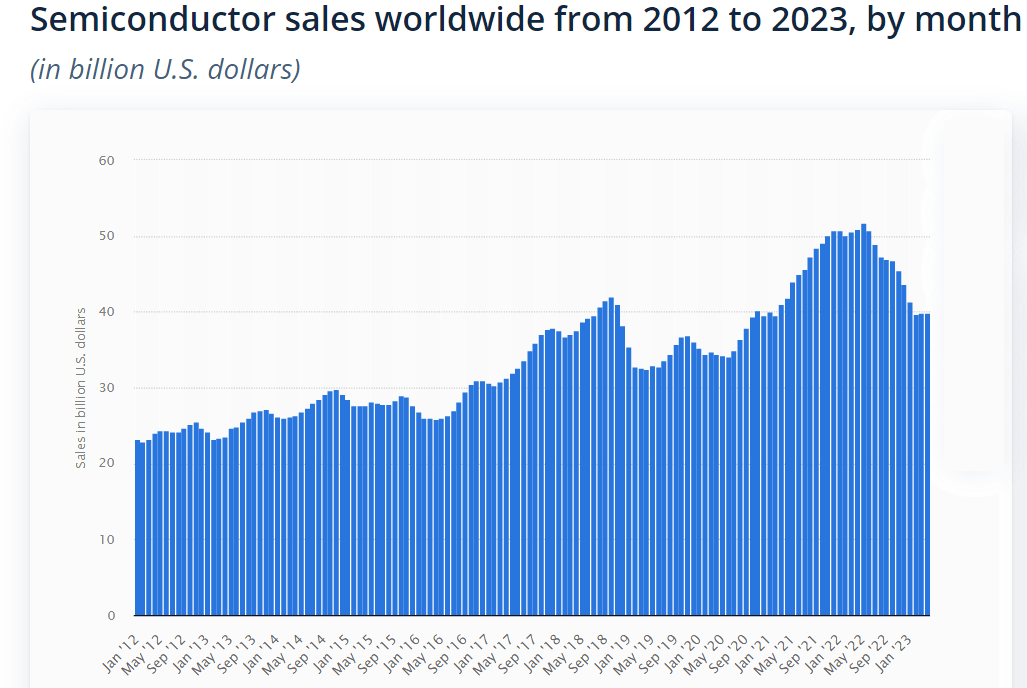

Our buy hypothesis is predicated on long-term secular tailwinds, manifested in an exponential demand for computing capacity driven by new technologies such as AI, Cloud Computing, IoT, and Sustainable Energy. In the medium term, we expect that the increased adoption of ASML’s High NA Lithography equipment to create the next wave of demand for KLA’s metrology and inspection tools. High NA requires exceptional flatness of the wafer surface, a feature inspected by KLA’s tools. In the short term, a recovery of consumer spending will help increase utilization, boding well for KLA’s service segment sales, followed by a gradual recovery of equipment revenue. To monitor the validity of our hypothesis, we will continue watching semiconductor demand.

Statista

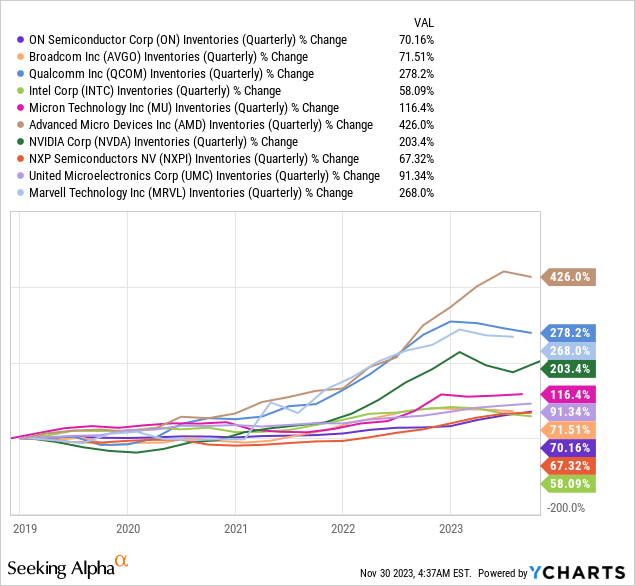

We will also continue to watch inventory levels of semiconductor designers and manufacturers, which offer a leading indicator of utilization levels influencing KLA’s service sales.

Summary

The WFE market is experiencing a temporary slowdown after a period of rapid capacity expansion. However, long-term secular tailwinds remain strong, with demand for semiconductors expected to surge to $1 trillion by 2030, up from $580 billion in 2022, suggesting a robust horizon for KLA’s specialized offerings. The company’s sales are closely aligned with its customers’ capex decisions, creating a cyclical demand for its Metrology and Inspection equipment. However, nearly a quarter of revenue comes from services that are independent of unit sales and instead influenced by the size of its systems’ installed base, creating a cushion against this cyclicality. Management expects service revenue to increase as a chunk of its installed base transitions from warranty to service contracts. The second revenue catalyst stems from the expected increase in system sales for high-tech instruments compatible with the latest lithography techniques developed by ASML. Beyond sales expectations, KLA is also good at managing demand cycles with a flexible cost structure. KLA has never reported a loss since 1990. KLA’s market position, flexible cost structure, accommodative long-term secular tailwinds, medium-term EUV technology catalysts, and short-term service contract transition create an attractive opportunity for KLA.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.