Summary:

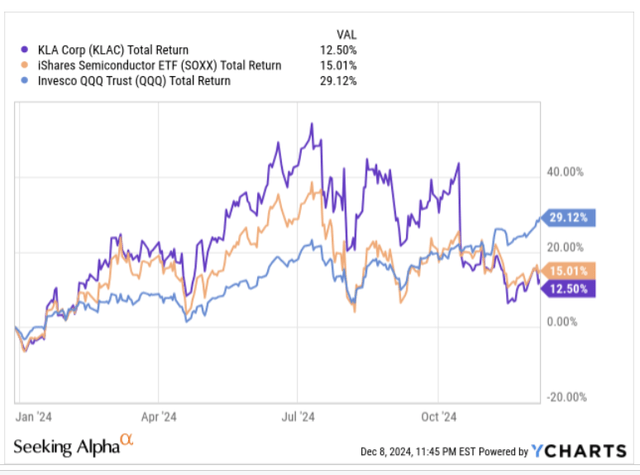

- After a robust first 9 months, KLA Corp. is now underperforming the Nasdaq by a significant margin.

- KLAC’s largest region – China is likely to see a slowdown in WFE spending, even as the US expands export controls.

- Despite Chinese market woes, the North American region driven by leading-edge chip momentum and advanced packaging demand offers some optimism for KLAC’s future performance.

- KLAC’s forward P/E valuations are now in line with its long-term average of 21x, but from an FCF yield and dividend yield perspective, it is still not attractive.

- On the weekly chart, the stock has broken a two year trendline, while momentum indicators on the daily chart don’t look good.

leezsnow/E+ via Getty Images

A Disappointing Close to 2024

The stock of KLA Corporation (NASDAQ:KLAC), a semiconductor capital equipment entity, noted primarily for its expertise in semiconductor-related process control work, hasn’t had the most dazzling of years. In fairness, up until October, KLAC was on a roll, outperforming both its peers from the semiconductor terrain, as well as the Nasdaq, but it all appears to have gone pear-shaped from mid-October, so much so that on a YTD basis, KLAC is now not even generating half the returns of the benchmark index, while underperforming its close peers by ~250bps.

Could 2025 see a reversal in fortunes, or is this bout of underperformance here to stay?

China Market Woes

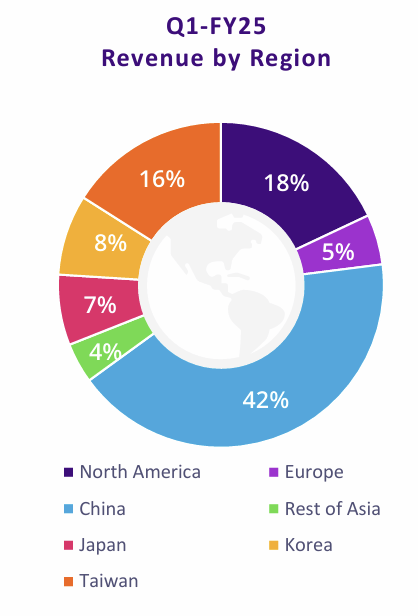

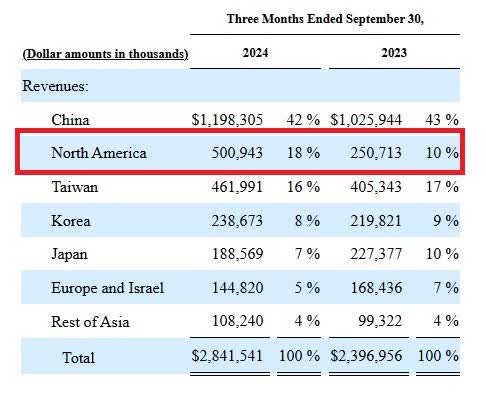

Well, it’s difficult to expect the market to view a company in a positive light, when that company’s largest regional exposure is likely to face challenges. In KLAC’s case, that is the Chinese region, which contributed a mammoth 42% of total group topline in Q1-25.

Q1-25 Presentation

For the current quarter (Dec 2024), KLAC management had first suggested that the Chinese contribution to the overall pie would dip to the mid-30s levels, with further attrition next year, closer to the 30% levels (with a +/-200bps variance). To be clear, KLAC management initially didn’t believe that the dollar value of Chinese sales would fall of a cliff (the Chinese share in the overall mix was likely to be impacted by a pickup from other areas), and were actually guiding to a flattish development there, buttressed by “pretty stable” investment levels.

However, last week, we saw the US come out with further export controls on various chipmaking tools and equipment to China, which could likely send the contribution of Chinese sales in KLAC’s mix down to the low 20s percentage. This is still a very fluid situation, and the eventual outcome could be a lot worse or better (the concerned licensing terms with its Chinese clients may still offer opportunities for KLAC to provide support services) than initially expected, but in last week’s Wells Fargo TMT event, the CFO of KLAC pegged the “preliminary” FY25 calendar impact of this development at around $400-$600m (there won’t be any immediate negative impact in the current quarter which is still expected to be the 3rd straight quarter of sequential revenue growth for KLAC as a whole).

As things stand, consensus is largely sitting on the fence, and has only brought down next year’s sales estimates by less than -0.5%, whereas a $400-$600m impact potentially represents a 2-5% negative impact on KLAC’S annual topline.

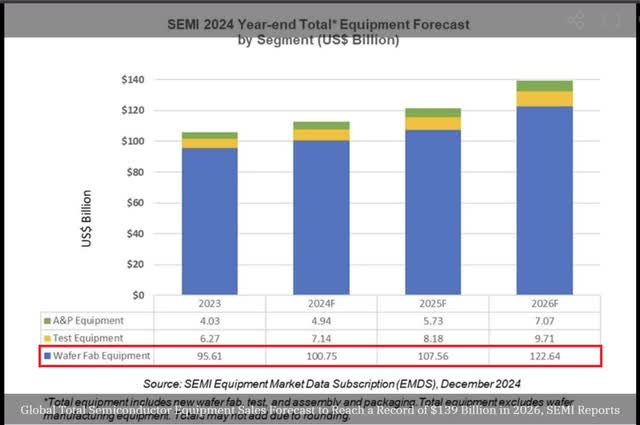

Even before this news came out, some members of the sell-side community were already suggesting that YoY spending on Chinese WFE (Wafer Fab Equipment) was likely to slow by 5% to $41bn in FY25 (mainly on account of a pull-forward of spending in recent years), leaving a mark on overall WFE spending. However, note that the official semiconductor industry body – SEMI, which came out with a forecast just today believes that despite a slowdown in the Chinese WFE investments, the overall global WFE spending for the global market could still grow by an impressive 7% (at $107.6bn), better than the 5.4% growth that will be seen by the end of FY24.

Nonetheless, we feel it would be too soon to believe that the Chinese market weakness has been digested by the markets, as the Trump regime hasn’t yet got going, and under his stewardship, things are unlikely to get better.

Leading-Edge Chip Momentum, And Advance Packaging Demand, Could Serve As Mitigating Sub-plots

The Chinese market may be on the way down, but investors can take heart from the fact that the North American region, which only accounted for 10% of KLAC’s total revenue last year, has doubled, and is now the second-largest region after China (contributing 18% of Q1-25 sales or over $0.5bn). Much of this is driven by AI-related momentum and High-Performance Computing (HPC) requirements, which are innately more complex and will necessitate the need for even more process control intensity.

10Q

We would expect this region to continue to build clout, given the impetus by the US to cultivate a leading-edge logic chip manufacturing hub (from no exposure last year, the US is now targeting 20% market share in leading-edge chips by 2030). In fact, KLAC management highlighted that in Q1-25, this was the chief driver of sales for their North American segment, and that the quarter was characterized by requests from their leading-edge customers for “more systems than they’d originally planned for”.

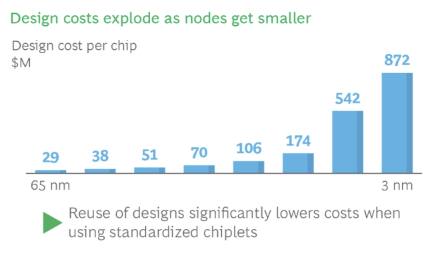

Besides the tailwinds from leading-edge momentum, investors may also be comforted by KLAC’s competence in advanced packaging, a tech which is going to see a lot of takers, given how effective it can be in bringing down chip manufacturing costs and power consumption even as design costs on smaller semiconductor nodes get more prohibitive.

BCG

This advanced packaging business, which accounted for $300m of KLAC’s annual sales last year, is currently growing at a pace of 67% YoY in FY24 (at $500m), and next year, it could end up growing by another 50%, while also crossing the $750m mark! $250m of additional sales could be a great boon when the Chinese exposure is expected to take a $500m hit next year.

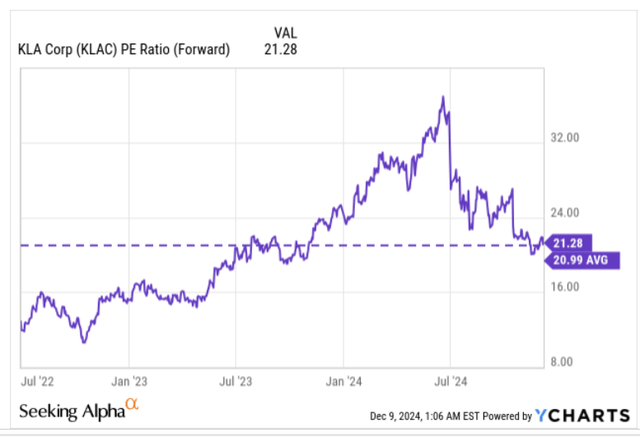

Valuations Are A Mixed Bag

What the sell-off in KLAC has made the forward valuation picture a look more palatable. 6 months back, this was a stock priced at over 35x P/E, but now it is priced at just a marginal premium over its long-term average of 21x. Crucially, it is no longer one of the priciest names in the semiconductor industry, where the current forward industry average multiple of 29x is around 38% higher.

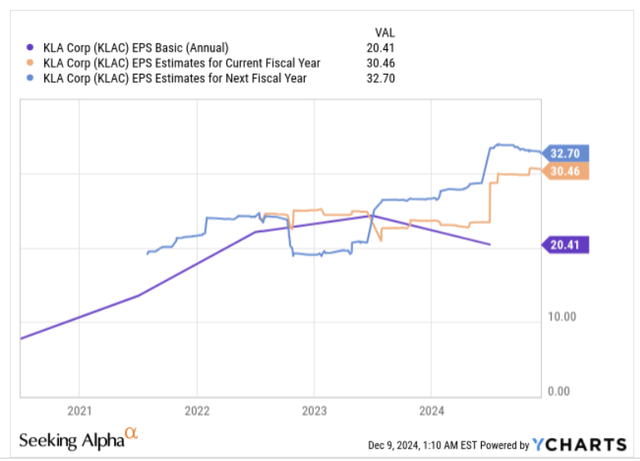

Investors may also be enthused to note that for the current multiple of 21x, they are still getting an attractive cadence of earnings growth over a two-year duration. The image below showcases reported earnings as well as earnings estimates two years out, and what we can infer is that is a business that will likely provide 2-year earning CAGR of 27%. This would translate to a lowly forward PEG (Price-to-Earnings Growth) of just 0.77x.

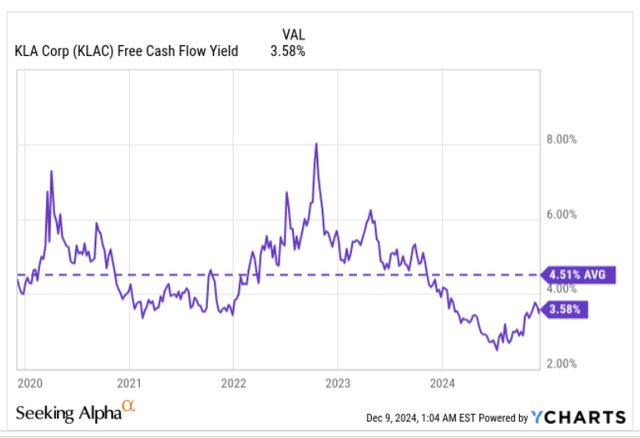

Having said that, investors may want to note that on an FCF yield basis, KLAC still doesn’t look too attractive relative to what it has traditionally yielded (currently roughly 100bps lower than the 5-year average of 4.58%).

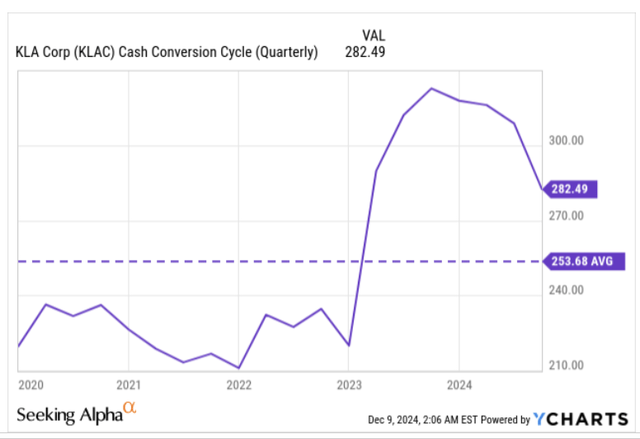

Don’t get us wrong, FCF generation is still robust enough (they are currently converting an impressive 33% of sales and 95% of net profits to free cash), but what it tells us it that the market-cap is still at a relatively high threshold. There’s still scope for KLAC to get better on the FCF front, as the number of days that cash is tied up in working capital work is still quite high by historical standards (11% higher than the 5-year average)

Then we’ve previously talked up KLAC’s stellar dividend profile, but despite an impressive hike of 17% recently, the current yield is still lagging the 4-year average of 1.08% (which once again is a reflection of a steep share price/market-cap effect)

What Do The Charts Suggest?

If you’re someone who takes a cue from the charts, you’d note that it’s probably not the best time to exhibit some bravado, even if the P/E valuations are in a better place.

Firstly, note the developments on the daily chart, which suggest a shift in momentum indicators. Since November 2022, KLAC had managed to defend the psychologically key 200DMA (the blue line), but that is no longer the case. Now it is trading below all three key moving averages, with even the death cross taking place in November (usually a catalyst for further bearish pressure). What may also be rather dispiriting to note is that during the sell-off in November, KLAC’s CEO decided to sell some of his holdings to the tune of $9.5m (the first time any insider has resorted to any selling since August).

On the larger time frame weekly chart, also note that from the start of Q4-22 through Nov 2024, the price had been bouncing against an ascending trendline, every once in a while, but we’ve finally seen this give way, with the price not quite able to recoup the old trendline.

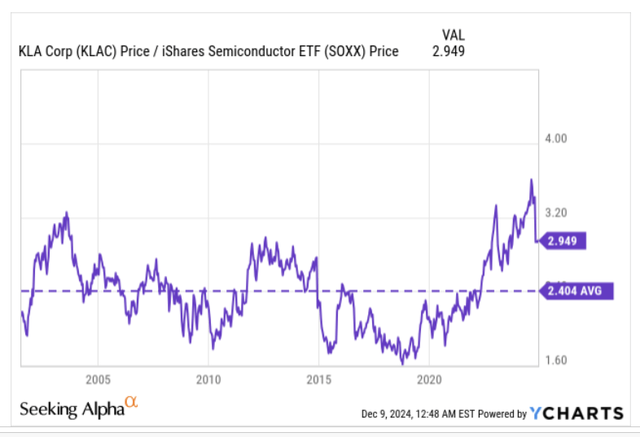

Finally, the relative strength charts, which capture KLAC’s positioning versus it semi peers, tell us that, whilst it no longer looks like one of the most overbought stocks in this universe, the current relative strength ratio still has further scope to normalize, given that it is still around 22% higher than its two-decade old mean value of 2.4x.

Closing Thoughts

To sum up, at current price levels, where the valuations are a bit more palatable than six months ago, we don’t feel an investment in KLAC will be a disaster, but considering the uncertain Chinese market risks, which is their largest region, (which could prompt more earnings revisions going forward), we would prefer to sit on the fence. KLAC is a HOLD for now.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.