Summary:

- KLA Corp is expected to benefit from long-term growth trends in chip manufacturing, process complexity, and the advanced packaging market.

- The stock price may be overvalued due to industry momentum, and FCF and ROE growth need to be monitored.

- Initiating coverage with a Hold rating due to KLAC’s slowing growth rates and potential overvaluation.

- My analysis specializes in identifying companies that are experiencing growth at a reasonable price. Rating systems don’t consider time horizons or investment strategies. My articles aim to inform, not to make decisions.

praetorianphoto/E+ via Getty Images

Investment Thesis

KLA Corp (NASDAQ:KLAC) CFO Bren Higgins was at the J.P. Morgan (JPM) Global Technology, Media, and Communication Conference at the beginning of this week. At the conference, he discussed how the company is expected to benefit from several long-term growth trends, including rising capital intensity in chip manufacturing, increasing process complexity at advanced nodes, and growth in the advanced packaging market.

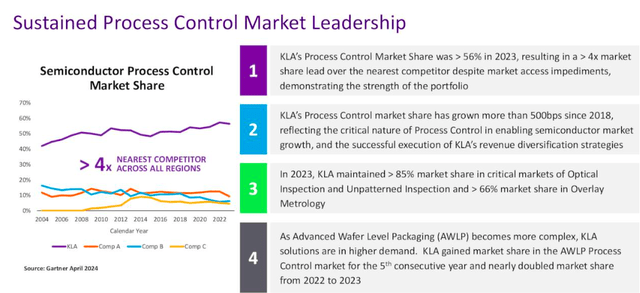

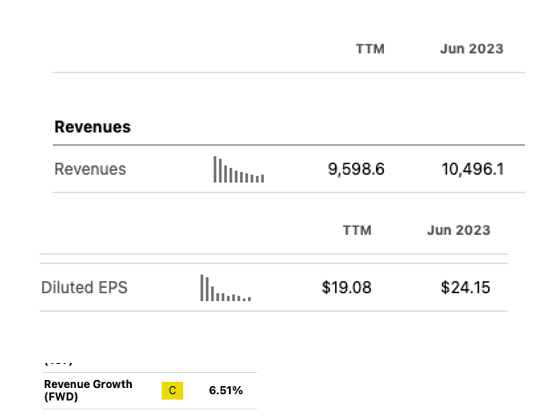

KLAC has a strong market share, financial reports show a focus on R&D, and a resilient services business position it well to capture this growth. According to the company’s latest guidance, financial targets for 2026 are $14 billion in revenues, 63% gross margins, and $38 in EPS remain achievable despite a recent industry slowdown, according to Higgins. This would represent a high-growth rate from current numbers. As you can see below, that would be an approximate 40% jump in revenue and 57% increase in EPS.

SeekingAlpha

However, I believe there are some factors to consider. The recent industry slowdown and potential macroeconomic headwinds could impact revenue growth. KLAC has acknowledged this, with forecasts showing a slowdown to only a 6.51% growth on a forward-looking basis. To achieve their ambitious $14 billion target by 2026 they would need a higher growth rate.

The stock’s current valuation might not fully reflect the company’s growth prospects. The stock seems to be hitting new all-time highs constantly, potentially due to momentum created by accelerated demand in the semiconductor space.

SeekingAlpha

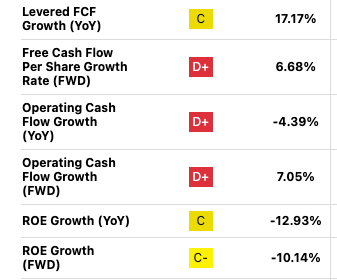

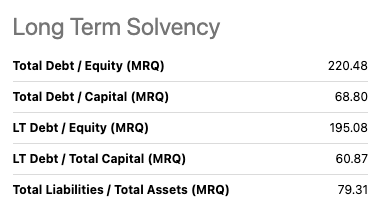

Another area of concern is KLA’s high debt level, which has been used to fund R&D and capital expenditures. While these investments appear to be paying off in the form of maintaining market share, and that I consider their debt under control according to their latest earnings presentation, a bad year could be problematic. This increase in debt has already impacted their ROE growth, resulting in a decrease of -12.93% on a YoY and is expected to continue decreasing. On the positive side, FCF has been increasing, which helps mitigate concerns about the high debt level.

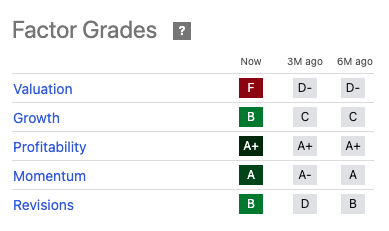

Given the momentum factors in the semiconductor industry, the market might have gotten ahead of itself, dragging the price of KLAC to overbought territory. This is further supported by their PEG ratio, which is higher than the industry average on a forward-looking basis (2.76 vs 2.0) and the Seeking Alpha valuation grade. For these reasons, I am inclined to start coverage with a Hold until I see some price correction.

SeekingAlpha

Management Evaluation

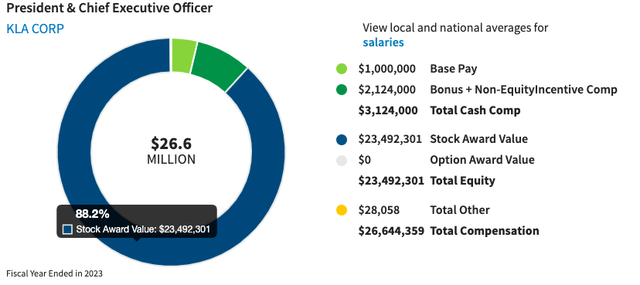

Rick Wallace is a seasoned executive with over 30 years of experience with the company. He currently leads KLA Corp as both CEO and President, and sits on their board. Wallace started his career at the company as an application engineer in 1988 and steadily climbed the ranks through various leadership roles. He is also on the board of other companies in the industry. I believe he has a very “high alignment ratio” given his tenure with the company and that 88% of his compensation is in the form of stock awards.

CFO Bren Higgins, with over 25 years at KLA in various senior finance roles, oversees the company’s financial health. The company has been increasing debt to fund investments, with a current D/E with over 200% that’s impacting ROE. This raises concerns, but it’s also important to consider the company’s current strong momentum. This high debt level might not be an immediate threat, but it warrants close monitoring to ensure sustainable growth.

SeekingAlpha

Overall, I believe KLA Corp Management team seems committed to be the company’s long-term success, as evidence by Wallace’s alignment and positive employee sentiment on Glassdoor. However, there’s room for improvement in managing the company’s financial structure, particularly regarding the high debt level and ROE. Considering all the factors, I am inclined to give KLA management team a “Meets expectations”.

Glassdoor

Corporate Strategy

KLA enjoys a dominant position in yield management, a crucial stage in chipmaking that ensures high-quality water production. This dominance is built upon their leadership in process control. KLA’s tools and expertise enable chipmakers to monitor and optimize their manufacturing process in real-time, minimizing defects and maximizing yield. This leadership translates to strong customer relationships and a reputation for innovation, taking on smaller competitors like Onto Innovation (ONTO) and Camtek (CAMT) that have more niche markets. Their strategy leverages this dominance to expand into new areas like advanced packaging and emerging technologies, aiming to solidify their position as a leader in the evolving semiconductor landscape. However, dependence on mature markets and high debt levels remain challenges.

I have created the table below to compare their strategy to bigger competitors:

|

KLA Corp |

LAM Research (LRCX) |

Applied Materials (AMAT) |

ASML Holding (ASML) |

Samsung Electro-Mechanics (OTCPK:SSNLF) |

|

|

Current Strategy |

Leverage leadership in yield management to expand into new areas like advanced packaging and emerging technologies |

Focus on customer collaboration and developing next-gen deposition and etching tech for advanced nodes |

Diversified product portfolio across chipmaking. Invest in R&D for advanced materials and process control |

Maintain dominance in lithography systems and develop next generation EUV technology |

Integrate vertically within Samsung chip ecosystem and expand into broader market segment |

|

Advantages |

Dominant player in yield management. Strong customer relationship. Focus on innovation. |

Expertise in deposition & etching processes. Strong R&D capabilities. Global presence. |

Broad product range in the industry. Leading position in several segments. Strong brand recognition |

Unmatched expertise in lithography. High barrier to entry. Strong financials |

Cost advantages within Samsung supply chain. Growing presence in advanced packaging |

|

Disadvantages |

Reliant on mature markets. High level of debt |

Vulnerable to chip market fluctuations. Lower market share compared to KLA |

Lower margins compared to some competitor. Complex organizational structure |

Limited product portfolio. Reliant on few major customers |

Limited brand recognition outside of Samsung ecosystem. Reliant on parent company success |

Source: From companies’ website, presentations, SeekingAlpha

Valuation

KLA Corp currently trades at around $780 and has appreciated around 20% after reporting earnings in late April.

Employing a conservative 11% discount rate (r). This represents a hurdle rate that an investor expects to receive, considering time value and inherent risk of that investment. To calculate it, I used a 5% rate for time value in addition to a 6% average market premium.

Then, using a simple 10-year two staged DCF calculator and I reversed the formula to obtain its implied FCF growth rate, which is around 20%.

$780 = sum^10 FCF (1 + “X”) / 1+r) + TV FCF (1+g) / (1+r)

*I added Book Value in the calculation

That is, the market currently anticipates KLAC FCF to grow at 21.5% this year. However, KLA Corp expected FCF growth is 6.68%. So, valuation seems to be overvalued

SeekingAlpha

Technical Analysis:

The stock price has positive momentum and seems to be hitting all-time highs since the last earnings report due to the positive momentum in the semiconductor industry. However, the company expected growth rates as described above are not reflecting that now. For this reason, I believe the stock might still continue to see positive momentum; however, I will stay off until there is a sign of weakness. I believe in the long-term story just not at this price. I will consider a sign of weakness as an opportunity for buying and consider it to start looking attractive around $700.

Next earnings report is estimated to be July 26.

Takeaway

KLA Corp. shows promise for long-term growth in the chip industry, but there are concerns. Strong market share, R&D focus, and a resilient services business position them well. Ambitious 2026 targets seem achievable. However, a recent industry slowdown and high debt raises need to be monitored. The stock price might be inflated due to industry momentum. While management seems committed, FCF and ROE growth require monitoring. Considering potential overvaluation and headwinds, I am inclined to start coverage with a Hold and would reconsider once the price becomes more attractive.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.