Summary:

- The FTC issued a second request into the UnitedHealth Group Incorporated acquisition of LHC Group, Inc.

- Seeking Alpha reported on rumors among traders the deal wouldn’t be challenged.

- That wouldn’t surprise me, given the government lost a court case opposing UnitedHealth’s previous target.

- The prior case appeared easier to argue from an antitrust perspective.

Wolterk

Last week, LHC Group, Inc. (LHCG) rose 4% as Seeking Alpha reported there is speculation among traders the Federal Trade Commission won’t sue to stop the deal with UnitedHealth Group Incorporated (NYSE:UNH). In the same week, the Justice Department’s Antitrust Division announced the withdrawal of three outdated antitrust policy statements:

The Justice Department’s Antitrust Division announced today the withdrawal of three outdated antitrust policy statements related to enforcement in healthcare markets: Department of Justice and FTC Antitrust Enforcement Policy Statements in the Health Care Area (Sept. 15, 1993); Statements of Antitrust Enforcement Policy in Health Care (Aug. 1, 1996); and Statement of Antitrust Enforcement Policy Regarding Accountable Care Organizations Participating in the Medicare Shared Savings Program (Oct. 20, 2011).

the agency also said:

Withdrawal therefore best serves the interest of transparency with respect to the Antitrust Division’s enforcement policy in healthcare markets. Recent enforcement actions and competition advocacy in healthcare provide guidance to the public, and a case-by-case enforcement approach will allow the Division to better evaluate mergers and conduct in healthcare markets that may harm competition.

and

The healthcare industry has changed a lot since 1993, and the withdrawal of that era’s out of date guidance is long overdue,” said Assistant Attorney General Jonathan Kanter of the Justice Department’s Antitrust Division. “The Antitrust Division will continue to work to ensure that its enforcement efforts reflect modern market realities.

If you ask me, regulators have been fairly aggressive on the antitrust front and the market seems to bake a lot of concern into deal spreads. This is a $5 billion target being swallowed by a $500 billion juggernaut. Interestingly enough, the DOJ failed to block a previous $8 billion acquisition by UnitedHealth for Change Healthcare. In my opinion, that merger was a lot more problematic because it had a significant data component to it and more overlap between the businesses. Here’s a Paul Weiss commentary on that case.

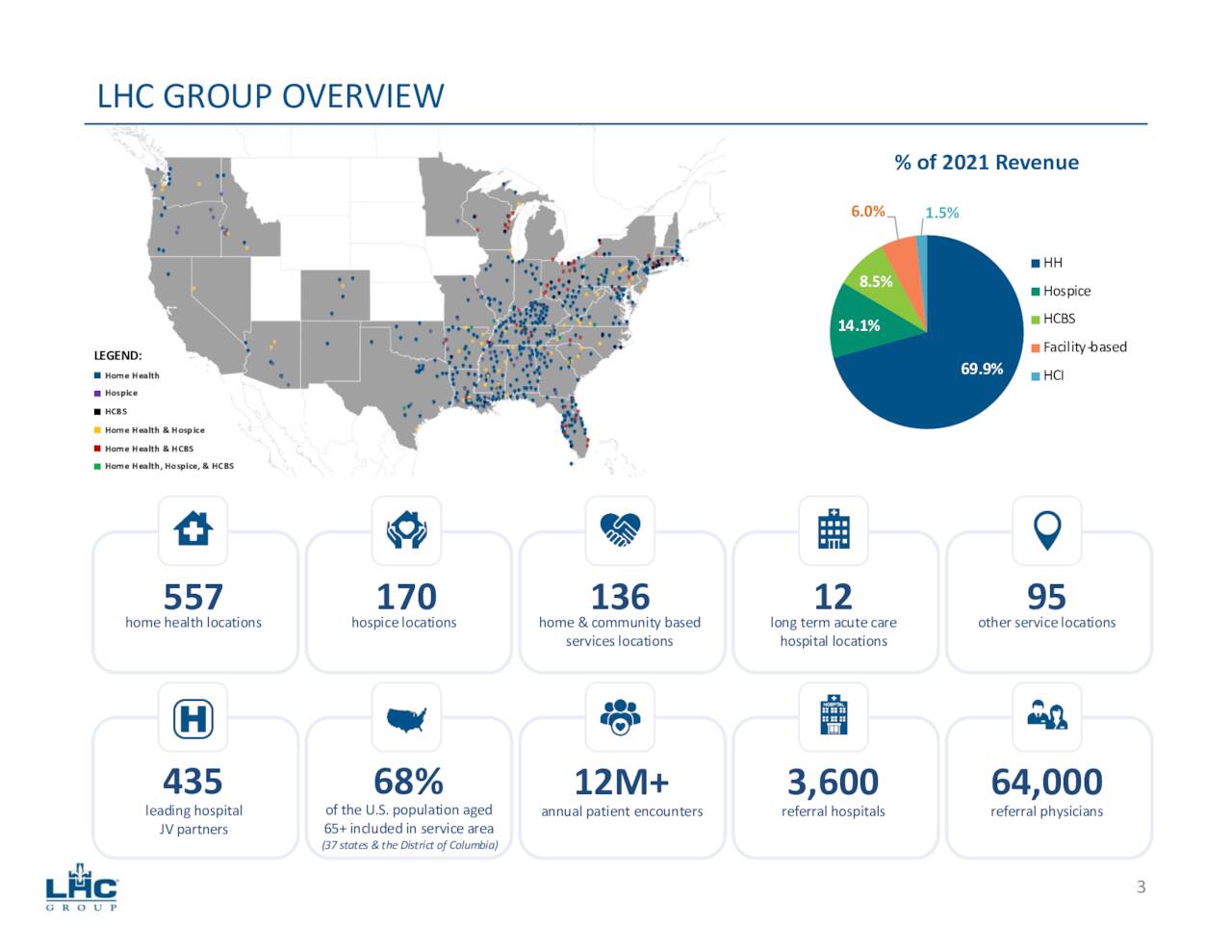

LHCG Group is primarily a care provider:

LHC Group operations (LHC Group)

UnitedHealth Group is a diversified healthcare company offering insurance, healthcare services, and software and data products to hospitals and other healthcare providers.

I think it is possible the government won’t challenge this deal in court because the prior DOJ case is a strong indication its chances aren’t great with this type of deal, the fact there seem to be rumors indicating the same thing, and a 2nd request of a medium-sized deal being finalized right about now makes sense to me.

Given the recent scrapping of the antitrust policy statements and the philosophy that companies should rely on enforcement action and court rulings to navigate the environment, this is starting to look quite good.

Because many deals are getting challenged in court or threatened to be challenged in court lately, the market likely expected at least significant delays. The LHC Group, Inc. deal has been extended to March 28, 2023, but could be extended until June 28, 2023. There is 2.4% upside left to the closing price of $170. If the deal gets across the finish line by end of March, that’s an excellent annualized return. I think this is now a base case.

It could also take longer, which would bring the annualized return down to something in the neighborhood of what’s available at the front end of the treasury yield curve (4.x%). If the deal does break after all, LHC Group, Inc. stock could fall to ~$130 or lower. That’s a 21% loss or worse.

Overall, I think this is a reasonably attractive merger to be involved with. The LHC Group, Inc. deal is not the best thing I’ve ever invested in, but a solid addition to my portfolio. It helps diversify the deals I’m exposed to while it still seems to have a very reasonable risk/return profile.

Disclosure: I/we have a beneficial long position in the shares of LHCG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.