Summary:

- Understanding the Chip Wars and the geopolitical landscape remains critical for allocating capital to semiconductor stocks.

- Under a comparative contextual analysis, TSM is superior, but both stocks are in the middle of a cyclical downturn correction.

- Intel remains miles away from its potential, leading to its undervaluation. Still, from a macro perspective, Intel possesses a vital function in the semiconductor sphere that faces challenges, but its turnaround path gets more apparent.

- This year’s industry-wide sales decline is expected to be 6.5%, with the chip oversupply expected to normalize in 2024. However, the industry is cyclical and remains on sale, expected to rebound between 2H-2023 and 2024.

kritsapong jieantaratip/iStock via Getty Images

Investment Thesis

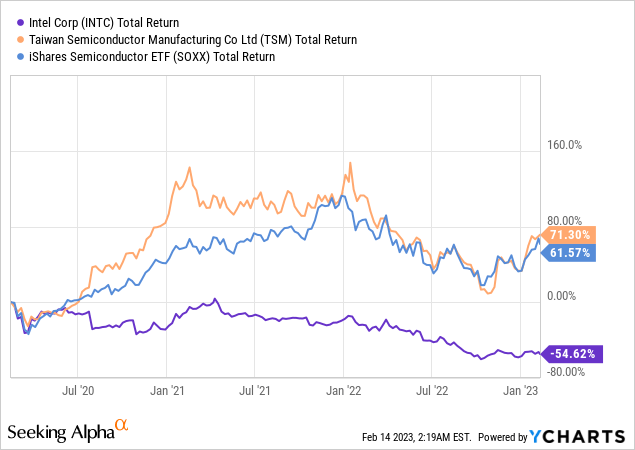

Intel Corporation (NASDAQ:INTC) has lost more than half of its value. In contrast, Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) has delivered a 71% return over the past three years outperforming the SOXX index by 9.7%. The last two years were a challenging environment for semiconductors due to prolonged chip shortages, geopolitical tensions, and ongoing chip wars. As a result, the average investor would be better off investing in the index, taking less risk for a decent return.

However, Intel has stuck, and the market penalizes its stock at every chance. INTC has not recovered, but it might have found a bottom at $25, close to its book value per share. This analysis explores the two chip giants, and even though TSM is the clear winner, supported by its robust prospects and lower uncertainty, INTC remains undervalued with a more attractive risk/reward profile that might surprise the market in the next 2-3 years. Inpatient investors might be better off avoiding INTC as the bumpy ride and challenges are not over, and its turnaround plan will take years to materialize.

Introduction

Intel and TSMC are both leading semiconductor companies. Based in the United States, Intel is a multinational corporation that designs, develops, and manufactures computer components, including microprocessors and chipsets. In the Far East, the Taiwanese conglomerate TSMC specializes in the fabrication of integrated circuits, mainly using the manufacturing process of foundry services.

TSMC has gained significant market share in recent years as a supplier of chips for companies such as Apple and Huawei. In contrast, Intel has faced challenges in staying competitive in the contract chip manufacturing market. As a result, both Intel and TSMC have made significant investments in advanced manufacturing technologies and R&D to maintain their position as leading players in the industry.

Different Business Models

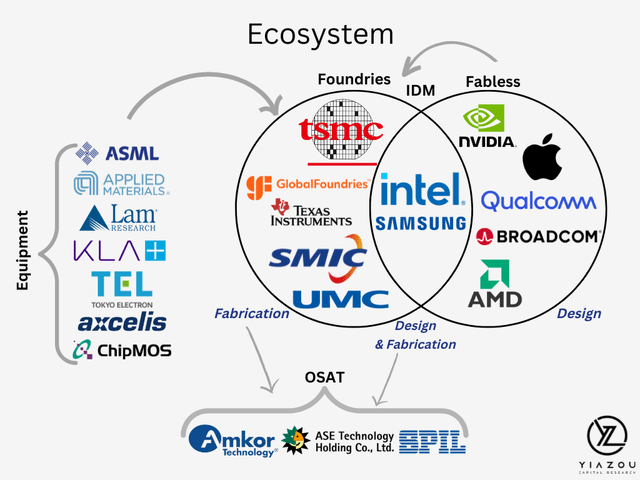

In our recent research, “Chip Wars: The Battle For Technological Hegemony,” we have extensively analyzed the major semiconductor market participants and the different business models. Undoubtedly, the global semiconductor supply chain is highly interconnected and vital to the smooth operation of today’s modern and digital society.

Intel adopts an Integrated Device Manufacturer (IDM) approach, which requires involvement in every phase of the supply chain, from developing to making to selling IC devices. The advantages of a vertically integrated supply chain motivate large semiconductor companies to pursue an IDM approach. It could be more economical and productive if you have complete control over the production process. IDMs are also exempt from production capacity restrictions imposed by outside foundries.

TSMC adopts a “Pure-play foundry” model, which includes fabrication companies that exclusively produce IC and have no design capabilities. Most of these foundries are located in Asia, specifically in Taiwan and China, where skilled labor is still freely available and competitively priced. Although the cost to develop a new fabrication factory would range from $15 to $20 billion, there are substantial hurdles to entry into this industry.

Yiazou Capital Research

PC Slump & DataCenter Weakness

Weakening end demand for products such as smartphones and PCs, coupled with high inventory levels in the supply chain, might persist through the first half of 2023. This drives the semiconductor to downcycle even though IT spending remains resilient due to cloud-services demand.

Structural demand for advanced chips looks set to hold up well due to 5G, high-performance computing (HPC), and AI demand, providing opportunities to the three leading players: TSMC, Intel, and Samsung. Demand for mature nodes, however, will depend on how fast end-markets recover and inventory destocking’s pace. China’s reopening might improve consumer sentiment and ease supply-chain, logistics, and labor problems. Although some foundries have announced CapEx cuts or delays, capacity expansions remain aggressive, leading to near-term oversupply.

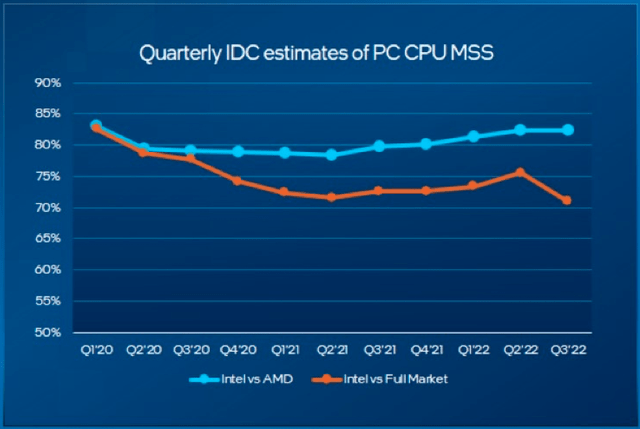

More than half of Intel’s sales stem from processors (CPUs) for PCs. In 2020 and 2021, the company benefited from robust volume growth for PCs spurred by the pandemic. In 2022, however, PC volumes shrunk, with the pace of decline worsening as the year progressed. Pressured sales at Intel reflect tepid end-demand for PCs, especially consumers and the education segment, and reduced demand from hardware manufacturers, as they scaled back production to allow excess inventories to clear.

As a result, revenues for the division focused on PC products declined by 36% year-on-year in the quarter, much worse than the declines in prior quarters, but the company has not lost track yet to regain market share from its CPU rival, AMD, in the following 2-3 years.

intel.com

However, Intel expects to regain competitiveness in the data center space gradually. It seeks to ship improved server CPUs (Sapphire Rapids) that were delayed in large numbers in 2023. It also signals confidence in regaining chip design and manufacturing leadership by 2025. The latter will require a closing of the gap with well-performing Asian foundries. For example, Taiwanese foundry TSMC is the chip factory of the world, supplying advanced chips to all the leading chip vendors, which solely focus on chip design and outsourcing production, which has become complex and capital-intensive.

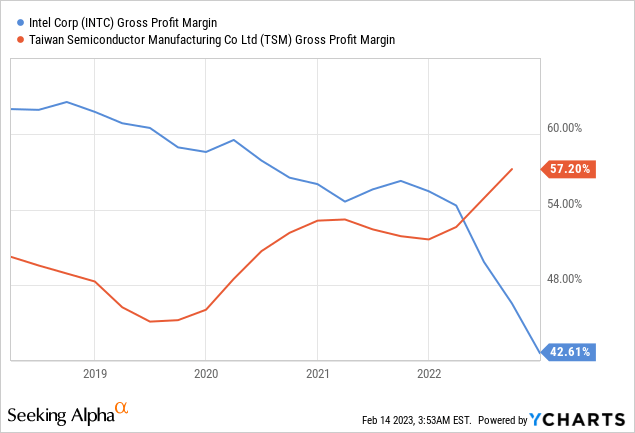

TSMC produces the chips of all of Intel’s key rivals, including NVIDIA, AMD, and Qualcomm, and the custom designs of former and current Intel customers. TSMC ended 2022 with 27% sales growth and a 55% rise in net profit, in contrast with the deterioration of Intel’s performance. Intel’s sales fell by 20% last year, and its EPS dropped by 60%, impacted by a severe weakening of its gross margin.

Challenging Road Ahead For Intel

Intel’s planned transformation and many of its strategic steps can be understood in light of the shift in profit opportunities in the chip sector, but it will take a few years to materialize. Moreover, a sharp correction in the PC market and ongoing competitive losses in its data center unit in the near term may limit the firm’s financial flexibility, which could endanger dividend payments or the firm’s capital spending plans.

Apart from regaining technological leadership, Intel’s turnaround strategy refocuses on chip segments with a more attractive outlook. Examples are graphics chips (GPUs) and foundry services. It means that Intel will, for the first time, produce its own chips and design them for others. Moreover, the foundry strategy may pay off, as Intel still enjoys key advantages, and many chip customers would like to rely less on TSMC, given the geopolitical factors.

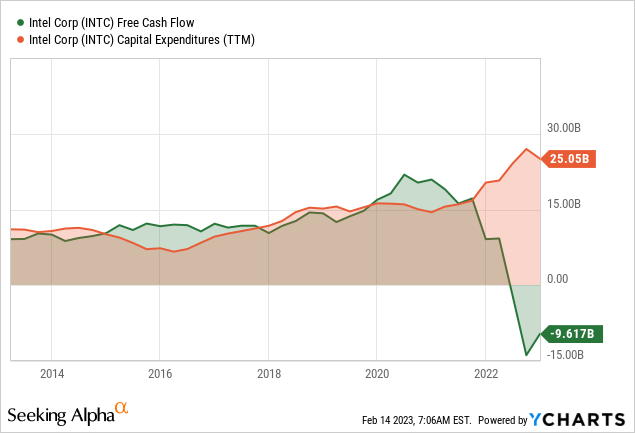

High CapEx will be required to build or expand factories and invest in the latest manufacturing technologies. Spending like crazy, Intel is preparing to build new facilities in Ohio, Arizona, Germany, and other parts of Europe, leading to CapEx at an all-time high while suppressing its free cash flow. As a result, the capital intensity of Intel’s business model will structurally rise, whereas Intel also signals a commitment to sustaining dividends.

Intel’s financial position has deteriorated notably, with even a negative free cash flow of $4 billion last year. Nevertheless, management plans aggressive cost-savings in the coming years to enable high spending. It is also lobbying for government subsidies to reduce the costs of new US and European plants. In addition, it has struck an agreement with global alternative asset manager Brookfield to invest in US factories jointly.

Intel could also raise cash by selling more of its stake in Mobileye, a well-performing subsidiary specializing in driver-assistance and autonomous driving solutions that went public last year. In addition, Intel’s leadership claimed that despite last year’s disappointing financial performance, it made considerable progress toward its transformation by rebuilding its leadership team and culture. It also claims to be at or ahead of its goal of upgrading to five more advanced manufacturing nodes in four years.

BS-PDN Is Intel’s Inflection Point

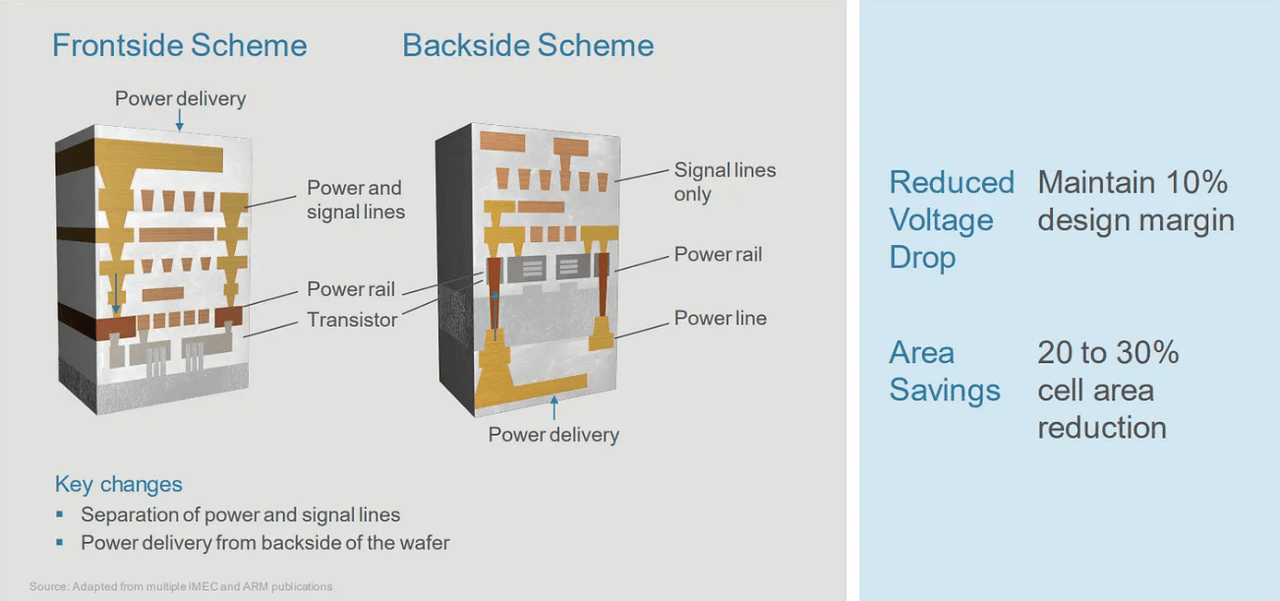

The convention of fabbing signal/power layers on the same top side of a wafer will give way to the backside power delivery network (BS-PDN), which splits the signal and power lines into two stacks. As a result, signal lines on the top of the wafer have more room to scale (typically driven by litho).

There are multiple ways to accomplish BS-PDN; as a rule of thumb, the more complex the processes (i.e., more yield-challenging), the more the area scaling benefits. For example, backside contact to Source/Drain (S/D) scales the best, although it is the most complex. Intel is investing in the medium-level complex process’ PowerVia,’ and it will be used along with RibbonFET (Intel’s version of GAA/gate all around) for launch in 20A in 2024, according to the company’s plans. TSMC, on the other hand, will take the more pragmatic ‘Buried Power Rail’ approach to BS-PDN, which has fewer scaling benefits, as a possible test run.

Theoretically, Intel’s make-or-break on its more aggressive BS-PDN execution (assuming its EUV execution, which is still unproven) would see a binary outcome; either regaining the process leadership at N2 or keeping its current laggard status. However, at this point, Intel’s repeated delay in Sapphire Rapids’ release (built on Intel 7 node) has not convinced the market. Moreover, its planned EUV adoption at Intel 4 has not yet been production-proven, and I expect it will be challenged by TSMC’s years of EUV production experience with superior efficiency since N7+, which now penetrates 55% of the global installed base, according to the company.

www.fabricatedknowledge.com

TSMC Remains Well-Positioned For Growth

After TSMC took a significant share from Samsung at Nvidia and Qualcomm in recent years, I suspect that TSMC’s leading-edge share of ~90% will remain for a while. Notably, reports in the S. Korean press suggest that Samsung has finally made progress with its 3nm GAA process on yields, while TSMC noted on the Q4 call that its 2nm GAA process had “very good progress” as it looks to enter risk production in 2024. As for Intel, the main hoped-for advantage is that Intel will be the first to launch backside power delivery (BPD) with 20A/18A, while TSMC will only feature BPD in a later version of 2nm.

However, opponents argue that Intel’s decision to separate design and production further might play into TSMC’s hands. In addition, a major advantage that TSMC enjoys is in advanced packaging (3D Fabric, SoIC), which is likely to crush its competition along with a far superior record of execution compared with Samsung and Intel.

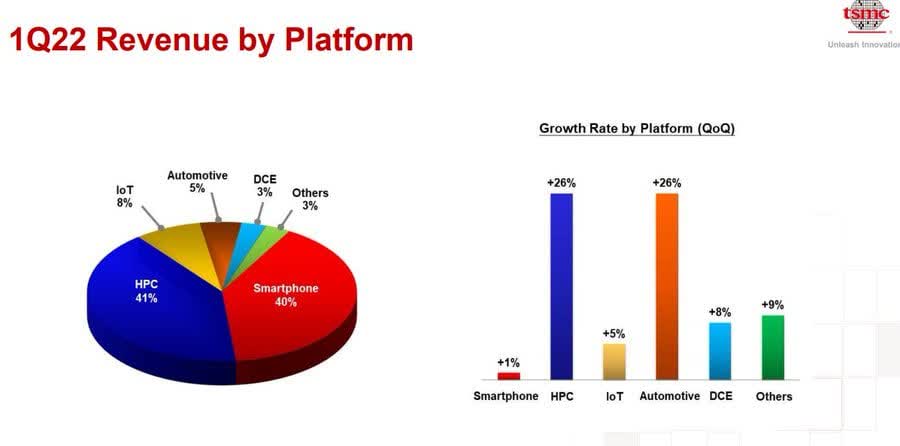

TSMC is placed as an enabler of the next computer revolution in the semiconductor industry, with multiple architectures, chip platforms, and design teams competing to push computing and AI innovation. As a result, I expect HPC to take over the growth baton from Smartphones in the next several years. HPC revenue surpassed Smartphones in 2022, and I believe it will continue to expand in the next few years, led by growing demand for in-house silicon from hyperscalers and an ongoing compute revolution (from x86 CPU to diversified compute platforms, including ARM, RISC-V based GPU, DPU, ASIC, FPGA), with TSMC being the critical enabler.

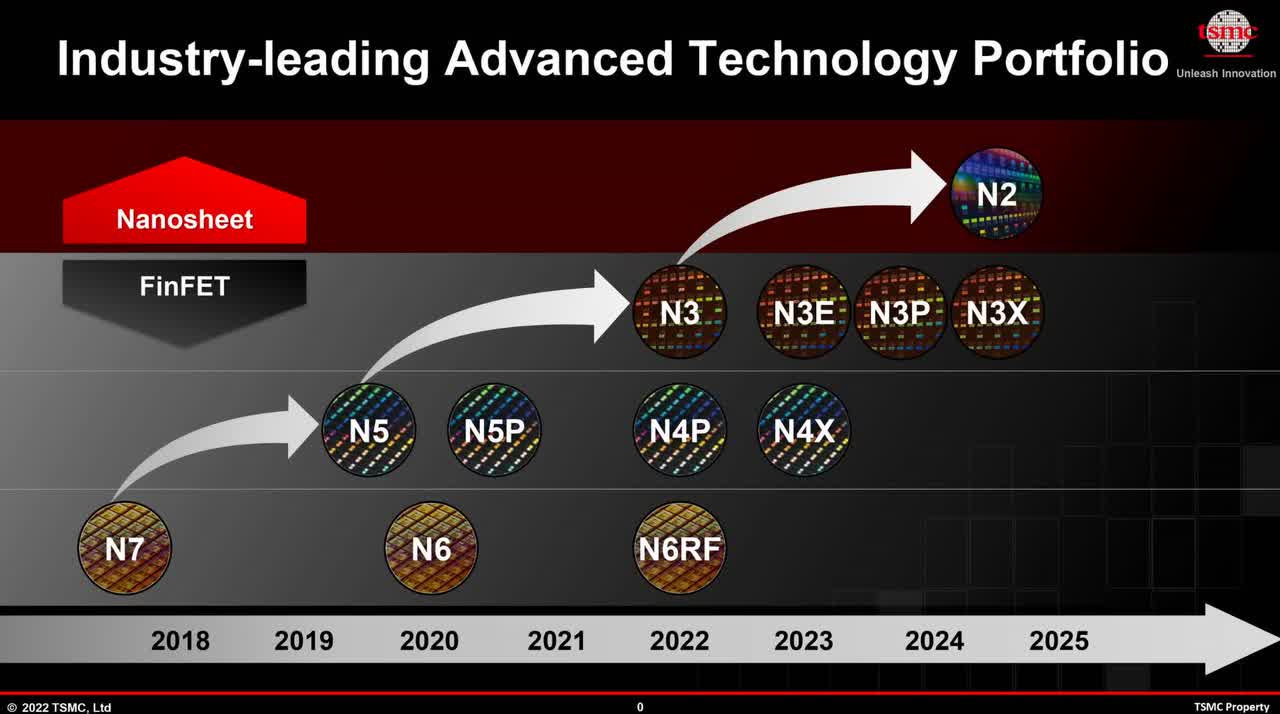

To that effect, the long-term growth outlook for TSMC remains relatively strong, with continued growth in HPC, substantial share gains in N5 and N3E, and a clear roadmap into the nanosheet era with N2. In addition, Intel will likely become a bigger customer for TSMC from 2024 than previously expected.

TSMC

A Clear Roadmap Towards N2

TSMC indicated that N2 is progressing slightly ahead of expectations and will enter mass production in 2025. It is reasonable to expect that N2 will likely see a lot of adoption of SoIC solutions since HPC and mobile chips could seamlessly integrate chiplets from several process technologies for various functional blocks.

As advanced packaging technology becomes more mainstream and mature in the next few years, the chiplet design approach will gain more traction in the next few years due to the faster time-to-market, better yields, and wafer cost savings. With continued area scaling, improved power efficiency (through backside power delivery), and the SoIC advanced package, TSMC remains an undisputed global leader.

TSMC

INTC Vs. TSM: A Clear Winner

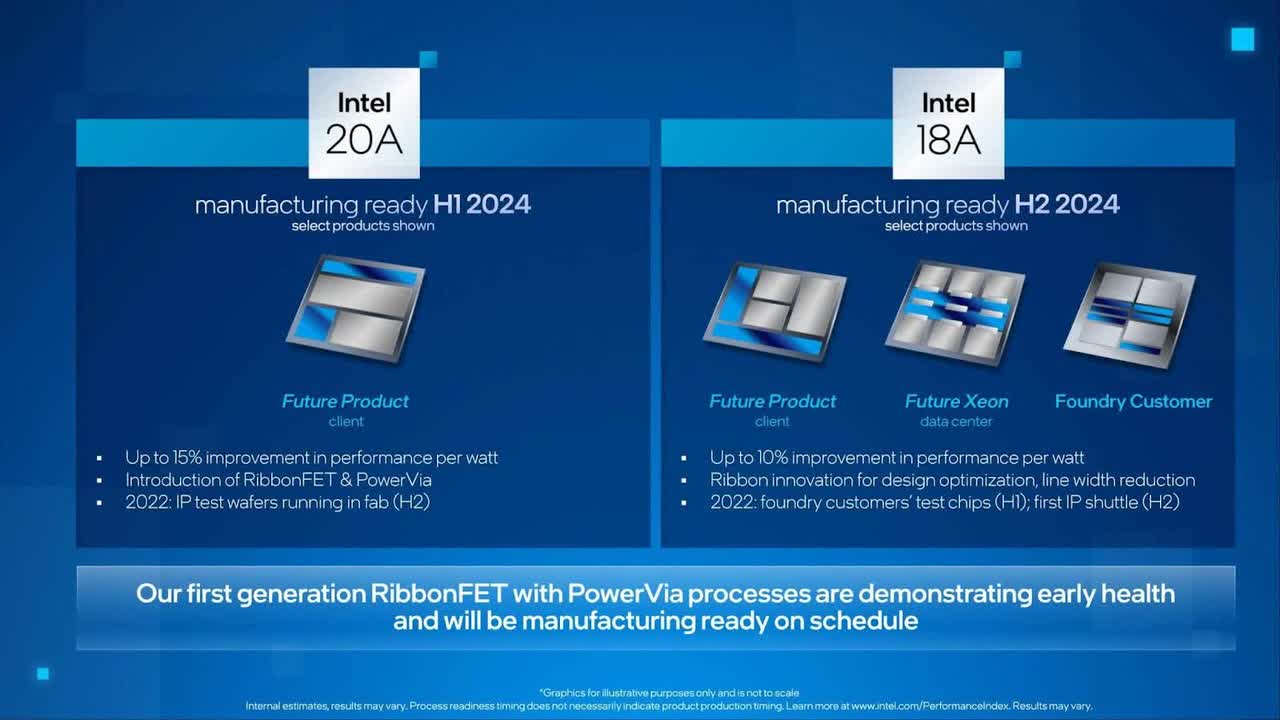

I do not expect Intel to challenge TSMC, even though the strategy shifted since Pat Gelsinger took Intel’s CEO seat with a renewed focus on regaining process leadership and Intel Foundry Service (IFS). Intel’s tech roadmap calls for the rollout of five nodes (i7, i4, i3, 20A, and 18A) over four years (2022-25) to be at process parity with TSMC by 2024/leadership by 2025.

Intel would start using EUV production for Intel 4, and TSMC has years of experience since N7+ in 2019, armed with c.50% of the global EUV installed base. The concurrent shift to RibbonFET (Intel’s GAA architecture) and PowerVia (backside power delivery network) at 20A in 1H 2024 may see a step-up in production challenge, and 18A would mark the move to high NA EUV.

Intel

TSMC is better positioned than its chip-manufacturing peers to execute on EUV since it has the world’s largest installed base. While Intel’s aim is to be at process parity with TSMC by 2024 and leadership by 2025, based on the tech roadmap calls for the rollouts of process nodes at an unprecedented rapid pace of five nodes over four years (2022-25), it’s EUV adoption will remain years behind TSMC.

The shortage of EUV system supply, which ASML has monopolized, will continue in the foreseeable future. Such development will further tilt in favor of TSMC, which already has the largest EUV installed base in the world and runs those machines efficiently with higher productivity. On this basis, TSMC will execute better than its other chip manufacturing peers to prioritize the precious EUV capacity on hand to the wafer layers, where the use of EUV adds the most value to design, manufacturability, and performance.

Concluding Thoughts

The industry-wide sales decline for this year will be 6.5%, and it is expected to normalize somewhere between 2H 2023 and 2024. Intel continues to disappoint in the short run, leading to its undervaluation. Still, despite these difficulties, Intel serves a crucial role in the semiconductor industry from a macro perspective, and the path to recovery will become more evident toward the end of 2023. Therefore, I remain bullish on both stocks and the sector in general.

Disclosure: I/we have a beneficial long position in the shares of INTC, TSM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Author of Yiazou Capital Research

Unlock your investment potential through deep business analysis.

I am the founder of Yiazou Capital Research, a stock-market research platform designed to elevate your due diligence process through in-depth analysis of businesses.

I have previously worked for Deloitte and KPMG in external auditing, internal auditing, and consulting.

I am a Chartered Certified Accountant and an ACCA Global member, and I hold BSc and MSc degrees from leading UK business schools.

In addition to my research platform, I am also the founder of a private business.