Summary:

- On the backdrop of the ChatGPT tailwind, Nvidia shares have started to rebound aggressively, reflecting investor optimism about the potential of generative AI technology.

- While I acknowledge the tailwind that Nvidia is likely to see from AI computing… I would like to have more growth transparency before buying into a x60 EV/EBIT valuation.

- In that context, I am excitedly looking forward to study post-earning Q&A commentary about the likely fundamental tailwind in relation to ChatGPT/ generative AI.

- Going into Nvidia’s Q4 earnings announcement, I assign a ‘Hold’ rating to NVDA shares.

Justin Sullivan

Thesis

After reaching a valuation of more than $800 billion in late 2021, Nvidia (NASDAQ:NVDA) shares fell sharply — intermittently by as 70% from the all-time high. With that frame of reference, Nvidia’s fundamentals were pressured by a slowdown in gaming, crypto-mining and the broader personal computer market. However, on the backdrop of the ChatGPT tailwind, NVDA stock has started to rebound aggressively, reflecting investor optimism about the potential of generative AI technology.

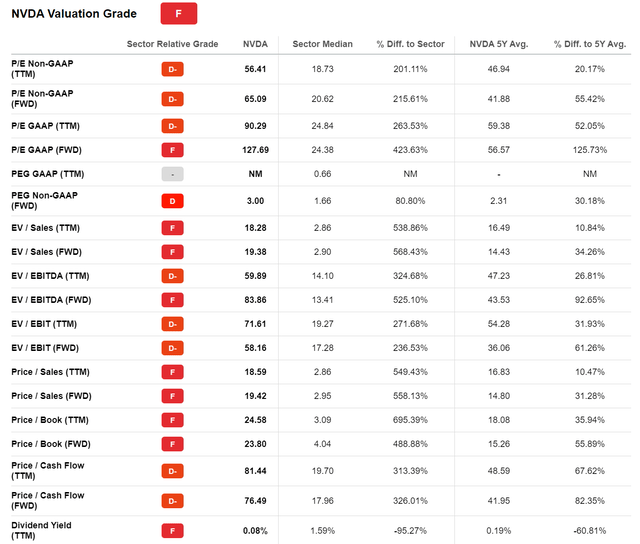

While I acknowledge the tailwind that Nvidia is likely to see from AI computing, I also argue that the thesis remains speculative, given the early stages of the technology. Moreover, investors should consider that the market is already pricing lots of optimism–with NVDA shares valued at a FWD EV/EBIT of close to x60.

Nvidia is scheduled to report Q4 2022 earnings on February 22nd, and I assign a ‘Hold’ rating pre-announcement.

Seeking Alpha

Nvidia’s Q4 2022 Preview

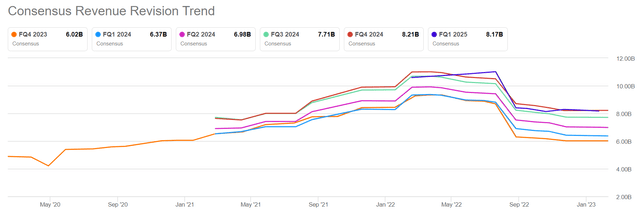

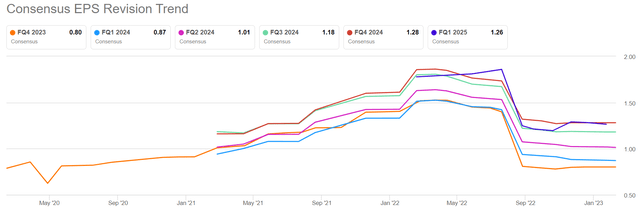

According to data compiled by Seeking Alpha, as of February 13th, 34 analysts have submitted their estimates for Nvidia’s Q4 results. Total sales are expected to be between $5.95 billion and $6.11 billion, with the average estimate being $6.02 billion. If an investor would assume the average as the anchor, Nvidia’s Q4 sales are estimated to contract by about 21.2% as compared to the same quarter in 2021.

Seeking Alpha

EPS estimates are between $0.62 and $0.85. The average is $0.8, which would imply a year-over-year growth of negative 39%.

Seeking Alpha

Although I think analyst estimates for Nvidia’s key financial metrics are reasonable, I don’t believe a slight earnings miss/ beat will move NVDA shares much. In fact, investors’ focus is likely to be fixated on post-earnings Q&A, where analysts will likely push to discuss business developments related to emerging AI opportunities.

Nvidia’s ChatGPT Tailwind

Nvidia’s CEO Jensen Huang has previously voiced bullish sentiment regarding the potential AI tailwind for computing. In that context, he termed ChatGPT as a game-changer and an “iPhone moment” of AI–potentially boosting Nvidia’s sales growth.

The reasoning behind the potential sales boost for Nvidia is relatively simple. Nvidia holds a dominant position in the market for chips designed for intensive computing required for AI applications. As more people utilize ChatGPT, the program [OpenAI] will require more computing power to generate responses to the numerous queries received.

Analysts from FierceElectronics estimated that the Beta version of ChatGPT was likely trained using 10,000 NVIDIA GPUs. Moreover, the analysts argued that with ChatGPT gaining widespread popularity, the system has likely been overwhelmed and unable to accommodate the large user demand — expanding the GPUs count to close to 30,000 as of early February. And while it is possible that other vendors could serve the GPU need, it is likely that Nvidia continues to dominate the demand:

It is possible that ChatGPT or other deep learning models could be trained or run on GPUs from other vendors in the future. However, currently, NVIDIA GPUs are widely used in the deep learning community due to their high performance and CUDA support. CUDA is a parallel computing platform and programming model developed by NVIDIA that allows for efficient computation on NVIDIA GPUs. Many deep learning libraries and frameworks, such as TensorFlow and PyTorch, have built-in support for CUDA and are optimized for NVIDIA GPUs.

With that frame of reference, according to an estimate from Citigroup, the growth of ChatGPT usage could bring in sales of between $3 billion and $11 billion for Nvidia over the course of a year. Although it is challenging to predict growth for a new service like ChatGPT, analyst Atif Malik arrived at these figures by considering projections for the number of words generated by ChatGPT and the revenue per word for Nvidia. Similar commentary was voiced by analysts at Bank of America and Wells Fargo.

It will be interesting to learn how Nvidia management views the ChatGPT tailwind in relation to Nvidia’s fundamentals–and NVDA shares will likely move accordingly.

A ‘Hold’ Pre Q4 Earnings

Nvidia is scheduled to report Q4 2022 earnings on February 22nd. I think revenue and earnings estimates are reasonable. But I am excitedly looking forward to study management commentary surrounding the likely fundamental tailwind in relation to ChatGPT/ generative AI. However, as a function of valuation, I am cautious to be bullish already. Investors should consider that, according to data compiled by Seeking Alpha, Nvidia is valued at a one-year forward EV/EBIT of 58, which represents a more than 236% valuation premium versus the information technology sector. Nvidia’s EV/Sales is x19, a valuation premium of 568% respectively.

Seeking Alpha

Going into Nvidia’s Q4 earnings announcement, I assign a ‘Hold’ rating to NVDA shares. While I acknowledge the tailwind that Nvidia is likely to see from AI computing, I would like to have more growth transparency before buying into a x60 EV/EBIT valuation.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Not financial advice.