Summary:

- Netflix membership and revenues continue to grow, albeit at slower rates, but free cash flow generation is improving.

- Growth through re-investment and acquisitions remain the priority for management, though there is some hope for investors seeing buybacks this year.

- Our overall view of Netflix is positive but with uncertainties. We don’t see compelling reasons to buy or sell and maintain our “hold” rating.

Mario Tama

Our view

In our last of Netflix (NASDAQ:NFLX) back in September 2022, we rated the stock as a “hold.” Since then, the company’s stock price has increased by more than 50% and it has released its full-year results for FY22.

Overall, Netflix had a decent year in FY22. Memberships and revenues were up, though the trend of slowing growth continues. The company also made a number of significant changes to its business model, including introducing the ad-supported tier launched in November. Results and information about its success are limited, but there are no immediate signs that it has had any negative impact on average revenues per member.

In terms of cash flow, the company is now free cash flow positive, though a significant amount of cash continues to be absorbed by content. Reinvestment is expected to continue to be the priority for free cash flow as management pursues further growth opportunities, though there’s hope for the repurchase plan to be continued in FY23.

At $364 per share, Netflix is valued $162 billion, a price-to-earnings ratio of more than 35x based on FY22 earnings. At this valuation, our analysis implies annual compound returns across the next decade ranging from slightly negative to double digits.

Overall, we like the company, its performance, and the direction of key metrics, though growth is inevitably slowing. However, at the current valuation, we don’t feel sufficiently confident that it represents value and don’t see enough reasons to make it a compelling buy. With that being said, we definitely don’t see any strong reasons for long-term holders to sell, either. For that reason, we maintain our neutral “hold” rating.

Business review

Netflix subscriber numbers

The number of paid memberships – or subscribers – has been and continues to be a key metric for Netflix and investors. So how many subscribers does Netflix have now?

Company reports

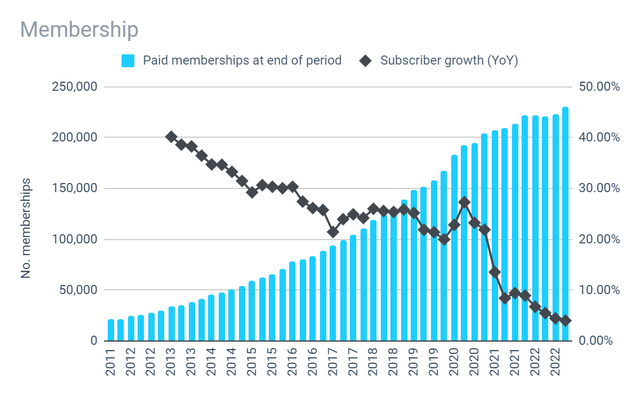

While Netflix’s subscriber continues to grow, the rate of growth has slowed significantly and continues to do so. In their recently released Q4 FY22 results, the company reported that it had 231 million active subscribers as of 31 December 2022. This represents an annual growth rate of 4%, much lower than recent rates of growth which were in excess of 20% p.a. until as recently as 2021.

While membership has been the key metric so far, things are starting to change. From Q3 2022, management no longer provides any forward guidance or forecast for membership numbers. The reason for this is that the introduction of an ad-supported tier, as well as paid account sharing, has started to decouple Netflix’s revenue from its subscriber count.

Under the previous ad-free model, revenue was generated from memberships regardless of the volume of content consumed, meaning the number of subscribers alone was key. However, as advertising revenue begins to account for an increasing proportion of overall revenue, membership count alone will become less meaningful.

Company reports

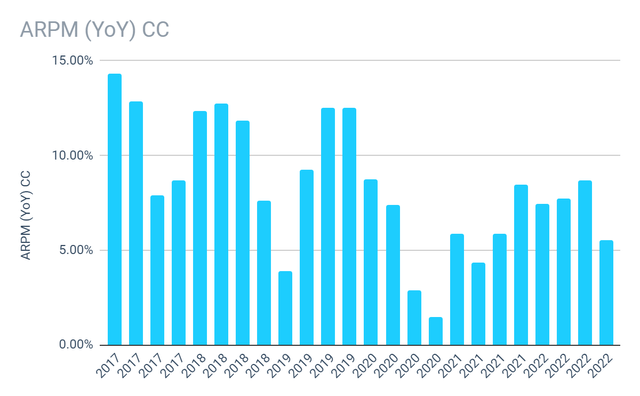

The ad-supported tier was introduced in November 2022. Unfortunately, there’s no data on the membership data split between ad-free and ad-supported tiers. If there was a significant number of members switching from ad-free to the cheaper ad-supported plan, we might expect to see an initial drop off in Average Revenue per Member (ARPM), though this also would depend on how well Netflix was monetizing its viewership through ads.

While ARPM growth slowed in the final quarter of 2022 when the ad-supported tier launched, it’s still growing at over 5% annually (on a constant currency basis). Based on the limited information available, there’s no obvious indication that paying subscribers are opting to downgrade. Or if they are, it isn’t having an obviously detrimental effect on revenues.

Netflix earnings

Memberships continue to grow as does ARPM, but what does that mean for the profitability of Netflix?

Company reports

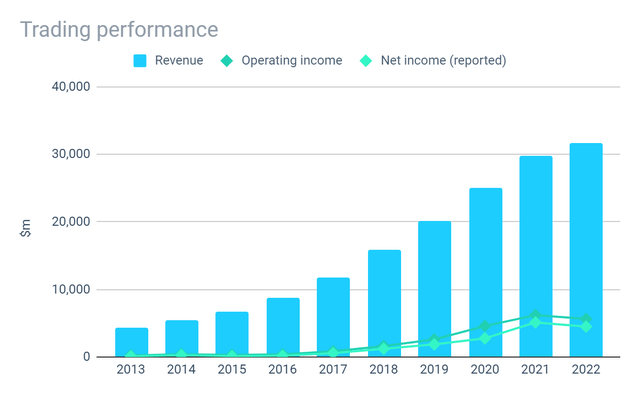

Well, while it’s true that the fundamental drivers continue to perform relatively well, the company is still suffering from the strength of the U.S. dollar. And as the company’s costs are predominately based in USD, adverse exchange rates negatively affect income without much a corresponding benefit on costs.

For the year ended 31 December 2022, Netflix’s reported revenues were up 6% on the prior year. However, excluding the impact of adverse foreign exchange movements, underlying revenue actually grew by over 8%. Meanwhile, operating margins fell from c.21% to c.18% on a reported basis, with some, but not all, of this decline attributable to currency headwinds.

Netflix content spending

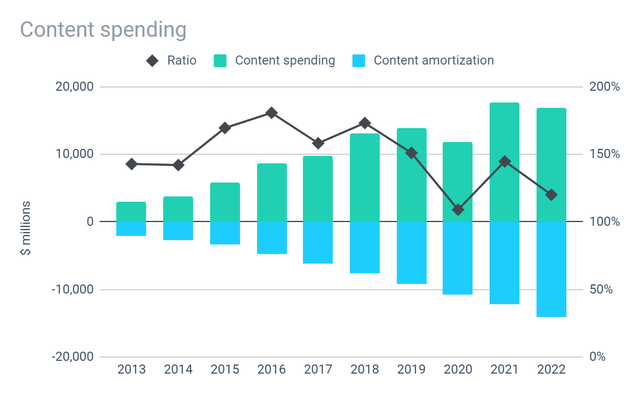

While Netflix’s profits look good on paper, the amount of spending on content continues to outstrip the amortization charge recognized in the income statement, meaning a proportion of those profits are absorbed back into the business.

Company reports

The overall trend in this area is positive, however. In FY22, the company actually reduced the total spending on content, though this is probably reflective of FY21 spending being artificially inflated by spending deferred by COVID-19 in 2020, rather than being indicative of a trend that should be expected to continue. The ratio of content spending to amortization in FY22 was 120%, which is an improvement compared with recent years when it was often in excess of 150%, highlighting the progress the company is making towards a sustainable free cash flow-generating model.

Netflix cash flow

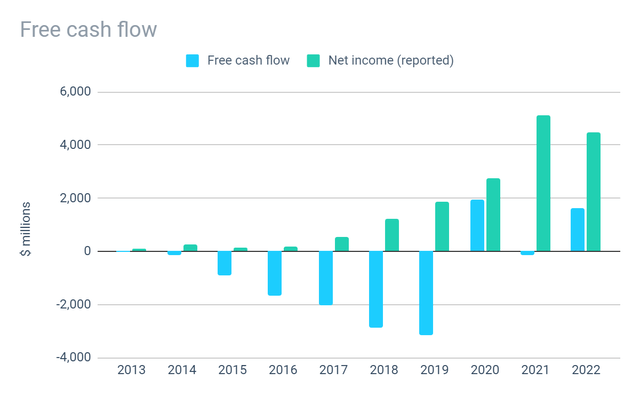

Historically, the difference between the reported profits of Netflix and free cash flow generation has been significant. However, since 2019 the trend has been moving in the right direction.

Company reports

With the exception of 2020, when content creation was put on hold due to COVID-19 meaning cash outflows were delayed into 2021, this year is the first year that the company has generated any free cash flow at all. It seems the company has now reached a critical mass whereby its membership base and revenue can sustain the level of content spending required, while allowing the company to free up some cash for other potential uses – such as acquisitions or returns to investors.

Company reports. Analysis by author.

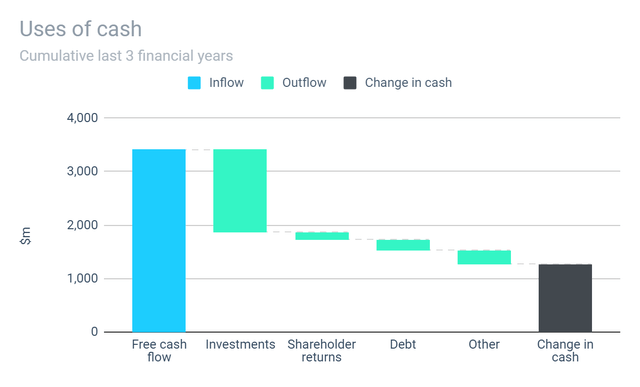

In the period FY20 – FY22, the company has only generated $3.5 billion in free cash flow, despite generating in excess of $12.4 billion in profits – equivalent to an FCF conversion rate of c.30%. However, the overall trend is positive, as highlighted by the improved FCF conversion of 36% in FY22.

The only significant use of the limited free cash that Netflix has generated has been acquisitions, including the acquisition of Animal Logic, a leading animation studio, and Spry Fox, a games studio, which were completed in Q4 2022.

These acquisitions are indicative of what to expect going forward. While the company is starting to generate free cash flow, management is still in growth/investment mode with re-investment in the company’s own operations and “selective” acquisitions being the main priorities. However, there’s some prospect of shareholders seeing some returns this year. Assuming no material acquisitions are identified, management expects to resume their share buyback program during FY23.

Netflix debt

Company reports. Analysis by author.

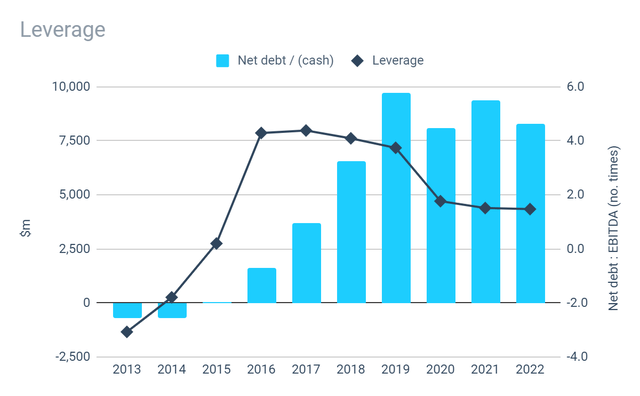

There has been no significant change in Netflix’s debt in recent years. On 31 Dec 2022, gross debt stood at just over $14 billion, at the upper end of management’s target range of $10 billion – $15 billion. Based on FY22 EBITDA of $5.6 billion, this company has a leverage ratio of around 1.8x implying that management’s current maximum target leverage ratio is c.2.0x. Further growth in EBITDA should create additional debt capacity, which could be used to boost acquisition and/or shareholder returns.

Netflix outlook

There are many positive signs that investors should like. But what is the long-term outlook for Netflix? In the earnings release, management confirmed that long-term guidance remains unchanged:

Our long term financial objectives remain unchanged – sustain double digit revenue growth, expand operating margin and deliver growing positive free cash flow.

So what does this mean for 2023? Management expects revenue growth to accelerate over the course of the year (on a constant currency basis), as they grow the advertising business and launch paid sharing. They also expect year-over-year operating profit growth and operating margin expansion for the full year (assuming no material swings in F/X). At current F/X rates, management expects to deliver an operating margin of 21%-22%, an increase of at least 4ppts compared with FY22.

Risks

The key risks are consistent with those set out in our previous in-depth analysis. A summary of these is as follows:

Content spending

Content costs are largely fixed in nature and contracted over several years meaning the company has limited flexibility to reduce costs in the short term. The acquisition and/or creation of new content has historically consumed all of the company’s free cash generation.

Competition

Competition in the video entertainment market is strong and increasing. Competition is not limited to alternative video streaming services, with the company competing for user attention with other platforms such as Instagram, YouTube and TikTok.

Economic conditions

Netflix is an easy target for households looking to cut their monthly spending. However, it also may benefit from consumers looking for cheaper stay-at-home entertainment options. As long as the strength of the U.S. dollar prevails, it will be a headwind for profitability. In the medium term, the ability of the company to maintain margins will depend on its ability to adjust its pricing and cost structure to compensate should exchange rate headwinds persist.

Netflix valuation

As of 26 January 2023, the company’s shares traded at around $364, giving a total market capitalization of $162 billion.

Our approach to valuing operating businesses is based on determining the true underlying earnings power of the business or “owner earnings.” Based on its FY22 net income of $4.5 billion, Netflix is valued 36x times net income. In the case of Netflix, it would be prudent to assume that reported net income overstates actual owner earnings due to needing to continually reinvest profits into the creation of new content.

While there are a lot of positive signs, Netflix is at a transitional point and we consider the outlook to be difficult to predict with certainty. For that reason, our valuation scenarios apply a wide range of possible assumptions:

| Valuation assumptions | Lower | Mid | Upper |

| Earnings growth | 7.5% | 10% | 15% |

| Re-investment rate | 80% | 70% | 50% |

| Price-to-earnings ratio (10Y) | 15.0 | 17.5 | 20.0 |

| Total return (10Y) | -5% | 42% | 159% |

| Implied compound annual return | -0.5% | 3.6% | 10.0% |

The high level of uncertainty is reflected in our analysis which implies a wide range of possible outcomes for investors over the next decade. We have modeled our base case on a prudent interpretation of management’s long-term targets, with double-digit net earnings growth achieved, but with the majority of profits reinvested to achieve this.

At the lower end, we assume that an even higher proportion of cash generation continues to be absorbed by content spending or other investment and that earnings growth will be well below target at 7.5% p.a. At the upper end, we assume that the company achieves net earnings growth of 15% p.a. and converts 50% of its earnings into free cash flow available for distribution to shareholders.

These wide-ranging assumptions imply a wide range of potential outcomes, with negative annual compound returns at the lower end, but increasing to double-digit returns of 10% at the higher end of our range.

Conclusion

The results for 2022 served as confirmation of many well-established trend. On the positive side, the company is actually generating free cash which it can use to further its growth opportunities, both organically and through acquisitions, and maybe even find a little left over for shareholders.

On the other hand, membership growth continues to slow and the company will need to find new avenues to fulfill its growth ambitions. The changes to the pricing model should help, but it’s too early to tell what impact it is having.

Netflix remains at an important point and the outlook from here is generally positive, but ultimately with some uncertainty which makes it difficult to forecast.

Overall, we reach the same conclusion we reached in our most recent analysis. While we retain a positive long-term outlook for Netflix in general, we don’t feel that the current price provides the right balance of margin of safety and expected return. For that reason, we continue to rate it as a “hold.”

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.