Summary:

- I remain very negative on Tilray Brands stock, which has seen a 13.8% decline since my last recommendation to sell.

- Tilray’s FY24 growth was driven by M&A, with organic growth lagging and adjusted gross margins declining despite high revenue growth.

- The stock is near its all-time low, underperforming the overall cannabis sector, and appears expensive with a high enterprise value to EBITDA ratio.

- I prefer other Canadian LPs like Cronos Group, Organigram, and Village Farms, which offer better valuation and strategic investor backing.

bestdesigns

I advised readers here 8 weeks ago to get rid of any investment in Tilray Brands (NASDAQ:TLRY), and the stock has declined 13.8%. I continue to be very negative on the stock, which reported its Q4 in late July. In this follow-up, I review FY24, updated the outlook, take a look at the chart and assess valuation.

Tilray Grew in FY24 Through M&A

On July 30th, Tilray Brands filed its 10-K after it hosted its conference call on the 29th. There was a lot of growth in FY24, which ended 5/31, but it was driven by mergers and acquisitions. Plus, the share-count grew a lot too.

For its Q4, analysts were expecting revenue to be $229 million with adjusted EBITDA of $28 million, according to AlphaSense. These were slightly lower than they had been forecasting going into the Q3 report in April. The company reported revenue of $229.9 million, which was up 25% from a year earlier and slightly ahead of expectations. Adjusted EBITDA of $29.5 million grew 37% and was also higher than had been expected.

Looking at the full year, Tilray Brands generated revenue of $788.9 million, which was up 26% from FY23. Adjusted EBITDA grew only 3% to $60.5 million. Near the beginning of the year, analysts had been projecting adjusted EBITDA of $69 million on a lower projected revenue. Ahead of the Q1 report in early October a year ago, analysts were projecting $671 million revenue and $70 million adjusted EBITDA. So, while the year had more revenue than expected, it had less adjusted EBITDA. For FY24, the adjusted EBITDA margin was 7.7%, far below the 10.4% margin analysts had expected at the end of September 2023.

I don’t think that Tilray Brands does a good job of explaining this, but the organic growth was not nearly as strong as the overall revenue growth of 26% in FY24. The company did a big beer-related acquisition and also closed on the HEXO acquisition in cannabis.

Looking at the 10-K, the company breaks down revenue into 4 operating segments: Beverage Alcohol, Cannabis, Distribution and Wellness. Beverage Alcohol, boosted by acquisitions, grew its revenue by 113% to $202.1 million, which was about 26% of overall net revenue. Cannabis revenue of $272.8 million grew 24% and represented about 35% of overall revenue. Distribution, which is pharmaceutical distribution in Europe, represented 33% of overall revenue at $258.7 million, which was flat from FY23 and down slightly from FY22. Wellness, which is hemp-related, grew 5% to $55.3 million, just 7% of overall revenue. The company did not provide organic growth rates.

The company did share its gross margins and adjusted gross margins by operating segment. The adjusted gross margin adjusts for inventory valuation adjustments and purchase price accounting step-ups. Overall, the company reported a gross margin of 28%, up from 23%, but the adjusted gross margin was 30%, down from 33% in FY23. By segment, adjusted gross margins fell from 53% in Beverage Alcohol to 46% and from 51% in Cannabis to 36%. Distribution was flat at 11%, and the tiny Wellness expanded from 29% to 30%.

Investors saw high revenue growth and improving gross margins, which is true, but they should take the time to look deeper. The revenue growth was boosted by acquisitions, and the adjusted gross margins ended up declining. Operating cash flow for the year was negative at -$30.9 million after reaching $7.9 million in FY23. The share-count expanded dramatically in FY24 as the company paid debt with stock issuance.

The 2026 Outlook for Tilray Has Gotten Worse

Ahead of the Q4 report, analysts were projecting revenue growth for FY25 and FY26, as well as adjusted EBITDA growth. For FY25, they were projecting revenue of $874 million with adjusted EBITDA of $87 million, a margin of 11.3%. For FY26, the analysts were expecting revenue to increase to $943 million with adjusted EBITDA of $132 million, a 14% margin.

Analysts raised their outlook for FY24 revenue, which is now expected to increase 16% to $915 million. The company just closed on another acquisition of a beer brand from Molson, but it never disclosed the amount it paid or the projected revenue contribution. The press releases said nothing, and it has not yet filed an 8-K. The projected adjusted EBITDA increased as well and is now $92 million, a margin of 11.4%.

For FY26, analysts also raised their outlook for revenue, now expecting revenue to grow 8% to $989 million. The adjusted EBITDA, though, is now expected to be less than before at $113 million, a margin of 13.0%.

Tilray’s Chart Is Frightening

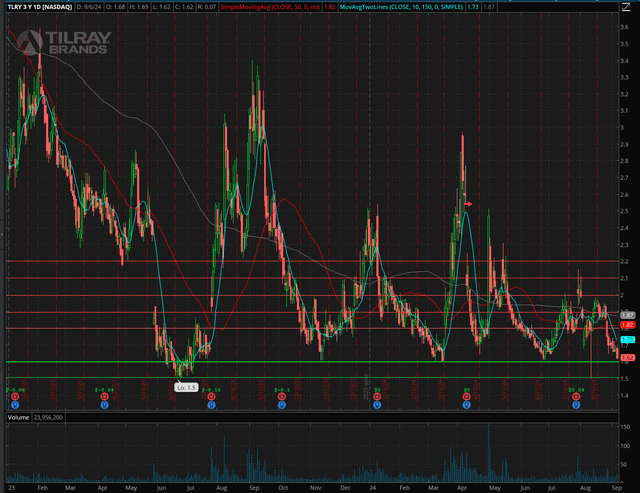

TLRY is just 8% above the all-time low set in June 2023 at $1.50. It appears to be basing, but it is spending a lot of time close to its all-time low:

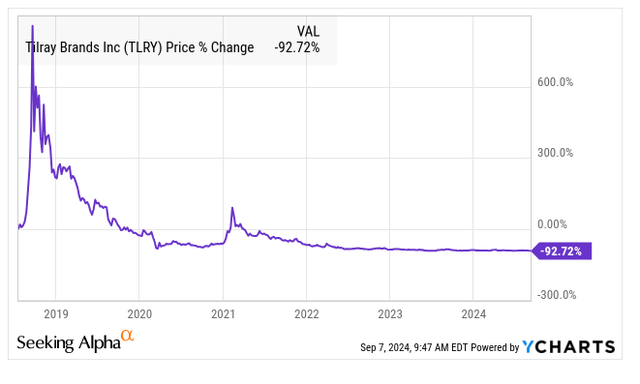

The stock started off in 2018 with an IPO price of $17 and quickly ran to $300, which made no sense. A lot of traders and investors look at the current price as being down a lot from the IPO or the post-IPO peak and get excited, I suppose. The chart since the end of 2022 shows very poor performance:

I see support at $1.60 and then $1.50, but I don’t believe that these levels can hold and expect sellers to emerge ahead of it, “making a new all-time low” perhaps. As I discuss below, the stock seems quite expensive. I do see resistance at $1.80 and higher levels.

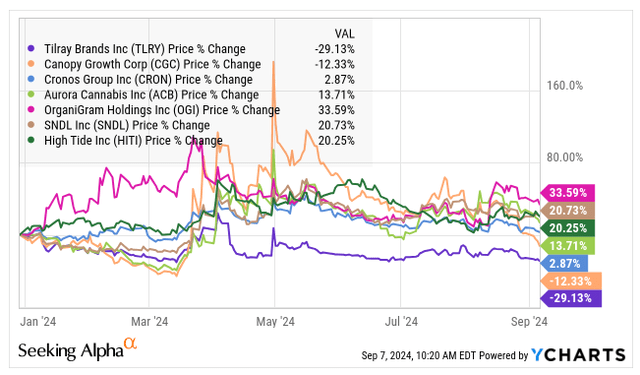

The overall cannabis market, as measured by the New Cannabis Ventures Global Cannabis Stock Index, has dropped 0.3% so far in 2024, while TLRY is down a stunning 29.6%. Since the end of 2022, the GCSI has declined 16.7%, while TLRY has dropped 39.8%. It is underperforming the overall cannabis sector, and it is also lagging other Canadian cannabis companies. Here is TLRY with the other stocks that are currently in that index so far in 2024:

Tilray Looks Expensive Despite Its Decline

Valuing Tilray is difficult for me, as the company operates across four very different segments. I focus on cannabis companies, but I understand that being diversified can be a good thing. In this case, though, I am aware of alcohol companies that look better than Tilray Brands. I don’t care for the pharmaceutical distribution business – it was a bad acquisition that has failed to provide growth. In cannabis, which is an area that I can more easily compare the company to its peers, Tilray Brands does not stand out at all. It has done acquisitions that have not worked out at all.

In the past, I have noted that the price to tangible book value for Tilray has been high relative to peers, which does remain the case. At 2.8X, it is higher, but it is not so high that it must fall. I view this measure of valuation as a downside protection indicator. It is more relevant for companies that have weak cash flow, like TLRY, and high levels of debt. The net debt of Tilray Brands has dropped a lot.

When I look at Tilray, it operates both in Canada and globally in other markets, but it is not in the U.S. at all. It had a potential play in MedMen, now bankrupt. I follow four other Canadian LPs closely, including Canopy Growth (CGC), Cronos Group (CRON), Organigram (OGI) and Village Farms (VFF). I have written negatively about CGC in the past and continue to believe the stock will go down a lot. It is down 12.3% in 2024 so far. I include the other three in my model portfolio at 420 Investor that attempts to outperform the Global Cannabis Stock Index.

I just added Cronos Group back last week, and it is currently 4.0% of the model portfolio, similar to its weight in the index. It trades at 0.8X tangible book value. The company has a lot of cash and no debt, and it has an outside investor, Altria (MO). Organigram is currently 13.2% of my model portfolio. It too has an outside strategic investor in British American Tobacco (BTI). This stock currently trades at 0.9X with net cash. Finally, Village Farms, which is not in the index, is 17.0% of the model portfolio. The company has a small amount of net debt and no outside strategic investor, and it trades at a very low 0.6X its tangible book value.

Compared to its projected adjusted EBITDA for a blend of FY25 and FY26 of $99 million (1/3 FY26 and 2/3 FY25), the current enterprise value of TLRY relative to this is 14.1X, which seems high. This will be the one-year forward number at year-end. In my piece here two months ago, I shared a target of $0.71 (based on 1.5X tangible book value), which then would have been 9.7X the FY25 projection at the time. Looking at 10X the blended projection, that would work out to $1.07, down 34% and a new all-time low. I am not sure 10X will bring in buyers, as the company has negative operating cash flow and a projected EPS for FY25 that is negative.

Conclusion

I like cannabis stocks a lot more than I did at the beginning of this year and sense a new bull market beginning soon, but I still don’t like Tilray Brands despite the big fall in price. The company’s growth is not as strong as it appears due to heavy M&A, and its valuation is not attractive.

For those that want to buy Canadian LPs, I have discussed three here that I cover and that make more sense, and there are others too. I am overweight MSOs currently relative to the index, as they are likely to do better when rescheduling is finalized. This would end 280E taxation, which would help their cash flow and likely excite investors. I think that ancillary cannabis companies make more sense too. While they are not direct beneficiaries of 280E going away, they will benefit from an economically improved customer.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

420 Investor launched in 2013, just ahead of Colorado legalizing for adult-use. We have moved the service to Seeking Alpha. Historically, we have provided strong coverage of the sector with model portfolios, videos and written material to help investors learn about cannabis stocks, and we are excited to be doing it here!