Summary:

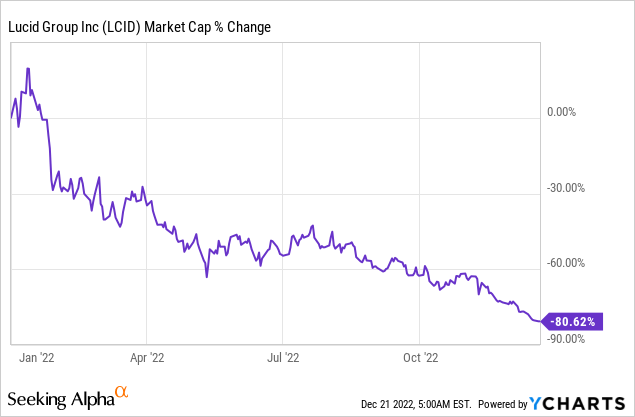

- Lucid Group, Inc. has lost a significant amount of its market cap in 2022.

- Negative sentiment overhang may be overdone at this point.

- Lucid just successfully completed a $1.5B stock sale.

JannHuizenga

Shares of Lucid Group, Inc. (NASDAQ:LCID) have seen an 81% revaluation to the downside so far in 2022, but negative sentiment regarding the electric vehicle (“EV”) firm may have gone too far now. The repricing of Lucid’s growth prospects this year has had a lot to do with the company lowering its production forecast in February of 2022, which resulted in a loss of investor confidence in Lucid’s manufacturing ramp for its first-ever production car. Since other EV companies have also seen steep declines in their market caps this year and sentiment toward electric vehicle firms has greatly deteriorated in recent months, I believe there is a case for a rebound to be made in 2023!

Strong reservation/revenue growth ahead

Lucid had more than 34 thousand reservations as of November 7, 2022, which represented a revenue potential of $3.2B. Lucid has seen strong interest in the Lucid Air and reviews have so far been stellar (see investor presentation page 28). Given high customer interest in the Lucid Air, I believe the EV company could grow its reservations to 50 thousand by the end of FY 2023, which would equate to a revenue potential of $4.7-4.8B. My estimate implies about 35% year-over-year order growth, assuming that Lucid will end the current year with a reservation book showing about 37 thousand reservations in its system.

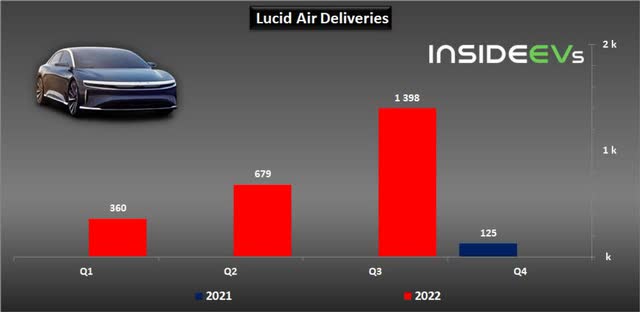

Lucid produced 2,282 electric vehicles in the last quarter and deliveries amounted to 1,398. Although Lucid was forced to lower its production forecast twice in FY 2022 due to logistical issues as well as parts shortages, the company has finally managed to ramp up production in the third-quarter… during which Lucid tripled its production compared to Q2’22. Lucid also just announced that it has started to deliver its first electric vehicles to customers in Europe which creates a new ramp for growth in 2023.

With production ramping up in the second half of this year, Lucid is in a strong position to hit the ground running in FY 2023.

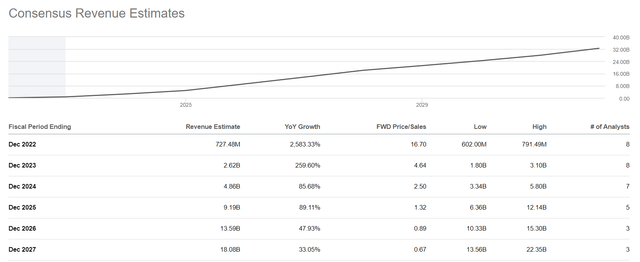

The expectation is for Lucid to see 260% revenue growth next year as FY 2023 will be a crucial year for the company regarding its production ramp. The longer-term revenue outlook is also very positive as analysts see Lucid increase its revenue potential to $18.1B by FY 2027, showing a 25-fold increase over FY 2022.

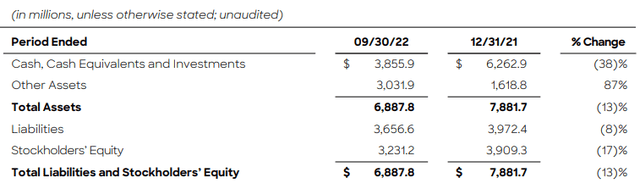

Recent $1.5B stock sale

Lucid already hit the ground running last week when it announced that it successfully raised new capital from its shareholders. The stock sale raises Lucid’s capital position by $1.515B, $915M of which comes from Saudi Arabia’s Sovereign Wealth Fund. The capital raise further adds to Lucid’s solid cash cushion of $3.86B (as of the end of the September-quarter) and allows the company to strengthen its liquidity position and aggressively ramp up production of the Lucid Air in FY 2023 and beyond.

Lucid’s valuation

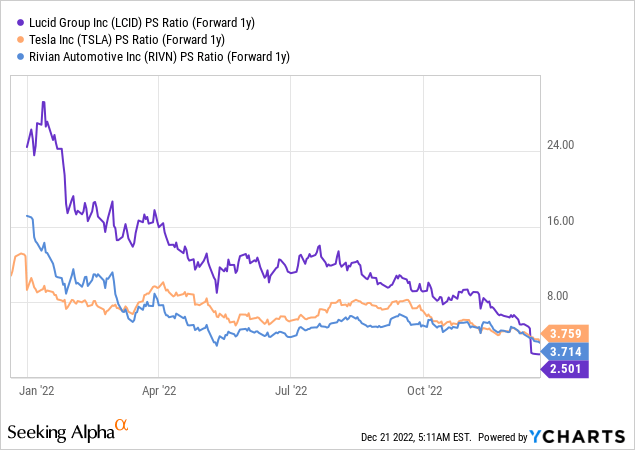

Lucid now has a P/S ratio that is lower than the P/S ratios of Tesla (TSLA) or Rivian Automotive (RIVN), despite having strong potential for revenue growth in the less-crowded luxury sedan market. Lucid currently has a forward (FY 2024) P/S ratio of 2.5 X which compares against a P/S ratio of 3.8 X for Tesla and a price-to-sales ratio of 3.7 X for Rivian Automotive. The comparison to Tesla and Rivian is not straightforward — due to differences in product and marketing strategies — but it nonetheless shows that investors may have turned too bearish on the EV company.

Risks with Lucid

Lucid has lost 81% of its market cap this year. Unfortunately, this doesn’t mean that the stock can’t fall further in 2023 if Lucid’s production ramp doesn’t go according to plan. Shares of Lucid are not necessarily cheap with a P/S ratio of 2.5 x, which means the stock will continue to be vulnerable to disappointments on the production front. From a commercial perspective, a weak forecast for FY 2023 production and delivery volumes is likely Lucid’s biggest risk.

Final thoughts

Lucid may be a promising recovery play as we are heading into 2023. Shares of the EV firm have seen a strong down-side revaluation in 2022, but Lucid, I believe, has considerable potential in the luxury EV segment which most EV manufacturers are not serving. Most EV companies focus on the production of either all-electric pickup trucks or SUVs, while the premium sedan market remains widely under-served. Given the strong market reception of Lucid’s first production car and easing supply chain pressures, I believe Lucid could surprise to the upside in 2023!

Disclosure: I/we have a beneficial long position in the shares of LCID either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.