Summary:

- Lucid has consistently fallen short of its pre-IPO commitments, raising concerns about its ability to deliver on promises.

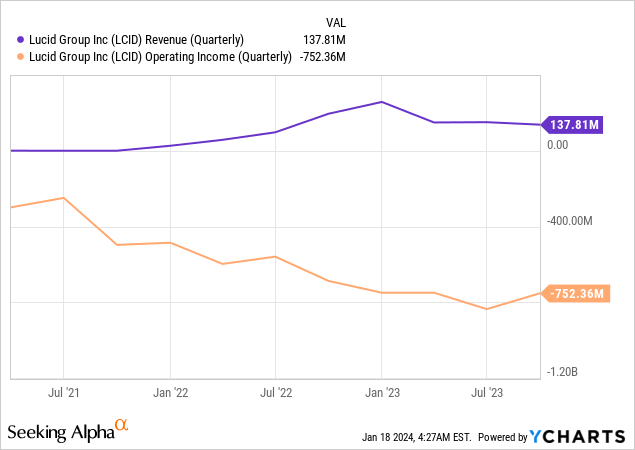

- I harbor reservations about the sustainability of the company’s business model as its operating loss continues to widen despite an increase in revenue.

- Under a moderate case scenario, my target price for LCID stock is $1.

jaanalisette/iStock Editorial via Getty Images

Introduction

Did you know that Lucid’s (NASDAQ:LCID) CEO, Peter Rawlinson, was the highest-paid CEO in 2022, with a staggering $380 million compensation? When I read this news, I thought that LCID must be one of the most promising stocks currently traded in the U.S. stock market. But I was slightly disappointed when I dived deep into the company’s fundamentals, which look weak. The company is deeply unprofitable, and its operating loss is expanding despite revenue ramping up. Such patterns raise concerns about the effectiveness of Lucid’s business model. Additionally, Lucid’s actual delivery numbers are much lower than the ones promised before the company’s IPO. Deliveries growth lags behind the overall U.S. electric vehicles market, a concerning trend for a young and ambitious enterprise. Despite trading nearly 20 times below its all-time high, the current valuation fails to resonate as attractive, which makes Lucid’s stock a “Sell.

Fundamental analysis

Lucid Group is an automotive company targeting the electric vehicles (“EV”) luxury segment. The company is young and offers only one model, the sedan called Lucid Air, which comes in different variations depending on the vehicle’s technical specifications. The second model, the Lucid Gravity SUV, is expected to be released in late 2024.

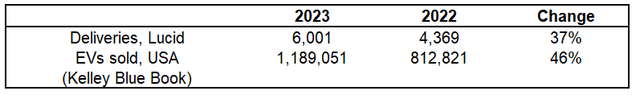

Let us now look at the most crucial metric for an automotive company: the number of vehicles produced and delivered in the last full fiscal year. According to the company’s website, in 2023, Lucid produced 8,428 vehicles and delivered 6,001 vehicles. The number of Lucid cars delivered in 2023 represents 0.5% of all the EVs sold in the U.S. in 2023. Therefore, Lucid cannot be called a notable player in the American EV market. Despite its smaller scale, Lucid lagged behind the overall U.S. EV market in 2023 regarding the growth in the number of cars sold. Total EV sales in the U.S. grew by 46% in 2023, according to estimates from Kelley Blue Book. At the same time, Lucid’s deliveries increased only by 37%. The notable lag behind the broad market by a young and ambitious company like Lucid suggests a weakness in the company’s product offerings.

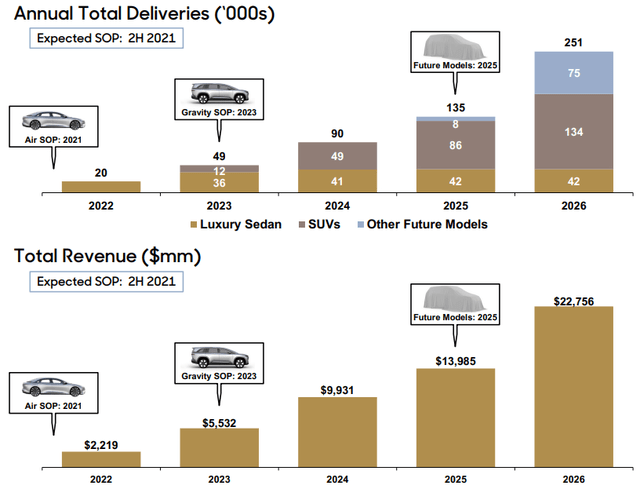

It’s noteworthy to highlight that Lucid has a track record of falling short of its commitments, raising concerns about the company’s credibility. Reviewing the company’s investor deck from February 2021, just a couple of months before Lucid’s IPO, reveals a handful of commitments that were left unfulfilled. For example, it was planned that the Gravity SUV sales would have started in 2023. The new deadline is late 2024, which might also be postponed. However, this might not be a dramatic problem, considering the inherent complexity of designing and manufacturing new models. For example, Tesla (TSLA) several times delayed the launch of its Cybertruck.

But what is indeed crucial and a big warning sign is a substantial deviation from projected deliveries and revenue estimates for 2022 and 2023, to put it mildly. Lucid had outlined delivery targets of 20 thousand vehicles for 2022 and 49 thousand for 2023. However, as indicated in the above table, the actual deliveries fell dramatically below these projections, mirroring a comparable underdelivering in revenue, which likewise lagged behind the pre-IPO estimates.

Lucid’s investor deck as of February 2021

Operating on a modest scale, it’s understandable that the company may not be immediately profitable. However, my concern arises from the fact that Lucid’s operational losses have significantly deepened despite revenue growth in the past three years. In a sound automotive business model, the trajectory shall be the opposite – as scale increases, operating profits should improve thanks to the lower per-unit costs. The notable increase in operating losses with expanded production volumes seems counterproductive to a logical production ramp-up.

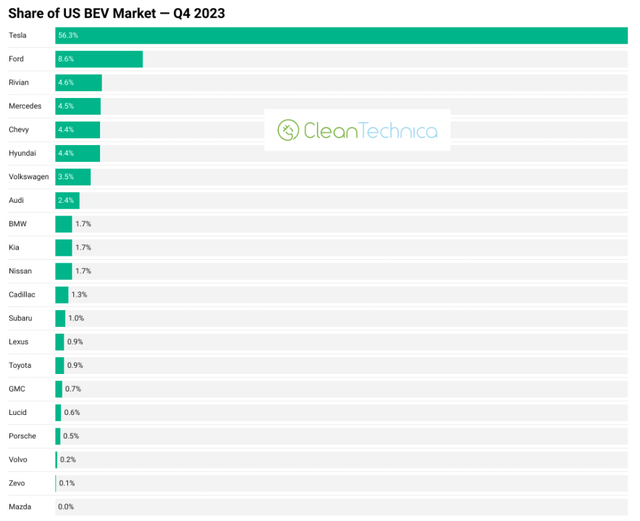

While the EV industry remains dynamic, it’s paramount to highlight the intense competition within the market. There is an absolute EV leader in the U.S., Tesla, which holds 56% of the market share. The remaining 44% of the total pie is shared between several large companies, including iconic brands like Ford (F), Toyota (OTCPK:TOYOF), Mercedes-Benz (OTCPK:MBGAF), Volkswagen (OTCPK:VWAGY), BMW (OTCPK:BMWYY), and Audi. Notable players in the U.S. EV market also include very South Korean brands like Hyundai and Kia.

I think it will be very difficult for Lucid to compete with all these giants, which can produce millions of vehicles per year and have massive expertise and financial resources. While Lucid positions itself as a luxury brand, some people might say that comparing Lucid to Toyota or Hyundai would be inappropriate. That will be true; however, it’s essential to acknowledge the fierce competition within the luxury segment, particularly from established German brands such as Mercedes, BMW, Porsche, and Audi, which collectively command a 9.1% share of the U.S. EV market. It’s noteworthy to highlight that Mercedes and Porsche exhibit the highest brand loyalty in the premium segment, a factor that should not be overlooked.

Competing with these automotive giants with only one sedan, Air is a big challenge. Moreover, Lucid Air’s pricing ranges between $79k and $249k and is comparable to its competitors from German luxury automakers. For example, Porsche’s Taycan is within the $91k to $195k range. Mercedes’s luxury electric sedan, the EQS, can be bought within the $106k to $137k range. Lacking the brand loyalty enjoyed by competitors and facing no pricing advantage, it becomes challenging to envision how Lucid’s Air will successfully capture the market.

Valuation analysis

Lucid’s stock price history since its IPO looked like a roller-coaster before it peaked in November 2021. The stock trades at $2.8 per share, almost 20 times lower than its all-time high of late 2021. The stock price declined by around 66% over the last 12 months, and it is currently around 70% cheaper than the IPO price.

The company’s present market capitalization stands at $6.6 billion, appearing notably generous in light of the long-term consensus EPS projections, foreseeing a break-even point only post-FY 2027. It is pivotal to highlight that these EPS forecasts are based on assumptions of extensive revenue growth, with consensus estimates anticipating a three-year consecutive doubling of revenue. However, given the company’s historical pattern of significantly falling behind expectations, the feasibility of achieving such ambitious projections appears highly doubtful.

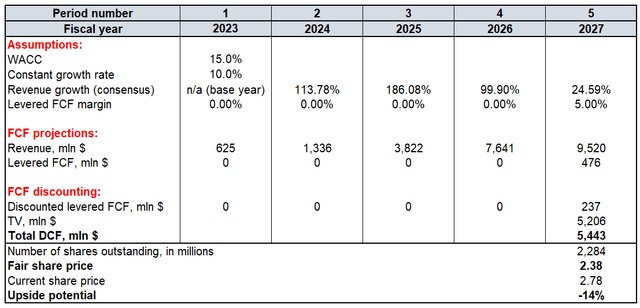

However, to avoid being too pessimistic about Lucid, I will conduct my discounted cash flow (“DCF”) valuation by implementing consensus revenue growth estimates and using a very high 10% constant growth rate. I expect zero FCF margin for the next four years and a 5% starting from FY 2027. To balance this scenario, I use a high 15% discount rate because of the extreme level of uncertainty regarding Lucid’s ability to double revenue for three years in a row and the remoteness of the positive FCF timing. The number of shares outstanding is currently slightly below 2.3 billion.

As shown above, the fair valuation for the stock stands at $2.38, a notable 14% below the current market price, even when incorporating extremely optimistic revenue growth assumptions.

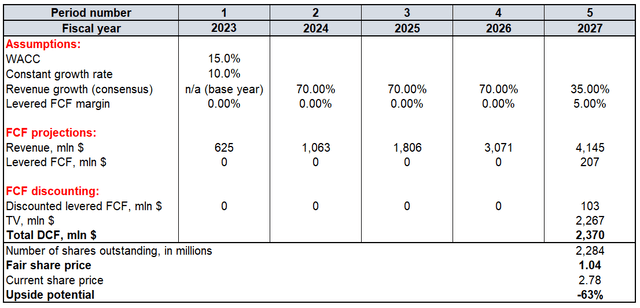

The financial model relies significantly on a revenue growth trajectory. Should a more conservative 70% revenue CAGR be applied for the next three years (which is still challenging to complete), the stock’s fair value plunges to a mere dollar. Consequently, even after its notable decline in recent months, I cannot say that Lucid’s stock is attractively valued.

Mitigating factors

While numerous challenges are evident in Lucid’s outlook, there are also positive factors that could temper my bearish perspective. The most apparent strength of Lucid is that this company is financially backed by the Public Investment Fund (“PIF”) of Saudi Arabia, which owns a 60% stake in Lucid. Even despite burning a lot of cash every quarter, the company still had $4.4 billion in cash as of the latest quarterly reporting date, which is explained by the extensive financial support from PIF. Considering the PIF’s substantial total assets of $777 billion, it appears feasible for them to sustain support for Lucid until the company achieves the pivotal moment of disrupting the EV market with an unparalleled offering, potentially serving as an inflection point for the company.

Despite having company-specific challenges, let us not forget that Lucid operates in one of the hottest industries amid a substantial global shift towards sustainability supported by governments in major economies. Despite its struggles, Lucid benefits from the significant positive momentum within the global EV market, which is projected to grow at a 16% CAGR in the coming years. This positive trend should not be discounted.

Conclusion

When evaluating Lucid, the negatives significantly outweigh the positives. Furthermore, my target price estimates indicate a valuation below the current market price, emphasizing its unattractiveness. The company’s consistent underperformance against commitments and notable doubts about its business model’s viability. The significant competitive threat posed by German luxury automakers should not be overlooked. All these unfavorable factors combined led me to assign the stock a “Sell” rating.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.