Summary:

- Lucid Motors expects to grow production ~100% YoY in 2023.

- Market sentiment has turned against EV companies lately, including Lucid Motors.

- I still think that patience will be rewarded for long-term-focused investors.

David Becker

Lucid Group, Inc. (NASDAQ:LCID), an electric vehicle manufacturer, has projected a 14K vehicle production volume in 2023, representing a 100% YoY increase. The forecast is conservative, but there is room for improvement if supply-chain uncertainty is reduced throughout the year.

The market has turned decisively against electric-vehicle companies in recent months, and Lucid Motors is no exception.

Having said that, I believe that patient investors will be rewarded as Lucid Motors expands its production footprint and prepares to triple its production capacity over the next two years.

What Can Investors Expect From Lucid Motors In 2023?

Lucid Motors expects to increase production to 14.0K electric vehicles by 2023, up from 7.2K electric vehicles last year. Due to supply-chain issues and delays in scaling production, Lucid Motors was unable to transfer its momentum into 2022 after a strong start in 2021, but the company has nonetheless demonstrated that there is a large appetite in the market for luxury electric vehicles.

Lucid Motors did disappoint the market (but not consumers) twice in 2022 by lowering its production forecast to a range of 6-7K, which the company eventually exceeded.

With a 14K production target set for 2023, investors can expect Lucid Motors to ramp up production at the same time. The EV company intends to increase not only production but also installed capacity, which will significantly raise the company’s production ceiling. In 2022, Lucid Motors had a total annual installed production capacity of 34K electric vehicles, but this figure is expected to rise to 90K by the end of next year.

Lucid Motors is currently working on an expansion project in Arizona that will add 3.0 million square feet. Furthermore, Lucid Motors is constructing a manufacturing plant in Saudi Arabia that, when completed, will have a peak annual production capacity of 155K electric vehicles.

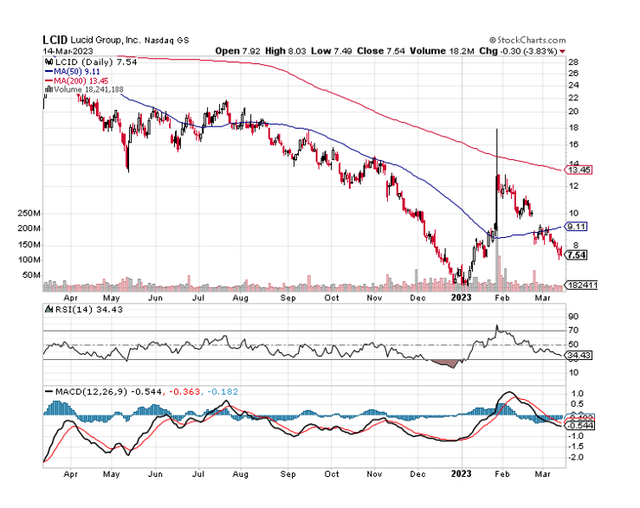

What Does The Chart Picture Tell Us?

Unfortunately, I purchased Lucid Motors far too early. I first bought the stock in 2021 when the hype was going strong and the stock traded at a substantially higher price (above $50) and valuation.

The electric-vehicle company got off to a fast start in 2021, becoming one of the first to begin EV deliveries. However, as supply chain issues arise and competition in the EV market heats up, Lucid Motors has given up the majority of its gains.

Moving Averages (Stockcharts.com)

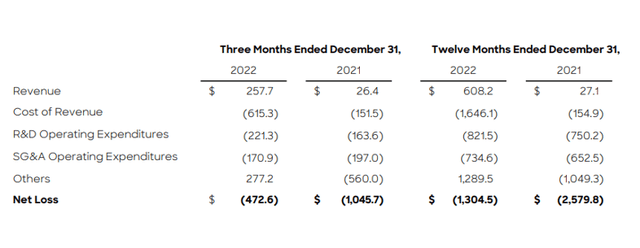

Sales Performance, Projections And Market Valuation

Lucid Motors generated $608.2 million in sales in its first year of operation, which is a commendable achievement. Lucid Motors is growing extremely quickly, though not as quickly as expected, with revenues of only $27.1 million in 2021. Lucid Motors should ramp up production in the United States and Saudi Arabia for at least the next few years, according to analyst projections that call for more than 100% annual sales growth in each of the next two years. I provide more context and specifics about sales growth projections for Lucid Motors further down in this article in the valuation section.

.

Sales Performance (Lucid Motors)

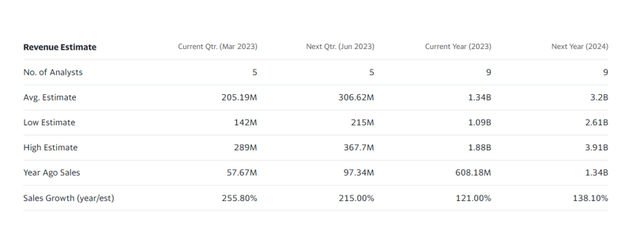

The market currently forecasts $1.34 billion in sales for 2023, a significant decrease from the $2.57 billion forecasted just a few months ago. Regardless, Lucid Motors is expected to see a significant increase in sales in 2023 and 2024. Lucid Motors’ revenues are expected to increase 121% this year, followed by a 138% increase in 2024.

Lucid Motors has a 2024 sales multiple of approximately 4.4x based on a current market value of $14.0 billion, which is less than half the multiple investors had to pay at the end of February.

Revenue Estimate (Yahoo Finance)

Why Lucid Motors Could See A Lower Valuation (Investment Risks)

Lately, concerns have popped up in the EV industry about falling prices after the largest EV company in the world by market value, Tesla (TSLA), increased pressure on peers by lowering electric vehicle prices.

Furthermore, Lucid Motors may not meet its 2023 production target if supply fails, inflation saps demand for new electric vehicles, or the market is confronted with a full-fledged crisis in the U.S. banking system following the failure of Silicon Valley Bank. All of these are micro and macro risks that investors should consider before purchasing Lucid Motors stock.

My Conclusion

Lucid Motors has fallen out of favor, which is unfortunate given how strongly the company began in the EV market with its highly regarded Lucid Air electric vehicle.

With that said, I believe the market’s disdain for EV start-ups, whether Chinese or American, represents an opportunity for long-term focused EV investors to purchase Lucid Motors’ discounted stock at around $7.40.

Despite the fact that the EV company has delivered some disappointments and has failed to meet sky-high expectations in 2022, I believe LCID stock is too good an opportunity to pass up, as sales are expected to grow quickly and the company aggressively scales up production.

Disclosure: I/we have a beneficial long position in the shares of LCID either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.