Summary:

- Lucid Motors reported a wider-than-expected loss in Q2, but secured $1.5 billion in funding from its majority shareholder.

- Concerns remain about Lucid Motors’ profitability, low production volume, and reliance on shareholder funding.

- Lucid Motors’ stock is considered overvalued compared to similar EV companies like Rivian Automotive, with limited potential for major re-rating.

Khosrork

Lucid Motors (NASDAQ:LCID) reported a wider-than-expected loss for the second quarter, but the electric-vehicle company secured $1.5 billion in funding from its majority shareholder, Ayar Third Investment Co, which is an affiliate of Public Investment Fund of Saudi Arabia.

I think Lucid Motors business model remains fundamentally challenged and I don’t see a realistic path to short-term profitable.

Though it is obviously a good development for Lucid Motors to see its biggest shareholder extend yet another lifeline, I think that the risk/reward relationship continues to work against Lucid Motors.

My Previous Rating

Lucid Motors guided and reaffirmed its production outlook for 9K electric vehicles in August which implies a deeply disappointing production ramp.

Previously, the slow scaling of production led me to issue a stock classification of Sell for Lucid Motors’ stock. Though the electric-vehicle company just said that it raised additional capital, I don’t think that the actual business is on a good path: It continues to lose a lot of cash, has a relatively low production volume on a run-rate basis and demand for electric-vehicles has been slowing, leading many traditional automakers to scale back investments in their EV transformations.

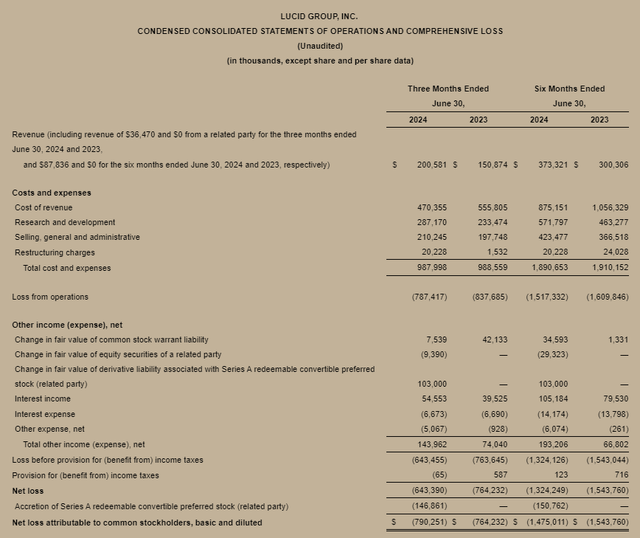

Lucid Motors Continues To Lose A Large Amount Of Money

Lucid Motors reported that it raised more cash from the Public Investment Fund of Saudi Arabia, creating yet another cash infusion for the cash-strapped electric-vehicle company.

The Public Investment Fund of Saudi Arabia has been a sponsor of Lucid Motors for years and participated in all major funding rounds. According to the most recent announcement, PIF is investing another $1.5 billion into Lucid Motors with funds being used to build a manufacturing facility in Saudi Arabia.

My biggest concern with regard to Lucid Motors is that the company still has a very low production and delivery run-rate which means that unless the EV company is seeing a drastic improvement in terms of numeric output soon, Lucid Motors is at risk of inflicting many more years of operating losses on its shareholders.

In the most recent quarter, 2Q24, Lucid Motors produced only 2,110 electric-vehicles. Tesla Inc. (TSLA) produced 410,813 electric vehicles in 2Q whereas Rivian Automotive Inc. (RIVN) produced 9,612 vehicles. So even Rivian Automotive, which is also not yet profitable, achieved a four-and-a-half-times higher production volume than Lucid Motors.

A low production volume compounds profitability challenges, as Lucid Motors has not nearly the volume required to produce EVs profitably. Consequently, Lucid Motors produced a net loss of $790.3 million in the second quarter and posted a loss of $0.34 per share, compared to an expected loss of $0.27 per share.

Moving forward, the electric-vehicle company should be anticipated to continue to rack up more losses and will likely have to continue to tap into the pockets of Saudi Arabia’s Public Investment Fund as well.

Condensed Consolidated Statements Of Operations And Comprehensive Loss (Lucid Motors)

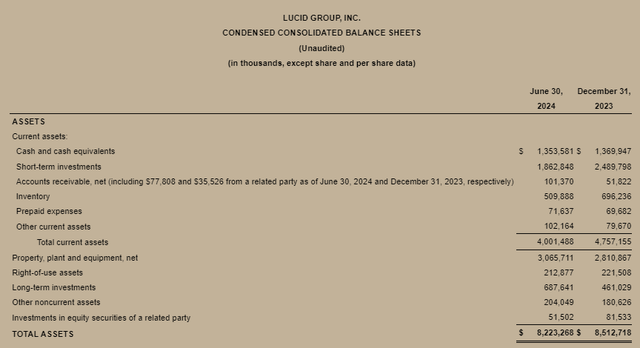

Lucid Motors has been backed by the Public Investment Fund of Saudi Arabia, and it is this backing that is a clearly a strength, and it shows in the company’s filled cash accounts.

As of June 30, 2024, Lucid Motors had total cash, cash equivalents and short-term investments in the amount of $3.2 billion, which was down from $3.9 billion as of December 31, 2023. The $643 million decline in cash and investments is due to negative free cash that it related to Lucid Motors investing in the Lucid Air production.

For the present year, the electric vehicle car marker sees $1.3 billion in capital spending, so approximately triple what it already spent in the first six months of the year.

The increase in capital spending towards the end of the year relates to Lucid Motor’s newest electric-vehicle project, the Lucid Gravity, which will be the company’s first SUV.

Condensed Consolidated Balance Sheets (Lucid Motors)

Lucid Motors’ Sales Potential Is Expensive

The market presently models $765 million in sales for this year and $1.65 billion next year. However, sales estimates are constantly receiving downward corrections, due to slow production and delivery growth and moderating demand for new electric-vehicles on the part of consumers.

In my last piece in May, consensus estimates for 2025 were anchored at $2.04 billion, approximately $390 million higher than today.

Revenue Estimate (Yahoo Finance)

Presently, Lucid Motors’ stock is selling for 5x leading sales. Rivian Automotive, which may be the most comparable EV company taking into account its similarly comfortable cash levels, is selling for 2.2x leading sales.

Rivian Automotive is also losing money, but the company just signed an equity deal with Volkswagen Group in order to jointly develop EV technology.

Lucid Motors appears to be overvalued here, in my view, particularly with respect to Rivian Automotive, as the latter is poised to produce about six times more electric-vehicles than Lucid Motors in 2024. A 3x leading sales multiple is what I could go along with paying for Lucid Motors, which leads us to an implied intrinsic value of $2.10.

Why The Investment Thesis Might Disappoint

There is, theoretically, a chance that Lucid Motors will grow to profitability over time. After all, the Public Investment Fund of Saudi Arabia seems to have considerable resources at its disposal and has consistently funded Lucid Motors’ operations in the last couple of years.

Should Lucid Motors against my expectations and better judgment, achieve profitability moving forward, I think there could be a scenario of a major re-rating.

Given the low production volume, soft full-year guidance and persistent losses, however, I think that the odds of such a major re-rating are relatively low.

My Conclusion

Lucid Motors might be dead money for a while, even though the stock did react positively to the company’s 2Q24 earnings.

Lucid Motors reported a higher-than-expected loss in the second quarter as the company is still fundamentally struggling with its profitability trajectory: The electric-vehicle company lost $790 million in the last quarter, which explains why Lucid Motors needs to constantly raise capital from its majority shareholder.

While it is obviously a positive thing for the electric-vehicle company that it has such a rich investor providing financial support, the constant pursuit of investor money indicates that the business model as such is deeply challenged, and potentially flawed.

I think that Lucid Motors does not present an attractive investment option, and therefore keep my stock classification unchanged at ‘Sell.’

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.