Summary:

- Lucid Motors is a luxury electric car manufacturer based in California, with a significant ownership stake held by Saudi Arabia’s sovereign wealth fund.

- The electric car market is growing rapidly, with EV sales increasing and market share expanding. Lucid Motors operates in the luxury segment of the market.

- Despite facing challenges with production and cash burn, there are reasons to remain optimistic about Lucid Motors, including the support from the Public Investment Fund and the upcoming launch of their new SUV model, the Lucid Gravity.

Justin Sullivan

Lucid Motors (NASDAQ:LCID) is an American car manufacturer based in Newark, California. The company makes luxury electric sports cars and soon SUVs. Very interestingly, unlike many other American corporations which are mostly owned by American-based investment companies such as BlackRock (BLK) or Vanguard (VTI), over 60% of Lucid’s ownership belongs to Public Investment Fund (PIF), Saudi Arabia’s sovereign wealth fund. The hedge group appears to bet a significant part of its resources on the company, which also in part gives me confidence for my bullish view.

Electric is King

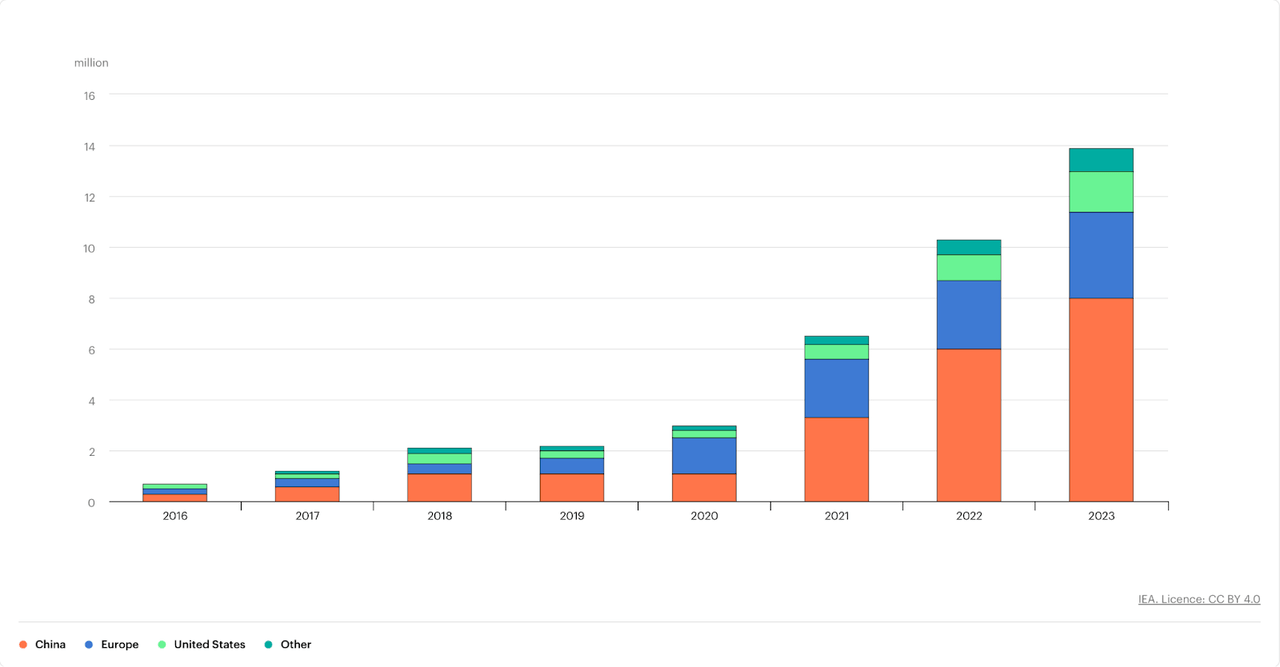

The electric cars market is expanding at unprecedented rates, we’re talking about 35% YoY growth in new EV purchase, while the shares in electric cars in total sales have more than tripled over the last 3 years. In fact, the best selling new car for the first quarter of 2023 in the world was the Tesla (TSLA) model Y, beating the Toyota Corolla which is half its price. Now, seemingly every automaker is starting to make EVs, as the market is expected to experience a CAGR of 15.5% between 2024-2032, compared to 7.1% for natural gas vehicles.

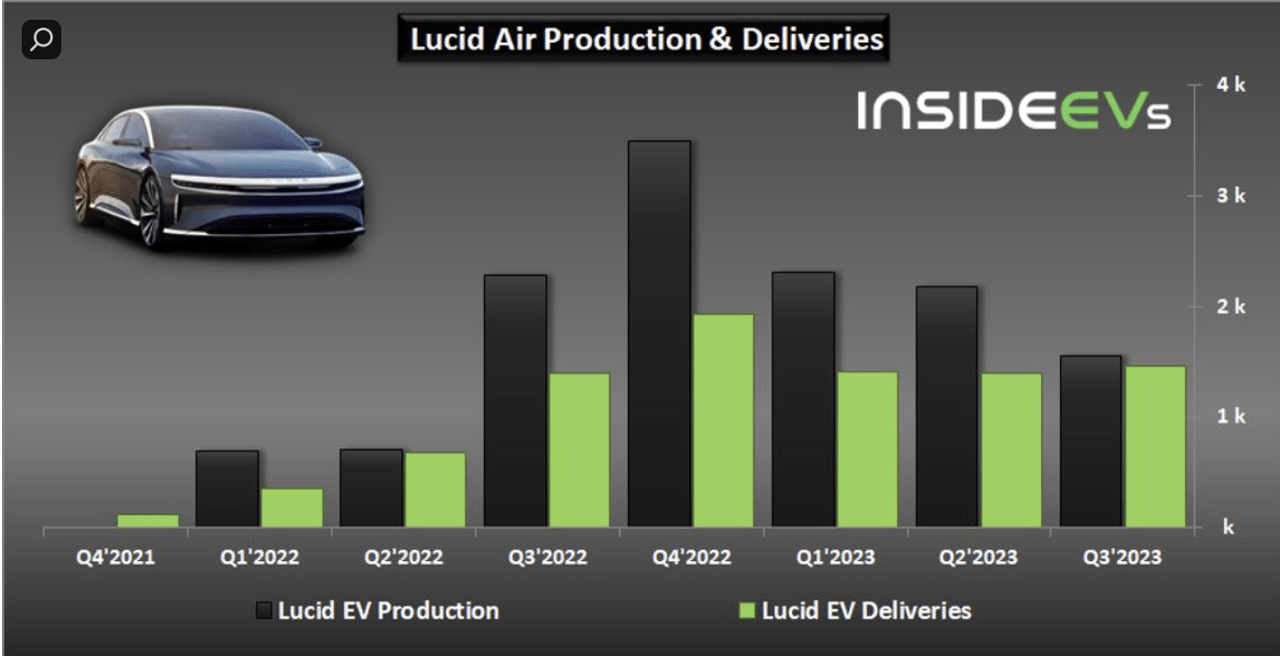

Lucid Motors operates on the luxury side of the market, with its only available model, the Lucid Air, starting at $76,475 USD. In the third quarter of 2023, Lucid produced 1550 vehicles and delivered 1457 during the same period. In the same period last year, the company produced 2282 vehicles and delivered 1398. The stock currently trades at under $4, compared to ~$7 in the same period last year. Part of this decrease can be thanks to Tesla aggressively cutting prices amidst higher interest rates, decreasing the appeal of Lucid’s luxury vehicle. As a result, the company guidance for production outlook from an already low 10,000-14,000 to 8000 for the year.

This has caused a lot of concerns for investors as new EV companies’ production and deliveries are expected to drastically increase YoY, yet Lucid seems to remain stagnant. However, I believe there are still reasons to remain optimistic.

How much cash left to burn

Taking a deeper look at the financials, in the 9 months prior to September 30, 2023, Lucid generated $438 million in revenue, compared to $350 million the same period in 2022. In the first 9 months of 2023, Lucid had taken $2.36 billion in losses from operations, compared to $1.84 billion the previous year. Annually, the company has a cash-burn rate of $3.6 billion, it’s no wonder many investors are skeptical about the fate of the company. With $4.4 billion cash and ST investments left, there are some who say the company may be in serious trouble by early 2025.

Losses like this are not unusual in the automotive startup world nowadays. Although many point to Tesla, who achieved a profitable business really early, the reality is that there are many companies burning through cash just like Lucid. Rivian (RIVN) currently is at a cash-burn rate of $1.62 billion per quarter; Fisker (FSR) and Canoo (GOEV), both companies with more debt than cash, had a cash-burn rate of $636 million and $358 million per year, respectively. We’ve entered a new era of start-up companies, where it is considered normal to invest in scaling up before worrying about profitability. Many conservative investors would stay away from the large amount of money these companies are burning away, but I believe there are strong reasons to keep Lucid in the high-risk, high-reward portion of the portfolio.

First, I would like to introduce the Public Investment Fund of Saudi Arabia. It is one of the largest sovereign wealth funds in the world, and one of its main goals is to diversify Saudi Arabia’s economy and move away from its dependence on oil.

Notably, the fund invested significantly in both American EV companies Tesla and Lucid. However, in 2020, the fund sold almost all of its shares in Tesla. Now it is hard to backup from Lucid also. What I’m trying to say is that Lucid is one of PIF’s key bets on foreign companies and the future of electric vehicles. Yeah, the company is making some other investments, like a $250 million investment on a Chinese EV startup, it is nothing compared to its $5+ billion stake in Lucid. So unlike other investment firms such as BlackRock or Vanguard, the PIF is likely to give more support to Lucid as it is an important piece of its diversification goal for the country. Instead of failing completely, investors should be more worried about Lucid further diluting its shares, however, I think now is an attractive time for the company, which is trading at its all-time low.

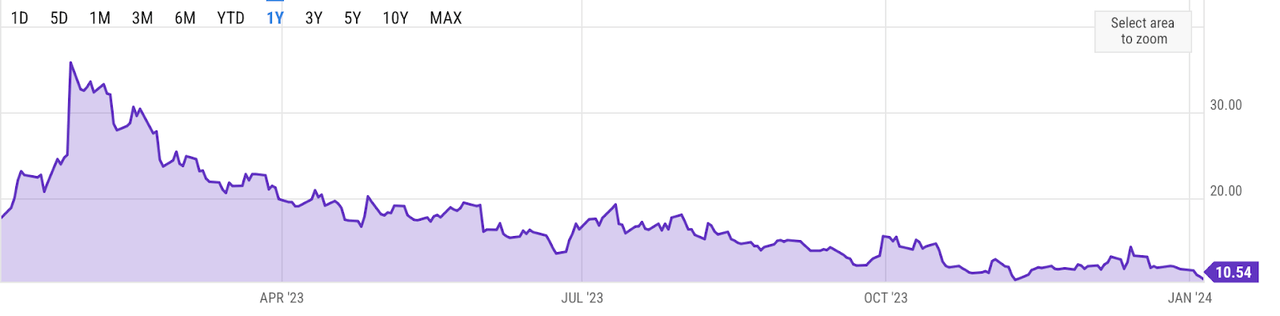

The company trades at a P/S ratio of 10.54, compared to ~18 a year ago.

Lucid 1-year P/S (ttm) (YCharts)

There is also a possibility of a complete buyout in my view. In January of last year, Lucid stock jumped almost 100%, to ~$17 as a rumor of the PIF potentially buying out the company (PIF already owns over 60% of Lucid). On a technical level, Lucid has sophisticated engineering and is one of the leaders in EV technology. So though it may be difficult for PIF to back out from Lucid, a buy-out is possible for its 361 global patents and a talented team of engineers. All in all, I don’t think bankruptcy would be an issue for Lucid, and with it also offering a great product, I am willing to place my bet on Lucid.

The Gravity

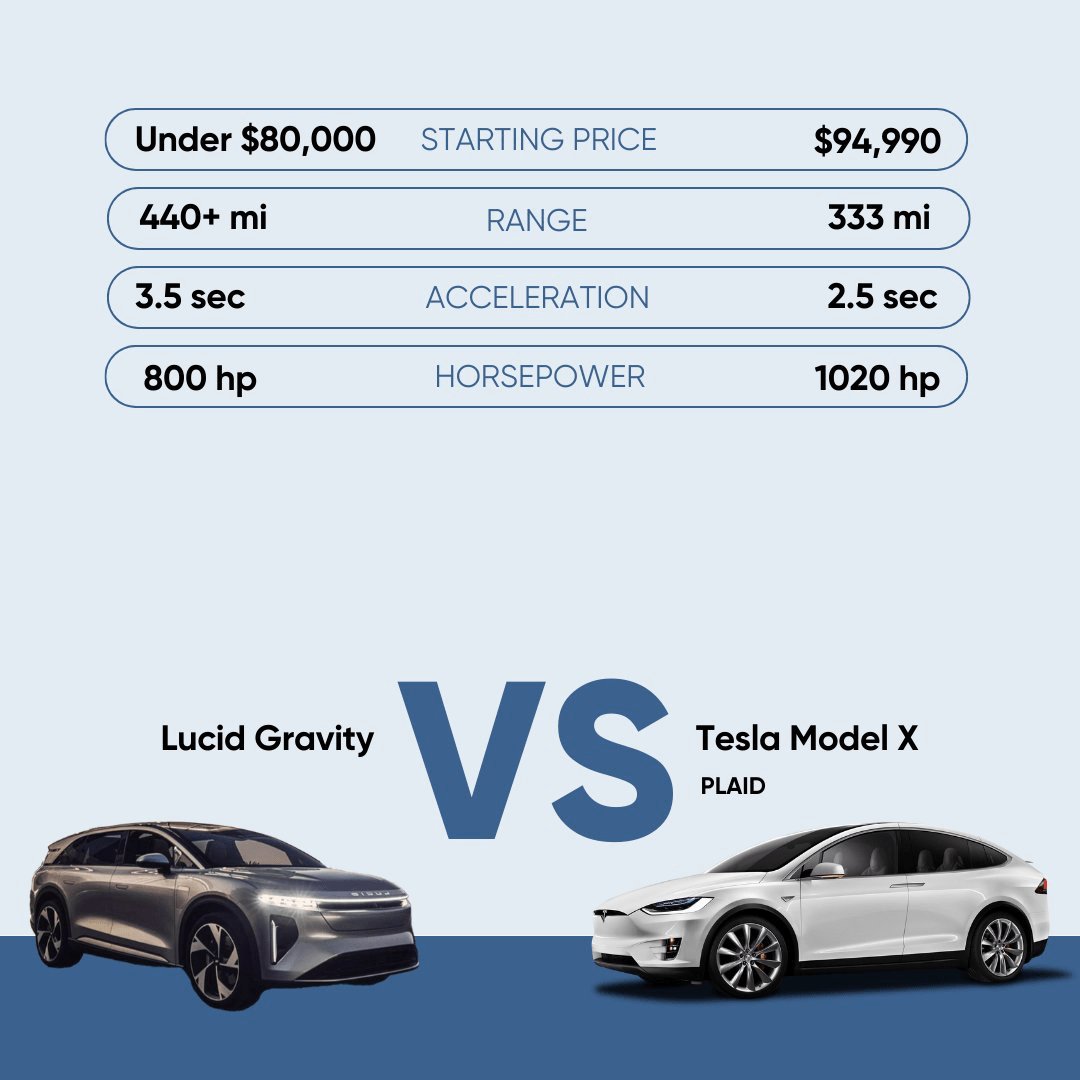

In late 2024, Lucid will launch its new SUV model, the Lucid Gravity. On the spec sheet, it looks like the car should be competitive at least to the other luxury EV SUVs. I have no doubts Lucid will make impressive vehicles, the real key is how the Gravity will help with demand issues.

Lectrium

The most popular types of cars in America are SUV and pickup trucks. However, much like the sedan, electric SUV is a competitive market. The key for Lucid to generate demand with this car is to have a selling point. With the Lucid Air, it’s just good- very comfortable, no complaints, but it doesn’t give much compelling reasons to choose it over a Tesla or a Porsche. With the Gravity, it looks like a big selling point is the luxurious space and its range of 440+ miles. It remains to be seen whether this is the right answer.

In my opinion, most consumers don’t need an EV to have a very long range, as it is easily rechargeable at home. However, its luxury features may be the key. In Lucid’s own words:

Lucid’s commitment to design excellence, spacious interiors, and versatility further sets Gravity apart from the competition.

Along with the Gravity, Lucid is introducing Lucid Sanctuary and Lucid Spaces, which are features that transform the interior of the car to an entirely different atmosphere. The car’s interactive 34-inch display may be the key to provide a driving experience some customers want. Again, it is unclear whether or not Gravity will be the solution to Lucid’s demand problem, but I believe Lucid has time to find its selling point and be able to comfortably ramp up production.

Conclusion

All in all, the biggest problem Lucid is facing is demand. On one hand, consumers are choosing the lower price tags of Tesla as interest rates stay high. On the other hand, luxury EV sedans are a very competitive market, with big names such as Tesla, BMW, Mercedes, Lamborghini, Porsche, Lexus just to name a few, it is difficult for Lucid to generate customers even with such a nice product.

However, it is not time to panic yet. The stock is trading at its historic low, even though the Gravity is just around the corner. Plus, I believe the PIF would not back away from funding the company. I believe that as soon as the company can find its unique selling point/niche to attract customers, it has a chance at a prosperous future.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of LCID either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.