Summary:

- Lucid reported worse than expected Q1’23 results.

- Lucid appears to have lowered its FY 2023 production target as well.

- Production setbacks and slowing growth are set to weigh on the EV maker’s valuation.

David Becker

Lucid Group (NASDAQ:LCID) announced earnings for the first-quarter yesterday and results were not exactly great. While the EV maker is still growing revenues, pre-released production and delivery numbers for the first-quarter already indicated that the company’s ramp may be happening at a slower pace than expected. Additionally, Lucid Group said that it plans to produce 10 thousand or more electric vehicles in FY 2023, which I understand to be a soft downgrade from the previously communicated guidance range of 10-14 thousand electric vehicles. While Lucid’s revenue growth and liquidity look solid, Lucid may not grow as fast as expected in FY 2023. A hard downgrade of the company’s production target would likely be a major negative catalyst for Lucid’s shares!

Lucid keeps disappointing

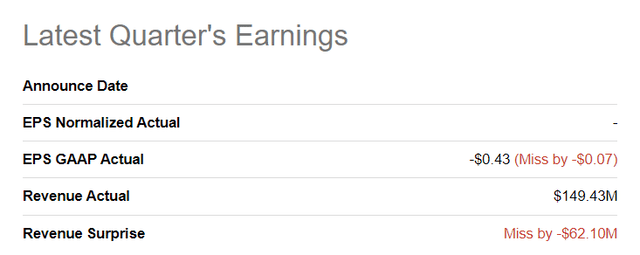

Lucid announced results for Q1’23 on Monday and the EV company missed on both the top and the bottom line. While revenues still ramped up nicely in the first-quarter (+159% Y/Y), analysts expected stronger revenues. Lucid also continued to lose money in the first-quarter.

All eyes on production and delivery performance in FY 2023

After reducing its production guidance for FY 2022 twice last year, it appears that Lucid is watering down its production target for FY 2023 as well. Due to headwinds to consumer spending and demand, Lucid has reported weak production and delivery numbers for Q1’23 at the beginning of the quarter.

Lucid said at the time that it produced 2,314 vehicles (+235% Y/Y) and delivered 1,406 electric vehicles (+290% Y/Y). However, demand seems to be an issue now and Lucid is not growing production as quickly as investors thought the EV maker could. Initially, Lucid guided for a production volume of 25 thousand units at the beginning of FY 2022 and the estimated production volume for FY 2023 is expected to be just about 10 thousand units. Given Lucid’s rather soft reaffirmation of its initial production guidance, I believe the EV company could see headwinds to its growth going forward. Additionally, Lucid is now no longer reporting reservation numbers which I consider to be a negative for investors. I believe it is likely that due to some cancellations and slowing reservation growth, Lucid is no longer comfortable reporting such numbers.

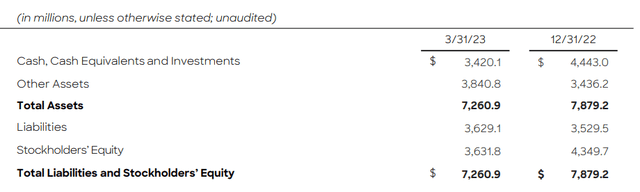

Strong liquidity position

If Lucid has anything going for itself besides a top-rated EV product, it relates to the company’s strong balance sheet and liquidity position. At the end of the first-quarter the electric vehicle manufacturer had cash on its balance sheet in the amount of $3.4B and it had another $700M in credit facilities available. In total, Lucid’s liquidity at quarter-end was $4.1B which I believe is sufficient to finance the EV maker’s operations at least all the way through FY 2023. Since Saudi Arabia’s sovereign wealth fund backs Lucid, I don’t believe that the EV manufacturer would have any problems raising additional cash if the company needed it.

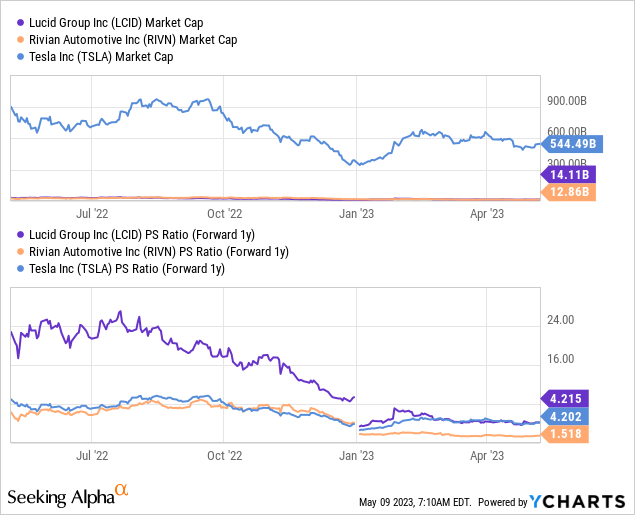

Lucid’s premium multiple may be at risk

Lucid is still one of the most expensive electric vehicle companies in the U.S. stock market when compared to Tesla (TSLA) or Rivian Automotive (RIVN) and in the past there was a good reason for a premium valuation. But with the current outlook for FY 2023 I believe Lucid could be at risk of losing this premium as the EV company clearly is not growing as fast as expected. Lucid is now valued at 4.2X revenues which is a multiplier factor that exceeds Tesla’s… although Tesla is already producing millions of cars annually and generating solid free cash flow. For Lucid, I believe it will be harder to defend its current valuation multiplier going forward, unless investors see a significant ramp in production and deliveries.

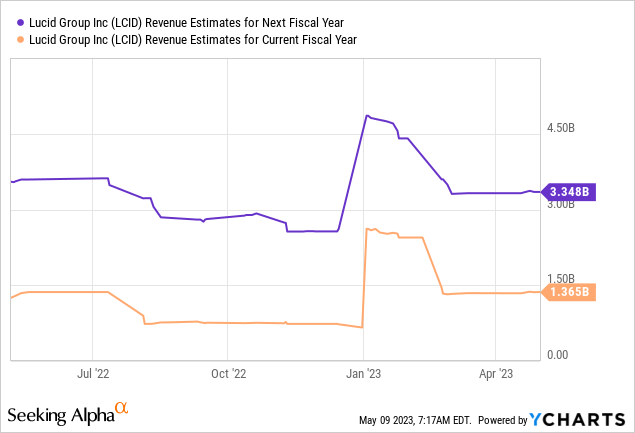

Estimates may be at risk as well

Since Lucid did not deliver a good earnings report for Q1’23, I expect revenue estimates to continue to be revised downward. Analysts have corrected their estimates a number of times to the downside as supply chain challenges last year and now demand issues weigh on Lucid’s near term top line potential. Analysts still expect $3.35B in revenues next year, however, implying a 145% year over year growth. If estimates continue to trend down, Lucid’s valuation multiplier is set to adjust to the downside as well.

Risks with Lucid

Lucid’s commercial risks do not relate to its liquidity situation or the strength of its balance sheet, but rather to the pace of the ramp in electric vehicle production and deliveries. The Q1’23 earnings card suggests that Lucid is having more trouble than expected ramping up deliveries which also may explain why the company is no longer reporting reservations. Slower top line growth, declining reservations and a weaker order book are all set to hurt Lucid’s revaluation potential.

Final thoughts

Lucid’s growth overall is slowing and the way I read the earnings report, I believe we have seen a soft downgrade in the firm’s FY 2023 production guidance. Lucid initially guided for 10-14 thousand electric vehicles as a manufacturing goal for FY 2023, but Lucid now said that it looks to produce “10 thousand or more” electric vehicles, thereby managing expectations that the company sees a production volume closer to the lower-range of its initial production range. While revenues are still growing rapidly and the company has solid liquidity, I believe that execution risks are high and that Lucid may not grow as fast as expected. For shares, this could spell trouble as Lucid remains one of the more expensive U.S.-based EV companies in the market!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of LCID either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.