Summary:

- Lucid Group’s stock has declined about 14% since May 2, when my first article about the company went live.

- The company’s Q2 earnings were weak, with significant revenue underperformance and weak profitability metrics.

- The near-term outlook for Lucid is unfavorable, with headwinds from high interest rates and inflation impacting demand for luxury EVs.

Khosrork/iStock Editorial via Getty Images

Investment thesis

My first bearish thesis about Lucid Group’s (NASDAQ:LCID) stock worked out well. The share price declined about 14% since May 2, when the article went live, which is significant underperformance compared to the broad stock market. Today I want to reiterate my bearish thesis because the last quarter’s earnings were weak, and the near-term outlook is unfavorable. Moreover, unrealistically optimistic revenue growth projections are priced in, meaning the valuation is far from the underlying fundamentals. To summarize, I assign a “Strong Sell” rating for LCID.

Recent developments

The company reported its Q2 earnings on August 7, significantly missing consensus estimates. I will ignore the bottom line, miss, because, at the company’s stage of development, it is much more important to focus on revenue growth and market share expansion. In terms of revenue, last quarter was very weak for Lucid, softly speaking. Quarterly revenue was about $151 million, missing consensus estimates by $54 million, which is a massive underperformance. Despite a 55% massive YoY revenue growth, I see a couple of red flags. First, on a QoQ basis, there was almost no revenue growth. I think that is a red flag because, usually, Q1 is the weakest quarter in a year for automotive companies. For example, last year, Lucid’s revenue grew about 67% between Q1 and Q2. Second, the YoY growth rate is decelerating rapidly, which is also a warning sign.

Profitability metrics are still very weak and far from turning positive. The gross margin narrowed YoY while the operating margin showed improvement. However, it is difficult to say that an expansion from -575% to -554% in operating margin can be called a “success”. Lucid still burns cash at a rapid rate, with combined net outflows from operating and investing activities in Q2 of $1.1 billion. That said, given the rapid cash burn rate, even an early summer $3 billion cash injection from investors does not look like a game changer in the long term.

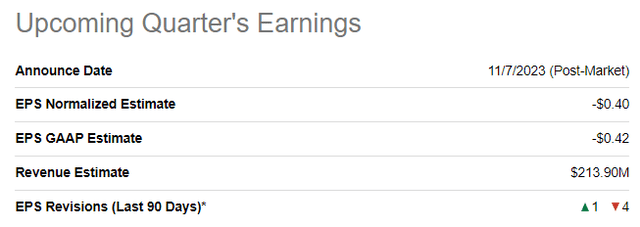

The upcoming quarter’s earnings are scheduled on November 7. Quarterly revenue is expected by consensus at $214, meaning about a 9% YoY growth which proves my statement above that Lucid’s revenue growth is decelerating massively. The adjusted EPS is expected to be flat YoY at -$0.40.

While the secular trend is positive for EV companies, the near-term headwinds are apparent. Interest rates are at record levels for multiple decades in the major part of the developed world, significantly weighing on the demand for durable spending from households. Since buying a car is costly, a major part of EV sales is financed by loan or lease. That said, the higher the interest rates are, the higher the monthly payment will be for a household. While inflation has moderated recently, prices are still much higher than pre-pandemic due to the inflation skyrocketing in 2022. Rent is still very expensive and not far from the record high as well. That said, households buying power deteriorates, which is a bearish sign for discretionary spending like luxury EVs, which Lucid offers.

Valuation update

The stock price appreciated about 1.5% year-to-date, significantly underperforming the broad U.S. market. LCID has a low “D-” valuation grade from Seeking Alpha Quant. Indeed, EV-to-sales and price-to-sales ratios are more than a thousand percent higher than the sector median. Other valuation ratios are unavailable because LCID still does not generate profits. Though, based on the multiples analysis, it seems that the stock is massively overvalued.

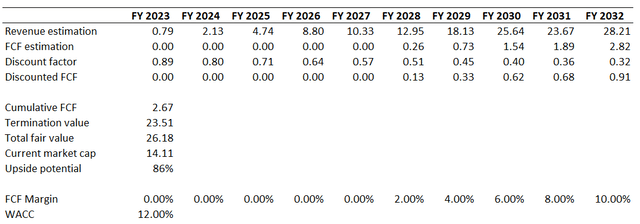

On the other hand, LCID is an aggressive growth stock, and we need to look at the discounted cash flow [DCF] model as well. I use an elevated 12% WACC for discounting due to the vast uncertainty regarding future profitability timing. The updated consensus revenue estimates look ridiculous, with a projected 49% CAGR over the next decade, but I will use it for my first simulation. I expect the company to generate a positive FCF margin in 2028 with a further two percentage points expansion yearly.

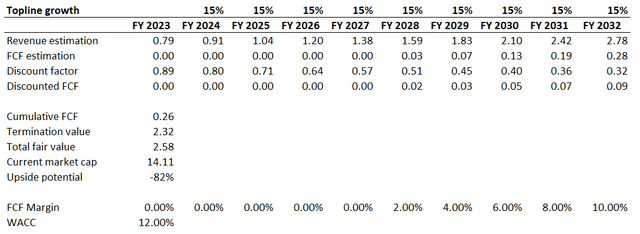

The stock might look massively undervalued with an 86% upside potential. But let me remind you that the revenue growth assumption is a massive 49% CAGR over the next decade. I think such revenue growth is unrealistic for Lucid to sustain over a decade. Of course, LCID bulls would argue that Tesla’s revenue compounded at 51% over the past decade, and that would be true. But LCID is highly unlikely to repeat Tesla’s growth trajectory. The EV market was much smaller ten and even five years ago, and the overall market grew rapidly. According to iea.org, about 700 thousand EVs were sold globally in 2016, about 15 times lower than the global 2022 EV sales. That said, global EV sales CAGR was at 57% between 2016 and 2022, and Tesla, the pioneering EV company, captured this secular tailwind successfully. But as the EV market is changing and growth is expected to decelerate. The EV market is expected to compound at 18.2% yearly until 2030, multiple times lower than LCID’s projected revenue growth. It is also important to emphasize that the competition in the EV market is intensifying significantly, making it difficult for Lucid to match the market’s growth rate. That said, for my second scenario, I implement a 15% revenue CAGR for LCID, with all other assumptions remaining unchanged.

With more realistic revenue growth assumptions, the stock looks about five times overvalued. The company’s substantial $2.9 billion net cash position will boost the fair value, but still, the combined figure would be more than two times lower than the current market cap. That said, Lucid’s stock is still massively overvalued.

Major risk for my bearish thesis

Potential mergers or investment injections from reputable funds or companies might greatly boost LCID’s stock price. We already saw it in recent months in a couple of EV Chinese start-ups like NIO (NIO) and XPeng (XPEV). Their stocks enjoyed massive short-term rallies, but stock prices are declining back to more normal.

Lucid is not an exception here, especially considering that LCID already has an investment agreement with Saudi Arabia’s public investment fund [PIF]. Additional injections from the Saudi side might be a big catalyst for the stock price. On the other hand, LCID already raised $3 billion, primarily from Saudi PIF, in early summer, and it did not help the stock price much. Still, the risk that new wealthy investors might enter the deal is the most substantial one for my bearish thesis.

Bottom line

To conclude, Lucid’s stock is still a “Strong Sell”. The financial performance is still weak, and near-term macro headwinds do not add optimism. Raising an additional $3 billion from Saudi PIF is good for the company, but its cash burn rate is still substantial. The probability of potential solid catalysts for the stock price is low, and the expected consensus growth profile with almost 50% revenue CAGR over the next decade looks ridiculous, especially given the expected deceleration in overall EV market growth. That said, I cannot conclude that the current valuation is attractive.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.