Summary:

- Rumors are swirling that Saudi PIF, the majority shareholder of Lucid, is eager to acquire the company, fueling speculation of a potential power play.

- The sudden surge of LCID sent shockwaves through the market, likely leaving short-sellers who had heavily bet against the stock from November 2022 with significant losses.

- Savvy investors who scooped up LCID in December and January likely cashed in on the buzz, profiting from the PIF speculation.

- Investors shouldn’t be tempted to jump in on rumors. Short sellers, take note: don’t underestimate the PIF again, or you may pay the price.

David Becker

A pleasant surprise for holders of Lucid Group, Inc. (NASDAQ:LCID) stock as a rumor about a takeover by its majority shareholder, Saudi Arabia’s Sovereign Wealth Fund (SWF): Public Investment Fund or PIF sent LCID surging.

However, the rumor has not been confirmed. Therefore, it could be just a rumored purchase and nothing else. Despite that, the PIF’s interest in Lucid is well-established.

We covered it in our previous article, highlighting why investors don’t give enough credit to Lucid’s most significant backer. It aims to overtake Norway’s sovereign wealth fund as the world’s leading SWF by 2030.

With $600B in assets, it’s still significantly far from Norway’s SWF assets worth $1.4T. Therefore, an investment in Lucid will likely not move the needle toward PIF’s chairman and Saudi Arabia Crown Prince Mohammed Bin Salman or MBS’ target.

Therefore, investors must be curious about what drove the PIF to consider taking over the remaining shares of Lucid?

We highlighted in our December article that significant macro and industry-specific headwinds drove LCID down to its December lows, causing a marked dislocation in its valuation and price action.

Note that the PIF invested another $915M in December for $10.68 per share, at a significant premium against its traded price. Hence, it’s clear that the Saudis likely values LCID at a much higher level.

With LCID recovering constructively, in line with the resurgence seen in EV stocks, led by leader Tesla (TSLA), the opportunity to take over the remaining shares at a reasonable price could dissipate if the PIF delays further.

Why? Even at $10.68 per share, it represents an FY25 P/S multiple of just 2.23x. It’s still higher than traditional auto OEMs’ average sales multiples but markedly lower compared to TSLA’s current valuation. But, of course, it also depends a lot on whether Lucid could continue to scale its production, with Tesla going after its rivals with its price cuts.

Moreover, Wall Street estimates suggest that Lucid could deliver 24K vehicles in 2023. However, with an ASP of $94K based on Q3’s reservations metrics, it would represent revenue of $2.26B for FY23, below the revised consensus estimates of $2.52B. Hence, Lucid would need to raise its ASPs (which is unlikely as it needs lower-priced products to scale) or increase production significantly.

In other words, there are significant execution risks for LCID to justify its FY25 sales multiple, which investors need to discount against. Furthermore, Lucid is also not expected to turn profitable through FY25, increasing the uncertainty for investors.

But if that’s the case, why is the PIF even rumored to consider buying up the remaining shares of LCID?

The PIF already owns more than 62% of its holdings. Based on LCID’s last closing price of $12.87, the PIF needs to cough up another $8.9B to subsume the rest of the shares it doesn’t own. Recall that LCID traded as high as $58 in November 2021, a premium nearly 3.5x above its last closing price. Is that a sufficient discount for the PIF?

Recall that the PIF paid $10.68 per share for its nearly $1B investment in December 2022. LCID’s last close of $12.87 represents a 20% premium against that valuation.

Does the price level make sense? If the Saudis think that Lucid could ramp up its production rapidly through 2025 without the distractions from the equity markets, it could be a reasonable deal. The PIF could continue to fund its production ramp fully and re-list it at a higher valuation subsequently.

Moreover, we believe the S&P 500 (SPX) (SPY) is slated for recovery through 2023, even though macro headwinds could intensify. Why? Because the market had likely anticipated those challenges at its October lows (remember, the market is forward-looking). Backtesting data based on the recent performance of global equity indexes also point to a favorable picture for the SPX. As such, well-beaten-down stocks driven to “ridiculous” lows by short-sellers sensing blood previously could be due for a revival.

Do you think the Saudis don’t know this?

Based on WSJ’s latest information, LCID’s short interest as a percentage of float reached 34.4% recently. Simply put, short sellers are betting heavily that LCID could crash further.

But, with yesterday’s momentum spike, we believe short-covering has likely been forced to happen.

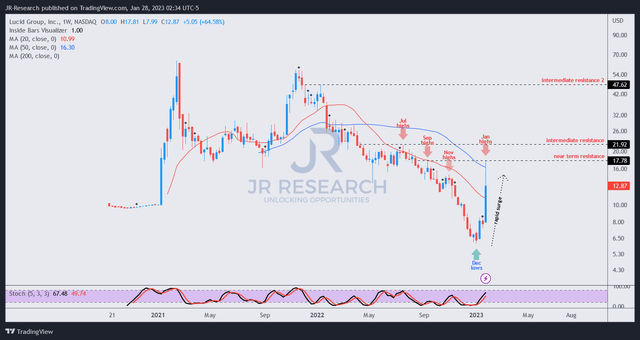

LCID price chart (weekly) (TradingView)

As seen above, short-covering likely intensified the rapid surge to take out LCID’s highs in November 2022 while briefly also touching September highs. Bottom-fishers from December and January could also have used the opportunity of the short-covering to take profits/cut exposure, as LCID closed the week well below its highs.

Hence, short sellers who loaded their bets from September 2022 have likely been eradicated, forced by the Saudi takeover rumor to cover their bets hastily. You are welcome if you want to bet against the $600B PIF. But don’t underestimate the will and power of MBS, who wants the PIF to become the world’s largest SWF. Lucid has chosen its cornerstone backer well, in fact, very well.

Of course, earlier short sellers are likely still holding on to their bets, but we could see the short interest as a percentage of float fall after the recent news, testing the conviction of the late short-sellers who got burnt.

Despite that, we urge investors to be cautious now, as a rumored takeover could be just a rumor. Moreover, at its current valuation, the dislocation in its valuation has already been normalized, suggesting that it’s contingent on Lucid to execute and scale its production to justify its premium.

But don’t bet (short-sell) against MBS again if you did.

Rating: Hold (Revise from Buy).

Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Are you looking to strategically enter the market and optimize gains?

Unlock the key to successful growth stock investments with our expert guidance on identifying lower-risk entry points and capitalizing on them for long-term profits. As a member, you’ll also gain access to exclusive resources including:

-

24/7 access to our model portfolios

-

Daily Tactical Market Analysis to sharpen your market awareness and avoid the emotional rollercoaster

-

Access to all our top stocks and earnings ideas

-

Access to all our charts with specific entry points

-

Real-time chatroom support

-

Real-time buy/sell/hedge alerts

Sign up now for a Risk-Free 14-Day free trial!