Summary:

- Recent news reports and rumors circulating on Lucid imply a takeover of the Saudi Public Investment Fund for the remaining stake in the BEV maker.

- Lucid Motors is sufficiently funded through FY ’25 even when factoring a $3 to $4 billion capital burn rate.

- Based on our model, we anticipate +36% upside to the stock over the next 12 months based on 80x FY ’25 adjusted dil. EPS.

- We’re offering a buy rating on the stock, as the downside case is also limited by the Saudi Public Investment Fund, but upside to the model implies TSLA-like returns.

- We think next quarter’s results could provide more support to the bull thesis in the form of margin guidance, and production surprises. Short cover rally likely continues into February.

David Becker

Lucid Group, Inc. (NASDAQ:LCID) jumped by as much as +75% on the Friday session before eventually settling to a +40% gain on the session. Much of the optimism is tied to news reports of the automaker’s remaining equity stake getting bought by the Kingdom of Saudi Arabia Public Investment Fund, which would limit some of the downside to the stock considerably. Though, we note that even in the absence of a full takeover from the Saudi Arabia Public Investment Fund, risk/reward favors bulls for the past 3-months, and any material news could send the stock higher.

As of the time of writing this article, LCID is trading at $13 per share, implying some upside in the stock price assuming a substantial takeover premium, though we’re not sure what the details of the takeover offer will be. Keep in mind that an SA news correspondent Joshua Fineman reported earlier, “Lucid told Seeking Alpha in an email that it doesn’t comment on rumors or speculation.”

We recommend Lucid Motors by starting with a buy recommendation, and offer a price target of $18 per share on 80x FY ‘25 adjusted dil. EPS. The stock is heavily undervalued on sector-specific negativity. Even with negative margins factored into vehicle deliveries for the next three-years we come away with the impression that Lucid Motors with its recent private offering kept itself funded until 2025 and will exit 2025 with profits on vehicle deliveries.

More legs to the rumor or saber rattling to bust Lucid shorts?

So, is it just rumors and speculation, or are there more legs to the report of the Saudi PIF (Public Investment Fund), taking over the remaining stake in Lucid? Furthermore, the outsized short position inside of the stock indicates that for the time being, it’s subject to a major short position cover at present given the explicit likelihood of some sort of M&A premium in the stock, which is why we wouldn’t be on the side lines, we’d be long Lucid Motors on long-term prospects for a turnaround, and more aggressive on timing of any M&A offer when trading the stock.

In a separate report from Market Chatter News, which we quote, “shares were up almost 35% in afternoon trading, amid several media reports citing a Betaville story that Saudi Arabia’s Public Investment Fund, or PIF, is aiming to buy the rest of the company.” The Market Chatter News source cited a Betaville story, which SA news reports, “The fund may be working with J.P. Morgan on a possible plan to buy the remainder, though it’s not clear if a formal offer will be made.” We think there’s a possibility of this because J.P. Morgan doesn’t provide a rating on the company, and may be working on a deal at present.

22% of the shares float is short, meaning that there’s a heavily concentrated short position on the stock, and while it’s difficult to confirm if rumors are true, or if the media circus is simply citing the same source repeatedly. We do know that Lucid has been undervalued for quite a significant time, and any further lower would have put it at a depressed enough of a valuation for a competitor to pursue a takeover as opposed to the existing shareholder base.

The prospects of a PIF takeover of LCID triggered a short cover rally putting bears on the side of the road, as they reassess whether the business is going to fail or not. While we remain constructive on the takeover announcement, we also want to discuss business fundamentals to determine where Lucid is, and how much upside it could have with a takeover, or absent a takeover.

Even if the rumors prove to be denied at a later point, and the Saudi Arabia Public Investment Fund pulls out from pursuing an aggressive takeover of the remaining shares, or the existing board and management wants to run the public markets lap longer, and stay the course, we then turn to our analysis of the company.

We like trading Lucid Motors on positive news but… be careful of rumors

Given the fact that we’ve traded in and out of Lucid over the past 12-month period we are hopeful of positive fundamentals and that the threat of a takeover doesn’t actually mean the Saudi PIF does take the company over. We think Lucid is a poorly understood early-stage BEV maker that with enough time will grow into a major BEV maker achieving a market cap in excess of $100+ billion. Of course, a lot would have to go right for it to ever reach such a massive valuation, and our immediate 12-month price target assumes a way more conservative scenario.

Lucid Motors is perceived as the most cutting edge BEV automaker with technologies that make it more differentiated than peers Rivian (RIVN), Tesla (TSLA) in our opinion. Though we acknowledge that TSLA has a substantial advantage in autonomous driving, we believe that Lucid Motors “luxuriousness” puts it a class above the rest and among other Luxury brands, at least that’s according to various YouTube reviewers who review high-end cars.

If they fail at achieving higher margins on higher component costs, so what. Downside is strictly limited because if the company gets too cheap, expect the company to go private at a premium due to its largest investor. Basically, the company can take whatever kinds of risks it wants, and if it means pursuing the ultra-high-end with a high burn rate on cash, it can still pursue this market and then look to push costs lower across the product line, which is what we’ve seen the company communicate.

Short the stock ahead of earnings at your own peril

The company doesn’t plan on releasing Q4 ‘22 earnings until February 22, 2023. Meaning that the stock could continue to rally before bears can re-arm themselves with more bad news following the upcoming quarterly call.

Basically, if you were a bear on the stock – you wanted the news to be bad enough to keep the stock price suppressed, but not so bad that a drastic takeover bid would knock out your short position. People who trade stocks and bet against companies might make a windfall on short-term news, but are exposed to risks that are unanticipated. It’s why we rarely short stocks for that matter, or tell readers to bet against certain stocks unless the fundamentals are tantalizing.

Group thinks is dangerous, and the ignorance of a $500 billion fund willing to write checks each time the business fails makes us hesitant on pursuing the stock lower. Instead, we expect Lucid to eventually turn the corner on production and get added funding if added funding becomes necessary as we exit 2023 and enter into 2024. The stock probably isn’t profitable, but if it can get production on track, and have it scale upwards… the rest of the growth narrative becomes easier to follow as investors stomach further shareholder dilution on the eventual build-up to volume production.

We are forecasting out to 2025 for Lucid Motors

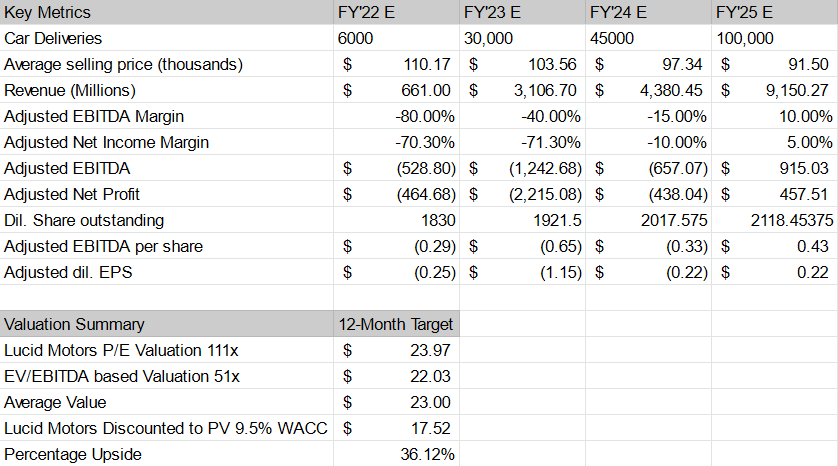

We anticipate a more gradual build-up of production volumes with a combination of demand/supply levers causing production to reach 100 thousand cars by 2025 at an average selling price of $91,500 per unit, which factors in the cost reductions that will start to take effect with the introduction of $78,000 entry-level model variants. Furthermore, we expect continued run-rate losses of -$2.5 to -$3.5 billion for the foreseeable 24-month time frame, putting some pressure on the balance sheet but not to the extent that bears are highlighting solvency as an issue. Given the $4 billion in current assets versus $1 billion in current liabilities, the firm has $3 billion in working capital.

Figure 1. Lucid Motors Financial Model and Valuation Summary

Author’s financial model and valuation estimate (Trade Theory)

Lucid Motors also raised an additional $1.5 billion on December 19, 2022, via a private placement involving Ayar and PIF. As such, the firm has $4.5 billion in working capital, and based on our model, the business should be able to fund itself until 2024 given our forecasted burn of $3.5 billion from FY ’22 to FY ‘24.

We think Lucid Motors starts to break-even towards Q4 ‘24 and into Q1 ‘25 where we shift the model towards a positive contribution at volumes above 100k/deliveries resulting in a better cash flow profile as we exit the burn phase of the Lucid Air ramp-up.

Even in the most adverse scenario of negative margins until volume production results in positive variable cost, or base of production offsets fixed capital cost, which is already captured in our simplified model.

We then value Lucid Motors on the basis of FY ’25 $0.22 dil. Adjusted EPS earnings and FY ’25 $0.43 Adjusted EBITDA, which translates to a 111x multiple on earnings, and 51x multiple on Adjusted EBITDA, which translates to a blended valuation of $23 per share, which we then discount by the firm’s WACC of 9.5% over the next three-year period to arrive at our price target of $17.52 per share implying +36.12% upside even with the gains priced-in from the recent rumors of the Saudi PIF takeover.

Lucid Motors a buy heading into February earnings announcement

We think there’s room for a guidance surprise over the next couple of weeks, as we think the business can be fairly valued upon an inflection to volume production once unit volumes exceed 100K shipments. We don’t think analysts or investors give the company enough credit for ramping up its manufacturing facility in Casa Grande, AZ and upon close inspection we anticipate that manufacturing will continue to gear up into 2025 and onward where the combined production output of the facility could exceed our already diminished expectations on deliveries to strictly 100k units by 2025.

We favor the lower volume yet higher profit ramp-up over the next three years given the weakness in demand. We think Lucid Motors is the only BEV maker that can maintain an ASP in the $90 thousand range until a lower-end higher-volume car gets introduced, which would be the next leg to the 2025+ thesis where Lucid transitions into a volume automaker. We don’t know the exact timing of this announcement, but we anticipate that over the next 12-month period the firm will communicate a strategy for large volume manufacturing diminishing some of the concerns tied to owning the stock on the basis of product/production surprise or M&A fueled speculation causing shorts to get wrecked.

We don’t anticipate the firm to deliver much in the way of revenue/earnings surprises until the second half of the year. Even so, any updates or progress reports that help address lingering concerns with pricing, or bill of materials would help analysts with forecasting the inflection from negative operating margins to positive operating margins. We expect the stock to trend higher and eventually reach our price target of $18 by the end of 2023 adding +36% upside to the stock on top of its already incredible M&A fueled run.

Disclosure: I/we have a beneficial long position in the shares of LCID either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.