Lucid: Possibly Bottomless Pit If Buyers Refuse To Return

Summary:

- Lucid’s premium positioning has likely not worked out well as macro headwinds intensified. As a result, we assessed that the market is likely pricing in a weak Q4.

- With the Fed likely to keep financial conditions tight to combat elevated inflation rates, Lucid’s demand outlook in 2023 could face significant headwinds.

- Investors appear to have shunned pure-play EVs, with leader Tesla’s remarkable slide impacting the industry.

- Perhaps the saving grace could be the highly oversold breadth and momentum indicators. But buyers need to demonstrate conviction now to stun the bears.

- Otherwise, more pain cannot be ruled out.

hapabapa

Pure-Play EV Makers Getting Hammered

The bearish case for Lucid Group, Inc. (NASDAQ:LCID) has strengthened in the near term after its languid FQ3 earnings release in early November. Pure-play EV start-ups have continued to be dragged down by Tesla’s (TSLA) stock price slide, as the industry underperformed the S&P 500’s (SP500) (SPX) remarkable recovery from its recent October lows.

We believe the market is likely sending a message to investors that it doesn’t expect a likely slowdown in the Fed’s rate hike cadence is sufficient to lift the industry’s troubles. We also believe that the de-rating in EV leader TSLA has impacted its smaller peers, such as LCID, as macro headwinds have intensified.

However, we also gleaned that the selloff in LCID has likely reached a crescendo, with momentum and breadth indicators firmly in oversold zones. Notwithstanding, we have yet to glean a bullish reversal, portending that a potential mean-reversion bear market rally is imminent.

Lucid: Premium Positioning Is Not Constructive

Furthermore, Lucid’s recent moves in attempting to shore up year-end sales with its employee purchase program suggest that its Q4 momentum could be weakening. Therefore, despite its premium-priced offerings (ASP of $94k based on Q3 reservations), Lucid is not immune to the broad-based economic slowdown, which could be exacerbated if the downturn worsens.

While we don’t expect Lucid to face a significant liquidity crunch due to its financial backing from the government of Saudi Arabia, with $4.2B in liquidity, on top of its new financing arrangements with the Saudi government. Therefore, we believe the critical challenge facing LCID investors now is whether the company could continue its ramp cadence.

For fledgling EV players like Lucid, the route to profitability is predicated on their ability to meet their aggressive production ramp and having sufficient reservation backlog to corroborate demand.

Hence, the lowered backlog of 34K in Q3 compared to 37K in Q2 certainly didn’t instill confidence, despite the recent battery supply deal with Panasonic. We believe investors are likely more focused on whether Lucid’s deliveries backdrop could be impacted, with the Fed’s revised dot plot today (December 14) carefully parsed by investors.

Interestingly, LCID buyers were not keen to support the stock’s malaise after the release of yesterday’s November CPI print. While the broad-based slowdown in inflation was welcomed by the broad market, it has not lifted investors’ sentiments over unprofitable companies like Lucid.

Hence, we assess the de-risking is likely necessary as the monetary policy lags are coming into play as it slows down the US economy markedly. Tesla CEO Elon Musk also alluded in a recent tweet that Tesla “doesn’t control macroeconomic tides.”

Consequently, we believe it’s getting increasingly clear that Lucid’s “new risk” caution in its Q3 filings is crystallizing, as it accentuated:

Because of our premium brand positioning and pricing, an economic downturn is likely to have a heightened adverse effect on us compared to many of our electric vehicle and traditional automotive industry competitors, to the extent that consumer demand for luxury goods is reduced in favor of lower-priced alternatives. (Lucid 10-Q)

Fed Could Still Cause A Hard Landing

Market strategists are also unsure whether the Fed’s revised dot plot could help the US economy dodge a hard landing, even though the stakes have been lowered with November’s CPI print.

Despite that, the Fed could continue to keep financial conditions tight, as signaling a quicker-than-anticipated pause/lowering of rates could implicate its 2% inflation target.

Accordingly, it could reverse the constructive progress made so far in its fight against elevated inflation, causing an unintended resurgence. Hence, we believe that the Fed would continue to keep its rates at a restrictive level for some time (economists’ consensus is a terminal rate of 5% through Q4’23).

Therefore, the market has likely priced in further headwinds on LCID’s growth momentum in FY23, seeing significant risks to Wall Street’s aggressive revenue growth cadence through FY25.

The critical question is whether the steep selloff could be stanched by buyers waiting for the selloff to subside before entering to stun the bears.

Takeaway

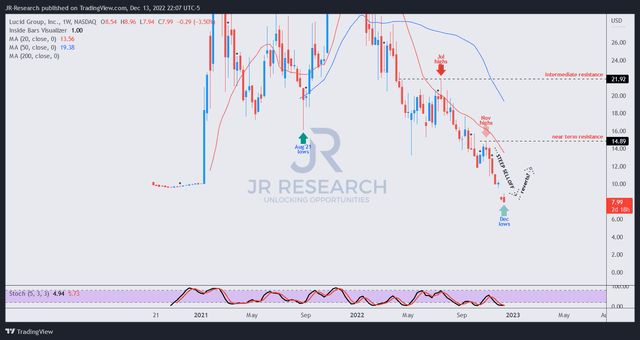

LCID price chart (weekly) (TradingView)

As seen above, the steep selldown from its November highs could be forming a bottom soon, even though we have yet to observe one.

However, we assess that LCID’s price action could consolidate against its December lows, as LCID’s momentum and breadth indicators are also oversold.

Moreover, with LCID’s price action well below its 20-week moving average (red line), we believe the conditions for a mean-reversion rally against its downward bias have improved.

Therefore, we urge investors to avoid selling into the panic now.

Maintain Buy, with a reduced price target (PT) of $11.

Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Do you want to buy only at the right entry points for your growth stocks?

We help you to pick lower-risk entry points, ensuring you are able to capitalize on them with a higher probability of success and profit on their next wave up. Your membership also includes:

-

24/7 access to our model portfolios

-

Daily Tactical Market Analysis to sharpen your market awareness and avoid the emotional rollercoaster

-

Access to all our top stocks and earnings ideas

-

Access to all our charts with specific entry points

-

Real-time chatroom support

-

Real-time buy/sell/hedge alerts

Sign up now for a Risk-Free 14-Day free trial!