Summary:

- Lucid’s shares exploded higher at the end of last week on takeover rumors tied to Saudi Arabia’s sovereign wealth fund.

- I believe takeover rumors are unfounded and gains have likely been driven by investors unwinding short positions.

- Instead of takeover rumors, investors should focus on Lucid’s production and delivery gains.

- Lucid’s outlook for FY 2023 could be a potent catalyst for the EV maker.

David Becker

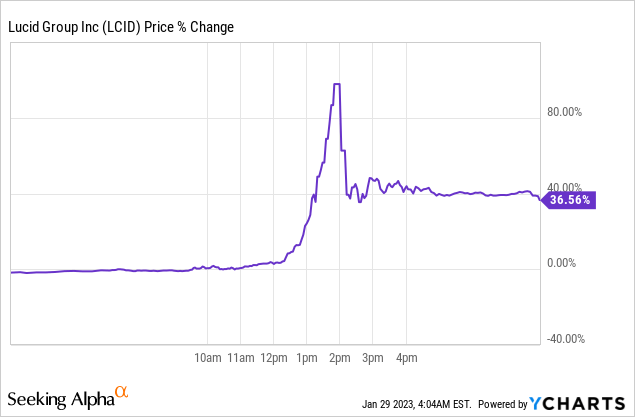

Lucid Group’s (NASDAQ:LCID) shares almost doubled on Friday and closed 43% higher on speculation that the electric vehicle start-up could be taken over by Saudi Arabia’s sovereign wealth fund. Lucid’s surge at the end of last week is likely explained by a combination of takeover rumors as well as the unwinding of short positions in the EV maker which were established throughout last year. While I don’t consider it likely that a PIF-led buyout will happen for Lucid, I believe that the stock continues to have an attractive risk profile, in large part because the EV company recently exceeded its production target for FY 2022. Lucid’s FY 2023 production forecast could be a catalyst for shares of Lucid to power even higher!

Deal speculation and short squeeze

Shares of Lucid soared 43% on Friday as rumors spread that Saudi Arabia’s sovereign wealth fund, which manages more than $600B, could be set to launch a takeover bid for the electric vehicle start-up. The Public Investment Fund, through its affiliate Ayar Third Investment Company, is an early investor in Lucid and owns more than 60% of the company’s outstanding shares. In the fourth-quarter, the Public Investment Fund agreed to participate in a capital raise for Lucid: an affiliate of the PIF (Ayar) agreed to purchase 85.7M shares of Lucid in a private placement that had an estimated value of $915M. The capital raised through the offering was to be used to finance the ramp of the Lucid Air as well as the international expansion of Lucid’s manufacturing base.

Besides providing capital for expansion, Saudi Arabia also emerged as a major buyer of Lucid vehicles in 2022: in April of last year, Saudi Arabia signed an agreement with Lucid — which I argued was a game-changer — that set out terms for the delivery of up to 100 thousand Lucid Air electric-vehicles for various government agencies over a ten-year period. The deal included an initial commitment to purchase 50 thousand electric vehicles and an option for the purchase of another 50 thousand electric vehicles. The government of Saudi Arabia entered into the agreement as part of its “Saudi Vision 2030” plan which formalizes Saudi Arabia’s commitment to the diversification of its energy industry and lays out a plan for accelerating investments in green energy technology.

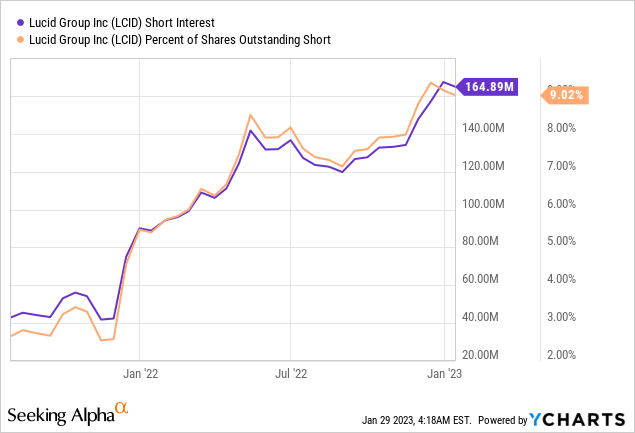

Excessive short interest ratio

Lucid has become a heavily shorted stock in 2022 with a short interest ratio of currently 9%. However, Lucid is not the only heavily shorted EV company and short interest increased dramatically in FY 2022 as the sector faced supply chain and sourcing problems, and fell short of production targets. Lucid’s short interest ratio also increased throughout 2022 as the stock price fell, possibly because short sellers doubled down on their bets. Takeover rumors linked to the Public Investment Fund likely caused the unwinding of some of those short positions on Friday. In other words, an element of a short squeeze likely played into Lucid’s upwards surge on Friday.

Could the PIF realistically be expected to make a takeover bid for Lucid?

I don’t believe so. Saudi Arabia’s sovereign wealth fund has financed the growth of Lucid for years and has been a significant capital source for the EV maker. However, the PIF has no history of making significant buyouts in the EV sector and has not communicated that it is looking to take over private or public EV makers as part of its investment strategy. As is often the case in the stock market, most rumors don’t have any legs to stand on.

What investors should be focusing on instead: Lucid’s production/delivery growth

Lucid kept its word and ended the 2022 fiscal year strongly. The EV maker, which had to lower its production forecasts twice in FY 2022 due to supply chain constraints and logistical challenges, reported that it produced 7,180 electric vehicles in the first full year of production. This is not a small feat for a start-up and something that Lucid definitely deserves credit for given how challenging the supply chain environment has been last year. Lucid also exceeded its own production forecast of 6-7 thousand electric vehicles which means Lucid’s production growth continued unabated in the fourth-quarter. Rivian Automotive (RIVN), as an example, did not meet its (lowered) production target for FY 2022 and reported a production volume of less than the 25 thousand EVs the firm guided for.

In Q4’22, Lucid produced 3,493 electric vehicles, showing an increase of 53% compared to the third-quarter. In Q3’22, Lucid produced 2,282 electric vehicles, which itself represented a tripling of production compared to Q2’22. The ramp in Lucid’s EV production is highly encouraging and possibly allows the EV start-up to begin FY 2023 with strong production momentum.

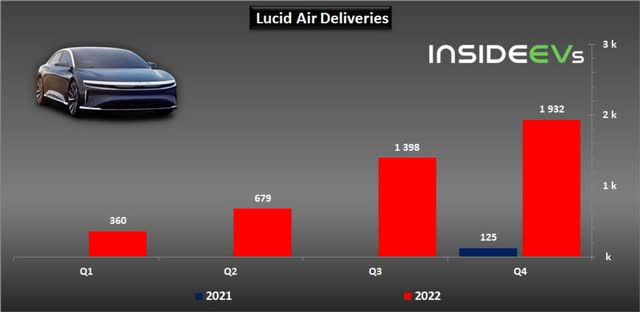

Lucid Air deliveries have also ramped nicely in the fourth-quarter, showing 38% quarter over quarter growth. For FY 2023, I estimate that Lucid could deliver between 10-12 thousand electric vehicles, assuming there are no further production setbacks. A strong production outlook for FY 2023, which will be presented later in February, could be a catalyst for Lucid’s shares.

Lucid’s revenue potential and valuation

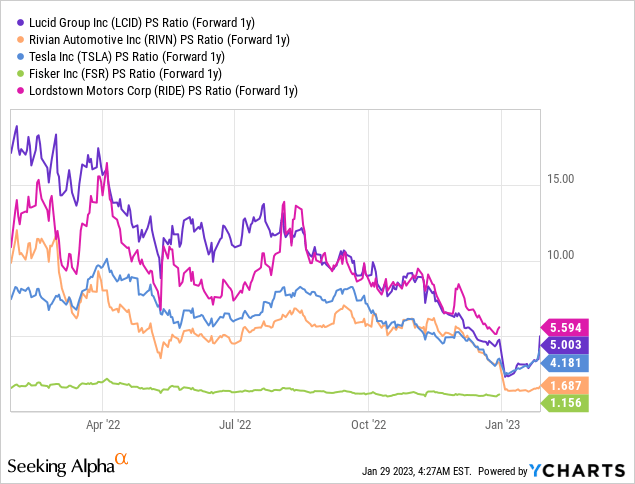

Lucid is expected to generate $2.44B in revenues in FY 2023, implying a year over year increase of 269%. Despite the robust ramp in production that has taken place in FY 2022, Lucid’s potential is still not fully reflected in the firm’s valuation, in my opinion. Lucid has a P/S ratio of 5.0 X, but only because the stock price soared due to takeover rumors on Friday… and investors should expect the stock price to fall back at least a little bit if those rumors are proven to be unfounded. Just a year ago, Tesla (TSLA) traded at a P/S ratio of 10 X while Lucid achieved a P/S ratio of 15 X. I believe that Lucid’s valuation has potential to grow as the company resolves its production issues and ramps up production of the Lucid Air in FY 2023.

Risks with Lucid

The biggest commercial risk for Lucid is execution. The EV start-up disappointed twice in FY 2022 by lowering its production target, first from 25 thousand EVs to 12-14 thousand EVs in February 2022. The second time, Lucid cut its producing target from 12-14 thousand to 6-7 thousand due to continual part sourcing problems which showed investors how unreliable production volume estimates of EV start-ups can be. Further disappointments, especially regarding the upcoming FY 2023 production/delivery outlook, could be seen as reasons for investors to ditch Lucid and result in new negative sentiment overhang for the stock.

Final thoughts

Shares of Lucid soared by nearly 100% on Friday on, I believe, unfounded takeover rumors before giving up some of those gains. Still, shares of the EV maker closed 43% higher as takeover speculation and, possibly, the unwinding of at least some short positions, changed the calculus for many investors.

I don’t believe that Saudi Arabia’s Public Investment Fund will launch a formal takeover bid for Lucid, however, as the fund has no significant buyout history. Rather, I believe PIF will remain an anchor investor in Lucid as the company ramps up production and grows its manufacturing footprint in the Middle East. While takeover rumors are no real reason for investors to consider the stock, the ramp in production and deliveries of the Lucid Air, however, are good reasons to own the EV maker going forward!

Disclosure: I/we have a beneficial long position in the shares of LCID either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.