Summary:

- Visa delivered solid quarterly results and managed to beat both top and bottom line estimates by Wall Street.

- Payment volume continued to increase, but growth is slowing down compared to previous quarters, although as expected.

- Visa continues to be a cash flow machine with close to $4 billion in free cash flow which it fully returned to shareholders during the quarter.

- Visa is trading at a P/E of above 27, but is still not too expensive to buy as I calculate a price target of $252, leaving investors with 9% upside potential.

mihailomilovanovic

Introduction

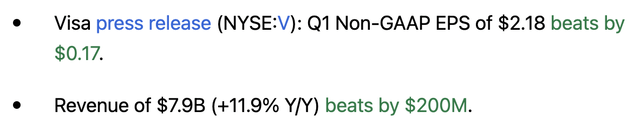

Visa (NYSE:V) released its 1Q23 results aftermarket on January 26, 2022. The company managed to beat both top and bottom-line estimates by Wall Street analysts and shares jumped up about 1.5% aftermarket. At first sight, results looked decent as growth was once again strong for Visa, despite economic headwinds.

Back in October 2022 I wrote my initial thesis on Visa and rated the company a buy. Back then, I concluded the following:

Visa will remain a crucial part of the global economy and will take advantage of the growing global trend from cash to digital payments and GDP growth. We do have to keep an eye out for competition and Visa’s market share. I hope management will come up with a solid plan in time, to support growth vs these FinTech firms. Another thing to watch for is legislation and regulators targeting Visa’s dominance. It is no surprise that Visa has a target on its back, but I do not see any threatening regulations coming through any time soon. It is something to keep a very close eye on since it could oppose a serious threat to profitability over the long term.

I rate Visa a buy on strong growth, a fair valuation, and strong business fundamentals. The recent downturn in the stock provides a good buying opportunity.

Since then, the share price has increased by 24% and the P/E is back above 27x. Within this article, I will go through the latest financial results and see whether Visa is still a buy for me.

Let’s get to it!

Quarterly results – 1Q23

Visa delivered very decent results and the jump in stock price over the next trading day was not unjustified. Visa saw its total payment volume grow by 7% during the quarter, which is not unimportant for a payment processor earning its revenue by taking a fee for every transaction made through its platform. Total transactions grew at a slightly faster pace of 10% resulting in an average of 571 million transactions every single day. This should give you a clue of just how strong the moat is for Visa.

The first quarter’s growth was driven by stable domestic volumes and a continued recovery of cross-border travel. It is important to note that Visa derives higher margins from cross-border travel and therefore the recovery of this segment drives higher revenue and margin growth as well.

US payment volume was up 9% during the quarter and down slightly compared to the last quarter of Visa’s fiscal year. International volume was up 15% and cross-border volume grew by 31%. Both were driven by China lifting restrictions and CEMEA benefiting from the World Cup in Qatar. Overall growth was driven by all regions, but international and cross-border drove the outperformance. We should expect this strong growth to slowly ease over the next 6 months as the travel industry will fully recover by then resulting in less growth for Visa from these specific segments. Management itself also acknowledged this during the earnings call:

The cross-border travel recovery continues. However, as expected, the pace of recovery has moderated as most borders are now open, including Japan in October and now China in January. As a reminder, we saw a very sharp cross-border travel recovery in October and November of 2021, which we are lapping.

As a result of the above, revenue for the first quarter grew by 12% to $7.9 billion. Net income grew at a faster 17% and EPS grew by 21% resulting in strong earnings for investors. Net income was $4.6 billion or 58% of revenue. EPS came in at $2.18. Free cash flow was once again very impressive for Visa as the company reported a free cash flow of $3.9 billion. Visa is a cash flow machine and looks completely unstoppable with travel almost fully recovered.

Besides strong financial results, Visa also performed strongly regarding business renewals. It renewed contracts with both Bank of America and Commerce Bank, and with both being top issuers of Visa cards, these are very important deals solidifying the competitive position of Visa.

Tink, the open banking platform from Visa (acquired in 2021) continues to deepen and develop relationships in Europe as it signed multiple agreements and renewals with large European banks. In simple words, Tink enables other companies to access and use financial data from multiple sources, like banks, with ease. This is what management said about the platform during the earnings call:

Tink recently signed a master agreement with BNP Paribas to be their main open banking and money movement services provider for millions of customers across Europe. Tink is already live with several businesses in the group. 3 million customers use Tink’s money management, data enrichment and transactions products at BNP Paribas Fortis in Belgium and BNL in Italy. Tink has also renewed and expanded its commitment with ABN AMRO to integrate Tink’s Money Manager and data enrichment products into the bank’s app for more than 3 million customers.

Tink is increasing in importance for Visa and although not playing a large role in revenue for Visa today, the segment is witnessing solid growth in Europe. Together with Currencycloud, it contributed 0.5% of revenue growth in 1Q23. Tink is a leading financial technology company in Europe with a strong platform and a talented team and should see strong growth over the coming years. Today, the platform serves over 6,000 banks in Europe.

Overall, it was another strong quarter for Visa as payment volume and revenue saw steady increases YoY. The slight increase in share price over the following trading days was, therefore, justified. Visa continues to solidify its strong position in the payment industry and seems to be resilient against economic weakness so far, with tailwinds such as the covid recovery outpacing headwinds. I don’t believe that the results leave much to be desired for shareholders.

Balance sheet & Dividend

At the end of its first quarter, Visa reported total cash and equivalents of $18.9 billion, leaving the company with plenty of cash to continue investing and expanding the business.

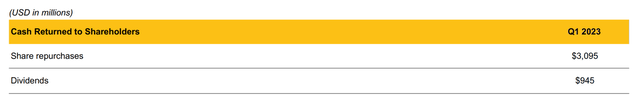

Visa also continues to use its strong balance sheet and cash flows to return cash to shareholders. During 1Q23 Visa returned $4 billion to shareholders which was almost completely covered by free cash flow of $3.9 billion. During the previous earnings call back in October, Visa authorized a new $12 billion share buyback program and announced an impressive 20% dividend increase showing the commitment by Visa’s management to return cash to shareholders.

Despite the impressive dividend increase, Visa stock still only yields 0.78% which is not all that high. Still, considering Visa combines this with impressive amounts of share buybacks total returns are not bad at all. The dividend payout ratio still only stands at 21% and so Visa has plenty of room to keep growing the dividend as long as cash flows remain strong, and there is absolutely no reason to believe this will not be the case. Visa has a 5-year dividend growth rate of 18% and has been growing its dividend for 14 straight years.

Returns to shareholders during fiscal 1Q23 (Visa)

Outlook & valuation

Most important to investors might be the outlook and even more so when considering the economic headwinds Visa might be facing over the next several months. Whether we are going to end up in a recession remains a question nobody has the definitive answer to, and every single large bank and analyst seems to have a different opinion ranging from a severe recession to a soft landing. I believe we will at least avoid a severe recession. Current economic data shows the economy remains strong and inflation is coming down at a solid pace now. Also, current expectations guide the federal reserve to increase interest rates by just 25 percentage points later this week as lower inflation requires slower rate increases. Best case scenario would be a complete soft landing, but I believe a mild recession seems most likely.

For the second fiscal quarter management expects payment volume trends to continue and to benefit from lapping an omicron-induced January. Visa is not expecting much change in revenue drivers compared to the previous quarter. Visa projects revenue growth of high single digits, but operating expenses growth to moderate over the rest of the year, primarily due to lapping higher expense quarters from last year. This should make sure that net revenue and EPS should grow by double digits.

How does this then compare to current analyst estimates for the fiscal second quarter? Analysts guide for revenue of $7.76 billion or 8% growth with EPS growth of slightly more than 10%. These estimates reflect expectations by management and seem fair. Considering the loss of the covid recovery tailwind in cross-border volume, it makes sense to expect a more normalized growth rate for the quarter. The China reopening will most likely be a tailwind during the quarter, but Visa expects cross-border revenue for China to get a boost by the second half of the year as many countries remain careful with permitting Chinese travelers.

The most obvious threat to the current outlook of Visa and its spending and investment plans is of course the weak economy and management shortly discussed this during the earnings call:

As we said last quarter, should there be a recession or a geopolitical shock that impacts our business, slowing revenue growth below our planning assumptions in the second half, we will, of course, adjust our spending plans by reprioritizing investments, scaling back or delaying programs and pulling back as appropriate in personnel expenses, marketing spend, travel and other controllable categories.

There is still much uncertainty from an economic standpoint in the months ahead. We will remain vigilant and ready to act.

With Visa being a relatively asset-light business, this should give them the ability to adapt quickly to economic changes.

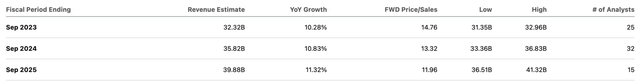

For FY23 analysts currently guide revenue to come in at $32.32 billion (10.28% growth YoY) and EPS of $8.40 (or 12% growth YoY). Again, I have to say that these estimates look fair with growth slowing down, but a China tailwind is to be expected by the second half of the year.

Visa Revenue estimates (Seeking Alpha) Visa EPS estimates (Seeking Alpha)

From a long-term perspective, Visa continues to be a no-brainer investment no matter your investment strategy. The business moat and duopoly remain unchallenged, putting the company in a perfect position to benefit from the increase in transactions, digital payments, and trends such as e-commerce. Visa keeps expanding its moat by getting more and more clients and banks to its platform while it also expands into new segments such as crypto and fintech.

Visa is currently valued at a forward P/E of 27.55 which is 14% below its 5-year average P/E of 32. It is also valued below its main competitor Mastercard (MA) which has a forward P/E of 30.69, although Mastercard is also expected to grow at a slightly faster rate over the next 3 years.

Considering the expected growth rates and business strength of Visa, I believe a P/E of 30 would be fair (although rather conservative still). Based on an FY23 EPS estimate of $8.40 I believe Visa deserves a price target of $252 per share. With Visa currently valued at $231.44, this leaves us with approximately 9% upside potential from its current share price. As a result, I believe that Visa is still not too expensive despite its strong increase in share price over the last couple of months.

Risks

As discussed before, it is most important to consider the health of the economy when investing in Visa. As Visa earns its revenue by taking a fee from every transaction made on the platform, the payment volume and amount of transactions are crucial for Visa. If we were to end up in a severe recession after all, against my expectation, this would most likely result in higher unemployment and a significant drop in consumer spending and, therefore, also transactions made through the Visa platform. This could significantly impact revenue for Visa. Still, I believe Visa is well prepared and this temporary slowdown should be of absolutely no worry to long-term investors as the long-term growth trajectory would not be impacted and Visa is still poised to show impressive growth rates over the next decade.

In addition to this, I would like to point to my initial coverage on Visa in which I discussed two other important risks being regulatory threats and the rise of fintech. These risks remain unchanged and are important to keep in mind when considering an investment in this payment giant. This is what I said back then:

Bigger risks for Visa are competition and political pressure. Most recently, on July 28th, two U.S. senators introduced the Credit Card Competition Act of 2022. Two months later, earlier this month, the bill was introduced as a proposed amendment to the NDAA, but this ultimately didn’t make it into the draft of the bill. The bill was supposed to increase competition in the credit card industry with the hope of fees being lowered by the major players. These are the earlier fees discussed from which Visa makes most of its money. This bill would require banks issuing these credit cards to offer a minimum of two different credit cards, with only one being allowed to be Mastercard or Visa to also stimulate smaller player entries. The bill was supposed to bring down swipe fees for merchants and increase competition with the entries of smaller players. But as I said, the bill didn’t make it. It does show the political attention for the business of Visa. A total of $137 billion is yearly billed in swipe fees. This indirectly increases prices in stores because merchants must pass these costs on to their customers. It is therefore no surprise that there is political attention for this (with current extreme inflation). This is just one example of a lot of actions by governments to limit the power of Visa and Mastercard. Therefore, I see this as a significant risk for the business of Visa. If a bill such as the one mentioned above would be accepted, then this could have a significant impact on the dominance of Visa over the long term.

Another risk for Visa is competition from FinTech companies. Nowadays there is an increasing amount of FinTech startups diving into the profitable payments sector. These companies pose a threat to Visa by offering cheaper, faster, and better solutions than the use of credit and debit cards. Examples are Block (SQ) (Square) and PayPal (PYPL). These companies offer newer and more innovative solutions.

Conclusion

Visa is an extraordinary business with an impressive moat and strong growth ahead due to strong positioning. Its latest financial results did not show many surprises to investors and Visa kept on growing its financials and moat without being significantly impacted by the economic slowdown or high inflation. The company is a serious money printing machine with a free cash flow margin of close to 50%.

Combined with strong dividend growth and plenty of share buybacks, I believe Visa is a no-brainer for any investor. The company is not cheap, but quality companies rarely come cheap. Based on current EPS expectations for FY23 I calculate a fair price of $252, offering a 9% upside from the current share price of $231.

Despite an increase of 24% since my previous article, I continue to be buy-rated on Visa as the long-term potential is impressive while offering a lot of financial safety through its impressive moat.

I rate Visa a buy with a price target of $252.

Disclosure: I/we have a beneficial long position in the shares of V either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.