Summary:

- Lucid Group, Inc. continues to enjoy robust financial support from the Saudi Arabia PIF, with the investments balancing the lack of profitability thus far.

- Despite the narrowing losses and lower annualized cash burn rate, the automaker’s near-term prospects remain uncertain, given the apparent gap in demand/ supply.

- With Lucid Group stock charting lower lows and lower highs, it remains to be seen when bullish support materializes, with the dire predictions of EV bankruptcies already happening to Fisker.

- Combined with the elevated short interest, lower than expected FY2024 production guidance, and intensified capex, Lucid Group stock remains uninvestable in the meantime.

Orla/iStock via Getty Images

We previously covered Lucid Group, Inc. (NASDAQ:LCID) in December 2023, discussing its pessimistic prospects as the premium electric vehicle, or EV, pricing became an inherent barrier to its mass appeal and adoption.

Combined with the impacted gross margins, lowered FY2023 production guidance, and lack of projected profitability over the next few years, we had remained uncertain about its investment thesis, worsened by the fact that it was highly shorted.

In this article, we shall discuss why we are maintaining our Hold (Neutral) rating, despite LCID’s robust financial support from the Saudi Arabia Public Investment Fund, or PIF, moderating cash burn rate, and the projected launch of its high-volume mass-model EVs in 2026.

With the stock continually charting lower lows and lower highs, it remains to be seen when bullish support may materialize, with Tesla, Inc. (TSLA) CEO Elon Musk’s dire predictions of EV bankruptcies already happening to Fisker Inc. (FSRN).

The LCID Investment Thesis Remains Overly Speculative Here

For now, LCID has received another lifeline from the PIF, with the $1B in investment effectively making up for the lack of profitability thus far.

For context, the automaker reports FY2023 revenues of $595.27M (-2.1% YoY) and gross losses of -$1.34B (-30% YoY), implying an eye-watering gross margin of -225.2% (-54.5 points YoY).

The bottom line headwinds are naturally attributed to its lack of production scale, with the automaker only producing 8.42K vehicles (+17.2% YoY) while delivering 6K in FY2023 (+37.6% YoY).

Demand appears to be weak as well, based on the gap between production and delivery at 71.2% (+10.5 points YoY), as the management records an eye-watering inventory write-downs worth $926.9M (+62.7% YoY) in FY2023.

On the one hand, it is apparent from these developments that LCID may continue to enjoy immense support from the PIF, as observed in the multiple investments since 2018.

The automaker has also reported a reduced annualized cash burn rate of approximately -$2.28B by FQ4’23, compared to the -$3.28B reported in FQ3’23.

This is on top of the narrowing costs per vehicle at an estimated sum of $322.38K (-14.4% YoY), based on the cost of revenues at $1.93B (+17.6% YoY) and 6K vehicles delivered (+37.6% YoY) in FY2023.

Assuming that LCID is able to sustain this trend moving forward, further aided by the “production of more affordable, high-volume midsized car in late 2026,” as with many other legacy automakers, it appears that we may slowly see the gross margins improve as its reports improved production scale moving forward.

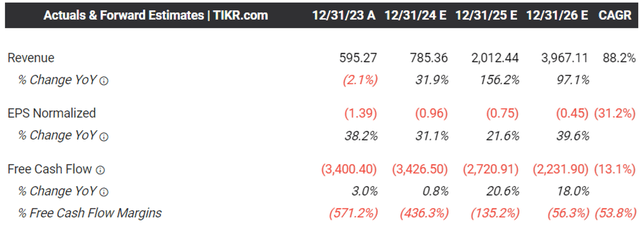

The Consensus Forward Estimates

On the other hand, with more uncertainties in the intermediate term, we concur with the pessimistic consensus forward estimates, with LCID not expected to generate any profitability any time soon.

This implies that the cash burn may continue, along with the consistent dilution from the 2.29B of shares reported in FQ4’23 (+0.01B QoQ/ +0.58B YoY/ +2.27B from FY2019 levels of 20.6M), with the latter partly attributed to the PIF capital raises.

This is on top of the elevated Stock-Based Compensations of $257.28M (-39.2% YoY) in FY2023, as insiders continue to sell even at these depressed levels.

If anything, LCID has guided the pessimistic FY2024 production of approximately 9K vehicles (+6.8% YoY), suggesting that its profit margins are likely to disappoint as well.

While the management has recently unveiled Gravity by late 2023, readers must also note that the new SUV platform is only expected to start production by late 2024 with bigger volumes only occurring by 2025. As a result, we may see its inventory impairments continue for a little longer, affecting the near-term optics.

Combined with the intensified capex guidance of $1.5B in FY2024 (+64.7% YoY), it is apparent that cash burn and dilutive capital raises may remain the norm ahead.

While LCID may target the upmarket segment of the EV market for now, we believe that part of the demand headwinds are also attributed to the elevated average Car Loan APR Rates of 11.6% for used vehicles and 7.1% for new vehicles by February 2024, compared to 8.2% and 5.4% in December 2019, respectively.

This is especially worsened by the loss of the Luxury Car of the 2023 Year at the prestigious World Car Awards in 2024 to Bayerische Motoren Werke Aktiengesellschaft’s (OTCPK:BMWYY) all-electric variant i5-series luxury sedan.

LCID Valuations

As a result of these developments, we maintain our belief that LCID remains uninvestable here, with the FWD EV/Sales valuation of 6.73x still appearing to be expensive compared to other unprofitable EV stocks, such as Rivian Automotive, Inc. (RIVN) at 1.22x and Polestar Automotive Holding UK PLC (PSNY) at 2.17x.

With LCID also priced at a notable premium compared to Tesla at 4.85x, we are not certain if it is wise to add the former here.

So, Is LCID Stock A Buy, Sell, or Hold?

With LCID listed under Nasdaq, there appear to be some ways to go before the stock may face any danger of delisting, based on the platform’s requirements as below (emphasis added):

If a company trades for 30 consecutive business days below the $1.00 minimum closing bid price requirement, Nasdaq will send a deficiency notice to the company, advising that it has been afforded a “compliance period” of 180 calendar days to regain compliance with the applicable requirements.

This is compared to its troubled EV peer, FSRN, with the NYSE already commencing the proceedings to delist the stock.

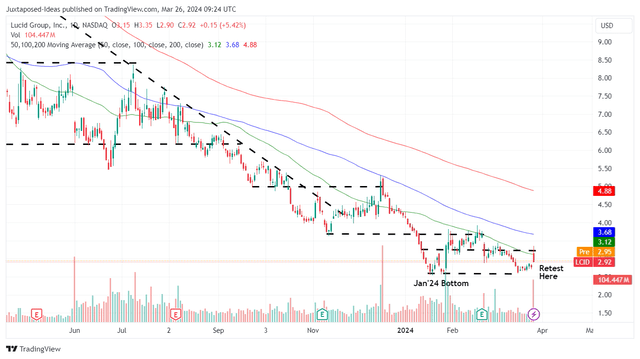

LCID 1Y Stock Price

Then again, based on Lucid Group, Inc.’s prices of $2.92 at the time of writing, it is apparent that the stock has been unable to retain much of the recent PIF gains of up to $3.35, with it likely to retest the January 2024 bottom of $2.76 soon.

Readers must also take note of its elevated Lucid short interest of ~29% at the time of writing, with the volatility from the aggressive short sellers potentially negating the potential upside from these bottom levels.

As a result of the growing headwinds, we believe that it may be more prudent to reiterate our previous Hold rating for the Lucid Group, Inc. here.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.