Summary:

- Luminar reports significant cash outflow of $81M in Q1, generating $21M in revenue with a negative 50% gross margin.

- Revenue projection influenced by LiDAR sensor production for Volvo, expecting a quarterly run rate of $35M by the end of the year.

- Luminar’s balance sheet shows a cash balance of $218.3M, but additional equity issuance and cost-cutting measures are needed to reach cash objectives.

JHVEPhoto

Luminar (NASDAQ:LAZR) was one of the first LiDAR companies to report their first-quarter results. Once again, the company had a surprisingly significant cash outflow of $81M in net cash used in operating activities, not estimated previously. Meeting the given estimate, it generated $21M in revenue, broken down into $15M for product sales and $5.6M for services. However, the gross margin remained a concern, although it improved, standing at a negative 50%.

The initiation of LiDAR sensor production for AB Volvo (OTCPK:VOLAF) has influenced Luminar’s revenue projection. While I do not anticipate seeing it a lot in Q2, perhaps $6M as part of my estimate at about $14M, a quarterly run rate of $35M is expected for the latter part of the year. This could lead to $105M in revenue for 2024, notably lower than my initial estimate in the Q4 review.

Luminar’s balance sheet revealed a cash balance of $218.3M. As discussed, the company has secured a $50M line of credit backed by shares, effectively extending its cash position to $268M. Luminar spent $81M on operating activities but selling $17.2M in equity helped to limit the reduction of the cash on hand to $71M.

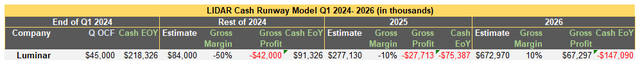

Based on the assumption that quarterly operating cash flow (OCF) consumption will be $45M for the next three quarters and gross loss will be around $42M for the rest of the year, Luminar would spend $175M, leaving it with $91M at the year’s end. To reach the $150M cash objective, Luminar would need to add $59M.

On May 3rd, Luminar released a shelf offering, extending the at-the-market offering of $75M issued in February 2023. The 2023 program had $24M available at Q4’s end but was depleted by the sale of the mentioned $17.2M in Q1 and the last $7M in April. The ATM extension is now for $150M.

Concurrently with the shelf release, Luminar filed an 8K. The company announced a significant 20% reduction in headcount, the subleasing of production floors, and a transition to TPK, a partner and third-party manufacturer in China, to manufacture its Iris LiDAR sensor for a lower cost. These actions are expected to result in substantial savings of $400M over five years; however, it’s important to note that cash savings are much less, as quoted by CFO Tom Fennimore:

“As a first step, we announced last week a restructuring plan and other cost-cutting initiatives, which in aggregate is expected to total $80M in annual run-rate savings. A little over half of these savings are expected in cash and the remainder in stock issued to employees and vendors.”

Following up on the statement, I assume savings will yield $41M of cash annually. The costs associated with these transitions amount to $13M, with $8M allocated for headcount reductions and $5M for subleases. For 2024, the action will likely generate $20M in savings.

If savings of $20M were achieved this year, $39M of the new ATM would need to be sold in 2024. Then, in 2025, a remaining equity program would have to be sold to give Luminar $111M of cash left by the end of 2025 if $150M of OCF spent would become a norm. Without a significant contribution from gross profit and more information about additional costs, another ATM would have to be triggered in 2025. The CEO has stated that the company has enough cash by the end of 2025, including the shelf from May 3rd. The table illustrates the financial situation I have described. The 2024 is not adjusted for $20M in savings.

Luminar Cash Runway Estimate (Financial Statements, Author)

Investing in Luminar must include acceptance that the company needs to issue more equity, possibly for years, until the gross margin turns positive. Given the significant dilution, the share price will remain unbalanced. This condition is heightened by the convertible bond that will mature by the end of 2026, currently trading at 28 cents on the dollar, reflecting Luminar’s poor financial state.

Moving the focus away from the dilution, in the document published by Luminar, the CFO mentioned sensor sales to Tesla (TSLA), noting it as the largest customer, accounting for 10% of sales or $2M in Q1. A name synonymous with innovation and success may have been used to help inspire investors and instill a sense of reassurance about the future. It indeed moved the share price the following day.

Similarly, a significant portion of Investor Day in April was dedicated to a partner, TPK, where CEO Li Chien Hsieh described the relationship between the two companies as an “iPhone moment,” likening it to Apple (AAPL) outsourcing production of its device to Foxconn (OTCPK:FXCOF). It helped the share price recover at the end of April.

Outsourcing manufacturing has been standard. Granted, the decision to locate production in China is unusual, especially given the current tensions over LiDAR, including the connected car issue being reviewed by the Department of Commerce and several members of Congress/Senate. Considering these concerns, I expect TPK to produce for the Chinese market and Mexico for North America. Additionally, the reception of Luminar’s LiDAR technology in China remains to be determined, especially as Chinese LiDAR faces a potential ban in the US. Elon Musk famously visited China to lobby for the approval of Tesla’s Full Self-Driving (FSD) technology. That visit raises the question of whether Austin Russell, the CEO, must do the same for Iris. Lastly, while the names of Apple or Tesla may carry weight, the flash effect will matter little to the business of the company at hand when it has weak financial fundamentals and an unproductive business model.

During the Investor Day (ID), the company discussed its $4B order book and the commencement of production (SOP) with Volvo but did not disclose revenue details from this customer. The Q1 presentation revealed a $3.8B order book, with 2%, or $76M, expected to be drawn in 2024 and a significantly higher figure scheduled for 2025. It remains to be seen how many sensors Volvo ordered or at what price, but I hope Luminar will provide this information to help estimate future revenues.

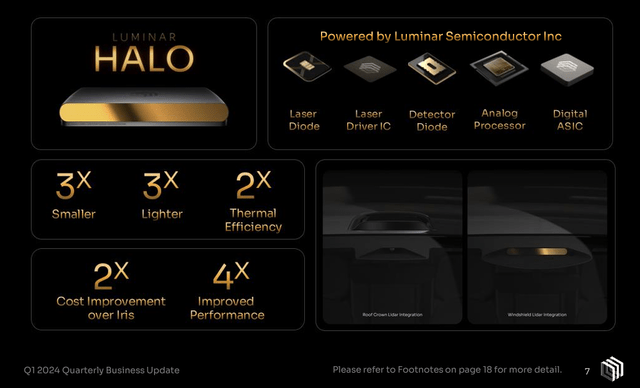

During the Investor Day, Luminar introduced a new Halo sensor, boasting several improvements over its predecessor. However, its capabilities were described as “multiples” without a clear benchmark for comparison. Remarkably, during the Q1 conference call, the CFO announced an order for $100M for sensors that will not be available until 2026.

New LIDAR sensor Halo (Luminar Technologies, Inc)

Despite the name-dropping getting much attention, Luminar remains in a financial crisis. The stock is unattractive because of ongoing spending, high dilution level, around 25%, and the comfort Luminar sells ATMs. I anticipate that headlines featuring Tesla will fade, and the company’s financial condition will influence the share price, likely resuming a downward spiral in anticipation of future cash requirements. I continue to rate Luminar as a “sell.”

Analyst’s Disclosure: I/we have a beneficial long position in the shares of OUST either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.