Summary:

- Mastercard’s earnings beat expectations, presenting a solid and healthy company.

- With Visa being in the ‘fair value’ territory, Mastercard fails to deserve its premium over Visa.

- Both a peer group analysis and a Discounted Cash Flow suggest that Mastercard might be overvalued right now.

jbk_photography

As of my latest article on Visa (V), I think V is at a great buying opportunity right now. Mastercard (NYSE:MA) – one of Visa’s major competitors – declared solid earnings on 27th July with beating both top and bottom line expectations. This poses the question, if Mastercard is currently also in an attractive region to initiate a position in the company.

The Market

The credit card market is pretty much composed of four different key players:

- Card Issuers: The companies that offer credit cards are often financial organizations like banks and credit unions. They generate revenue through yearly fees, interest rates on outstanding amounts, and numerous additional levies. They are also in charge of screening prospective cardholders.

- Cardholders: These are the customers and companies that transact using credit cards. They gain from the ease of use, the power of online shopping, and the opportunity to establish credit, but they also run the danger of running up debt because of high interest rates.

- Merchants: This group includes companies that take credit cards as a form of payment. While expanding their consumer base by taking credit cards, companies must pay transaction networks and card issuers fees as a necessary evil.

- Transaction Networks: Here our two companies Visa and Mastercard enter the picture. They – with other competitors like American Express (AXP) and Discover (DFS) – facilitate the transaction between the cardholder and the merchant. They serve as the intermediary in the transaction process and are compensated with fees.

The whole credit card market is expected to grow at a CAGR of 8.5% until 2030. This growth is mainly fueled by Asian Pacific countries increasingly use credit cards.

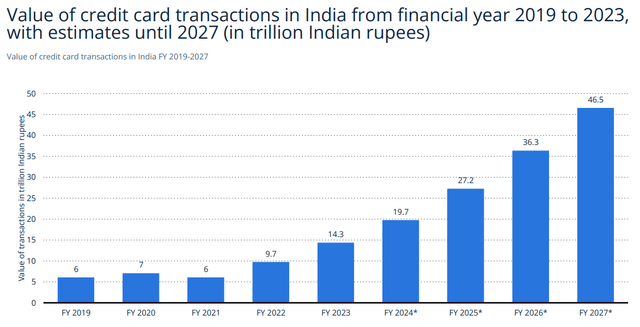

The expected growth in India for example is especially impressive in my opinion:

Value of Credit Card Transactions in India (www.statista.com/study/65254/credit-cards-worldwide/)

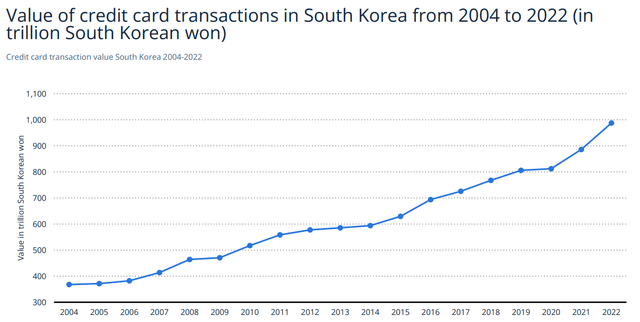

Equally impressive is the growth of credit card transactions in South Korea. In my opinion, this confirms that the expected growth rate of India is more than achievable.

Value of Credit Card Transactions in South Korea (www.statista.com/study/65254/credit-cards-worldwide/)

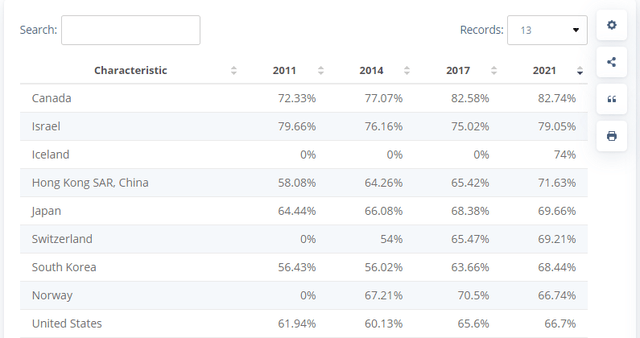

There are a lot of countries that already have a very high ownership-rate of credit cards, like Canada, Israel and of course – the biggest market for credit cards as of 2022 – the United States:

Ownership-Rate of Credit Cards by Country (www.statista.com/statistics/675371/ownership-of-credit-cards-globally-by-country/)

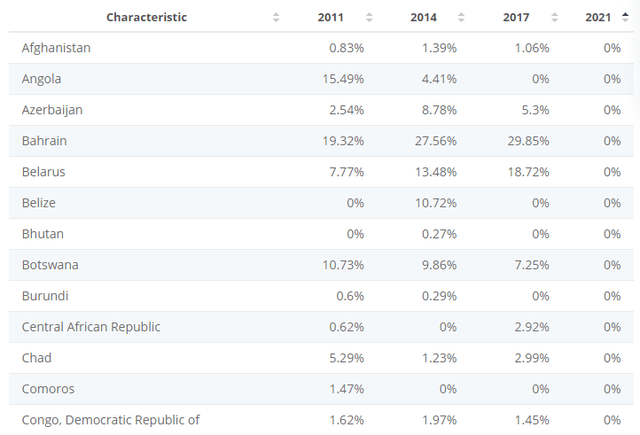

But there are also a lot of countries that have a very low ownership rate, see some examples below:

Ownership-Rate of Credit Cards by Country (www.statista.com/statistics/675371/ownership-of-credit-cards-globally-by-country/)

The credit card market as a whole seems like a very promising market. Especially the transaction networks should be able to capitalize on the growing market, as these are pure plays in this segment. To summarize the main points for Mastercard as a transaction network, I conducted a small SWOT-Analysis.

SWOT Analysis

Strengths

Global Brand Recognition & Extensive Network

As one of the most well-known brands in the world, Mastercard has a considerable competitive edge. The company also established global presence that is challenging for new competitors to match, with millions of ATMs and acceptance at tens of millions of establishments globally.

Technological Infrastructure

The business has strong technology infrastructure that can safely and effectively manage billions of transactions, giving it a solid base on which to expand and innovate its product offerings.

Partnerships and Alliances

Partnering with several banks, retailers, and other financial institutions has allowed Mastercard to provide a range of value-added services, rewards, and discounts to draw in and keep clients.

It think MA’s strength can pretty much be summarized by one word: Duopoly. The two companies Visa and Mastercard have a combined market share of around 65% of global network purchase transactions, as of 2020. While Visa is currently holding around 40% of market share and Mastercard “only” 25%. The rest of the market is pretty much held by UnionPay, a China based payment processor that is very present in Asian countries. Therefore one could say that the whole western world is reliant on either Visa or Mastercard to process their payments.

Weaknesses

Regulatory Scrutiny

Being in the financial industry, Mastercard is subject to stringent laws, which may be expensive to comply with and may have an impact on how the company can conduct business.

Dependence on Banking Partners

Mastercard’s business is heavily dependent on its relationships with issuing banks. The market reach and income of the firm may be directly impacted by any tension in these ties.

Limited Direct Customer Interaction

Unlike other financial tech businesses that provide consumer-facing platforms, MA largely acts as a middleman and has close to none direct interaction with the end user.

Opportunities

Emerging Markets

In undeveloped nations, where the majority of transactions are still made in cash, there is a sizable untapped market. If Mastercard wants to expand internationally, it can certainly concentrate on these markets.

Digital Transformation

Mastercard has the chance to further develop its online and mobile payment solutions as the trend toward digital payments is growing.

Expanding into Financial Services

By expanding its already existing financial services, such as those for insurance, loans, and investment goods, either directly or through partnerships, Mastercard may broaden the range of products it offers.

B2B Payments

The market for Business-to-Business (B2B) payments is mostly untouched and offers a sizable window of opportunity for expansion.

Threats

Intense Competition

MA is already just the number two behind Visa in the credit card market. Mastercard could continue to lose market share as V uses its size to gather more compelling deals with banks and other partners. Additionally other fintech companies like PayPal (PYPL) and even Apple (AAPL) are increasingly trying to gain market share in the payment industry.

Cybersecurity Risks

Cyberattacks frequently target the financial services sector, and any compromise may significantly harm Mastercard’s reputation and client confidence.

Regulatory Changes

The business strategy and market positioning of Mastercard might be impacted by unfavorable changes in financial rules or antitrust legislation, due to the duopoly of V and MA.

Economic Fluctuations

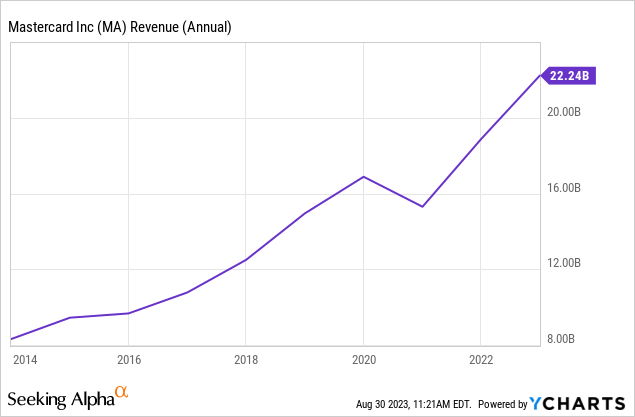

Mastercard is vulnerable to economic downturns since it operates in the financial sector, which can impact consumer spending and, as a result, transaction volumes. The “dent” from Covid-19 is clearly visible in MA’s revenue:

Disintermediation by Technology

Blockchain and other distributed ledger technologies could make it unnecessary for there to be middlemen in financial transactions, endangering the primary activity of Mastercard.

The SWOT-Analysis shows that Mastercard is a high quality company, which is very well positioned to capitalized on the growing credit card market. While there are Weaknesses and Threats, I believe that the Strengths and Opportunities outweigh the negative aspects for this company.

Valuation

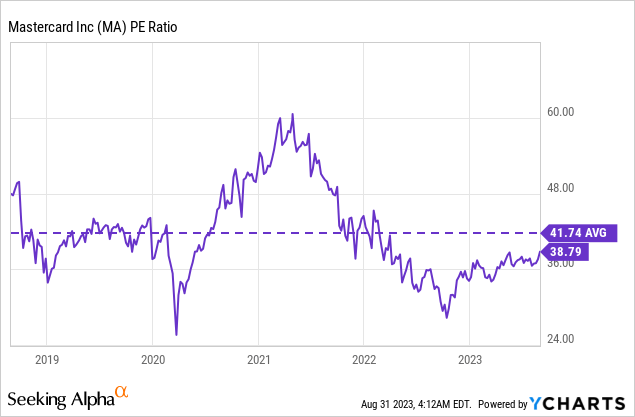

MA is currently trading at a P/E ratio of ~38x. While this seems high at first sight, it is around 10% below the companies 5 year average P/E ratio of 42x. These high P/E ratios indicate a very high quality company.

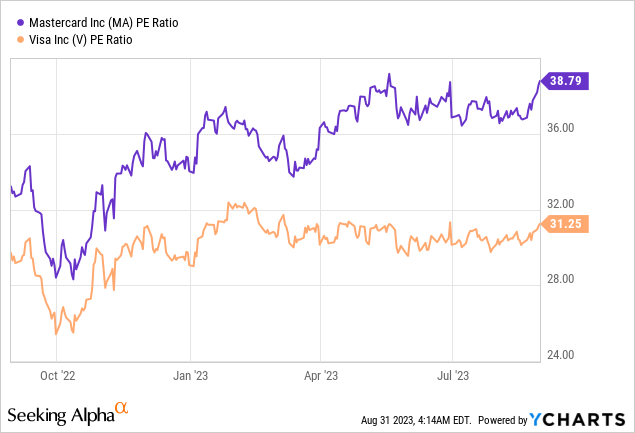

When comparing V and MA, we can see that MA is currently having a considerable valuation-premium, compared to Visa.

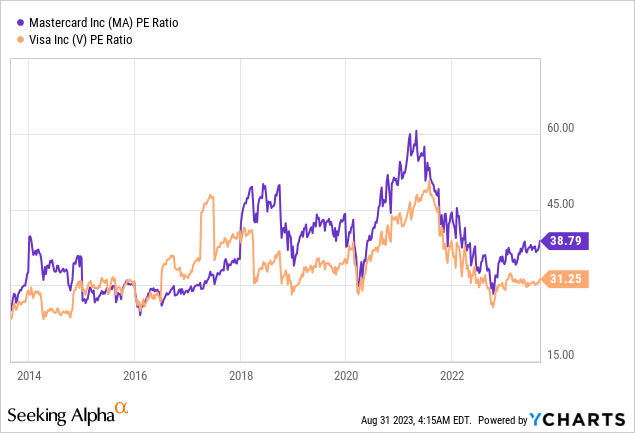

Over the last 10 years, it becomes apparent that they pretty much trade in line with each other, but MA – in general – is the company with the higher P/E ratio out of the two. However the discrepancy seems to have increased over the last few months:

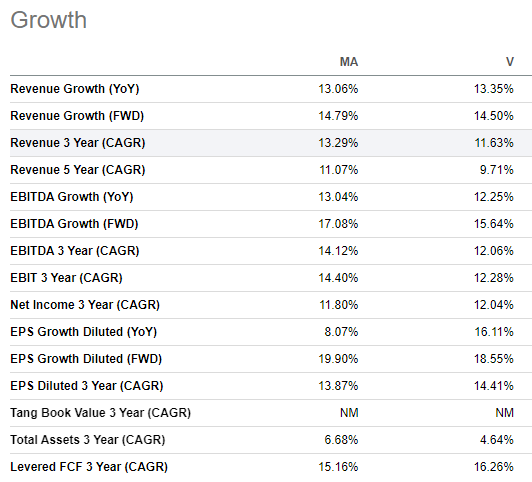

To justify this premium, one might argue that MA has to be the more high quality company of the two. When we however take a look at the current growth and profitability metrics, I think the two are pretty close together, with MA growing a bit faster in most metrics while Visa seems to be ahead on a lot of profitability metrics.

Growth Metrics MA vs. V (seekingalpha.com)

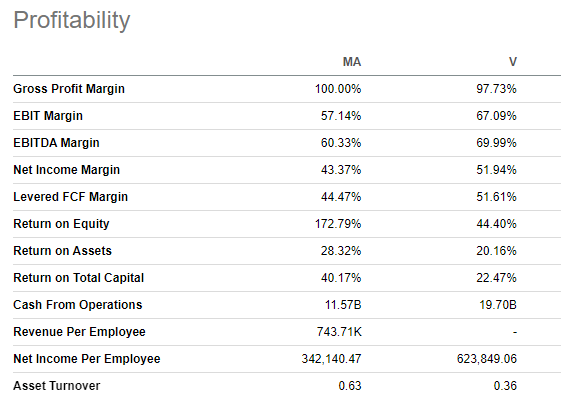

Profitability Metrics MA vs. V (seekingalpha.com)

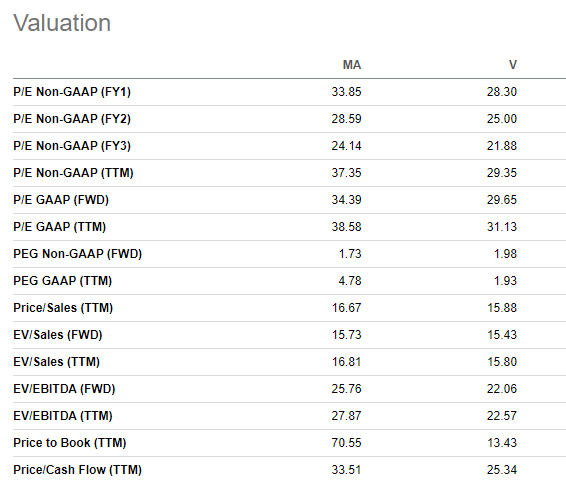

In almost all other valuation metrics, we get a similar picture, with Visa having a lower metric in almost every single one:

Valuation Metrics MA vs. V (seekingalpha.com)

As already mentioned above, I believe that Visa is currently at a nice/fair valuation and could be a solid buy right now. I have a price target of $243 for the company. More on that here. According to the peer comparison, we may assume that Mastercard looks expensive right now.

Discounted Cash Flow Analysis

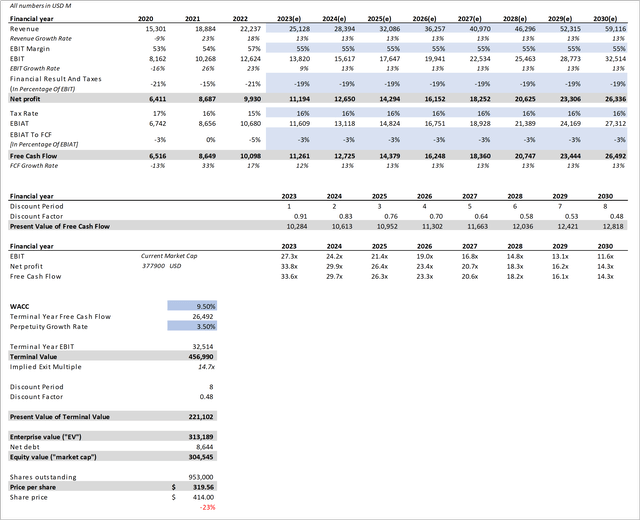

To valuate MA independently for Visa now, I conducted a small Discounted Cash Flow Analysis (DCF), that factors in Mastercard’s future expected growth rates. The blue cells in the analysis are the main assumptions I took, to evaluate the company.

- Revenue: I predicted an annual revenue growth rate of 13% for the next 8 years. This is 1% over the companies ten year CAGR but in line with analysts’ expectations. A reasonable assumption, I think, if we factor in that the 10 years include the Covid crisis. When considering the credit card market is expected to grow at 8.5%, this seems even aggressive.

- EBIT Margin: For the EBIT margin, I used the average of the last 3 years and anticipated that it will stay flat at 55% for the next 8 years.

- Financial Result And Taxes: I averaged the values of the last three years and therefore used -19% to calculate the Net Profit for the years 2023 to 2030.

- Tax Rate: For the tax rate, my calculations were pretty much the same. I averaged out the last three years and then anticipated that it’ll stay flat at 16% over the next years.

- Free Cash Flow: I calculated the EBIAT using the aforementioned tax rate and then attempted to estimate an appropriate EBIAT to FCF ratio. I here again averaged out the last three years and used -3% to calculate Mastercard’s future Cash Flow.

- WACC: I used the current WACC of MA, 9,5%

- Perpetuity Growth Rate: The perpetuity growth rate assumed for the analysis is 3.5%.

DCF for Mastercard (seekingalpha.com)

With the above mentioned assumptions, we arrive at a price target of ~$320. This indicates, that the company could be overvalued by around 20%.

Conclusion

I think that Mastercard is a very high quality company. The almost duopoly – with the therefore high achievable margins – between Visa and Mastercard definitely deserve some kind of premium against the overall market.

I additionally believe, that the credit card market as a whole is a compelling market to invest in. With a predicted growth rate of 8.5% p.a. and a lot of emerging countries to tap into, the market offers a attractive growth rate.

With our competitor analysis and our DCF however suggesting, that Mastercard is overvalued right now and the fact that Visa is the market leader with a ~40% global market share, I would rather invest in MA’s major competitor Visa right now. Visa is presently at a more compelling valuation and the slight difference in growth between Visa and Mastercard in my opinion doesn’t justify the hefty valuation premium MA has over V. Therefore I currently rate Mastercard as a ‘Sell’.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.