Summary:

- MA has one of the lowest yields of dividend payers that I own.

- Despite this, the dividend growth and upside potential for MA is strong.

- Shares have risen more recently but still present an opportunity for longer-term investors.

Digitalroomm

Written by Nick Ackerman. This article was originally published to members of Cash Builder Opportunities on November 28th, 2022.

Investors who identify as income investors tend to stick to securities with higher yields upfront. However, I think that a good mixture of positions could be considered for income investors to be well-rounded. That’s where something like Mastercard (NYSE:MA) can fit in. They offer a low dividend yield for now, but the growth potential in that income is quite remarkable, as they’ve already proven.

They’ve been raising their dividend for the last 11 years (12 now since the original post) and have been doing so aggressively. In the future, with strong growth expected in earnings, they should continue to have the ability to raise aggressively.

Recently, shares have been rallying back with the market. However, with something like MA, there are almost unlimited potential growth possibilities. Therefore, even at what could be seen as a premium, it could be a fairly strong opportunity for a longer-term investor.

A more patient investor could choose to wait for the next dip to potentially end up with a better entry-level. Additionally, selling puts is always an option that could be worth considering for investors that don’t mind going the options route.

Unlimited Growth Potential?

Everybody is swiping their credit cards more than ever lately – especially with the holiday season upon us. 2022 Black Friday just hit a record number of sales from online shoppers at $9.12 billion. That is up from $8.92 billion in 2021. You can bet that many shoppers were utilizing their Mastercard debit and credit cards. That’s the bread and butter of their business, more transactions, more fees and more earnings.

It’s one type of business that has new customers born every day. Mastercard’s payment processing doesn’t care about gender, race or age – they can generate revenue from any demographic. The richer the world, the better off they are. It might not seem like it all the time, but the world continues to become wealthier as a whole, and those in poverty continue to decrease.

There are also new markets they can penetrate into, leading to additional growth opportunities. This is something they highlighted in their recent earnings call.

We’re also growing commercial point-of-sale transactions by targeting small business, corporate T&E, purchasing and fleet flows. In the U.S., we announced our exclusive co-brand partnership with First National Bank of Omaha to issue the [indiscernible] small business card. This product offers small business owners industry-leading access to tools, benefits and services with a focus on equitable access to credit – very important.

In fact, a new initiative is growing that they don’t even have to provide plastic for the card. Going to virtual cards as the shift to e-commerce grows makes a lot of sense. They mention it specifically for business-to-business purposes.

We also continue to target B2B accounts payable flows by expanding access and reach leveraging our virtual card capabilities. We signed a deal with Marqueta to enable our next generation virtual card solution, Instant Pay. This solution intelligently and automatically sends instant payments to suppliers. We have also signed an agreement with SAP Taulia to integrate our virtual card solutions into Taulia and their SAP solutions, enabling their customers to facilitate virtual card payments.

In the Q&A section, they reiterate further that they see a lot of potential growth there.

…virtual card is the current and most immediate answer to go after B2B flows. There is the commercial POS piece somewhere, which is kind of in an in-between space between B2B and small business, but that’s a huge space with a lot of cash and checks.

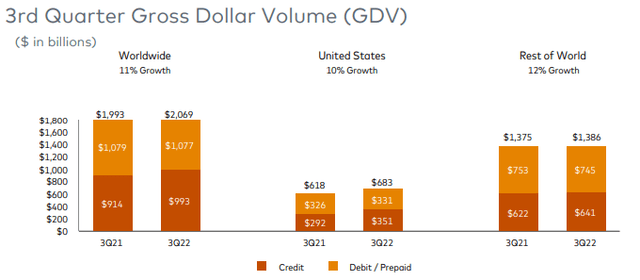

For these reasons of almost seemingly unlimited growth potential is why GDV can grow year-over-year, translating into earnings and revenue growth that can continue. Here’s a look at the year-over-year for Q3 in their latest earnings presentation.

MA Investor Presentation (Mastercard)

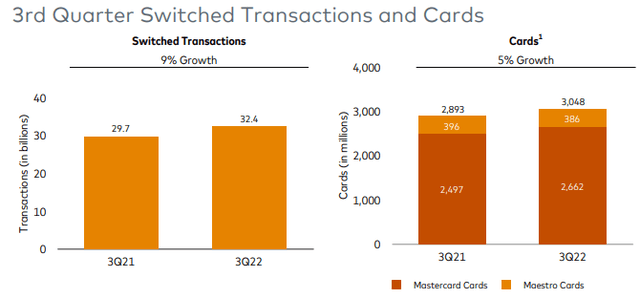

Some of the GDV growth here was on the back of 5% growth in cards and 9% growth in switched transactions.

MA Investor Presentation (Mastercard)

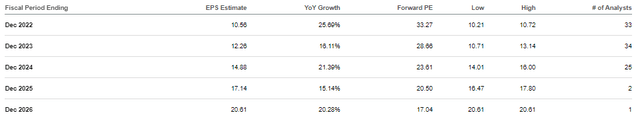

All these growth avenues come down to the expectation that growth is anticipated to continue to grow over the next five years at least.

MA EPS Estimates (Seeking Alpha)

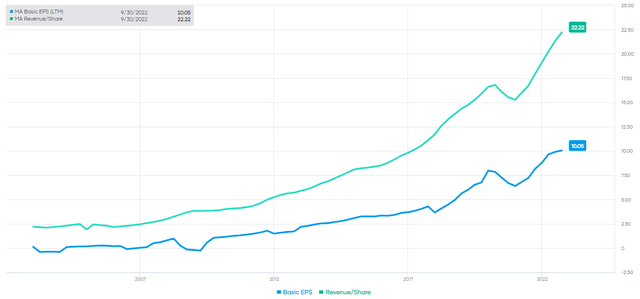

Over the years, MA’s revenue and EPS have been fairly recession-resistant. Small and temporary hits to these metrics can be seen below but were quickly reversed in 2020. What might be notable is that analysts believe that next year MA will still see EPS growth despite the widespread expectation for a slowdown into a real recession next year.

MA EPS and Revenue Growth (Portfolio Insight)

Ultimately, for someone who looks at holding for years rather than quarter-to-quarter, if we see a dip next year in earnings, it isn’t likely to cause us concern.

Threats To Business Operations

Of course, with a business that can seemingly be fairly recession resistant with strong growth potential into perpetuity, there comes competition. There is MA and then Visa (V), which could be seen most comfortably as the most widely known and popular. However, American Express (AXP) and Discover (DFS) are also formidable but less widely adopted competition.

That isn’t even to mention all the other niche players and startups getting into the space of payment processing. There is always a challenge for large financial institutions such as JPMorgan (JPM) to get into the payment processing business too. All that being said, none of that has materialized, at least nothing that has seriously threatened MA and V.

In fact, one could even argue that it would only further solidify these payment processors’ dominant positions. One example of this is that very recently, JPM and MA have teamed up to launch “pay-by-bank.” By teaming up, MA can potentially reach new revenue generation from consumers who wouldn’t normally have utilized their services.

If crypto is ever really adopted as a form of payment, don’t worry, MA can profit there too. They offer a crypto card program that can convert crypto to fiat. That might be against what crypto “stands for,” as it tries to be decentralized. The reality is that if it is ever adopted, it will need to conform to how society can use it easily and conveniently. This brings up the idea that crypto isn’t really necessary at all, but that’s a whole different discussion.

Our strategy to engage in the crypto economy leverages assets across payments, services, and new networks, a combination that yields a truly differentiated value proposition. Here, we’re deploying our payment capabilities to enable consumers to spend their crypto holdings on card and cash out their crypto wallets via Mastercard Send. This quarter, we partnered with Evonax, who will become our first partner in Australia to issue crypto-funded cards. We’re enabling off-ramp solutions with Mastercard Send and recently added five new players in North America and Europe, including finance supported by checkout.com and Nubay. In all instances, we do not handle crypto but rather take delivery of fiat currency.

The bottom line, crypto isn’t likely to kill off MA anymore than other more traditional competitors.

Dividend And Valuation

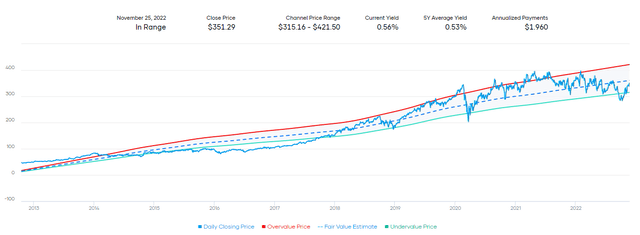

As mentioned at the start, this is a lower-yielding position. It generally floats around a 0.50% yield. According to the historical average dividend yield, shares are about fairly priced. However, there is a wide range here.

MA Dividend Yield Channel Price Range (Portfolio Insight)

Additionally, MA isn’t usually valued based on its historical yield, so this is more of an interesting chart than really helpful in determining fair value.

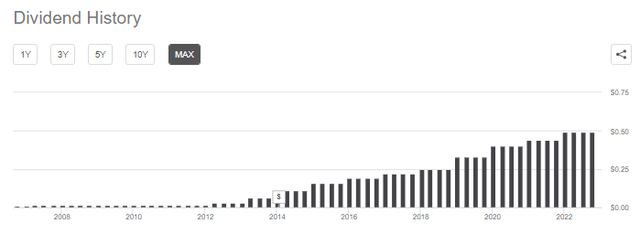

They’ve been raising their dividend for 11 years, and the next raise is expected to be announced any day now. The next one should be a raise to start off 2023. Historically, they announced late November/early December the raise for the next year.

MA Dividend History (Seeking Alpha)

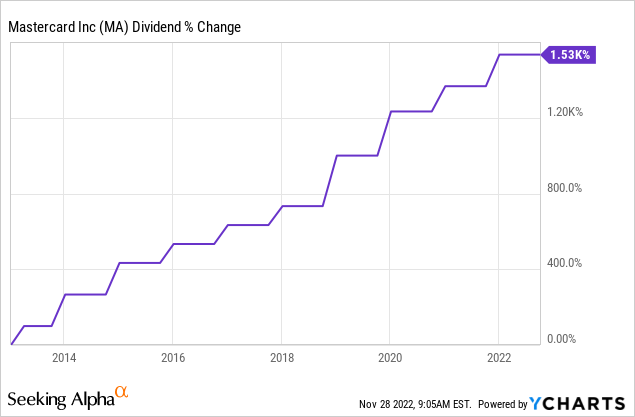

The 10-year dividend CAGR comes to 34%. That’s certainly been quite attractive, but increases in recent years have been more conservative. To look at it another way, the dividend has grown 1533.33% in the last ten years. They had a 10-for-1 split, so the $0.30 quarterly a decade ago is adjusted to $0.03.

Ycharts

Last year being declared through 2022, we saw a $0.05 quarterly raise or 11.4%. For 2021, it worked out to be a $0.04 increase in the quarterly or a 10% bump. Given the state of the economy, the increases were much lower than in prior years.

(Author Note: Since this was originally posted, they have announced the anticipated raise along with an additional $9 billion share repurchase. The announcement was for an increase of 16.3% to $2.28 annually, well above my expectations!)

The economy still remains a bit uncertain, so another ~10% increase could be likely. If that remains the case, we could see the quarterly raise to $0.54 for next year or an annualized $2.16. At around 10%, we are still beating inflation, which is a positive.

Shares just a short while ago touched down below $300. So the latest increase has been quite substantial as the overall market began its strong rally back starting in October. Still, shares of MA aren’t overly priced – dipping below their fair value estimate based on the historical P/E level.

MA PE Fair Value Price Range (Portfolio Insight)

That could indicate a bit of upside even if purchased at this level. Wall Street analysts have an average price target of nearly $395, which further indicates that there could be some upside from here. Clearly, the upside potential from this level vs. the ~$300 it was at is less compelling – but for longer-term investors, that doesn’t mean one can’t consider shares at this level.

Conclusion

MA is a lower yielder, which would probably send most income investors scurrying away. However, MA presents an attractive potential for significant dividend growth in the future based on its many avenues for revenue and EPS growth going forward. Balancing your income approach with higher yielders, slower growers and, lower yielders, higher growers can leave you in a more well-rounded position.

Disclosure: I/we have a beneficial long position in the shares of MA, JPM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Interested in more income ideas?

We are currently running a 20% introductory discount through the end of the year for new members who sign up. Take your 2-week free trial today to see if we are a good fit!

Check out Cash Builder Opportunities, where we provide ideas about high-quality and reliable dividend growth ideas. These investments are designed to build growing income for investors. A special focus on investments that are leaders within their industry to provide stability and long-term wealth creation. Along with this, the service provides ideas for writing (selling) options to build investors’ income further.