Summary:

- Visa has a greater presence in the market, and a larger market share in most countries but Mastercard has better revenue per share figures and greater future growth potential.

- It seems that they will be able to access India’s Unified Payments Interface system on which 4 billion smartphone-based transactions go through monthly.

- Ahead of the earnings Visa seems better valued than Mastercard.

- Which company would you buy right now?

Matt Cardy/Getty Images Entertainment

Investment thesis

Both Visa (NYSE:V) and Mastercard Incorporated (NYSE:MA) will report their last quarterly earnings for 2022 this week. In this article, I try to give a realistic estimate of what to expect from the earnings results and what are the most important future trends that investors should look at. Visa has a greater presence in the market, higher turnover, and higher valuation than Mastercard. However, when it comes to revenue per share, earnings per share, and revenue growth, Mastercard outperforms Visa. Both stocks are expected to have a positive performance and outperform analysts’ estimates for the last quarter of 2022 but Mastercard could potentially offer greater profit in the long term due to its growth prospects.

Digital trends to look for

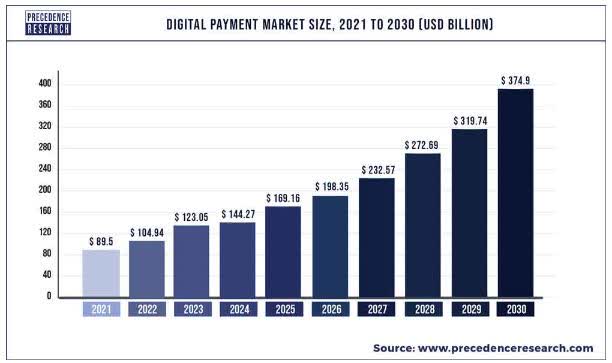

Digital payments will continue to rise in the next years but different markets will lead the growth than in the last 5-6 years. Multiple forces have led to the growth of the global digital payment industry in the past years, such as an increased shift away from cash transactions and a growing reliance on smartphones. Moreover, mass internet usage has helped to drive forward the global e-commerce sector during the pandemic. The digital payment market share worldwide was valued at $89.5 billion in 2021 and is projected to reach approximately $374.9 billion by 2030, a CAGR of 17.25% from 2022 to 2030.

precedenceresearch.com

North America accounted for the largest share of the global market revenue in the past decade. This was due to the rising use of digital wallets, and mobile payments in countries such as the U.S. and Canada. The high rate of adoption has been a major factor driving growth in this region. However, this market share is going to slightly decline as the emerging markets start to adopt digital payments rapidly. The Asia-Pacific region is forecasted to be the highest growth contributor to the digital payment market in the upcoming years. China is a huge market but neither Visa nor Mastercard could capitalize on that market just yet however India could be the key to growth for the two major credit card companies. Key government initiatives and policies in India are about to help to grow their market share and transaction volumes. The government of India is actively working on its strategy to digitize the economy and financial sector with the help of the two American giants.

India is opening up

The government’s launch of the Pradhan Mantri Jan Dhan Yojana in 2014 was a golden opportunity for RuPay debit cards, as it provided bank accounts to people living in poverty. Financial institutions were requested to suspend service fees for digital transactions executed through the RuPay network. There is no denying that Visa and Mastercard have almost total control over the credit card market, with an estimated 95% of all credit cards being issued by them however the credit card market is much smaller than the debit card market. India has about 77 million active credit cards compared to an astonishing figure of 940 million debit cards. Approximately 75% of these cards are powered by RuPay. The main disadvantage for MA and V was surprisingly not the number of cards they provide but the accessibility of the payment system [UPI].

The Unified Payment Interface or UPI, India’s mobile bank-to-bank payments solution, has become immensely popular since its commencement in 2016. It has driven the growth of digital payments in India significantly and continues to be the go-to payment option for many. Via UPI mobile payments to the merchants, there are approximately 4 billion smartphone-based transactions per month. The approximately 100 million point-of-sales transactions by credit cards seem insignificant because there are only 7.3 million point-of-sale terminals for physical cards in India. Up until now, only debit cards and select credit cards powered by RuPay could have used the UPI. According to reports, the Reserve Bank of India is in the process of formulating plans to integrate Visa and Mastercard credit cards with the UPI. Joining the UPI system would be a significant opportunity for Visa and Mastercard. Through the UPI, they would get access to an extensive network of 230 million QR codes which stores utilize to receive payments. This could be a huge boost to both Visa and Mastercard and they could exponentially grow their operations in India and eventually their revenues.

Ironically, the largest risk is somewhat similar. As merchants become more critical of how much Mastercard and Visa receive from each transaction, smaller and smaller fintech startups capitalize on this issue offering many lower-priced POS terminals for merchants. In addition, legislative bodies are paying increased attention to credit card companies’ activities and there is pressure on them in several countries to lower credit card operator fees. As some of the national banks and governments are easing up regulations (like India), some are about to tighten the grip on card and POS terminal provider fees.

Visa earnings estimates

Visa’s economic moat can be easily defined. Visa operates the most pervasive payment network globally with its services being used by more than 100 million merchants across 200 countries and the number of issued Visa cards worldwide is estimated to be around 3.8 billion. Additionally, more than $13 trillion in total volume goes through its payment processor network every year. Although, the barrier to entry to this market has been significantly reduced by the fintech revolution. The company’s moat is still there despite this revolution because building up the trust of new customers to use an alternative payment processor instead of Visa is challenging.

In the last quarter, the credit card company exceeded expectations in terms of profit and revenue and increased its dividend by 20%. I expect that the fourth quarter earnings will beat estimates as well. It is anticipated that the increased expenditure on travel and entertainment has given Visa a strong quarter. Moreover, digital payment options have likely seen continual growth during this period despite the consumer confidence decline in the U.S. The combined volume of cash and payments, which is a major contributor to service revenues, has expected to grow by 5-6% in comparison to the same quarter of the previous year due to the holiday season and Black Friday around the globe. The company earns revenue in the form of transaction processing fees when customers make payments with debit/credit cards; the fee is a set percentage of the total transaction value. Thus, higher spending translates to increased revenue.

According to my calculations, the total payment transactions could have increased by 10-12% compared to the previous year. I estimate that the rate of growth in U.S. operations in nominal USD could have grown by approximately 8-10% during the quarter party due to the high inflation and because consumers have to pay more for products and services in dollar terms. I expect an 8-9% Y-o-Y increase in data processing revenue for the quarter based on the travel industry recovery and due to the holiday season spending growth. It is anticipated that this would have put the firm in a favorable position for an increase in net income Y-o-Y along with more than expected earnings.

Nevertheless, increased expenditures because of inflation and rising interest rates are likely to have partially balanced out the positives from increasing volumes. My analysis indicates that the total operating expenses are likely to rise further (in the last quarter the expenses rose by 9%). This could be mainly due to an increase in price levels, salary increases, and network and processing fee expenses. Over the next 4-5 years, analysts estimate an average of 10.8% annual earnings growth for Visa which is quite remarkable based on the current and future economic uncertainties.

Mastercard earnings estimates

MA’s economic moat might seem weaker than Visa’s due to lower transaction volume and fewer cards in circulation. Despite the smaller overall market share, the company has a lasting advantage in the market. It boasts a comprehensive network within the financial service industry, comprised of millions of retailers from around the world. Their intangible benefits are stronger than Visa’s due to their brand loyalty and long-term presence in this sector, especially in continental Europe. Mastercard had stronger revenue growth in the past years and less decline in revenue during the pandemic. In addition, future revenue growth is projected to outperform Visa’s revenue growth by approximately 2-2.5%. Analysts forecast a 13.6% annual earnings growth for the company in the upcoming years.

In its third quarter of 2022, Mastercard reported great quarterly results, recorded a 4% rise in net income to $2.5 billion compared to $2.4 billion in the same period the previous year, net revenue jumped 15% on a year-on-year basis and gross dollar volumes were up by 11%. In the upcoming quarterly earnings result I expect that Mastercard’s revenues will be supported by the rising global dollar volume and the further recovery of cross-border volumes (it was up by 44% Y-o-Y basis last quarter). Despite inflationary pressures and the United States Michigan consumer sentiment index’s slight decline during the fourth quarter of 2022, consumer spending remained robust, which could have positively impacted MA’s quarterly performance. Due to these factors, I also expect that the total gross dollar volumes have increased further by approximately 3-4% compared to the third quarter and a 4-5% increase on a Y-o-Y basis.

Travel demand and larger volumes of international transactions could have also boosted MA’s revenue growth, the management expects the revenue growth to be at the higher end of the mid-teens rate on a currency-neutral basis, excluding any acquisitions made. They also anticipate that Mastercard-branded card activity, as measured by both local currency and U.S. dollar conversion values, has increased in the fourth quarter of 2022 with increased utilization of its debit and credit cards domestically and internationally. I believe that the number of transactions taking place through Mastercard’s network, known as switched transactions, could have increased in the fourth quarter due to an increase in the issuance of Mastercard-branded cards. Mastercard’s implementation of contactless acceptance initiatives could have provided a boost to its quarterly performance. In my opinion, switched transactions could have grown by 9-11% in the last quarter of 2022 from the reported figure during the same quarter last year.

Despite these anticipated positive growth figures, potential revenues may be impacted by increased discounts and incentives resulting from the improving number of orders and transactions made in the previous quarter, as well as new and resumed deals. Additionally, Mastercard’s operating costs in the fourth quarter are expected to have risen (just like Visa’s) due to acquisitions, high inflation, and personnel expenses. This could lead to a decline in margins if expenditures remain at an elevated level. During the last earnings call, the management projected that operating costs will see a low double-digit growth year-on-year in the fourth quarter.

Valuation comparison

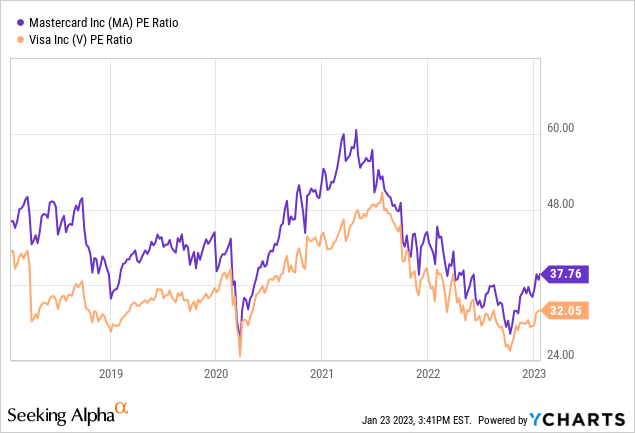

In a nutshell, Visa is better valued prior to the earnings season. Visa has been slightly more defensive than Mastercard with its lower beta figure of 120-150 basis points. The P/E ratio comparison could suggest the same, Visa has been trading with lower P/E multiples in the last years than Mastercard.

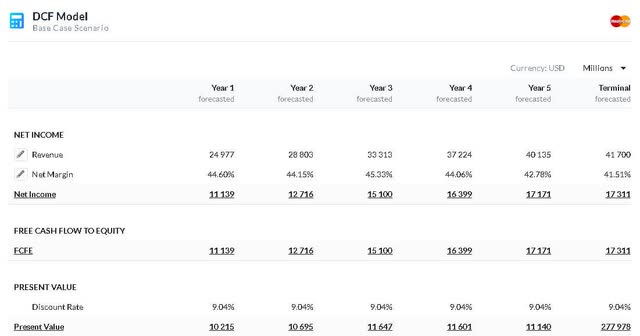

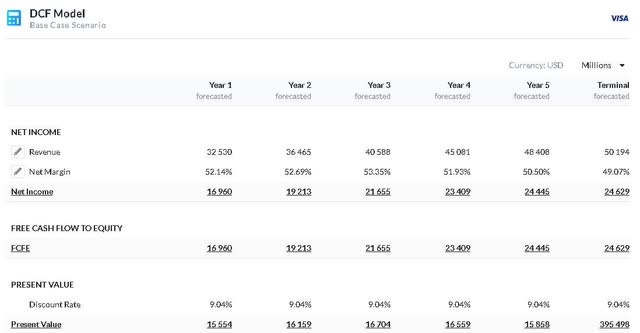

Purely looking at a Discounted Cash Flow model and calculating with a discount rate of 9% and a terminal growth of 5% for both Visa and Mastercard, Visa is slightly undervalued, by approximately 3-4% and its fair value would be around $230 per share. Mastercard however is slightly overvalued based on the same calculations, its fair value would be around $348 per share.

alphaspread.com

alphaspread.com

In terms of the dividend yield Visa is leading this comparison with a 0.8% forward dividend yield compared to MA’s 0.61% forward dividend yield. Both of the companies announced a dividend increase for the fourth quarter of 2022. The difference in valuation is so tiny between V and MA in my opinion that investors should not make their decision based on the current valuations of the two credit card giants but rather look at the market as a whole and try to get exposure to the sector (if they want to). Ahead of earnings Visa could be a better choice but in a couple of days Mastercard could be as attractive as Visa if prices drop by 5-6%.

Final thoughts

I expect both credit card and payment processor giants to report great quarterly results despite the growing operating expenses. The rise of international travel, inflation, and the holiday season could have helped their bottom line. Before the earnings, Visa is better valued than Mastercard but the difference is very slim. I rate both stocks as a buy because of the long-term growth potential. What do you think? Which one would you rather get exposure to?

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.