Summary:

- McDonald’s captured impressive comparable sales growth in 2022 despite the more challenging macro backdrop.

- The company is poised to benefit from a weakening U.S. Dollar and easing inflationary pressures as positive for earnings.

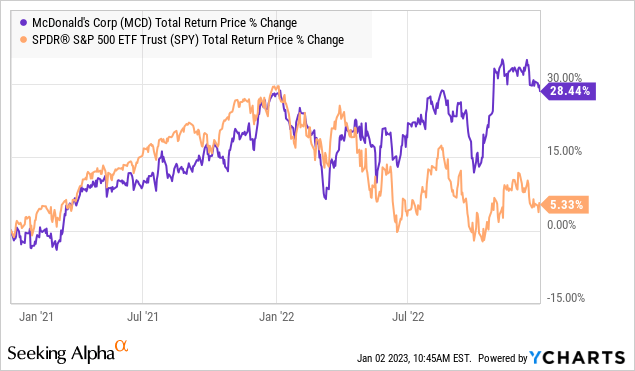

- We expect the stock to continue outperforming.

Alexander Farnsworth

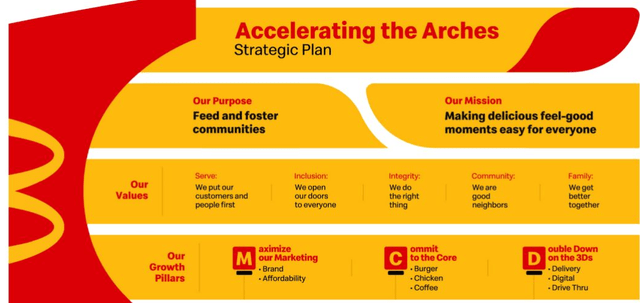

It’s been just over two years since McDonald’s Corp. (NYSE:MCD) launched its “Accelerating the Arches” initiative as a bold plan to recharge growth emerging from the pandemic. By all accounts, the strategy to push marketing, and invest in growth opportunities like digital, while focusing on its core food strengths has been a success. The stock is up nearly 30% since 2020 and strongly outperforming the broader market last year. Indeed, even amid several macro headwinds last year, the company delivered impressive comparable sales and overall solid results.

We believe that momentum can continue and possibly even get a boost with themes like easing inflationary cost pressures likely a positive for margins. We are bullish on MCD with a sense that there is an upside to what we see as a low bar of expectations while the company is well positioned to drive earnings higher as part of the bullish case for the stock in 2023.

MCD Key Metrics

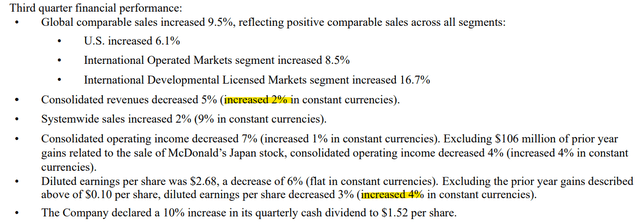

The company last reported Q3 earnings back in October with global comparable sales up 10% year-over-year and also up 6% just in the U.S. The context here considers softer trends in 2021 that were still being impacted by Covid restrictions in various regions. The figure was also up 6% in the U.S.

Q3 EPS of $2.68 declined by -6% from the period last year although it beat the consensus estimate by $0.18. The bigger takeaway is that the consolidated operating income climbed by 1% y/y in constant currency – meaning the EPS decline was driven almost entirely by FX volatility and the stronger Dollar compared to last year. Separately, excluding the sale of a “McDonald’s Japan stock” transaction from last year, the adjusted operating income was up an even stronger 4% y/y on a constant currency basis as a better measure of the underlying financial performance.

source: company IR

The theme here of significant currency impacts was also the case with the consolidated net revenue of $5.6 billion, down 5% y/y, but up 2% on an FX-neutral basis. This amount consolidates the franchise fees and sales from company-owned restaurants. The alternative measure for the business is the “systemwide sales” which climbed 9% y/y on a constant currency basis as a good indication McDonald’s is selling more of its burgers and fries globally.

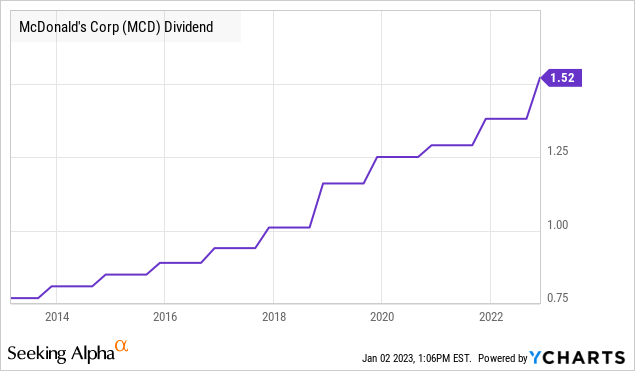

The financial backdrop was strong enough that the Board of Directors felt comfortable moving forward with a 10% increase to the quarterly dividend rate to $1.52 per share. The forward yield on the stock is now 2.3%.

What’s Next For McDonald’s

Management cited the company’s position of competitive strength supporting its long-term outlook. We mentioned the Accelerating the Arches strategy and one area where these initiatives have made progress include digital systemwide sales that have now reached $7 billion worldwide during the quarter, a pace on track to climb 55% higher compared to $18 billion for all of 2021.

source: company IR

What’s important here is that efforts like online ordering, delivery options, and the addition of digital ordering kiosks work to make the operation more efficient and ultimately more profitable. This is expected to continue and help balance some of the other high-level macro themes that were a topic of discussion during the conference call like commodity pricing pressures and wage inflation expected to linger for the next few quarters.

On this point, we note that there have been some material improvements in the outlook in the period since the Q3 earnings report. First, a sharp correction in the U.S. Dollar over the last few months essentially reverses the FX hit MCD has been experiencing. Part of the dynamic ties into an expectation inflationary cost pressures are easing, opening the door for the Fed to pull back from aggressive rate hikes. The global McDonald’s operation is benefiting from lower energy prices and food input costs. This factor should be positive for restaurant-level financial performance.

As it relates to wage pressures, there was a period in late 2021 when several industries in the U.S. were facing labor shortages with difficulty finding workers. With a consensus that the job market strength is slowing, McDonald’s and the rest of the restaurant industry should get some relief on this side to better manage their locations.

source: Finviz

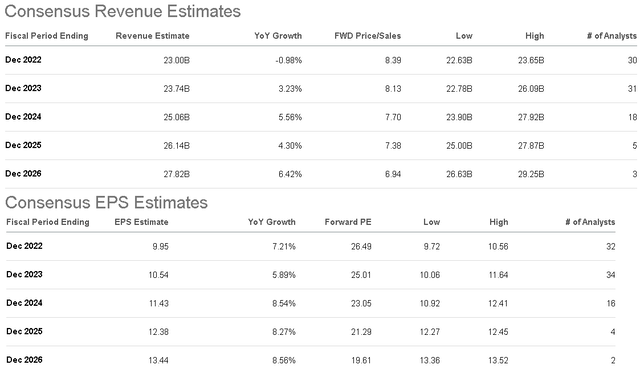

Putting it all together, we see room for McDonald’s to exceed estimates for the next few quarters and into 2023. According to consensus, MCD is on track to end 2022 with full-year revenue of $23 billion, down -1% from 2021. Again, depending on how FX trends get settled with the yet-to-be-reported Q4 results, we can see the company turning this one positive. The momentum can continue in 2023 where the market only expects to see a 3% increase in the top line.

With consumers also benefiting from declining inflation and stabilizing interest rates globally, stronger-than-expected demand can translate into higher sales and add to the earnings momentum. The current outlook is for a forecasted EPS of $9.95 this year to trend towards $10.54 in 2023, up 6% which could yet prove to be too conservative.

Seeking Alpha

Is MCD Overvalued?

One of the knocks on MCD is a prevailing view by some that shares are perpetually “expensive” and overvalued. The key is to recognize that the franchising model where approximately 95% of all global restaurant locations are managed by independent operators has proven to be highly profitable.

Entrepreneurs globally are more than willing to pay generous fees through the revenue share which translates into high margins and operating income for the corporate McDonald’s group. By this measure, while the company is a “restaurant” stock, it largely avoids the day-to-day operating expenses which are only captured indirectly by the performance of the underlying franchisees. The result is a lower variability of cash flow leading to higher-quality earnings that can justify a premium.

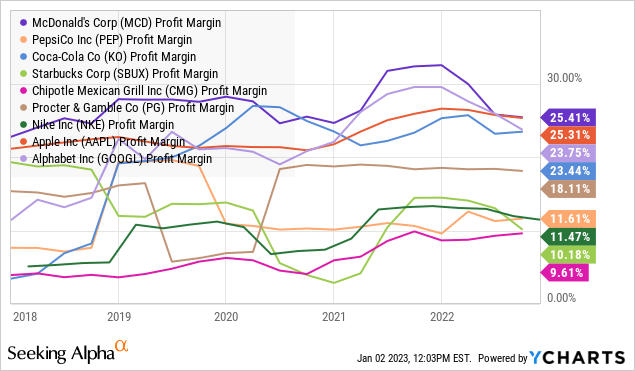

We can point out that MCD is more profitable through its model compared to many other “blue-chip” mega-cap corporations evidenced by a 25.4% net profit margin over the past year. This compares to Starbucks Corp. (SBUX) and Chipotle Mexican Grill, Inc. (CMG) closer to 10% which mostly operate their own locations and has higher Capex requirements. MCD is even more profitable than some tech leaders like Apple Inc. (AAPL) and Alphabet Inc. (GOOGL) by this measure.

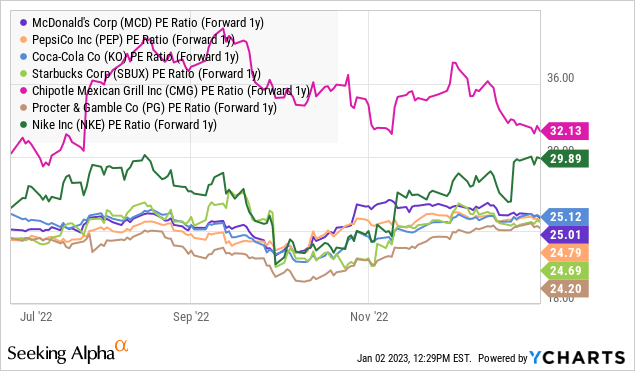

The point here is to say that when we look at MCD trading at 25x consensus 2023 EPS, the level is in the context where every incremental Dollar to the top line is exceptionally valuable. Factors like global brand recognition, a solid balance sheet, and the dividend-growth profile provide room for investors to expect more.

So within global consumer discretionary and staples names, MCD looks more than reasonable in our opinion next to stocks like NIKE, Inc. (NKE), Coca-Cola Co. (KO), and PepsiCo, Inc. (PEP) trading at a similar multiple. We can make the argument that the path of McDonald’s earnings growth trajectory has a lower risk considering the “defensive” aspect of fast food if consumers substitute more expensive dining options.

MCD Stock Price Forecast

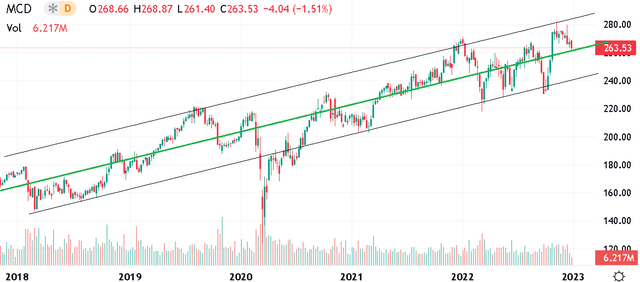

Taking a look at the stock price chart of MCD, the takeaway for us is the old adage of “the trend is your friend”. Outside of the historic pandemic volatility in early 2020, shares have been trending higher consistently over the last five years, based on the climbing earnings. There are many reasons for MCD to keep it going.

Seeking Alpha

Even if shares dip a bit lower over the near term, the call we have is that MCD can trade higher at this point next year. We rate MCD as a buy with a price target of $300. The way we get there assumes the current consensus EPS for 2023 at $10.54 has some upside towards $11.00, benefiting from some stronger-than-expected financial tailwinds, implying a forward P/E of 27x our target.

The return potential here is 15% including the dividend, but the real attraction here comes down to the stock’s quality. The scenario would be looking ahead to even stronger momentum into 2024 as macro conditions improve driving a resurgence of growth.

In terms of risks, as much as we like McDonald’s, the company would not be immune to a deeper deterioration of global economic conditions. Sharply higher unemployment or a new round of inflation impacts would likely result in a hit to demand at restaurants while further financial market volatility would open the door for more downside in the stock.

With the upcoming Q4 earnings expected at the end of January, monitoring points will again be comparable sales while management guidance for the year ahead will also be important.

Disclosure: I/we have a beneficial long position in the shares of MCD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Add some conviction to your trading! Take a look at our exclusive stock picks. Join a winning team that gets it right. Click here for a two-week free trial.