Summary:

- MCD has maintained strong financial performance against the backdrop of a challenging macroeconomic environment marked by inflation and interest rate hikes.

- MCD has leveraged its brand power to increase prices without losing market share or competitiveness.

- Management has also done a great job increasing sales through digital, delivery and drive-thru, which are all higher margin channels.

- The company has been able to grow EPS and dividends through the clever use of buybacks and leverage.

- The stock however has limited upside due to its current high valuation which is more than double the consumer discretionary sector median.

Justin Sullivan/Getty Images News

Analysts expect McDonald’s Corporation (NYSE:MCD) to report annual EPS of $9.95 against annual revenues of $23 billion when it reports FQ4 2022 earnings in the next few weeks. This will represent flattish top line and bottom line growth compared with FY 2021 when the fast food giant raked in revenues of $23.22 billion and reported EPS of $10.04.

While flat growth is nothing to celebrate, it’s important to view MCD’s 2022 performance within the proper context. To begin with, MCD is a mature business with operations in 100+ countries so expecting consistent double digit growth is a tall order.

Secondly, MCD has been able to maintain its financial performance during a period characterized by a challenging macroeconomic environment. As one of the largest purchasers of beef, pork, potatoes and other commodities, MCD’s restaurants and franchisees have had to grapple with increased input costs amid the record inflation witnessed in 2022. The tightening of financial conditions by the Fed and other central banks in response to this inflation has also put significant pressure on the consumer.

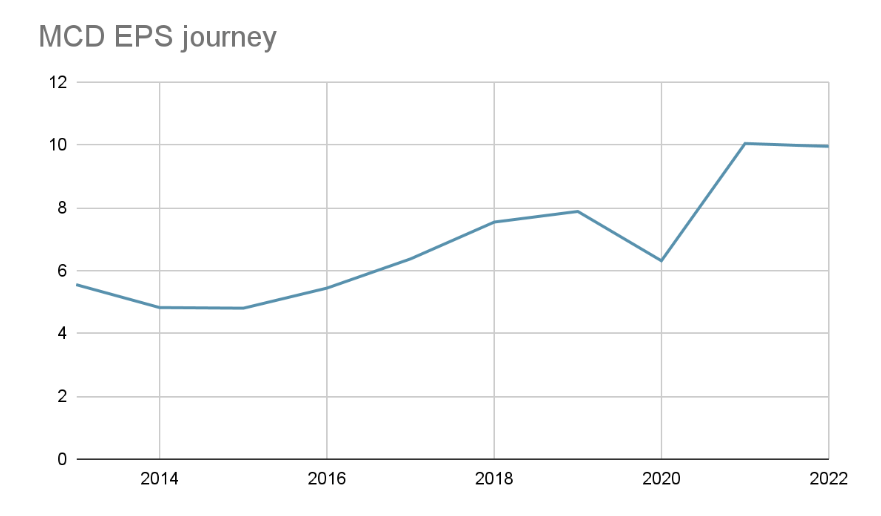

The fact that MCD has been able to sustain its year on year financial performance in the face of these macroeconomic headwinds is commendable. Importantly, the company has been able to steadily grow its EPS since 2016 (with the exception of the 2020 dip due to Covid-19 disruptions to the restaurant business). This EPS growth demonstrates its commitment to increase shareholder value.

Author compilation of EPS

Earnings drive stock prices in the long-term and MCD is no exception to this rule. Over the past five years, the stock has returned 52.78% vs the S&P 500’s 41.52%.

Bold decisions

MCD’s leadership has taken bold but rewarding decisions over the past few years that have enabled it to deliver strong performance. The company has leveraged on the power of its brand, which is number six in Kantar’s 100 most valuable global brands in 2022, to successfully increase its menu prices. It has also cut value meals and cheaper items from its menu and introduced premium offerings that have higher margins. These decisions have helped to partially offset the impact of inflation on margins.

Importantly, the increase in price points and changes to product mix to include higher margin items has not materially affected MCD’s competitiveness. During the Q3 earnings call, the company’s President and CEO Chris Kempczinski noted that MCD is in fact gaining market share in most of its key markets globally.

Global comp sales were up nearly 10% and most of our major markets are growing share which gives us confidence that we are operating from a position of strength even during difficult times.

Another point worth noting is that MCD has been successfully executing its business strategy dubbed “Accelerating the Arches”. The core pillars of these strategy, which was unveiled in late 2020, and rooted in the MCD identity, are as follows:

-

Maximize marketing (to drive brand and position it favorably on affordability)

-

Commit to the core ( a focus on burger, chicken and coffee)

-

Double down on the 3Ds: ( a focus digital, delivery and drive through)

The report card is, of course, mixed when you look at factors like affordability. However, when it comes to digital, delivery and drive through, MCD has excelled. In the company’s top six markets, digital now represents over one third of system-wide sales, fueled by over 43 million active customers on the app, the CEO noted on the Q3 earnings call. The advantage of digital and delivery is that it’s not only more profitable but also leads to more customer loyalty. MCD has loyalty programs in place across all of its top six global markets.

MCD is also actively innovating to improve service delivery, including launching a new burger platform in the US that will cut down the time it takes to prepare hamburgers. The new system is expected to be available nationwide by the end of June, with Loop Capital Markets noting that it could lift U.S. comparable sales by 400 to 500 basis points by the second half of 2023.

Income investors have been rewarded

By maintaining strong financial performance through the years, MCD has been able to sustain its dividend policy, increasing dividends for 21 years in a row. Its current quarterly dividend of $1.52 per share is 50% higher than the $1.01 payout in 2018. Income investors who have held on to the stock for a long time have been rewarded and are unlikely to divest given the trend.

It’s important to note that the main reason MCD has been able to grow EPS and its dividends is financial engineering. Net income increased from $5.92 billion in 2018 to $7.54 billion in 2021 while the number of outstanding shares declined from 767 million to around 744 million over the same period. Moreover, net debt increased from $30.22 billion in 2018 to $44.64 billion in 2021. MCD has made strategic use of buybacks and leverage to grow its EPS and dividend payout.

Valuation not attractive

If MCD maintains the smart use of financial engineering, income investors are likely to continue benefiting from increased dividends. The stock price is also likely to go up over time as the EPS increases. Assuming it is sustained, the strong execution witnessed in the past few years against the backdrop of Covid-19 and the macroeconomic challenges presented by inflation and rate hikes is also another bullish catalyst.

That said, the stock is not a buy at current valuations. Its P/E (FWD) is 32.13x, more than double the sector (consumer discretionary) median while its EV/EBITDA (FWD) 19.93x. This premium is too rich in my opinion.

While there’s no good reason to sell if you already hold a position and have a decent cost basis, there’s no good reason to buy either at current valuations as the upside appears limited and the yield is a paltry 2.3%, which is lower than what most bonds now offer. It’s better to wait on the sidelines for a better entry point.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.