Summary:

- Dividend icon announces 46th consecutive dividend increase.

- 10% increase shows confidence in short to medium-term prospects.

- MCD has been a safe haven in 2022, outperforming the market handily.

Justin Sullivan

McDonald’s Corporation (NYSE:MCD) has just announced its annual dividend increase as Seeking Alpha has covered here. September to December continue to be a busy few months for dividend investors, with lots of dividend-related announcements. Here are a few quick highlights from the recent announcement:

- The new quarterly dividend per share is $1.52, up a healthy and surprising 10% from the previous $1.38 cents a share.

- The new dividend will be paid to investors on 12/15/2022, with an ex-dividend date of 11/30/2022.

- According to its website, McDonald’s has increased its dividends each year since 1976. The dividends have followed the quarterly cycle since 2008, before which it was on a yearly pattern. That makes it 46 consecutive years of dividend increases.

This article was written when McDonald’s announced its dividend increase in 2014, which is surprising to us as MCD is one of our long-term holdings. With the recent increase in mind, it is time to take a look at how the numbers stack up now. For ease of comparison, this article uses the same format as the 2014 article. Depending on how you look, eight years could be a very long time or very short.

New Dividend and Yield

The new annual dividend of $6.08 gives MCD a current yield of about 2.47%. What stands out immediately is that in 8 years, despite the annual dividend per share going up from $3.40 to $6.08, the yield has dropped more than a percentage point. This is due to the stock’s almost three-fold increase since then. Not bad to go with a nearly 80% increase in dividend in the same time period as well.

Payout Ratio

This surprised us a little when doing the numbers. 8 years, 8 dividend increases and an 80% increase in dividends later, the current forward payout ratio based on EPS stands exactly at the same 61%. This reaffirms that the company knows exactly what it is doing when it comes to its dividends: play it safe but sound and leave enough for future increases.

Five-Year Dividend Growth Rate

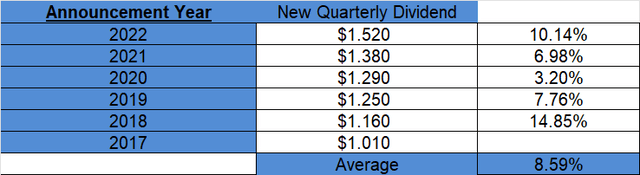

As the table below shows, this is the second-highest dividend increase in terms of percentage in the last 5 years (perhaps even longer). The five-year dividend growth average of 8.59% compares reasonably well with the 9.16% back in 2014. Detractors of dividends have recently been (rightly) pointing out that dividend growth rates pale in comparison with inflation. With a 10% increase, McDonald’s is at least showing it is aware of what is going on in the World.

Extrapolation

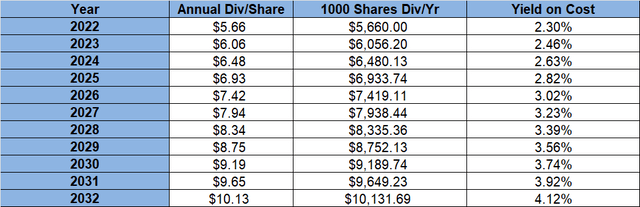

As always, this article includes an extrapolation on what the future increases might look like with reasonable assumptions. The table below assumes a 7% annual dividend increase for the first 5 years and 5% for the next five. With 4 of the last 5 increases being 7% at least, McDonald’s is not on the “Low D” notice right now.

Forward Thoughts and Conclusion

Pricing Power

Inflation is not necessarily affecting every company the same way. Some like Altria Group (MO) and McDonald’s have the unique combination of brands and selling feel-good, addictive products. As reported here, McDonald’s has been increasing its pricing and customers don’t seem to be minding it as of now. Customers are well aware that this is not a company that raises price just because it feels like it, as evidenced by the fact that the price of Cheeseburgers went up for the first time in 14 years.

Relative Safety

MCD, the stock, has been a relative safe haven this year, and we expect this to continue at least till the Fed pivots. While the S&P 500 has been decimated by almost 25%, MCD is down “just” 8%. The trade-off that MCD investors are making is that when the beaten-down stocks go up multi-fold in a recovering market, MCD is going to lag behind. But that’s perfectly okay for us as it also provides safety at times when high-flyers lose 80% or more. The rock-solid and ever-growing dividends add luster.

Conclusion

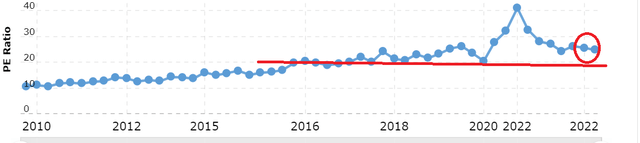

At 24 times forward earnings, the stock is fully to slightly overvalued here, perhaps getting its due respect for safety. It is interesting to note that the stock has almost never traded below a multiple of 20 in the last 5 years or so. Again, a respect for its safety. That makes MCD a comfortable hold here. If the overall market continues making new lows, MCD may not be spared either, and we will look at adding in the $220s region if the opportunity presents.

Disclosure: I/we have a beneficial long position in the shares of MCD, MO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.