Unity Software: Focused On The Long Term

Summary:

- Issues with Unity’s monetization business have caused revenue growth to decelerate significantly. These issues appear to be resolved, but it may take time for growth to recover.

- Advertising headwinds are likely to pressure Unity’s Operate business in the short term, and this will be exacerbated by the impact of a strong US dollar.

- Unity is investing aggressively in platform capabilities, which will be a drag on margins for the foreseeable future.

imaginima

Unity Software’s (NYSE:U) stock continues to face headwinds as investors shun unprofitable growth stocks. This has been exacerbated by problems with their monetization business, although these now appear to be largely resolved. Unity continues to invest aggressively in the capabilities of its platform and will need to begin showing returns on these investments going forward. The company’s ability to successfully integrate ironSource (IS) and Weta is also crucial. Problems here could drive the stock even lower.

Create

Unity’s Create segment provides tools that allow the creation of engaging and interactive real-time 3D experiences. At the moment, this business is driven by the gaming sector, but in coming years use cases outside of gaming, like digital twins and media, will become increasingly important. The business outside of gaming currently represents 40% of the total Create business and is growing rapidly.

Unity has seen record adoption of their 2021 Long-Term Stable (LTS) version. The LTS version is supported with biweekly fixes for two years and doesn’t introduce feature or API changes, allowing users to lock in production with confidence. Additions and improvements include:

- Visual scripting

- Editor extensibility

- Scene view overlays for artist driven tools and asset ingestion

The Tech Stream version provides earlier access to new features and in 2022 updates include:

- Refined our user input framework

- Improved developer and artist productivity, through features like better spline tooling and better material variant productivity

- Connectivity with other creation tools

Unity have also expanded the capabilities of their Data-Oriented Tech Stack (DOTS). DOTS is a technology stack that is data oriented rather than object oriented and offers 10-100x performance improvements for rich environments that have a lot of content, interactive objects and real-time 3D objects. Unity intend to introduce easy-to-use versions of DOTS into their core technology over the next 2-3 years. DOTS enabled V Rising to scale up the world size and the number of players and was a key factor behind Stunlock choosing Unity.

Unity continues to have the most success in mobile games, but has a growing presence across Console, PC, AR/VR and Web. Unity powers more than 70% of the top mobile games, and nearly half of Steam games for PC were made with Unity in 2021. Those games are also breaking through to the Steam charts, where 13 of the top 20 games in May were made with Unity. Unity games made up 80% of the most popular games on Oculus Quest in July and 72% of the top selling games.

The recent success of the Oculus Quest 2 is a potential indicator that the AR / VR market is reaching an inflection point. The Quest 2 has sold over 14.8 million units since launching in Q4 2020. For perspective, this is more sales than the HTC Vive and Xbox Series X and S, although less than the Nintendo Switch and PlayStation 5.

Meta (META) also has the Oculus Quest 3 and Project Cambria in the pipeline, with the latter supposedly targeted more at metaverse applications than gaming. The Quest 2 is by far the most popular VR headset, making up 78% of all sales in 2021. In comparison, DPVR captured 5.1% of sales and ByteDance’s PicoVR accounted for 4.5% of sales.

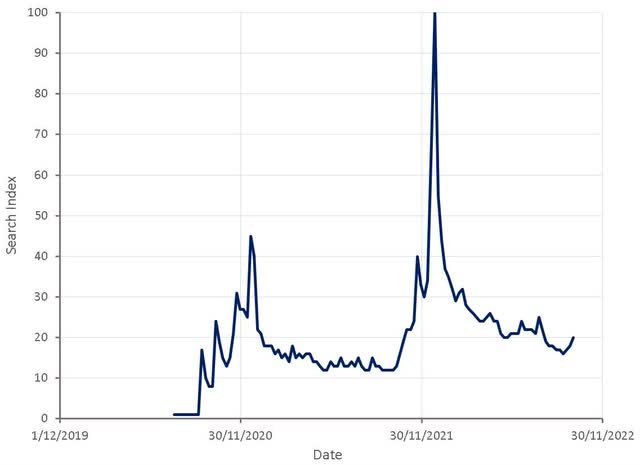

Figure 1: Google Trends “Meta Quest 2” Search Index (source: Created by author using data from The Federal Reserve)

Apple (AAPL) is also rumored to be working on an AR/VR headset and AR smart glasses, which could further accelerate the adoption of 3D experiences. Apple reportedly has a research unit with hundreds of employees working on AR and VR, with a product expected in 2023. The headset will reportedly focus on gaming, video streaming and video conferencing and could be priced over 2,000 USD.

In addition to the focus of companies like Meta and Apple on AR / VR hardware, a number of high-profile companies are working on 3D content. Meta views the metaverse as a successor to the mobile internet, and wants to control its own platform so that it is not at the mercy of companies like Apple. Meta have over 10,000 people working on their metaverse ambitions and are committing tens of billions of dollars. Roblox (RBLX), NVIDIA (NVDA) and Microsoft (MSFT) have also been building out virtual worlds.

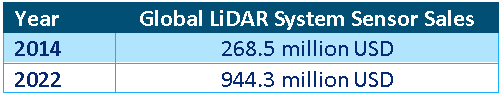

Another indicator of the growing importance of 3D applications are LiDAR sales, which continue to grow rapidly, driven in large part of transportation use cases. Apple also recently introduced LiDAR to their mobile phones.

Table 1: Global LiDAR System Sensor Sales (source: Created by author using data from Statista)

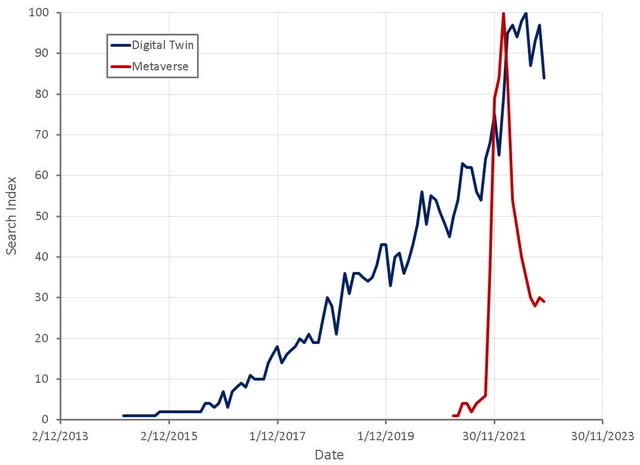

Unity’s Create business outside of games includes media and entertainment, e-commerce, industrial and manufacturing, architecture and engineering and construction amongst other industries. The use of digital twins is increasing rapidly and Unity are investing in capabilities to capitalize on this opportunity. One such example in Neural Radiance Field (NeRF), which uses a neural network to create a 3D scene from a series of 2D images, democratizing the creation of digital twins.

Figure 2: Google Trends “Digital Twin” and “Metaverse” Search Indices (source: Created by author using data from Google Trends)

The growing importance of Unity’s non-gaming business necessitates a shift in their sales model though. Unity recently partnered with Capgemini to develop sector-specific solutions and services for Unity’s customers. Targeted sectors include consumer goods, retail, telecommunications, energy and utilities. Capgemini is a consulting company that leverages technology to enable digital transformation. 85% of the 200 largest public companies on the Forbes Global 2000 list are Capgemini clients. This type of partnership is generally an important part of the go-to-market strategy for enterprise sales.

In addition to expanding the use of game engines outsides of gaming, Unity’s other focus for the Create business is democratizing the creation of 3D content. Creating 3D content is currently difficult for a number of reasons:

- Complex

- Expensive

- Large file sizes

- Complicated rendering techniques

Unity acquired Weta specifically to make powerful artistic tools more widely available. This has the potential to foster the development of 3D applications and significantly expand Unity’s market opportunity. For the potential of this acquisition to be realized, Weta must be integrated into Unity’s platform. Management believes this process is progressing well, with previews available for customers this year and the first Weta tools released next year, ahead of the initial M&A integration schedule.

Operate

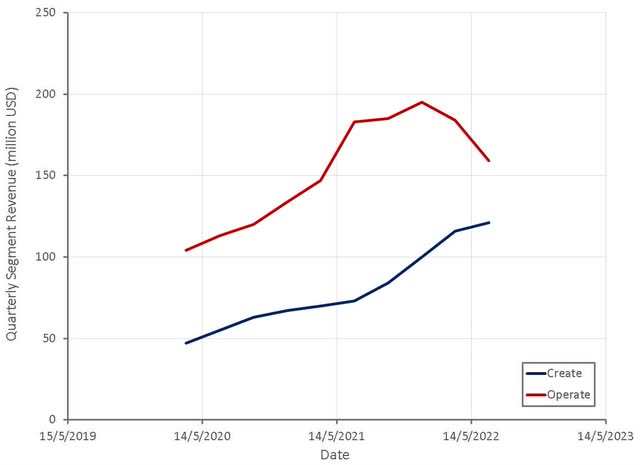

Unity’s Operate business has struggled this year due to the combination of technical issues with their platform and general weakness in the digital advertising market.

Unity had a data quality issue and problems with the accuracy of their audience pinpointer product earlier in the year that impacted the monetization business. Unity have now removed the bad data and improved their monitoring capabilities to try and prevent the same issue from occurring again. Audience Pinpointer accuracy is also improving and Unity plan on introducing features in the second half of the year that will improve customers’ return on ad spend. Revenue has not increased as quickly as expected though due to a combination of macroeconomic headwinds and the difficulty of projecting the trajectory of the monetization business.

Unity Gaming Service

Unity Gaming Service (UGS) allows customers to build their games in a single platform by providing tools for multiplayer services, game operations, user acquisition and monetization. UGS is a suite of tools and services that enable developers to create, host and manage their games in the cloud in a single dashboard experience. UGS is designed to be modular so that creators can select the best tools for their use case, whether the game was built with Unity Unreal or any other game engine.

UGS was released in beta in October 2021 and became generally available in June 2022, with more than 50,000 game developers signed up and 2,300 new customers added since the launch.

Figure 3: Unity Gaming Service (source: Created by author using data from Unity)

Unity’s merger with ironSource is supportive of their monetization strategy as it enables the combination of creation and growth into a single platform to increase creator success.

Gaming Market

The gaming industry is currently undergoing a post-pandemic correction, with US consumer spending on video game hardware, content and accessories in 2022 expected to decline by 8.7% relative to 2021. So far the impact of this decline on Unity’s Create business appears to be muted, but there could still be a flow through impact in coming quarters. The Operate business is likely being hit by a combination of reduced consumer screen time and a reduction in advertiser budgets.

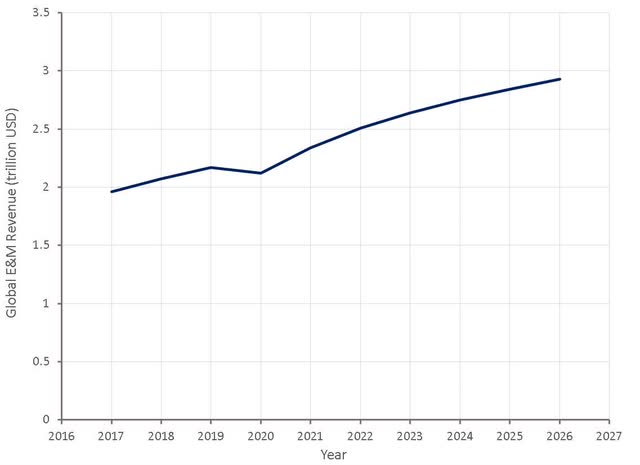

Longer term, global entertainment and media revenue is expected to continue outpacing global growth, rising approximately 10% annually through 2026.

Figure 4: Projected Global Entertainment and Media Revenue (source: Created by author using data from PWC)

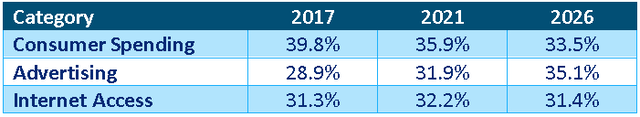

The entertainment and media industry is expected to become more digital, more mobile, more dependent on advertising and more evenly distributed globally. These are all generally positive trends for Unity, which has a dominant position in mobile gaming and continues to advance its advertising business. Advertising currently represents 32.2% of total entertainment and media industry revenues and is expected to increase at a 6.6% CAGR through 2026.

Table 2: Share of Global Entertainment and Media Spending (source: Created by author using data from PWC)

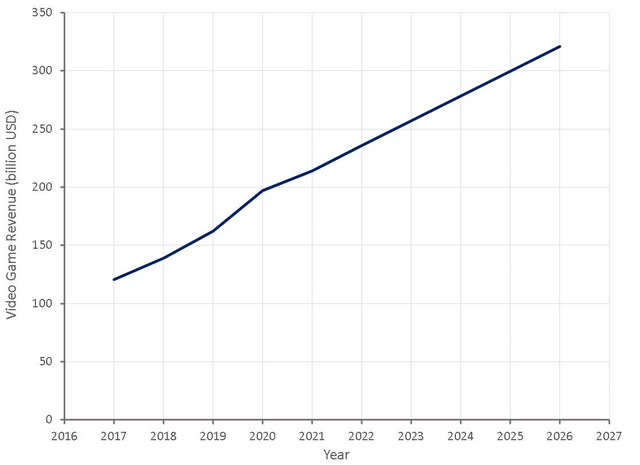

Video games revenue is expected to increase at an 8.4% CAGR through 2026, growing into a 321 USD billion industry.

Figure 5: Global Video Games Revenue (source: Created by author using data from PWC)

VR revenue is projected to increase at a 24.1% CAGR between 2021 and 2026, growing to reach 7.6 billion USD annually. The global active installed base is expected to increase to 65.9 million by 2026.

AppLovin

AppLovin (APP) made Unity an acquisition offer in August for approximately 59 USD per share. The deal made a lot of sense for AppLovin, from both a strategic and financial perspective, as the company is vulnerable to the combined Unity / ironSource entity, and has a weak balance sheet. Unity’s strong position in mobile gaming is obviously attractive to an ad mediation platform. Ad mediation is used by app developers to connect multiple ad networks to their app and serves as an ad network optimizer for developers looking to increase their ad revenue. With Unity combining their ad network with ironSource’s ad mediation, the competitive position of AppLovin is significantly undermined.

It is not clear what value AppLovin would provide to Unity though, and it is doubtful the deal was given serious consideration. With the large potential of Unity’s Create business, AppLovin having control of the company would be something akin to the tail wagging the dog.

Financial Analysis

Despite making progress with issues in the operate business, Unity lowered full year revenue guidance in the most recent quarter to 1.3-1.35 billion USD. This was attributed to a combination of the weak macroeconomic environment and difficulties projecting the revenue trajectory of their monetization business.

Operate revenue was down 13% YoY in the second quarter, likely in part due to monetization issues, the weak macro environment and the difficult comparable period in 2021. The number of large customers (more than 100,000 USD trailing 12 months revenue) grew 22% YoY in the second quarter and Unity’s net dollar expansion rate was 121%, compared to 142% a year earlier. Both of these figures were lower due to the Operate business.

Over 75% of Unity’s revenue is generated outside of the US, which is likely to be a headwind in coming quarters due to the significant appreciation of the US dollar.

Figure 6: Unity Segment Revenue (source: Created by author using data from Unity)

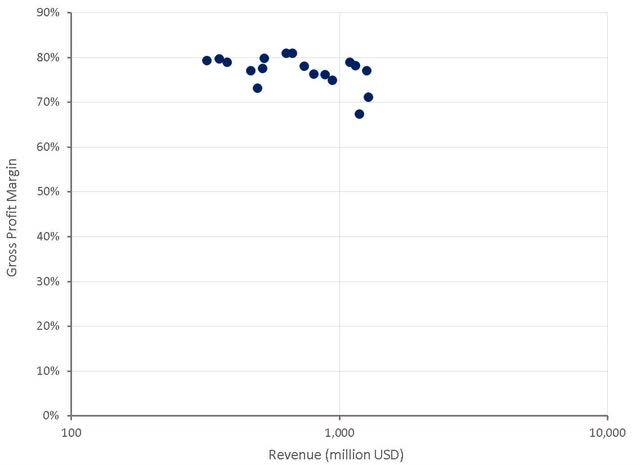

Unity’s cost of revenue consists primarily of hosting expenses, personnel costs for employees associated with product support and professional services, allocated overhead, third-party license fees, and credit card fees, as well as amortization of related capitalized software and depreciation of related property and equipment. Gross margins appear to be trending down over time, although it is not really clear why this is the case. Once monetization issues are resolved, gross margins will bounce back somewhat, but investors should look for a stabilization or improvement in margins as ironSource is integrated and Weta tools are commercialized.

Figure 7: Unity Gross Profit Margins (source: Created by author using data from Unity)

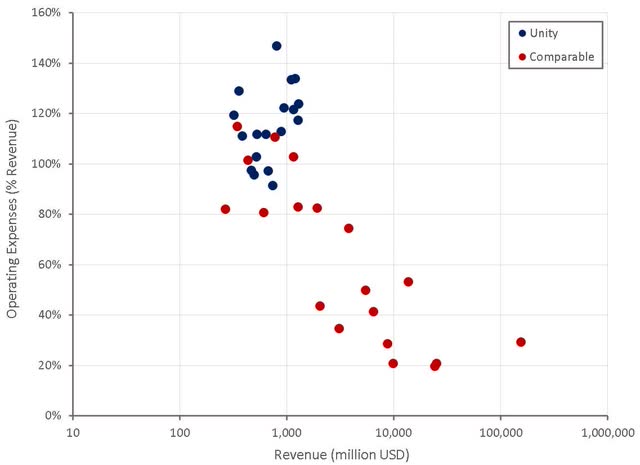

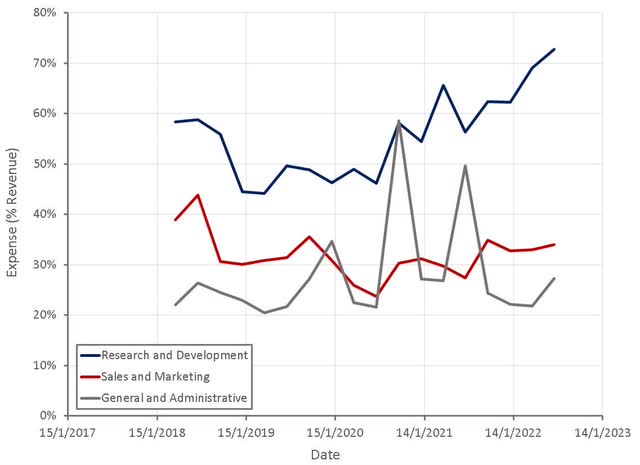

Unity’s operating expenses are extremely high due to the R&D investments they are making in the capabilities of their platform. These are primarily personnel costs and investors will likely want to see the burden of operating expenses fall before the stock moves higher. This should come through a combination of operating leverage and a 100 million USD cost saving program that was announced in the previous quarter.

Figure 8: Unity Operating Expenses (source: Created by author using data from company reports)

Figure 9: Unity Operating Expenses (source: Created by author using data from Unity)

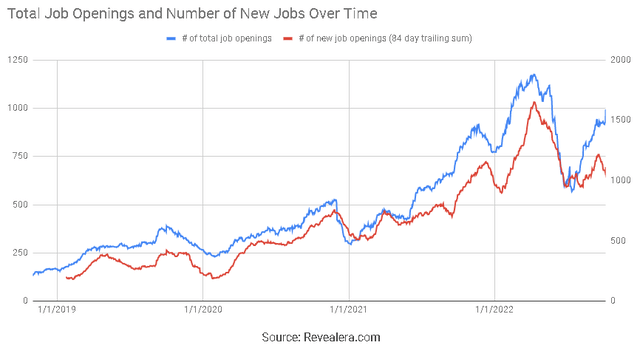

Unity’s pace of hiring slowed significantly during second quarter of 2022, which was possibly related to macro weakness. Since then, hiring has picked up modestly but it is not clear if this is due to growth reaccelerating or Unity continuing to invest in the long-term capabilities of their platform.

Figure 10: Unity Hiring Trend (source: Revealera.com)

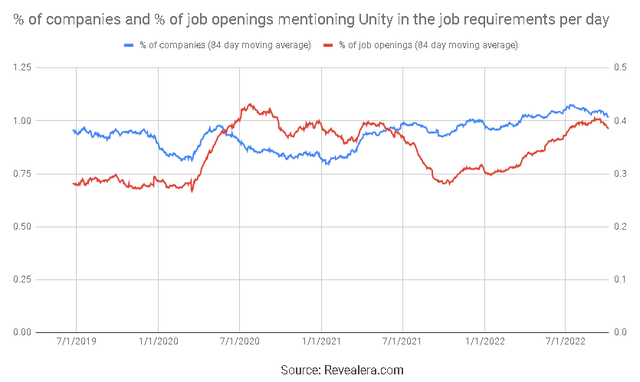

The number of job openings mentioning Unity continues to trend upwards modestly, with no real significant change in trend that would indicate a change in business fundamentals.

Figure 11: Job Openings Mentioning Unity in the Job Requirements (source: Revealera.com)

Valuation

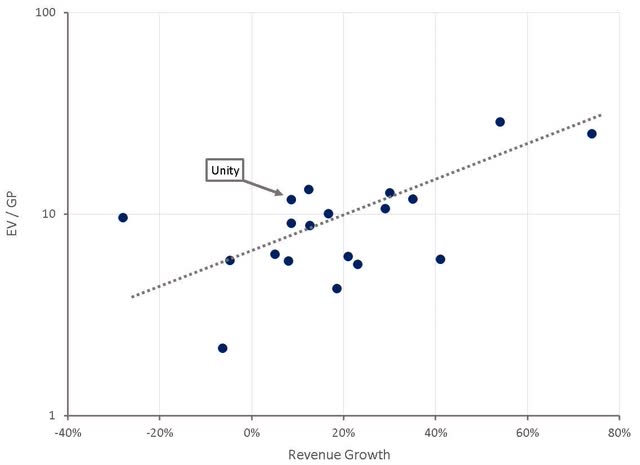

Unity’s stock is down by over 80% since its peak in November 2021, driven in part by a general pullback in growth stocks and in part by company specific problems. The stock now appears reasonably priced relative to peers and should provide significant upside potential once macroeconomic conditions stabilize and growth reaccelerates. Based on a discounted cash flow analysis I estimate that Unity’s stock is worth approximately 100 USD per share, although the company will likely to make significant progress towards profitability before these types of prices are seen again.

Figure 12: Unity Relative Valuation (source: Created by author using data from Seeking Alpha)

Conclusion

Unity’s heavy investments in R&D, coupled with a weak macro environment, mean the stock may continue to struggle in the short term. If the integration of ironSource can be successfully executed, a rebound in advertising and the commercialization of Weta tools should set Unity up well for the long term. The stock’s current valuation is more than reasonable given the company’s long-term prospects, although this is unlikely to matter in the short term due to Unity’s ongoing losses.

Disclosure: I/we have a beneficial long position in the shares of U either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.