Summary:

- McDonald’s has held up very well in 2022’s challenging market conditions.

- The value proposition remains compelling for customers, even with higher prices.

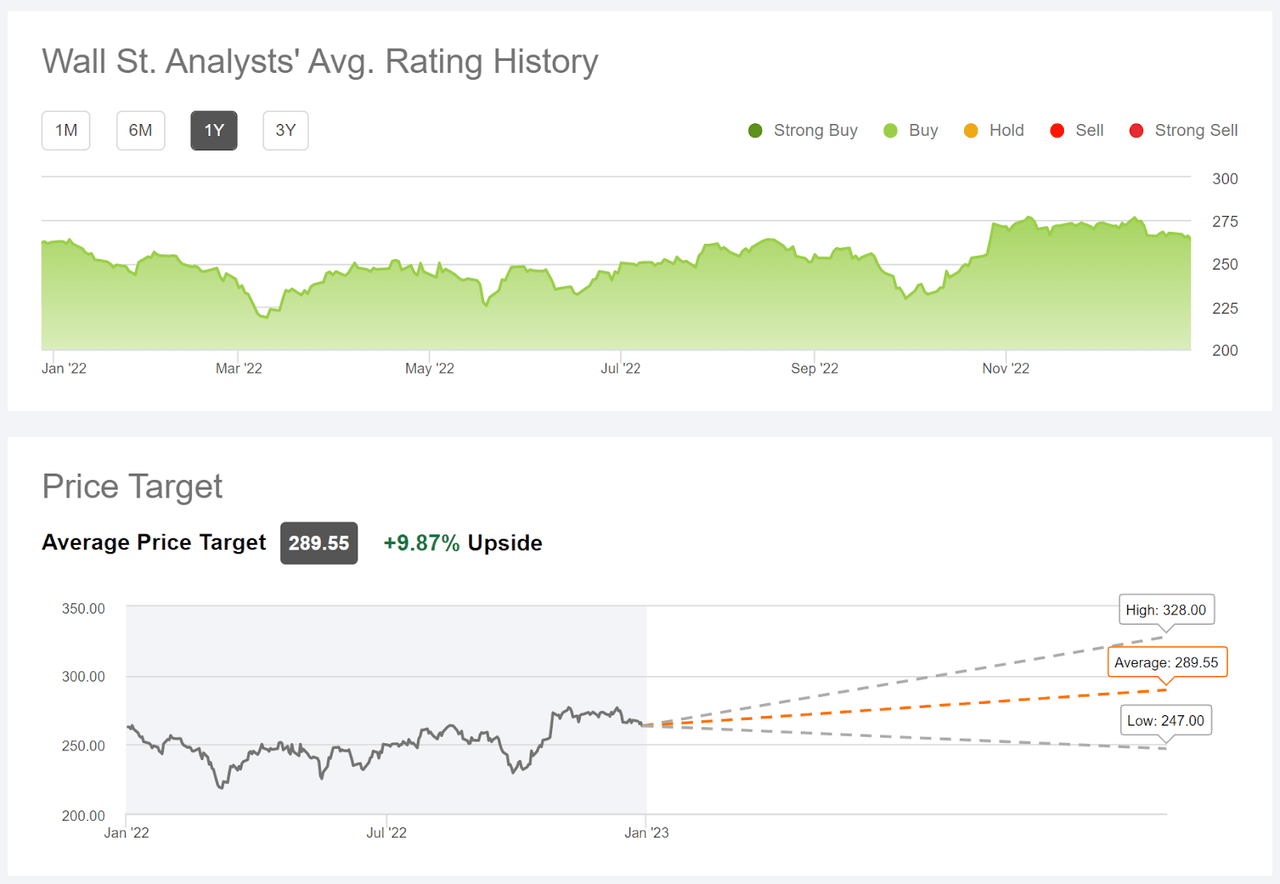

- The Wall Street consensus rating continues to be a buy and the consensus price target indicates reasonable upside for 2023.

- The market-implied outlook (calculated from options prices) continues to be bullish, with fairly low expected volatility.

RiverNorthPhotography

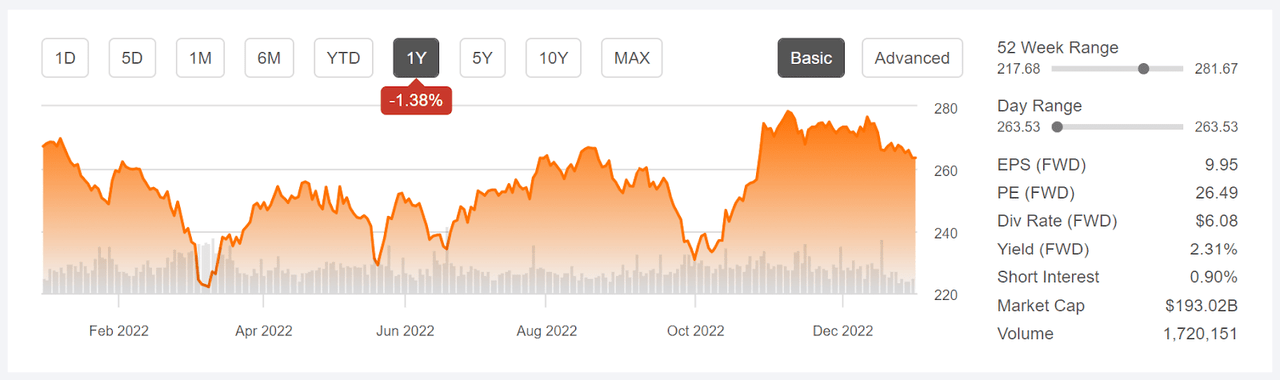

McDonald’s (NYSE:MCD) performed remarkably well in 2022, with a total return of +0.42% as compared with -8.4% for the restaurant industry as a whole and -18.2% for the S&P 500 (SPY). The shares have held up due to evidence that the company is weathering the high-inflation environment successfully. In the Q3 earnings results, the company reported that same store sales had climbed 9.5% on a global basis, far above the expected result. The results show that McDonald’s demand had held up even as the company has raised prices in response to inflation. Even though McDonald’s has raised prices by about 10% YoY, the restaurant is still a low-cost provider and probably benefits from customers trading down from more expensive options.

Seeking Alpha

12-Month price history and basic statistics for MCD (Source: Seeking Alpha)

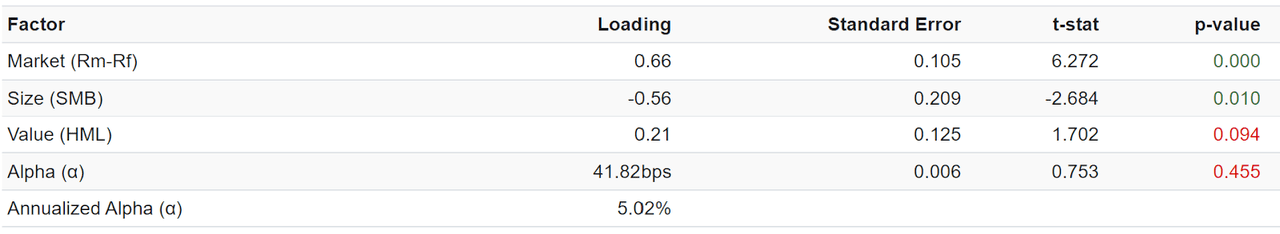

Some of the share performance in 2022 is due to MCD’s broad attributes rather than the specifics of how the company has fared. A Fama-French 3-factor regression shows that the beta (the market factor) is 0.66, so the shares would be expected to drop (or rise) ⅔ as much as the market as a whole over any given period. In addition, MCD has a small positive factor for value (albeit not statistically significant). Value dramatically outperformed growth in 2022, with the iShares S&P 500 Value ETF (IVE) returning a total of -5.4% vs. -29.5% for the iShares S&P 500 Growth ETF (IVW).

Portfolio Visualizer

Fama-French 3-factor regression results for MCD for the 5-year period through November 2022 (Source: Portfolio Visualizer)

Rising interest rates disproportionately reduce the net present value (NPV) of expected earnings from growth stocks vs. value stocks because more of the NPV of growth stocks is due to earnings that will occur further into the future. Additional interest rate increases, or even a prolonged period of rates at the current level, will tend to be a tailwind for MCD.

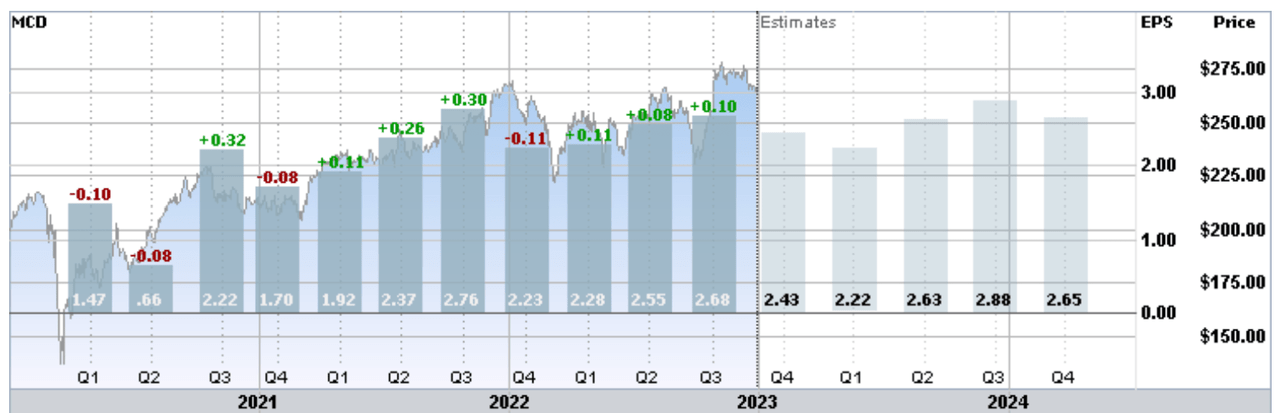

After suffering a significant drop in 2020 during the pandemic surge, MCD earnings have rebounded. The company has beaten EPS expectations for the past 3 quarters. The most-recent miss, Q4 of 2021, was by a small amount. The consensus outlook for EPS growth over the next 3 to 5 years is 7.5% per year.

ETrade

Trailing (3 years) and estimated future quarterly EPS for MCD. Green (red) values are amounts by which EPS beat (missed) the consensus expected value (Source: ETrade)

With a forward P/E of 26.5 and the modest expected earnings growth, MCD looks fairly expensive compared to historical values. The P/E has been in a long-term upward trend over the past decade.

I last wrote about MCD 6 months ago, on June 28, 2022, at which time I maintained a buy rating on the shares. At that time, the TTM P/E was 26.2. The Wall Street consensus rating was a buy and the consensus 12-month price target was about 13% above the share price at that time, for an expected total return of 15.3%. The market-implied outlook, a probabilistic price forecast that represents the consensus view from the options market, was substantially bullish to the end of 2022 and to the middle of 2023, with expected volatility of 24% to 25%. As a rule of thumb for a buy rating, I want to see an expected 12-month total return that is at least ½ the expected annualized volatility. Taking the Wall Street consensus price target at face value, MCD met this criterion (15.3% total return vs. 25% volatility). While the valuation was a concern, the bullish Wall Street consensus buy rating, the consensus price target, and the bullish market-implied outlook all supported an overall buy rating for MCD. From closing price on June 28, 2022 through the end of 2022, MCD returned a total of 9.7%, as compared to 1.3% for the S&P 500 (SPY).

For readers who are unfamiliar with the market-implied outlook, a brief explanation is needed. The price of an option on a stock reflects the market’s consensus estimate of the probability that the stock price will rise above (call option) or fall below (put option) a specific level (the option strike price) between now and when the option expires. By analyzing the prices of call and put options at a range of strike prices, all with the same expiration date, it is possible to calculate the probable price forecast that reconciles the options prices. This is the market-implied outlook. For a deeper discussion than is provided here and in the previous link, I recommend this outstanding monograph published by the CFA Institute.

I have calculated updated market-implied outlooks for MCD and compared these with the current Wall Street consensus outlook in revisiting my rating.

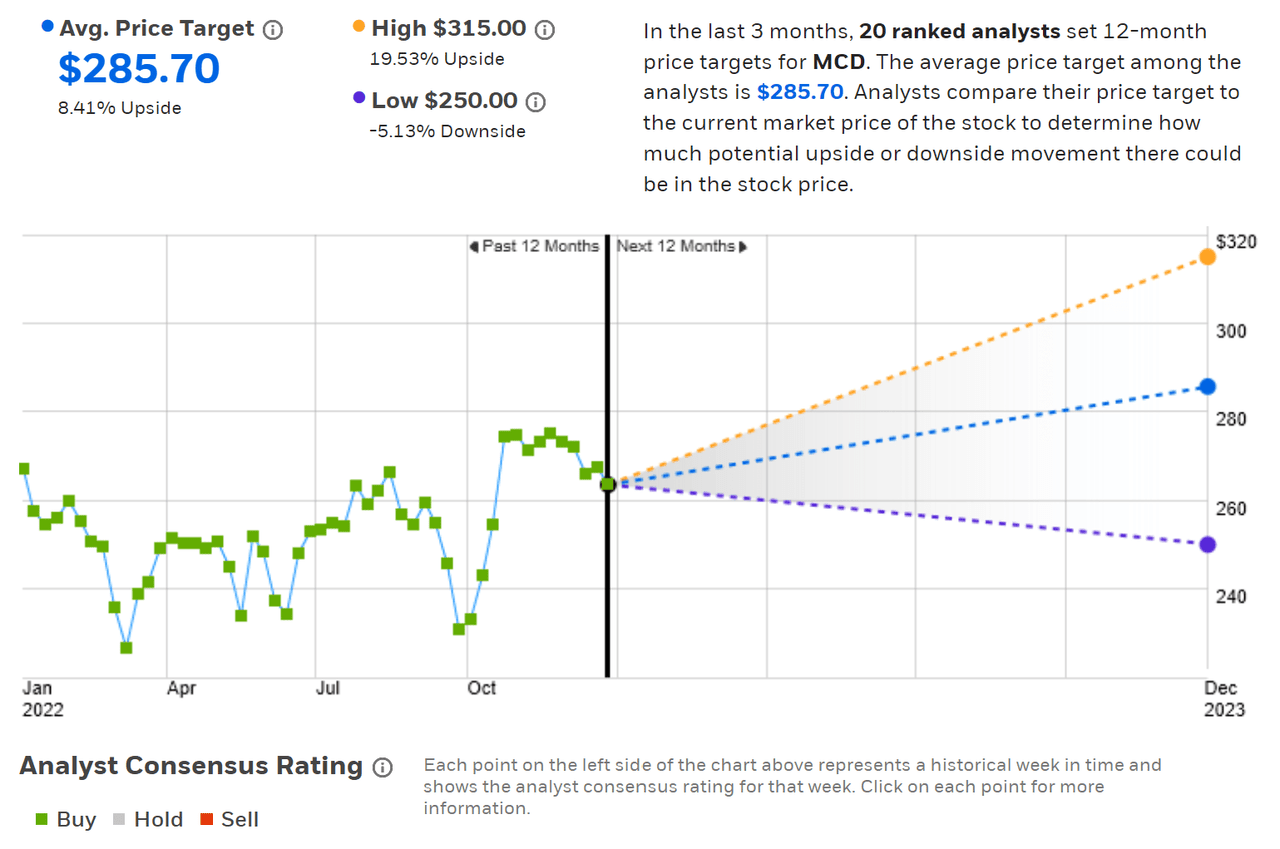

Wall Street Consensus Price Target for MCD

ETrade calculates the Wall Street consensus outlook for MCD using the views of 20 ranked analysts who have published ratings and price targets in the past 3 months. The consensus rating is a buy, as it has been for all of the past year. The consensus 12-month price target is 8.4% above the current share price, for an expected total return of 10.7% over the next year. The consensus 12-month price target at the time of my previous analysis was $279.33.

ETrade

Wall Street analyst consensus rating and 12-month price target for MCD (Source: ETrade)

Seeking Alpha’s version of the Wall Street consensus outlook is calculated using the views of 37 analysts who have published ratings and price targets over the last 90 days. The consensus rating is a buy and the consensus 12-month price target is 9.9% above the current share price, which implies an expected total return of 12.2%.

Seeking Alpha

Wall Street analyst consensus rating and 12-month price target for MCD (Source: Seeking Alpha)

These 2 calculations of the Wall Street consensus both continue to have a buy rating for MCD. Averaging the consensus price targets, the expected total return is 11.5%, slightly less than the trailing 15-year annualized total return, 11.9% per year.

Market-Implied Outlook for MCD

I have calculated the market-implied outlook for MCD for the 5.4-month period from now until June 16, 2023 and for the 12.5-month period from now until January 19, 2023, using the prices of call and put options that expire on these dates. I selected these two expiration dates to provide a view to the middle of 2023 and through the entire year.

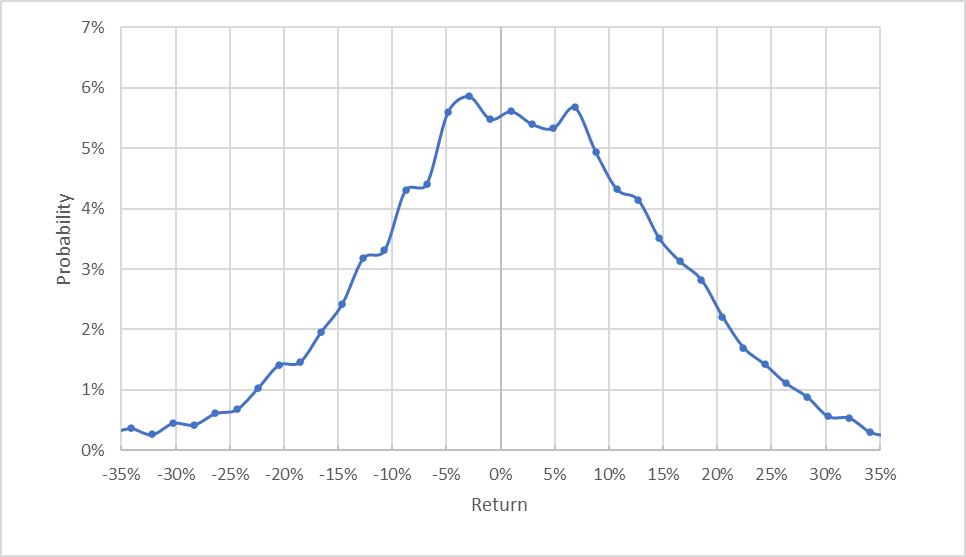

The standard presentation of the market-implied outlook is a probability distribution of price return, with probability on the vertical axis and return on the horizontal.

Geoff Considine

Market-implied price return probabilities for MCD for the 5.4-month period from now until June 16, 2023 (Source: Author’s calculations using options quotes from ETrade)

The outlook to June 16th has a flattened peak, indicating that there are a range of outcomes that are expected to occur with comparable probability. The distribution is shifted to the right of zero return, indicating elevated probabilities of positive returns. Compare, for example, the probability of having a +10% return with the probability of a -10% return. The expected volatility calculated from this distribution is 23.2% (annualized), slightly lower than the expected volatility calculated in my June 28th post.

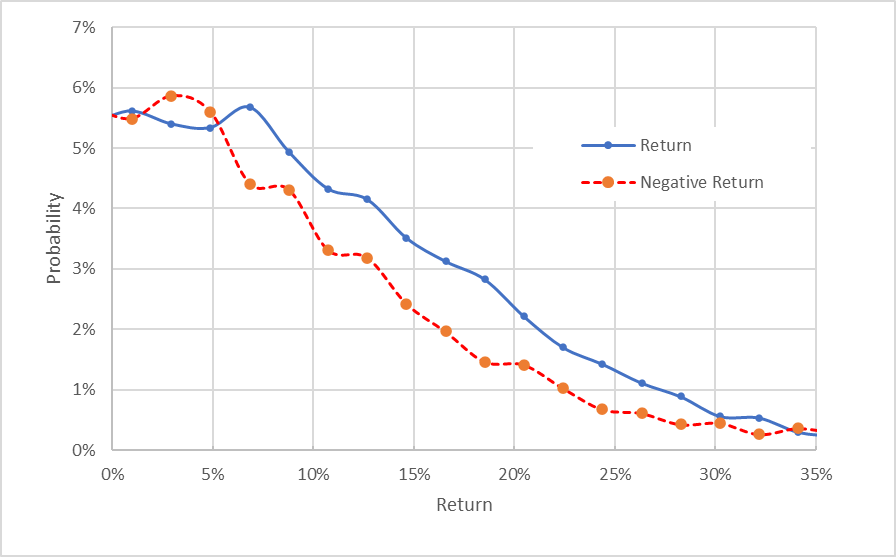

To make it easier to compare the relative probabilities of positive and negative returns, I rotate the negative return side of the distribution about the vertical axis (see chart below).

Geoff Considine

Market-implied price return probabilities for MCD for the 5.4-month period from now until June 16, 2023. The negative return side of the distribution has been rotated about the vertical axis (Source: Author’s calculations using options quotes from ETrade)

This view shows that the probabilities of positive returns are consistently above the probabilities of negative returns of the same magnitude, across almost the entire range of possible outcomes (the solid blue line is above the dashed red line over almost all of the chart above). These results suggest a bullish view to the middle of 2023.

Theory indicates that the market-implied outlook is expected to have a negative bias because investors, in aggregate, are risk-averse and thus tend to pay more than fair value for downside protection. There is no way to measure the magnitude of this bias, or whether it is even present, however. The expectation of a negative bias reinforces the interpretation of this outlook as bullish.

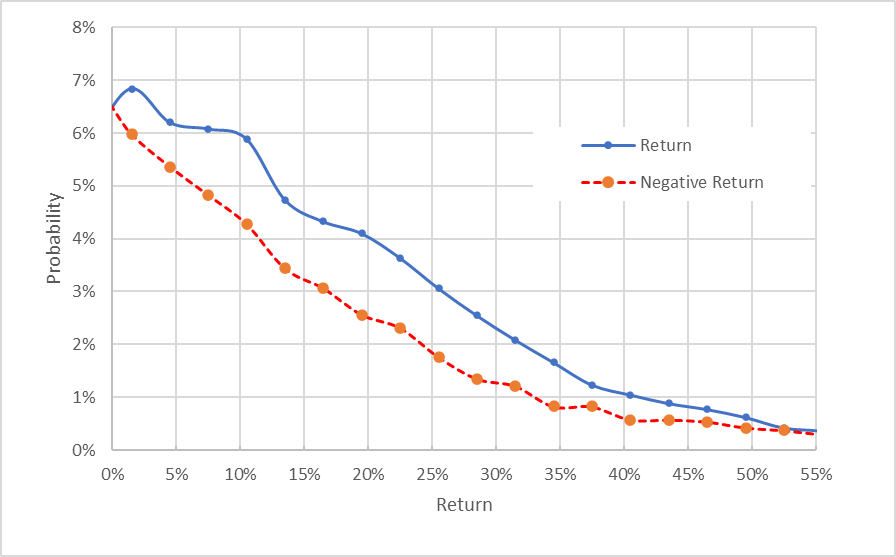

The market-implied outlook for the next 12.5 months is also bullish, with consistently asymmetric probabilities favoring positive returns. The expected volatility calculated from this distribution is 23.0%.

Geoff Considine

Market-implied price return probabilities for MCD for the 12.5-month period from now until January 19, 2024. The negative return side of the distribution has been rotated about the vertical axis (Source: Author’s calculations using options quotes from ETrade)

Summary

Considering the very challenging market conditions, McDonald’s has had a very successful year. The results add confidence in management and the commitment to consistent execution of the growth strategy. The low beta and slight value orientation should continue to be positive for the shares in an environment with continuing high interest rates and/or further market declines. That said, the shares have become somewhat expensive. The Wall Street consensus rating continues to be a buy and the consensus 12-month price target corresponds to a total return of 11.5% over the next year. The market-implied outlook for MCD is bullish to the middle of 2023 and into the start of 2024, with expected volatility of 23%. Taking the Wall Street consensus price target at face value, the expected return is right on ½ the expected volatility, indicating a reasonable risk-return balance. While the valuation is a concern, the positive momentum (Seeking Alpha momentum grade of A-) and the bullish outlooks from the Wall Street analysts and the options market convince me to maintain a buy rating.

Disclosure: I/we have a beneficial long position in the shares of MCD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.