Summary:

- McDonald’s has launched affordable meals and bundles to attract customers in the high inflation environment, leading to robust same-store sales growth.

- McDonald’s same-store sales growth is superior to that of main competitor KFC, attributed to effective franchise management and emphasis on quality and cleanliness.

- Financial analysis shows strong year-to-date growth and a projected 11% top-line growth, but the stock price is considered overvalued with a fair value of $260.

TonyBaggett

McDonald’s (NYSE:MCD) has launched affordable meals and bundles across the globe to capture a massive customer base amidst the high inflation environment. Their strategy is proving successful, with robust same-store sales growth due to these initiatives. However, the stock price appears overvalued. I am initiating coverage with a ‘Hold’ rating and a fair value of $260.

McDonald’s versus KFC

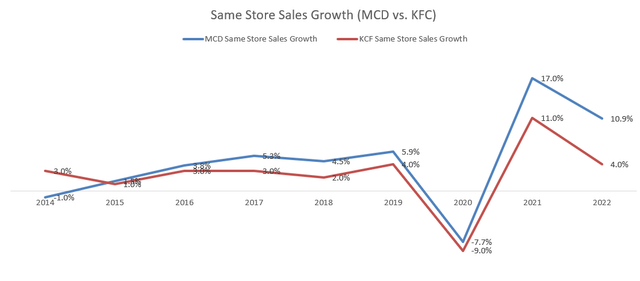

The chart below demonstrates that McDonald’s same-store sales growth is superior to that of their main competitor, KFC. In other words, McDonald’s has been gaining market share since 2015. I believe their success can be attributed to several factors.

McDonald’s has effectively managed its franchise model in comparison to KFC. Regardless of location, McDonald’s ensures a consistent customer experience across all its stores. In contrast, some KFC restaurants are situated in less favorable areas, leading to varying customer experiences.

Furthermore, McDonald’s places considerable emphasis on maintaining quality, service, and cleanliness in both company-owned and franchised establishments. Within the same price range, customers are more likely to choose fast-food restaurants that prioritize superior quality and cleanliness.

Cheap Affordable Meals or Bundles

To cope with high inflation, McDonald’s has introduced numerous affordable meals or bundles worldwide. For example, in Germany, they unveiled the McSmart menu earlier this year, featuring smaller and more cost-effective meal options. During the Q3 FY23 earnings call, the management highlighted the success of the McSmart menu in Germany, contributing to the positive same-store sales growth.

In the U.S. market, McDonald’s launched “The D123 Everyday Value Menu,” offering an affordable bundle that appeals to customers seeking a lower-priced yet higher-quality meal.

I agree that these affordable bundles or meals play a crucial role for the company in achieving growth amid the high inflationary environment. Low-income families, grappling with increased fuel prices, rising grocery expenses, and mortgage or rent payments, still have the desire to dine out. McDonald’s affordable plans cater to the needs of these customers, providing a budget-friendly option for those seeking to eat out despite financial constraints.

Financial Analysis and Outlook

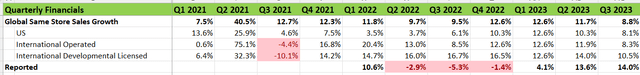

During Q3 FY23, McDonald’s achieved an impressive 8.8% global same-store sales growth. Both the U.S. and international businesses have shown strong year-to-date growth. The consolidated operating income increased by 13% in constant currency, and diluted EPS rose by 15% year over year in constant currency. Overall, these robust quarterly results can be attributed to the success of their affordable meals initiatives.

For the full year, they anticipate an adjusted operating margin of about 47%. Given their strong year-to-date financial performance, I expect a robust growth rate for the full year, exceeding historical norms, with an anticipated 11% top-line growth. This growth assumption is contingent on McDonald’s affordable meals continuing to capture market share in the current high inflation environment.

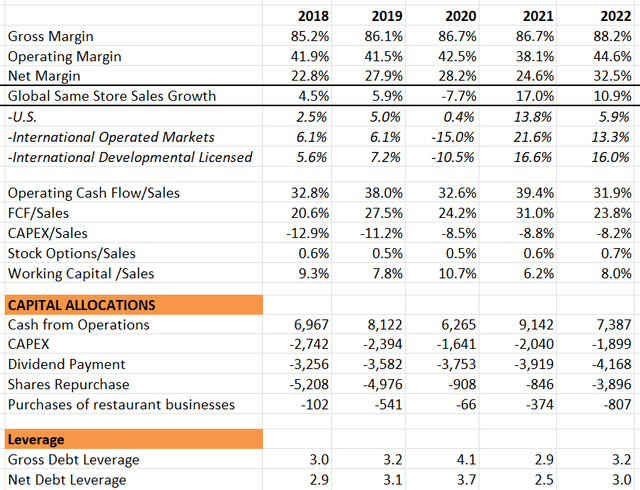

The table below analyzes their financial performance over the past five years, revealing consistent strong organic revenue growth across markets and expanded profit margins. They have effectively managed capital expenditure as a percentage of total sales by shifting towards a more franchise-oriented business model.

In terms of capital allocation, they allocate cash for dividends and stock buybacks. The repurchased shares are then placed in their treasury, leading to a negative equity value on the balance sheet. Despite this, the net debt leverage stands at around 3x, which I find reasonable for a stable company.

Valuation

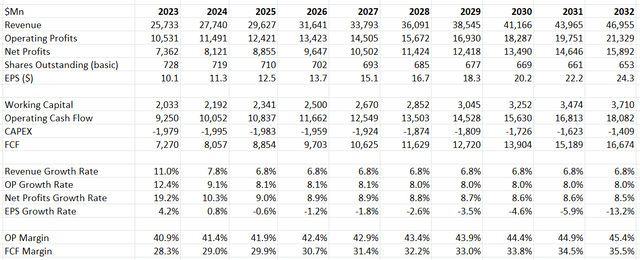

I assume an 11% revenue growth rate for FY23, aligning with their performance year-to-date. For the normalized revenue growth rate, when inflation reverts to historical levels, I project a 6% same-store sales growth—a high-end range of their historical average. This assumes continued market share gains in the fast-food sector. Additionally, I expect an 80bps growth contribution from store acquisitions, consistent with their track record.

On the margin front, I anticipate ongoing benefits from operating leverage. As inflation subsides, the growth in prices may slow down or even present negative growth. However, this could be counterbalanced by declining labor and commodity costs. Overall, I estimate a 50bps margin expansion in the model.

McDonald’s DCF – Author’s Calculation

The model utilizes a 10% discount rate, a 4% terminal growth rate, and a 21% tax rate, resulting in a fair value estimate of $260 per share according to your calculations.

Key Risks

Temporary franchisee assistance: In an effort to support their European franchisees, McDonald’s has implemented a temporary franchisee assistance program to mitigate the impact of elevated costs. According to information shared during the Q3 FY23 earnings call, the management anticipated an expense impact of $100 million to $150 million for the full year. Given the ongoing economic challenges in Europe and the persistently high inflation rates in these countries, it is plausible that these assistance programs could be sustained for an extended period.

Weak traffic growth: Despite achieving robust same-store sales growth in recent quarters, McDonald’s has been grappling with negative traffic growth year-to-date. In the Q3 FY23 earnings call, management highlighted that, on a two-year stacked basis for the quarter, their traffic showed a strong increase. However, they expressed concern about the traffic specifically from low-income family customers, those with an annual family income under $45,000. Addressing this segment’s traffic challenges may become a priority for the company.

Price Adjustment when inflation comes down: In FY23, McDonald’s anticipates an overall price level increase of 10%. However, they have observed a declining contribution from price increases as the current inflation rate starts to recede. The company acknowledges the need to adjust prices downward when inflation returns to normal levels. In this scenario, if they are unable to stimulate more traffic growth, there is a concern that their same-store sales growth may decelerate. The challenge lies in finding ways to attract customers and maintain sales momentum amid changing economic conditions.

NLRB New Labor Rule: The National Labor Relations Board (NLRB) is currently considering expanding the definition of a “joint employer,” potentially making it easier to hold parent corporations accountable in labor disputes and negotiations with trade unions. Although the proposal was announced last September, it remains pending and has not been finalized. If implemented, this change could significantly impact McDonald’s franchise model, particularly since 95% of McDonald’s restaurants in the U.S. are owned and operated by local franchises.

On October 26, 2023, the NLRB issued the final rule on Joint Employer status, with the effective date set for December 26, 2023. During the Q3 FY23 earnings call, McDonald’s indicated their intention to contest the ruling in both the courts and Congress. This suggests that the company is prepared to challenge and navigate potential legal and legislative implications stemming from the new rule.

Conclusion

Their affordable meals strategy aligns well with the current highly inflationary environment, and I believe their growth rate will remain strong in the near term. Despite this, I consider the stock price to be overvalued, and as a result, I am initiating a ‘Hold’ rating with a fair value of $260.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.