Teva: 4 Key Drivers For A 2024 Revival (Upgraded Rating)

Summary:

- I am upgrading Teva Pharmaceutical to “Buy” for 2024, buoyed by opioid litigation resolution and promising drugs like TEV’574.

- Strong Q3 2023 performance, marked by revenue growth in Austedo, Ajovy, and Uzedy, and increased R&D investment.

- TEV’574, in collaboration with Sanofi, shows significant promise in inflammatory bowel disease treatment, enhancing TEVA’s pipeline.

- The Company’s disciplined financial management and innovative product pipeline make it a compelling buy for 2024.

tanit boonruen/iStock via Getty Images

At a Glance

Teva Pharmaceutical Industries Limited (NYSE:TEVA) has emerged as a compelling investment opportunity, prompting an upgrade from “Hold” to “Buy” for 2024. This shift is driven by Teva’s successful resolution of opioid litigation, strategic rebranding efforts, and the promising potential of their anti-TL1a drug, TEV’574, for inflammatory bowel disease [IBD]. The settlement marks a significant turnaround, allowing Teva to refocus on growth and innovation. Coupled with a stronger balance sheet and the growth trajectory of key products like Austedo, Ajovy, and Uzedy, Teva is positioning itself as an attractive option for investors seeking a turnaround story in the pharmaceutical sector.

Teva’s Legal Resolution: Stepping Stone to Future Innovation

Teva’s recent settlement of opioid lawsuits across the United States, including an agreement with Nevada for $193 million, represents a significant shift for the company. By resolving claims with all 50 states and the majority of other litigants, Teva demonstrates a strategic decision to move beyond these legal challenges. The total financial commitment, reaching up to $4.25 billion, indicates a substantial effort by Teva to address past concerns.

A notable aspect of the settlement is Teva’s commitment to supply up to $1.2 billion in generic Narcan, an opioid overdose reversal drug. This decision reflects a focus on public health and patient safety. The commencement of Narcan distribution, paired with the expected settlement payments starting in late 2023, marks a deliberate step in Teva’s recovery process.

This development could be pivotal in restoring Teva’s reputation and reinforcing its position in the pharmaceutical industry.

Teva’s Triple Threat: Uzedy Joins the High-Flying Austedo and Ajovy

Teva’s financial performance in Q3 2023 and the outlook for 2024 are anchored by the growth of Austedo, Ajovy, and the newly introduced Uzedy.

Austedo, Teva’s blockbuster drug for treating tardive dyskinesia and other movement disorders, experienced a notable 30% revenue increase in North America, achieving $339 million, significantly fueled by the demand for its new extended-release formulation, Austedo XR. The safeguarding of Austedo XR with nine Orange Book patents, effective until 2041, offers a substantial opportunity for sustained growth for years to come.

Ajovy, Teva’s prominent migraine prevention medication, has shown promising growth, evidenced by a 16% and 8% revenue increase in North America across the second and third quarters respectively. This growth has boosted Ajovy’s U.S. market share to over 25%, reinforcing its strong position in the competitive CGRP migraine market. Notably, recent studies have demonstrated Ajovy’s effectiveness in diverse patient groups, including those with comorbid obesity, aligning with trends toward personalized migraine treatment. Additionally, a 22.6% Y/Y sales increase highlights Ajovy’s expanding market reach, further cemented by positive outcomes in patients with migraine and major depressive disorder, underscoring its potential in addressing complex migraine challenges.

The launch of Uzedy marks a pivotal development in schizophrenia management. It’s the inaugural subcutaneous, extended-release version of risperidone, utilizing the novel SteadyTeq technology. This innovation offers a major leap in treatment flexibility with its 1- and 2-month dosing options. Crucially, Uzedy has been shown to significantly cut the risk of relapse, a common challenge in schizophrenia therapy. This is particularly important as consistent medication adherence is a known issue in schizophrenia, often leading to relapse.

Looking ahead to 2024, Austedo, Ajovy, and Uzedy are likely to be central to Teva’s revenue generation. Their current performance, market acceptance, and strategic alignment with Teva’s focus areas indicate a robust growth trajectory. However, it’s important to monitor how Teva manages operational costs and integrates these products into its broader portfolio, as well as how it navigates the competitive landscape in the pharmaceutical sector. The success of these products will be crucial in determining Teva’s market position and financial health in the coming year.

TEV’574: Teva and Sanofi’s Joint Venture to Tackle IBD

TEV’574, Teva’s novel anti-TL1A therapy, is emerging as a potentially impactful treatment for IBD, particularly ulcerative colitis and Crohn’s disease. This drug’s development journey and market potential are characterized by several key elements:

-

Clinical Trial Progress: TEV’574 is at a critical phase, currently undergoing Phase IIb clinical trials for both ulcerative colitis and Crohn’s disease. This stage is pivotal for assessing the drug’s efficacy and safety in IBD treatment. Consequently, forthcoming updates and interim results, anticipated in the second half of 2024, are expected to be major drivers of value.

-

Sanofi Collaboration: The partnership with Sanofi (SNY) in co-developing and co-commercializing TEV’574 signifies a strong vote of confidence. Financial backing, including a substantial upfront payment of $500 million and $1 billion in potential milestone payments, alongside Sanofi’s involvement in Phase III development, highlights TEV’574’s potential.

-

Market Dynamics: The introduction of TEV’574 into the IBD treatment market, already a focus for major players like Merck (MRK) and Pfizer (PFE), indicates a robust interest in TL1A-targeted therapies. Recall, Merck’s $10.8 billion acquisition of Prometheus in June starred PRA-023, a humanized monoclonal antibody targeting TL1A. Thus, TEV’574 enters a competitive but growing market segment.

-

Significance of Low Anti-Drug Antibodies: A standout feature in early trials of TEV’574 is its low rate of anti-drug antibodies (slide 15). This is crucial because anti-drug antibodies can reduce a medication’s effectiveness and increase the risk of adverse effects. A lower incidence of these antibodies suggests TEV’574 could offer improved efficacy and safety over existing treatments, making it a potentially superior option for IBD patients.

-

Marketing Strategy and Clinical Benefits: The development of a user-friendly subcutaneous auto-injector for TEV’574 could enhance patient adherence. Teva and Sanofi’s split commercialization strategy aims to maximize market penetration across different regions.

Considering these factors, TEV’574, targeting a projected $28 billion market (slide 14), presents a substantial opportunity for Teva. Its prospective effectiveness in managing IBD, backed by robust corporate support, a tactical commercial strategy, and notably its low incidence of anti-drug antibodies, sets TEV’574 up as a strong contender in the IBD treatment arena in the foreseeable future.

Teva’s 2023 Financial Recap: Debt Reduction and Revenue Resilience

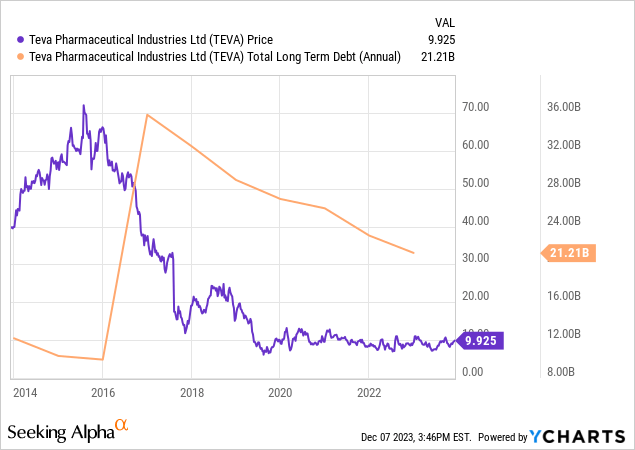

Teva continues to make notable strides in financial management, particularly in reducing its debt. The company managed to cut its debt from $21,212 million at the end of 2022 to $19,974 million by September 2023. This was primarily achieved by paying off $1.65 billion in senior notes, despite partially offsetting this with a new $500 million credit facility. In a significant move, Teva repaid $1 billion of its 2.8% senior notes in July 2023.

The company’s revenue in the third quarter of 2023 rose by 8.3% to $3.9 billion, compared to the same period last year. This increase was accompanied by an 11% growth in gross profit and an improved gross margin of 48.1%, highlighting strong financial performance.

Regarding operational expenses, Teva’s R&D spending went up by 16% to $726 million, and its selling and marketing expenses increased slightly by 1% to $1.73 billion over the first nine months of 2023. However, general and administrative expenses saw a 2% decrease to $870 million.

The balance sheet as of September 30, 2023, showed a slight decrease in total assets, from $44 billion at the end of 2022 to $42.1 billion, and a decline in total liabilities from $35.3 billion to $34.6 billion. Total equity also decreased from $8.7 billion to $7.5 billion, mainly due to a net loss of $1.05 billion and adverse currency exchange impacts.

Overall, Teva’s financials in 2023 demonstrate a strong focus on managing debt and improving operational efficiency, successfully navigating market challenges, and maintaining a steady growth in revenue.

My Analysis & Recommendation

Teva emerges as an attractive turnaround prospect for investors in 2024. The resolution of its opioid litigation, a key milestone, dispels significant uncertainty, potentially restoring investor confidence and allowing Teva to concentrate on its core operations.

The company’s 2023 performance, highlighted by the success of innovative products like Austedo, Ajovy, and Uzedy, demonstrates Teva’s capacity for growth in critical segments. These products are not only revenue contributors but are also poised to become major drivers of future revenue. Teva’s increased R&D investment signals a strong commitment to developing a dynamic product pipeline, bolstering its long-term outlook.

The collaboration with Sanofi on TEV’574 for IBD further brightens Teva’s prospects. This partnership lends credence to the drug’s potential while providing significant financial backing, reducing development risks.

Teva’s effective debt management, marked by reduced debt levels and controlled spending, reflects a strategic financial approach, crucial for the company’s enduring stability and likely to attract positive investor attention.

Investors should adopt a diversified portfolio strategy to balance risks, including Teva’s stocks alongside other healthcare and pharmaceutical investments. It’s important to continuously monitor Teva’s litigation status, debt situation, and the progress of key pipeline products. Keeping an eye on broader market trends and regulatory changes in the pharmaceutical sector is also vital.

In light of Teva’s progress in surmounting challenges, its promising product pipeline, and disciplined financial management, the company is well-positioned for a potential turnaround in 2024. This makes Teva a compelling “Buy” for investors looking to leverage the company’s recovery and prospective growth.

Risks to Thesis

In reviewing my “Buy” recommendation for Teva, I identify several potential risks and areas for critical reassessment:

-

Opioid Litigation Overhang: While the settlement of opioid litigation is a positive step, the long-term reputational damage and potential for unforeseen liabilities should not be underestimated. The pharmaceutical industry is under intense scrutiny, and any regulatory changes or public sentiment shifts could adversely impact Teva.

-

Dependence on Key Products: My bullish stance heavily relies on the success of Austedo, Ajovy, and Uzedy. However, over-reliance on a limited portfolio can be risky, especially if market dynamics shift or if these drugs face unexpected competition or regulatory challenges.

-

Execution Risk in R&D: The optimism surrounding TEV’574, while justified, must be tempered with the understanding that drug development is inherently risky. Clinical trial outcomes are uncertain, and regulatory approvals are not guaranteed. The collaboration with Sanofi does mitigate some risk but does not eliminate it.

-

Teva’s Debt Challenge: Teva remains encumbered by considerable debt, despite strides in reducing it. The current climate of escalating interest rates threatens to elevate debt servicing costs. Additionally, prioritizing debt clearance may constrain Teva’s capacity to pursue other growth avenues. The company is also committed to settling its $4.25 billion opioid-related obligations over the coming years, adding to its financial pressures.

-

Market and Macroeconomic Factors: Teva operates in a highly competitive and regulated industry. Changes in healthcare policies, pricing pressures, and competition can affect its market position. Additionally, global economic conditions, including inflation and currency fluctuations, could impact its financial performance.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article aims to offer informational content and is not meant to be a comprehensive analysis of the company. It should not be interpreted as personalized investment advice with regard to "Buy/Sell/Hold/Short/Long" recommendations. The predictions and opinions expressed herein about clinical, regulatory, and market outcomes are those of the author and are rooted in probabilities rather than certainties. While efforts are made to ensure the accuracy of the information, there might be inadvertent errors. Therefore, readers are encouraged to independently verify the information. Investing in biotech comes with inherent volatility, risk, and speculation. Before making any investment decisions, readers should undertake their own research and evaluate their financial position. The author disclaims any liability for financial losses stemming from the use or reliance on the content of this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.