Medtronic Is A Compelling 3.6% Dividend Grower

Summary:

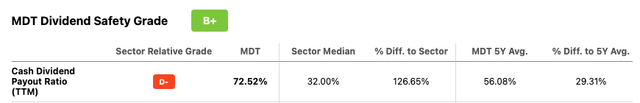

- 3.6% Dividend Yield. Dividend increased 8% last fiscal year.

- High 80% cash flow conversion with 50% Free Cash Flow (FCF) shareholder return target.

- Huge growth portfolio, with 230 products entering the trial phase and 200 approvals in FY22. Repositioning toward a higher growth portfolio.

- Chinese drag being offset with double-digit growth in other developing markets.

- Portfolio streamlining including a spinoff of low-growth segments into NewCo.

JHVEPhoto

Investment Thesis

Medtronic (NYSE:MDT) is the world’s largest medical device producer and developer. Across 50,000 patents and 150 countries, MDT generates over $30 billion in revenue.

MDT has a robust FCF with 80% conversion target. In addition, 50% of FCF is returned to shareholders MDT. increased its dividend by 8% and bought back 1.2% of its shares.

Despite persistent headwinds causing a reduction in FY23 guidance, it has 4% organic growth and $5.30 EPS (Earnings Per Share). Year over year, FY22 saw a 34% increase in EPS with a significant effort toward repositioning the company toward a high-growth portfolio. This effort includes spinning off the slow-growth segments into a new company called NewCo which is detailed below.

MDT has had 45 consecutive years of dividend payments and expects to increase the dividend in line with earnings. Over the long term, MDT’s extensive portfolio of existing patents and development pipeline will allow it to maintain its global leadership position.

|

Medtronic |

E2023 |

E2024 |

E2025 |

|

Price-to-Sales |

3.3 |

3.2 |

3.1 |

|

Price-to-Earnings |

14.5 |

13.8 |

12.8 |

Operations

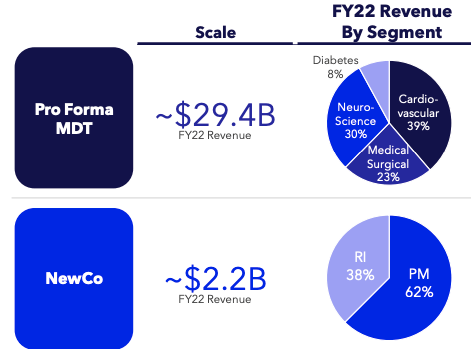

MDT operates 4 segments, cardiovascular, medical-surgical, neuroscience and diabetes. Cardiovascular is primarily implants and specialized surgical tools for repairing or mitigating heart problems. Medical-surgical is robotics, patient monitoring tools, and implements. Neuroscience encapsulates implants and medical tools for neurosurgery and neurology. Diabetes care is primarily driven by novel monitoring systems for blood sugar and implants.

So far in FY23, MDT recovery from macroeconomic issues such as supply chains has been lackluster and disappointing. Additionally, the decrease in severe COVID-19 cases has reduced the number of respirators required which Medtronic sold. Combined, this caused a decline of 3% in the surgical portfolio. However, the growth in other sectors fully offset this decline. Growth highlights are focused on neuroscience which saw 9.1% organic growth in the specialty therapies division. In addition, growth was geographically diversified with emerging markets leading the way with high single-digit growth.

|

Segment |

Revenue Growth (2Q23 year-over-year) |

Revenue as % of Total |

|

Cardiovascular |

4% |

36.1% |

|

Medical Surgical |

-3% |

28.8% |

|

Neuroscience |

5% |

27.7% |

|

Diabetes |

3% |

7.4% |

MDT FY22 Presentation

Growth Repositioning

MDT is launching an initiative titled the “Medtronic mindset.” The goal is to launch more products annually. With supply chain issues seeing some relief MDT expects bottom-line acceleration going into FY23. While this recovery was slower in 2Q23 than expected, causing a reduction in guidance, earnings per share were still at the top end of the expected range at $1.30 per share. Nonetheless, MDT has generated FCF of $1.3 billion so far in FY23. As the growth is realized, management expects to increase the dividend in line with earnings over the long term.

This initiative includes extensive portfolio management, including a spinoff titled NewCo. NewCo will be made up of patient monitoring, renal care, and respiratory intervention (intubation) section from the Respiratory, Gastrointestinal & Renal divisions. In FY22, the NewCo divisions made reported $2.2 Billion in revenue but significantly lower growth than the rest of the company. NewCo would have had a 7% revenue decline.

Long Term Pipeline

Through FY22, MDT conducted 230 clinical trials and had 200 products approved. One of the highlights is the introduction of a PFA Catheter for the heart. This product is designed to be a non-thermal solution to ablation, which traditionally uses heat or cryogenics that can damage surrounding tissue. It uses a catheter to reach the heart where it uses an electrical pulse to kill the cells that cause atrial fibrillation. The PFA Catheter is then removed before the surgery’s conclusion. Over the next 18-24 months, this is expected to exit trials and enter the approval process. After approval, it would be first to market in the United States.

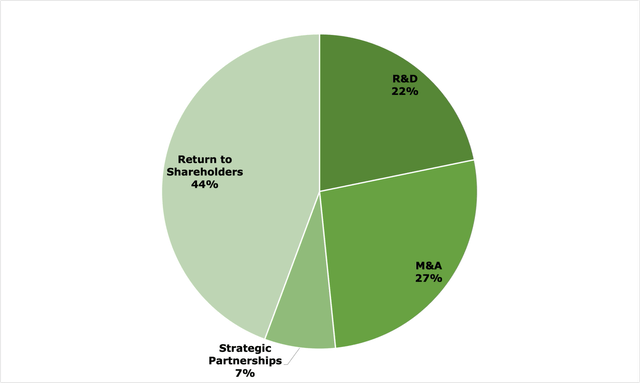

Capital allocation as it relates to internal investments focuses around “tuck-in” M&A. MDT made $3.3 billion in acquisitions across 9 companies. Organic R&D was $2.7 billion and increased 10.2% in FY22. MDT also invested $900 million in 75 strategic partnerships and minority stakes.

BuildingBenjamins, from MDT 2Q22 10Q

Risk

Healthcare products run several major risks. Proving clinical effectiveness, getting government approvals, competitive products, customer acceptance and pricing. In addition, if MDT finds itself with defective products or with large recalls this could cause significant impairment to the company’s financial position and ongoing reputation. Moreover, if any of their products create adverse outcomes for patients, it could result in class action suits.

The Chinese market experienced high single-digit contraction to revenue. This is due to China’s Volume-Based Procurement (VBP) policy. In short, this policy attempts to reduce the cost of medical devices by buying in bulk in advance for a far lower price rather than on demand. This has already led to a significant reduction in the realized price, by almost 90% in certain areas. While this is partially offset by growth in other developing markets, China’s incredibly large addressable market getting a significant hit is noteworthy as it increases regional pricing competition significantly.

Conclusion

MDT’s repositioning is a sign that the dividend will grow in line with earnings, and if the initiative is successful it could also provide a healthy amount of capital appreciation. We believe that the NewCo spin-off will provide a leaner balance sheet and growth profile that will support long-term growth. Despite the pervasive macro headwinds MDT has still shown strength, and as those alleviate we expect top-line acceleration.

Disclosure: I/we have a beneficial long position in the shares of MDT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.