Medtronic: Buy The Dip And Start The DRIP

Summary:

- Medtronic is a durable healthcare products company with a longstanding history of success and a sound business model.

- Market sentiment has been highly negative around the stock based on what I see as being temporary headwinds.

- Those with a long-term focus may do well to lock in the stock at the current low price with a historically high dividend yield.

JuSun

Buying quality stocks on the cheap is a great way to accumulate long-term wealth. Case in point is a number of beaten down pharmaceutical companies like Merck (MRK) and Amgen (AMGN), that were trading in bargain basement territory just a short 12 months ago, when market sentiment was working against them for one reason or another.

At that time, the market was flying high, but moat-worthy drug makers were shunned by the market. Since then, many pharmaceutical companies have posted market-beating returns, returning back towards their fair value.

This brings me to Medtronic (NYSE:MDT), which has fallen out of favor with the market, posting a 30% decline over the past 12 months. As shown below, MDT is now trading just a couple percentage points shy of its 52-week low. This article highlights why now may be a great time to layer into this moat-worthy name on the cheap.

MDT Stock (Seeking Alpha)

Why MDT?

Medtronic is a medical device giant with a presence in over 150 countries, generating $31 billion in total revenue over the trailing 12 months. Its broad array of products includes pacemakers, stents and insulin pumps, treating 70 various health conditions. Its patent base and track record of medical innovation give it pricing power and helps to insulate it from headwinds in any one particular product category or geography.

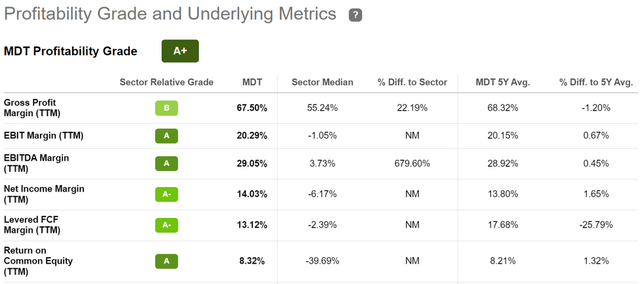

This is reflected by MDT strong profitability. As shown below, MDT carries an A+ score with sector leading gross and EBITDA margins of 68% and 29%, respectively.

MDT Profitability (Seeking Alpha)

It’s no secret that MDT has seen some struggles this year, given supply chain headwinds, hospital labor shortages, and commodity price inflation. Revenue declined by 3% and 2% YoY on an organic basis during the third quarter, to $7.6 billion, and adjusted EPS also declined by 2%. It’s worth noting, however, that much of the decline was driven by a strong dollar. Excluding currency effects, MDT’s revenue would have been $457 million higher, resulting in a 2.5% YoY increase in sales.

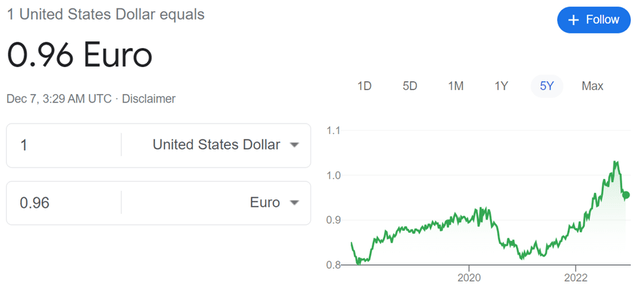

The stronger dollar has been a result of higher interest rates driven by the Federal Reserve, making US Treasuries more attractive to foreign investors. This trend, however, has been reversing in recent weeks as other countries have also begun raising interest rates. As shown below, the US Dollar to Euro ratio has declined in recent weeks.

USD to EURO Ratio (Google)

Notwithstanding currency effects, MDT’s results are still lackluster, as slower than expected procedures and supply recovery were attributed as the primary reasons for top line weakness. This, combined with delayed U.S. regulatory approval of its 780g insulin pump and battery replacement headwinds in neuromodulation has driven market sentiment down around the stock.

Nonetheless, MDT is far from being a one-trick pony considering its deep bench of products in its Cardiac Rhythm and Structural Heart businesses. Moreover, management noted that Neurovascular, ENT, and Cardiac Surgery segments were outperforming expectations.

Moreover, management noted during last week’s Evercore ISI Health Conference that it’s doubling down on investments into the big market for diabetes with a broad pipeline of sensors, insulin delivery devices, and other accessories around this large ecosystem. It’s also shifting its strategy to partner closely with healthcare providers, which could help it to better navigate the evolving reimbursement landscape. This was noted by Morningstar in its recent analyst report:

Medtronic has slightly shifted its strategy to include partnering more closely with its hospital clients by offering greater breadth of products and services to help hospitals operate more efficiently. By partnering more closely and integrating itself into more hospital operations, Medtronic is well positioned to take advantage of more business opportunities in the value-based reimbursement environment, in our view. In particular, Medtronic has been pioneering risk-based contracting around some of its cardiac and diabetes products, which we think is attractive to hospital clients and payers alike.

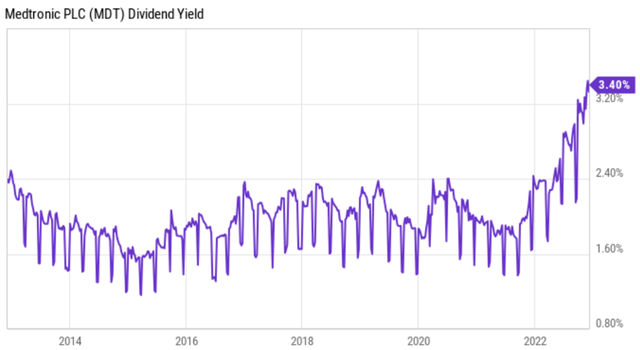

Meanwhile, MDT carries a strong A rated balance sheet and has a long history of paying an uninterrupted dividend. Recent share price weakness has pushed the forward dividend yield up to a respectable 3.5%. The dividend is also well covered by a 49% payout ratio and comes with a 5-year CAGR of 8%. As shown below, MDT’s dividend yield is currently at the top end of its 10 year range.

(Note: The following yield is based on trailing 12 months’ dividends)

MDT Dividend Yield (YCharts)

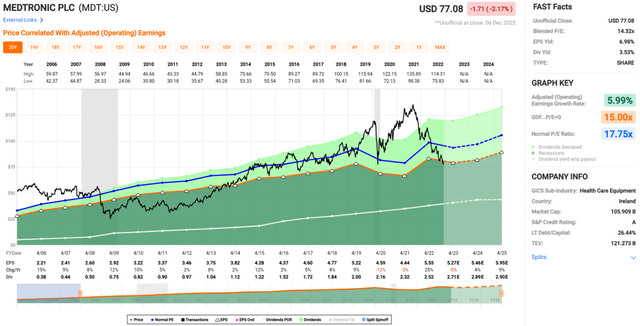

Turning to valuation, I find MDT to be reasonably cheap at the current price of $77 with a blended PE of 14.3, sitting well below its long-term PE of 17.8. I find a PE of 17 to be a fair value for MDT for investors with a 5+ year investment horizon.

MDT Valuation (FAST Graphs)

This is considering the quality of the enterprise and the reputation of its products among healthcare providers, with the consideration that near term issues such as currency effects and supply chain concerns will ameliorate over time. Morningstar has a fair value estimate of $112 and analysts have a consensus Buy rating with an average price target of $90.

Investor Takeaway

All in all, Medtronic remains one of the most reliable healthcare products companies in the industry, with a longstanding history of success and a sound business model. Although currency effects and supply chain issues have been hurting near-term results, I believe these will be temporary.

Additionally, MDT’s strategy shift should benefit the enterprise over the long-run. Finally, MDT’s current valuation is attractive for investors with a long-term mindset. For these reasons, I believe Medtronic to be an attractive investment opportunity at its current price, especially considering the potential benefits from dividend reinvestment at low prices.

Disclosure: I/we have a beneficial long position in the shares of MDT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am not an investment advisor. This article is for informational purposes and does not constitute as financial advice. Readers are encouraged and expected to perform due diligence and draw their own conclusions prior to making any investment decisions.