Summary:

- Medtronic seems to be a blue-chip company that’s committed to increasing its dividend.

- Its financial position is stable, and its payout ratio is sustainable.

- Its ~3.5% yield and A-grade credit rating suggest its a relatively low-risk stock investment.

- Slow EPS growth has been weighing on the stock.

alvarez

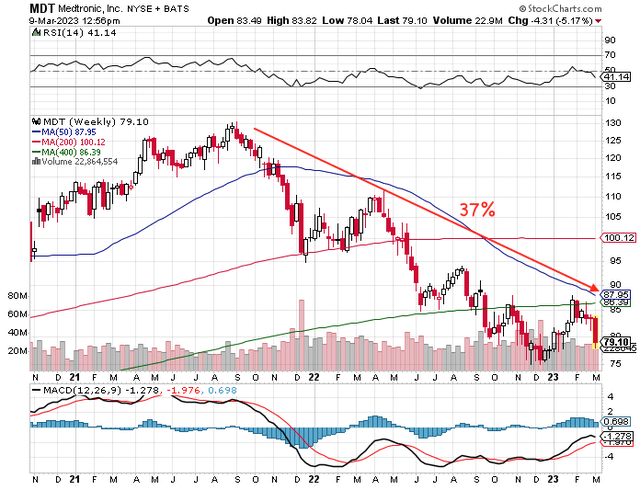

The stock of Ireland-based Medtronic (NYSE:MDT) has been in a slump for the past 1.5 years – down close to 37% in that period.

Stockcharts with author annotation

Slow Growth

Slow growth seems to be a big factor. Here are some key highlights from its income statement. From fiscal 2019 to fiscal 2022, revenue only increased 3.7% to $31.7 billion. Higher cost of revenue in the period weighed on gross profit, which only rose marginally by 0.6% to $21.5 billion.

Although Medtronic kept a good control of the Selling, General, and Administrative expense, which declined 1.2% to $10.3 billion, overall operating expenses rose 5.8% to $15.6 billion.

Research Development (“R&D”) is an essential operating expense of the Medical Devices company. In this period, the R&D cost increased by 18% to $2.7 billion, averaging 8.2% of revenue.

Operating income ended up falling 11% to $5.9 billion. Interestingly, Medtronic managed to shrink its interest expense substantially to $553 million in fiscal 2022 versus fiscal 2019’s $1,444 million. Ultimately, net income increased 9.9% from fiscal 2019 to fiscal 2022, which translated to diluted earnings per share (“EPS”) growth of 9.4% to $3.73. At a compound annual growth rate (“CAGR”), diluted EPS grew about 3%.

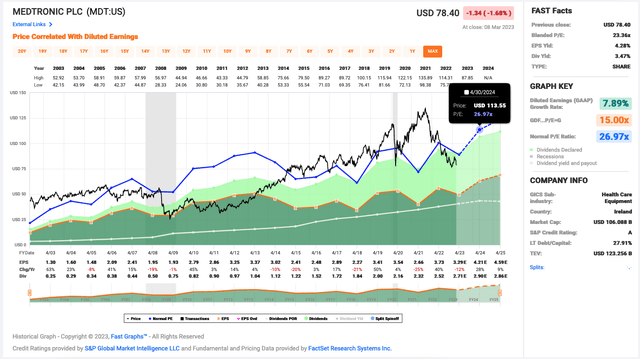

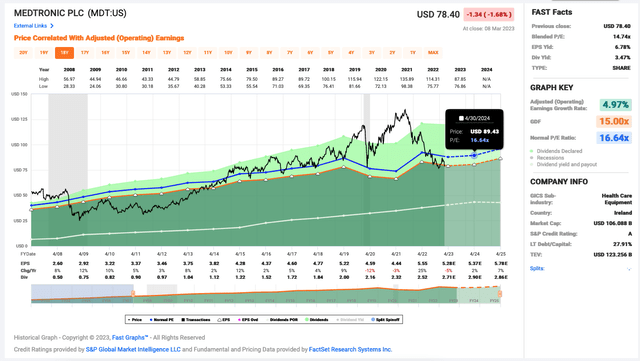

The MDT stock price follows its valuation graph based on price to adjusted earnings more closely than the graph based on price to diluted earnings. However, adjusted EPS increased at an even slower rate of just over 2% in the period.

F.A.S.T. Graphs: Price to Diluted Earnings F.A.S.T. Graphs: Price to Adjusted Earnings

Higher Cost of Capital

Rising interest rates starting in 2022 increased the cost of capital. Not only does this increase the cost of borrowing, but it also weighs on stock valuations, making it less attractive (maybe even irrational) to raise capital from new equity offerings.

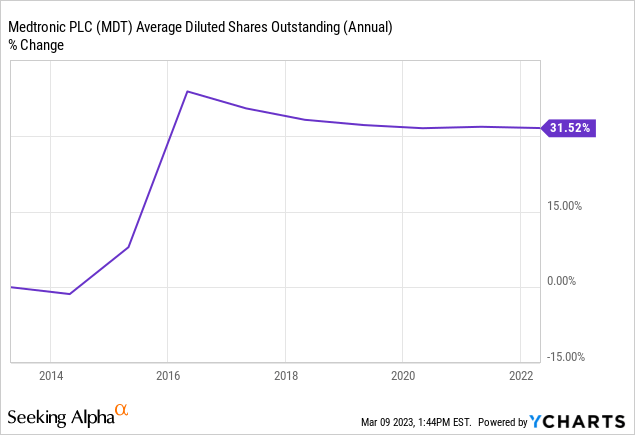

Notably, Medtronic hasn’t relied on raising capital from its common stock. The last time it did so was around 2015-2016.

The company also managed to reduce its debt ratios. From fiscal 2019 to fiscal 2022, its debt to equity ratio declined from 79% to 73% and its debt to asset ratio from 44% to 42%.

| Fiscal Year | Debt to Equity | Debt to Asset | Interest Expense ($M) |

| 2022 | 72.8% | 42.1% | $553 |

| 2021 | 80.7% | 44.6% | $925 |

| 2020 | 78.5% | 43.9% | $1,092 |

| 2019 | 78.8% | 44.0% | $1,444 |

Dividend Safety

The Medical Devices company is awarded a high S&P credit rating of A. Moreover, Medtronic is not a capital intensive business. From fiscal 2019 to 2022, it used just over 18% of its operating cash flow for capital spending. It paid out 59% of its free cash flow (“FCF”) as dividends, while the payout ratio was 67% of net income.

Its payout ratio is estimated to be about 51% of its adjusted earnings this year. So, it should have no problem maintaining its dividend growth streak that it has maintained for about 45 consecutive years.

For reference, its five- and 10-year dividend growth rates are 7.9% and 10%, respectively. Its last dividend hike declared in May 2022 was 7.9%.

At the recent quotation, the stock offers a yield of almost 3.5%. If Medtronic continues experiencing slow growth, though its dividend growth hasn’t shown signs of slowing significantly beyond 8% yet, shareholders should be prepared for slower dividend growth.

Valuation

Medtronic has so far reported three quarters of results for fiscal 2023. Its latest guidance targets adjusted EPS of $5.28 to $5.30, which suggests the dividend stock is trading at a forward price to earnings ratio (“P/E”) of about 14.9. This earnings guidance also implies a nearly 5% decline from the prior year.

The stock tends to command a premium long-term normal valuation. Since 2012, this valuation was 17.26 times earnings. Assuming a more conservative target of 16.64 times (see the second F.A.S.T. Graphs above), the stock has a price target of approximately $89, which indicates a discount of about 11%.

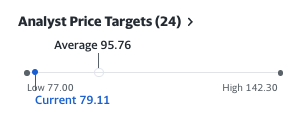

The consensus analyst 12-month price target of $95.76 is more optimistic. It indicates a discount of almost 18% from $78.76 per share at writing.

Yahoo Finance

Over the next three to five years, analysts are expecting modest EPS growth of about 2.1% per year. Assuming this growth rate were to materialize and the P/E miraculously expanded to about 16.64, annualized returns over the next five years would be just beyond 8%.

Investor Takeaway

Medtronic appears to be a blue chip company that is committed and has the capability to increase its dividend. Its financial position is stable and its payout ratio is sustainable. The stock has sold off and appears to be trading at a slight discount, but because of a modest growth outlook, we rate Medtronic as a “Hold”.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer: This article consists of my opinions and is for informational purposes only. Please do your own research and due diligence and consult a financial advisor and or tax professional if necessary before making any investment decisions.