Summary:

- Medtronic faced challenges, including poor focus, lack of innovation, and COVID-19 impact, leading to share price stagnation since 2018.

- Despite recent improvements in performance, Medtronic remains undervalued with solid competitive advantages and a promising dividend streak.

- The company’s focus on innovation, strong market position, and dividend growth potential make it a long-term buy for conservative investors.

Wolterk

Medtronic (NYSE:MDT) has faced several challenges in the past decade. Some were probably because of poor focus and lack of innovation, while others, like COVID-19, were out of their control. Consequently, the share price has languished after peaking in mid-2021. It currently trades at levels in 2018. However, Medtronic is a market leader with solid competitive advantages. Also, performance has recently improved. The stock is undervalued and possesses a nice yield. I expect the dividend streak to continue and the stock to become a Dividend King. I view Medtronic as a long-term buy for conservative dividend growth investors.

Overview of Medtronic

Medtronic plc is a global leader in medical devices. It develops, manufactures, and sells devices to hospitals, physicians, and other customers in many end markets. Revenue is almost equally divided between the United States and internationally. For tax purposes, the firm is based in Minnesota but headquartered in Ireland.

The company operates in four business segments: Cardiovascular, Neuroscience, Medical Surgical, and Diabetes. Medtronic sells products in many end markets in these segments. It is usually the market leader or number two in each end market.

Total revenue was more than $32.36 billion in fiscal year 2023 and $32.58 billion in the last twelve months (“LTM”).

Revenue and Earnings Growth

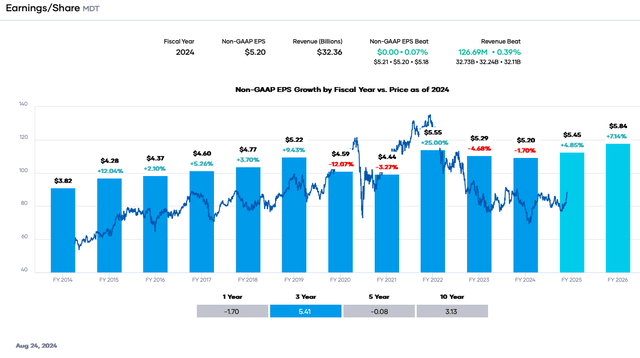

Medtronic’s revenue and earnings per share (“EPS”) growth has been inconsistent since 2015 when it acquired Covidien. It has been in the low single digits or flat for many years. A few years have seen declines because of the COVID-19 pandemic. Revenue growth has been only about 1% in the past five years, while EPS growth has actually been a negative 0.1%. Obviously, these are not great numbers and should concern dividend growth investors because growth must occur to maintain long-term streaks.

That said, Medtronic’s operational execution is improving. Revenue increased around 3.6% in fiscal year 2024, although EPS fell about 1.5%. However, the company forecasts a 4% to 5% revenue, and a 9% to 11% EPS increase in fiscal year 2025. Investors may ask if this represents a turnaround. It does, but the investors have placed Medtronic in the ‘show me before I believe it’ category. The share price has languished despite beating estimates in the past two quarters. It is up only ~3.1% in the last six months and ~7.3% this year. In fact, the share price is about the same as in 2018.

Portfolio Insight

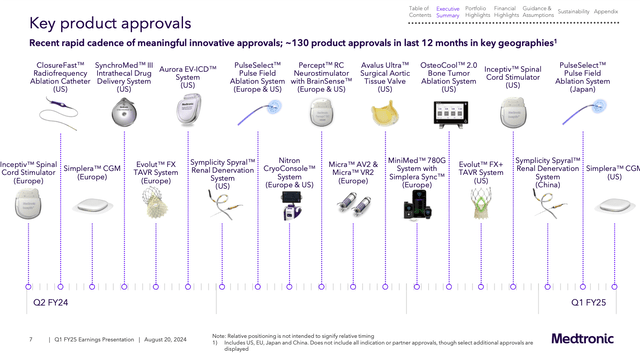

Notably, growth is coming organically, with some periodic tuck-in acquisitions. The firm is focusing capital on research & development for organic growth. It spent $2.3 billion in fiscal year 2020, which rose to $2.7 billion in 2024, a 4% compound growth. The result has been a relatively high cadence of innovation and FDA product clearances, with approximately 130 in the last twelve months. Medtronic continues to focus on innovation and intellectual property development under the current CEO, and thus, we expect this pace to continue. Revenue and EPS growth will likely benefit.

Besides IP and product development, Medtronic relies on a well-trained sales force and clinician relationships. Physicians and nurses often develop device preferences based on efficacy, safety, and training. Well documented clinical trials demonstrating the first two and sales reps helping clinicians with the third area are critical for long-term growth.

Medtronic Investor Relations

Recent Challenges

Besides the COVID-19 pandemic, which caused medical procedure deferrals and supply chain disruptions, Medtronic has faced difficulties since the large Covidien acquisition revolving around operational execution and a lack of innovation.

The firm faced an FDA warning letter for Its MiniMed 600 insulin pump, which I highlighted in an earlier article. This, combined with competition from pod-based insulin delivery with no pumps or needles and continuous glucose monitoring (“CGM”), impacted sales. The firm’s recent product approval of the MiniMed 780G and better execution have seemingly turned around the segment, which saw 12.6% organic growth in the just-completed quarter. Also, the firm announced it is integrating CGM with its insulin delivery platforms, which should drive sales.

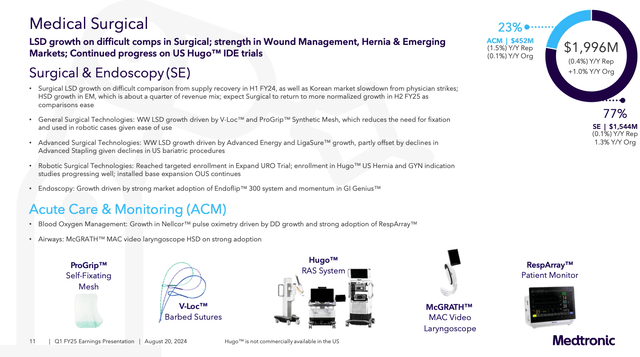

Next, the company had two underperforming businesses, Renal Care Solutions and Patient Monitoring & Respiratory Interventions. They were experiencing falling sales and margin compression despite being leaders in their end markets. The company planned to spin out or sell these businesses. However, management sought more than buyout firms were willing to offer because of their struggles. More recently, management has changed course, and the businesses are being retained and housed in a new acute care and monitoring business unit, but ventilator sales will be discontinued. Respiratory ventilators are increasingly unprofitable. Still, the Medical Surgical segment is struggling with flat growth. This segment must return to growth before investors are fully convinced about Medtronic’s turnaround.

Medtronic Investor Relations

Besides the items discussed above, Medtronic’s main risks are regulatory and legal. It must gain FDA clearance before marketing a product. Another risk is that Medicare payments may be reduced or at least negotiated, causing lower profitability.

Competitive Advantages

Medtronic has several enduring competitive advantages that should allow its top and bottom lines, and consequently the dividend, to increase over time.

The company’s scale in medical devices is unparalleled. It is one of the largest pure-play medical device makers in the world. Along these lines, it is the market leader in heart devices, insulin pumps, neuromodulators, spinal products, acute care & monitoring, etc. This scale and leadership lead to switching costs. Competitors must demonstrate efficacy and safety with new technologies to gain market share. Marginal improvements will probably not cause significant shifts in customer usage.

Next, Medtronic has well-known brands to its customers. The firm’s long history of innovation and pipeline builds on past successful products. Physicians and nurses often prefer products based on relationships with sales representatives and user experience. Competitors must overcome these barriers to displace an extant product. Although relationships may be supplanted, user experience and training are more significant barriers that result in product loyalty for each iteration.

Lastly, Medtronic has an innovation culture. Because of continuous innovation, medical device technologies have a finite lifespan. Even though patents exist for many years, companies must develop new products to replace older ones that have become outdated. Medtronic’s innovation focus and cadence are an advantage.

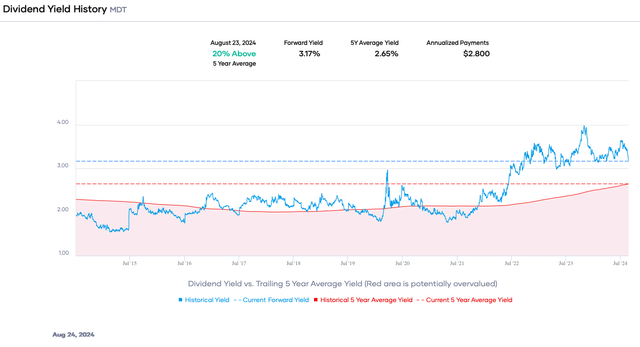

Dividend Analysis

Medtronic’s underperformance has caused the share price to drop and the dividend yield to soar simultaneously. It nearly reached 4%, the highest value in the past decade. Recent share price gains have caused the yield to decrease to roughly 3.2%, a still respectable value. It is more than the 5-year average of 2.65%. In fact, until 2022, the yield did not exceed 3%, making the current value an excellent one.

Portfolio Insight

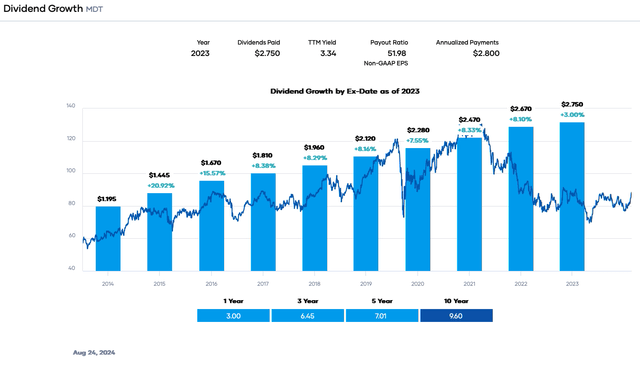

Furthermore, Medtronic is a Dividend Aristocrat with a 47-year streak of increases, the most recent on May 23rd. The quarterly dividend was raised 1.4% to $0.70 from $0.69 per share. The dividend growth rate has been around 7% in the trailing five years and 9.6% in the last decade. Although the growth rate has slowed, the company is better positioned for the future because the payout ratio has come down.

Portfolio Insight

The annual dividend is supported by solid safety, which has improved with better earnings results. The earnings payout ratio is approximately 52%, less than our target value of 65% or less. Free cash flow (“FCF”) of $5,200 million supports the dividend requirement of $3,646 million. The dividend-to-FCF ratio of 70% is precisely our desired value but above the firm’s minimum of 50%. Although not elevated, it is worthwhile to monitor this value. An increase would make Medtronic less desirable. However, FCF improved about 14% compared to fiscal year 2023. Higher revenue and operating income should push FCF higher over time.

Medtronic’s other safety metrics are reasonable. After ballooning from the Covidien purchase, net debt on the balance sheet has come down. It is currently at $20,022 million with a leverage ratio of ~2.1X and interest coverage of ~8.8X. These values are rational, and debt does not place the dividend at risk for a cut. The credit rating agencies give an A/A3 upper-medium investment grade long-term rating.

Medtronic has done an excellent job of improving its results and operational execution after the Covidien acquisition. It has also increased the dividend and repurchased shares, while reducing debt by about $14 billion.

Valuation

The share price has languished for years. It is down about 16% in the past five years. Better results have renewed investor interest this year. But still, the share price has gained only about 7.3% year-to-date and nearly 5.6% in the past year. Concurrently, the price-to-earnings (P/E) ratio is 16.2X, below the trailing five- and ten-year ranges. The valuation drop is primarily because of recent challenges and investors taking a wait-and-see attitude.

The consensus analyst estimates and mid-point of company guidance for earnings per share in fiscal year 2025 is $5.45. We will use 17X as the fair value multiple near the midpoint of the 10-year range, accounting for past difficulties. As a result, our fair value estimate is $92.65. The present share price is ~$88.35, indicating Medtronic is undervalued.

Applying a sensitivity calculation using P/E ratios between 16X and 18X, we obtain a fair value range from $87.20 to $98.10. Hence, the stock price is approximately 90% to 101% of the fair value estimate.

Estimated Current Valuation Based On P/E Ratio

|

P/E Ratio |

|||

|

16 |

17 |

18 |

|

|

Estimated Value |

$87.20 |

$92.65 |

$98.10 |

|

% of Estimated Value at Current Stock Price |

101% |

95% |

90% |

Source: Dividend Power Calculations

How does this calculation compare to other valuation models? Portfolio Insight’s blended fair value model, combining the P/E ratio and dividend yield, estimates a fair value of $101.82 per share. The Gordon Growth Model provides a fair value of $93.33, assuming a discount rate of 9% and a conservative annual dividend growth rate of 6%.

The three-model average is ~$95.33, signifying that Medtronic is undervalued at the current price.

Final Thoughts

Medtronic’s share price has been depressed, and the stock is undervalued because of past operational execution challenges, COVID-19, and declining sales in some end markets. The equity has historically yielded less than 3% but is greater than that percentage now. Moreover, the forward P/E ratio is ~16.2X, below the 5-year and 10-year ranges. Medtronic has also reinvigorated its product pipeline and improved results as part of a turnaround. The combination of undervaluation, dividend growth, dividend safety, and competitive advantages is attractive. I view Medtronic as a long-term buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MDT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.