Summary:

- Merck’s operating income was $5,293 million in Q2 2022, up 37.5% year-over-year.

- Merck’s key medicines have received regulatory approvals from the US and Europe, thereby increasing the number of indications, which will positively affect the company’s financial position.

- Merck’s share price continues to remain close to its all-time highs, despite the significant decline in the S&P 500 in the last two quarters.

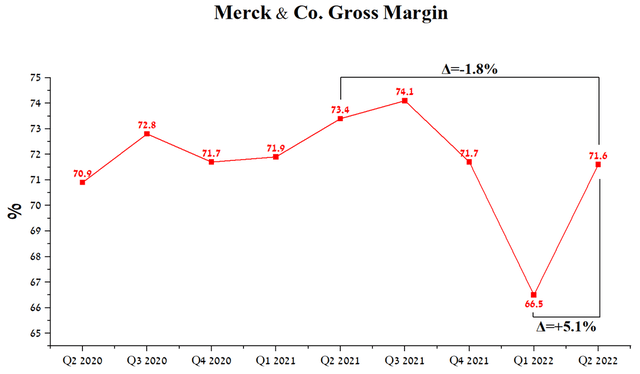

- In Q2 2022, Merck’s gross margin was 71.6%, well above the healthcare sector average.

- Merck’s dividend yield is 3.21%.

FatCamera

In the first half of 2022, Merck medicines (NYSE:MRK) continued to actively increase their share in the treatment of oncological and cardiovascular diseases, which are among the leading causes of death in the world. In addition to expanding the company’s product portfolio, Merck’s revenue and operating income show a significant increase of tens of percent compared to the previous year. With a high dividend yield of 3.21%, Merck is an attractive candidate for investors with a long-term investment strategy during a Fed rate-hiking cycle.

Company’s Financial Position

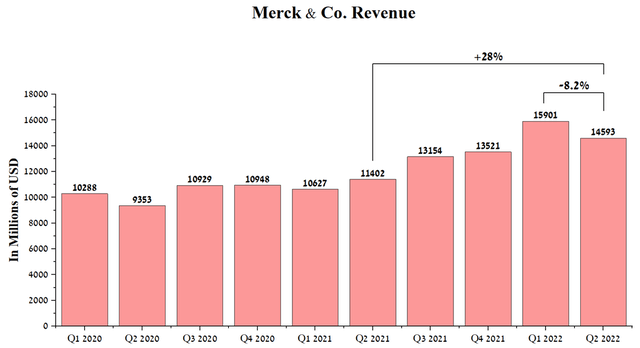

Merck pleased investors with revenue growth for the second quarter of 2022, which amounted to $14,593 million, up 28% year-over-year. At the same time, the 8.2% drop in sales of the pharmaceutical giant compared to the previous quarter was the result of a decrease in demand for Lagevrio, used to combat COVID-19, which is moving from a pandemic stage to an endemic one.

Source: Author’s elaboration, based on Seeking Alpha

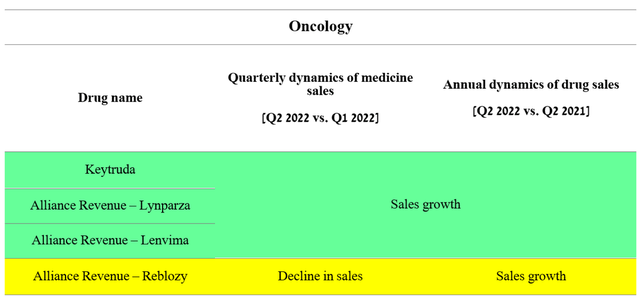

Sales of Merck’s oncology portfolio continue to show growth both quarterly and year-on-year, which is directly related to the expansion of indications for the use of medicines and increased demand for them from doctors.

Source: Author’s elaboration, based on quarterly securities reports

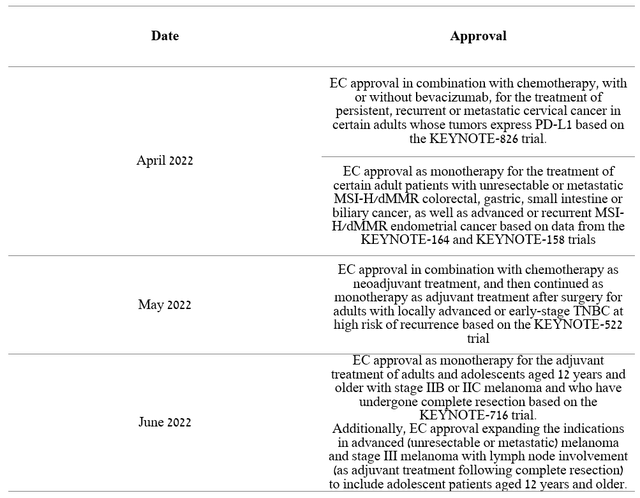

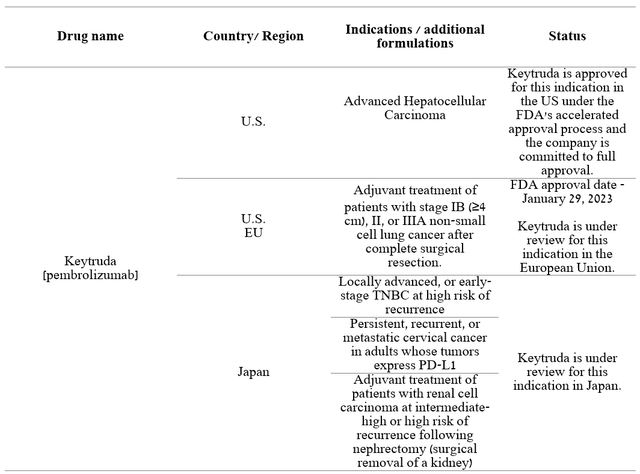

Merck’s key drug, Keytruda (pembrolizumab), whose sales account for 36% of the company’s total revenue, received four EMA approvals in Q2 2022.

Source: Author’s elaboration, based on 10-Q

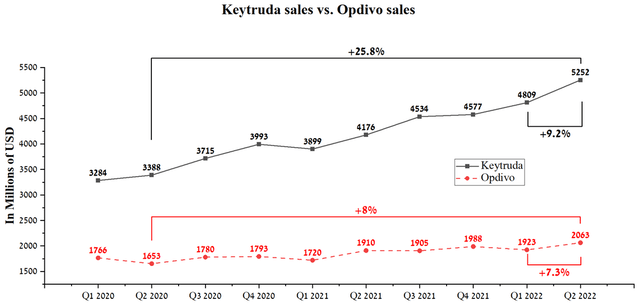

Worldwide sales of Keytruda were $5,252 million in the second quarter of 2022, up 25.8% year-on-year. The growth in sales of the company’s drug was due to the increase in the use of Keytruda in the treatment of certain types of kidney and rectal cancer. In addition, physicians are showing an increased interest in the use of Keytruda in the treatment of certain types of neoadjuvant/adjuvant triple-negative breast cancer and melanoma. While the sales of Keytruda’s direct competitor, namely Bristol Myers Squibb’s Opdivo (BMY), do not show such a breakthrough in sales. This is mainly due to fewer indications for use, less effectiveness of the drug in treating certain types of cancer, and the ability of Merck’s management to use more innovative approaches in working with doctors and medical organizations.

Source: Author’s elaboration, based on quarterly securities reports

The company is awaiting approval of Keytruda for the following indications in Japan, the US, and Europe. In the case of a positive decision by the regulatory authorities, this will increase the potential number of patients by tens of thousands, which will positively affect the growth of Merck’s net income.

Source: Author’s elaboration, based on 10-Q

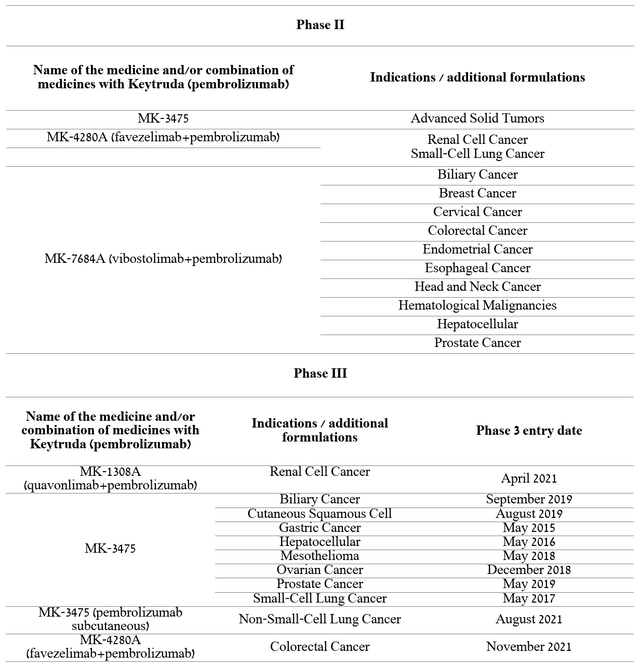

Moreover, the company continues to conduct many phase III clinical trials that aim to determine the effectiveness of Keytruda (pembrolizumab) alone and in combination with other medicines in the treatment of as many different types of cancer as possible.

Source: Author’s elaboration, based on 10-Q

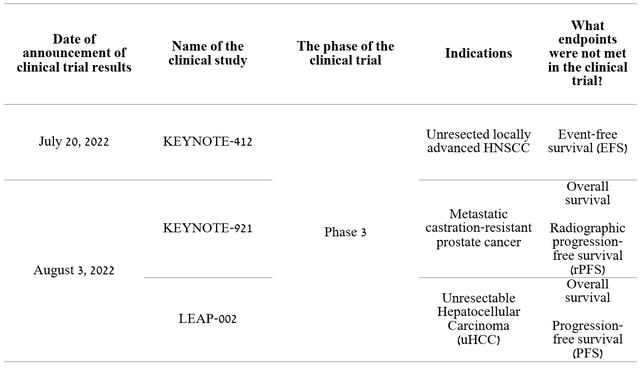

In my assessment, the company will continue to be proactive in finding drug combinations with pembrolizumab that will show significant gains in overall critically ill patient survival and ORR to mitigate the negative impact of Keytruda’s loss of exclusivity in 2027 on Merck’s financial position. However, as is often the case in the pharmaceutical industry, when a large number of clinical trials are conducted, failures occur among them. For example, two large phase III clinical trials that evaluated the efficacy of Keytruda did not reach their primary endpoints. As a result, it is unlikely that the company will be able to obtain approval for these indications in the future, which reduces the marketing potential of Merck’s blockbuster in the future.

Source: Author’s elaboration, based on quarterly securities reports

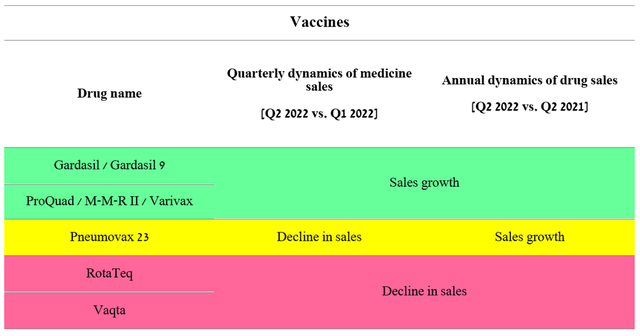

Merck’s vaccine portfolio is the second largest in the company’s structure, bringing in $2,709 million in Q2 2022, up 18% year-over-year. Despite the increase in sales in this segment of the company, two vaccines, namely RotaTeq and Vaqta, failed to demonstrate their former agility in increasing market share.

Source: Author’s elaboration, based on quarterly securities reports

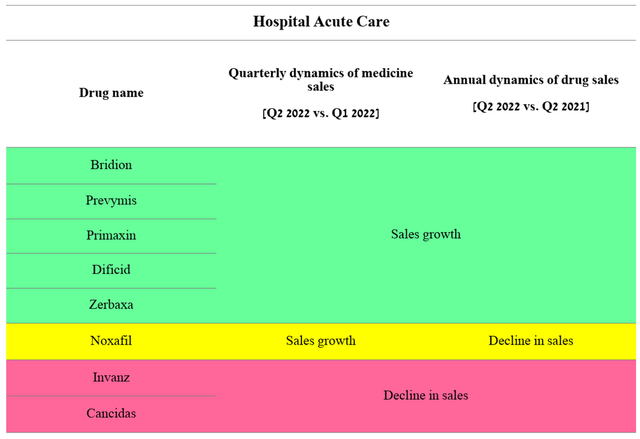

RotaTeq is a vaccine that has been approved by regulatory authorities in many countries to protect against rotavirus gastroenteritis in children. Sales of this vaccine were $173 million in Q2 2022, down 16.8% year-on-year mainly due to lower demand in China and lower public sector sales in the US. In addition, Vaqta is the second medicinal product in the vaccine portfolio to show a negative trend, with sales accounting for 0.2% of Merck’s total revenue and thus not having a significant impact on the company’s financial position. On the other hand, sales of the majority of medicines in Merck’s hospital acute care portfolio continue to grow and totaled $853 million in Q2 2022, up 15.1% from Q2 2021.

Source: Author’s elaboration, based on quarterly securities reports

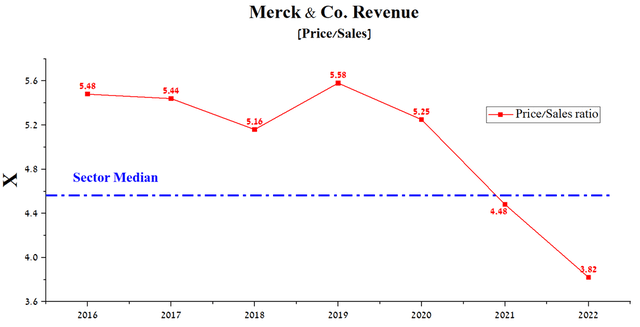

Bridion, which is used to speed up recovery after the use of muscle relaxants, and Prevymis, which is used to prevent cytomegalovirus disease in patients undergoing allogeneic stem cell transplantation, were key drivers of revenue growth. Bridion’s sales growth, both year-on-year and quarterly, was driven by higher demand for the drug in the US and Europe and an increase in the number of surgical procedures worldwide. On the negative side of Bridion is the imminent loss of exclusivity in the US, which Merck is trying to fight through litigation and deals with generic drug manufacturers. Merck management expects commercialization of the generic version of Bridion after January 2026, while Prevymis only received its first approval in 2017, and patent number 10,603,384 expires in 2033. The company’s price/sales ratio is 3.82x, which is 15.7% lower than the average for the healthcare sector. And given the innovative solutions implemented in the company’s business model, which contribute to revenue growth year after year, this indicates that Merck is undervalued by Wall Street.

Source: Author’s elaboration, based on Seeking Alpha

Merck has one of the highest gross margins among the top 10 pharmaceutical companies in the world, which was 71.6% in the second quarter of 2022, an increase of 5.1% QoQ, but at the same time showing a slight annual decline due to the negative impact of Lagevrio, part of the sales of which is shared with Ridgeback.

Source: Author’s elaboration, based on Seeking Alpha

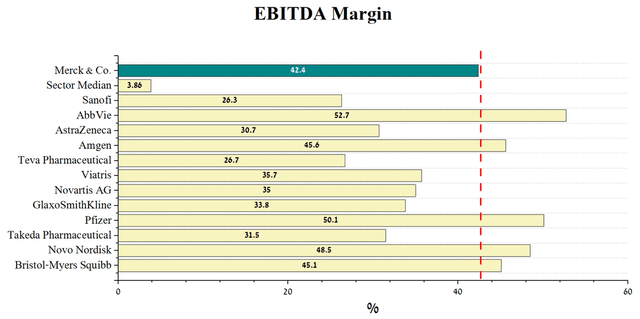

In addition, the company’s EBITDA continues to rise to $6,184 million in Q2 2022, up 35.6% year-over-year, driven by higher sales of Keytruda, Lynparza, and Gardasil/Gardasil 9. In my estimation, Merck’s EBITA will decline slightly in the next two quarters due to a decrease in sales of the company’s anti-COVID-19 drug, but continued strong demand for oncology drugs will offset this decline. When taking into account an equally important financial indicator, namely EBITDA margin, the situation is not entirely clear. At first glance, Merck’s EBITDA margin is significantly higher than the average for the healthcare sector, but on the other hand, it is not the highest in the industry and is inferior to other mastodons like AbbVie (ABBV), Pfizer (PFE), and Amgen (AMGN). Some of the main reasons for this are their smaller business size, having a product portfolio with fewer drugs that have lost exclusivity, and a temporary increase in drug sales, as was the case with Pfizer’s COVID-19 vaccine.

Source: Author’s elaboration, based on Seeking Alpha

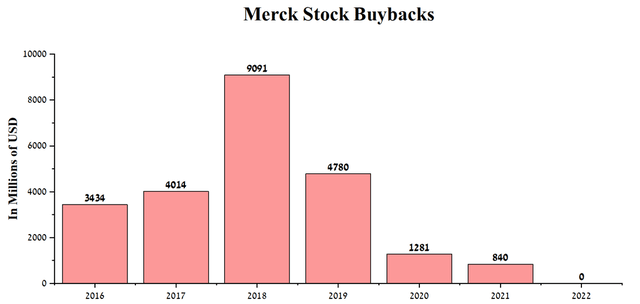

In 2018, in order to increase the value of Merck’s share capital and maintain investment interest, the company’s management authorized the purchase of Merck shares for a total amount of up to $10 billion. In 2021, the company purchased $840 million worth of shares, a marginal decrease from 2020 during a period of panic on Wall Street.

Source: Author’s elaboration, based on Seeking Alpha

Merck, led by Rob Davis, did not conduct a share buyback in the first half of 2022, despite a significant drop in the S&P 500 (SPY) and $5 billion in reserves committed to the task. At the same time, the company’s shares continued to rise and are now stable relative to other leaders in the pharmaceutical industry, which once again indicates increased interest in Merck and Wall Street’s faith in medicines and the vector of business development without resorting to additional incentives.

Risks

When analyzing Merck, I identified three main risks that can lead to a short-term drop in the price of a company’s shares.

Uncertainty in Merck Product Portfolio Development

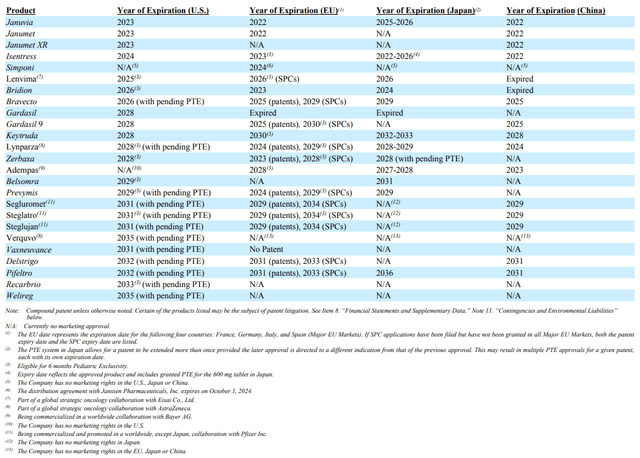

The company owns several drugs whose sales make up a significant share of Merck’s total revenue. Most of their patents expire between 2026 and 2029.

Source: 10-K

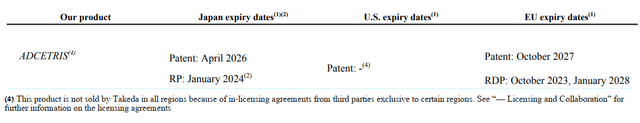

Understanding this, the company’s management is actively looking for takeover targets in order to mitigate the risks associated with the loss of exclusivity of Merck’s medicines. One of these candidates was Seagen (SGEN), but the negotiations were terminated due to disagreements on the price. Merck’s management has the ability to correctly assess the value of drugs that can capture a significant market share in the future. However, due to pressure from the relatively imminent loss of Keytruda’s exclusivity, this may lead Merck to buy out Seagen at an inflated price. I estimate the fair value of Seagen in the event of a buyout of $210 per share. In addition, Seagen is having a bit of a problem with the company’s leading drug, Adcetris, whose patents expire in 2022-2031, which also reduces interest from Merck.

Author’s elaboration, based on Takeda’s Form 20-F

Macroeconomic risks associated with the increase in interest rates of central banks

Merck’s financial position could be adversely affected by global economic conditions, which include rising inflation and higher interest rates of central banks and the cost of raw materials needed to manufacture medicines. In general, uncertainty in global economic conditions could lead to a slowdown in the global economy, which could affect Merck’s business due to the need to reduce the prices of the company’s medicines in order to maintain demand for them. On the other hand, the company’s senior notes have a fixed coupon, and as a result, the Fed’s interest rate hike will have minimal impact on Merck’s debt.

Geopolitical risks caused by the war between Ukraine and Russia

In February 2022, a military conflict began between Ukraine and Russia, which led to the destabilization of the situation in Eastern Europe. On September 21, 2022, the President of Russia announced the partial mobilization of Russian troops, and thus this only postpones the resolution of the conflict between the two countries. Moreover, in his address, Putin stated the following, which, in my opinion, only exacerbates the situation.

I would like to remind those who make such statements regarding Russia that our country has different types of weapons as well, and some of them are more modern than the weapons NATO countries have. In the event of a threat to the territorial integrity of our country and to defend Russia and our people, we will certainly make use of all weapon systems available to us. This is not a bluff.

The citizens of Russia can rest assured that the territorial integrity of our Motherland, our independence and freedom will be defended – I repeat – by all the systems available to us. Those who are using nuclear blackmail against us should know that the wind rose can turn around.

Conclusion

Thanks to Merck CEO Robert Davis, the company continues to be a world leader in the development and commercialization of medicines aimed at combating cancer, infectious and cardiovascular diseases. In the past seven months, the EMA has approved an expansion of indications for Keytruda, the best-selling immuno-oncology medicine, and along with AstraZeneca (AZN), Merck has received EU approval for Lynparza for the treatment of high-risk early breast cancer, and the FDA has approved a vaccine to prevent invasive pneumococcal disease in children. Merck’s financials, which are well above those of many of the world’s leaders in the healthcare sector, EBITDA and revenue growth, and an extensive pipeline are just some of the things that make the company more attractive to investors on Wall Street. However, given the risks and catalysts outlined in this article, I expect Merck’s share price to drop to $81/share in the short term and then rise to my target price of $110/share.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article may not take into account all the risks and catalysts for the stocks described in it. Any part of this analytical article is provided for informational purposes only, does not constitute an individual investment recommendation, investment idea, advice, offer to buy or sell securities, or other financial instruments. The completeness and accuracy of the information in the analytical article are not guaranteed. If any fundamental criteria or events change in the future, I do not assume any obligation to update this article.