Summary:

- Keytruda will overtake Humira as the world’s best-selling drug over the next two years, before the first patent expiry in 2028.

- It is apparent that MRK is already looking to bolster its pipeline, with the most recent partnership with Daiichi Sankyo appearing to be promising, though rather expensive.

- We believe that more deals/ M&A activities may be coming, similar to that observed in the industry, potentially eroding its balance sheet.

- Based on its lower lows and lower highs since the May 2023 top, we may also see the stock continue trading sideways at these levels, if not breach its support levels of $100 if bullish support fails to materialize.

- While it remains a decent dividend play, we prefer to rate the MRK stock as a Hold here.

izusek

We previously covered Merck (NYSE:MRK) in December 2022, discussing its bright prospects then, with the management still pushing to expand Keytruda’s indications and extend its eventual loss of exclusivity.

We had believed that the pharmaceutical company’s near-term top-line remained safe, since the therapy’s first patent expiry would only occur by 2028. However, since it was trading at a premium at that time, we had preferred to rate the stock as a Hold.

For now, MRK’s prospects have somewhat dimmed, with the management engaging on expensive partnerships to boost its pipelines, a trend that we have similarly observed with multiple pharmaceutical/ biotech companies.

With Keytruda replacement in sight and its growth prospects hanging in the balance, we believe that the management may embark on more expensive deals/ M&A activities, potentially eroding its robust balance sheet ahead.

We shall further discuss why it may be better to wait on the sidelines and observe MRK for a little longer.

The MRK Investment Thesis Appears Uncertain, As Patent Expiry Nears & Pipeline Remains Unproven

For now, MRK has reported a double beat FQ3’23 earnings call, with revenues of $15.95B (+6.1% QoQ/ +6.7% YoY) and adj EPS of $2.13 (non-comparable QoQ/ +15.1% YoY).

The management also raised its FY2023 revenues guidance to $59.95B at the midpoint (+1.1% YoY), compared to the original midpoint guidance of $57.95B (-2.2% YoY) offered in the FQ4’22 earnings call.

Most importantly, MRK’s best-selling therapy, Keytruda, continues to bring in massive annualized FQ3’23 revenue contribution of $25.32B (+1% QoQ/ +16.7% YoY), comprising 39.6% of its overall top-line (-2.1 points QoQ/ +3.4 YoY) in the latest quarter.

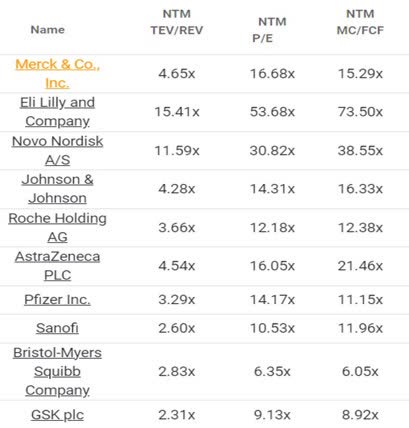

MRK’s Valuations

Tikr Terminal

Perhaps this is why the MRK stock’s FWD EV/ Revenues of 4.65x and FWD P/E valuation of 16.68x remain somewhat in line with its 3Y pre-pandemic mean of 4.65x/ 15.89x, though lagging behind the sector P/E median of 18.50x.

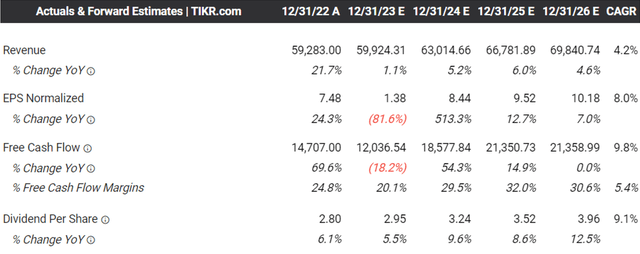

The Consensus Forward Estimates

However, the consensus has already estimated a notable deceleration in MRK’s top and bottom line growth at a CAGR of +4.2% and +8% through FY2026, compared to its historical CAGR of +6.9% and +12% between FY2016 and FY2022, respectively.

While these numbers still suggest a highly profitable growth trend, investors may want to note that Keytruda’s patent is set to expire by 2028, without a clear top-line replacement in sight, putting the pharmaceutical company’s prospects in jeopardy.

For example, MRK’s next two best-selling therapies, Gardasil/ Gardasil 9 only commands $2.58B in sales (+5.3% QoQ/ +12.6% YoY), as with Lagevrio at $640M (+215.2% QoQ/ +46.7% YoY), comprising 16.1% (-0.2 points QoQ/ +0.8 YoY) and 4% (+2.7 points QoQ/ +1.1 YoY) of its FQ3’23 top-line, respectively.

While the management has already attempted to extend the therapy’s use case and indications, slowing the erosion of its top-line, we may see sentiments start to reverse prior to that event, triggering the notable moderation in its stock valuations.

For example, the world’s best-selling therapy, Humira, produced by AbbVie (ABBV) is undergoing a painful correction in its top line performance to $3.54B in FQ3’23 (-11.7% QoQ/ -36.2% YoY), with the annualized sum down drastically by -33.3% from the FY2022 peak of $21.23B (+2.6% YoY).

The rate of decline for Humira’s sales since the patent expiry in the start of 2023 has been alarming indeed, nearing the ABBV management’s original erosion YoY projection of between -35% to -55%.

This headwind has also directly contributed to the moderation observed in the ABBV stock’s FWD P/E valuation of 12.37x, compared to its previous mean of 16.50x, leading to the stock’s sideways movement since December 2021.

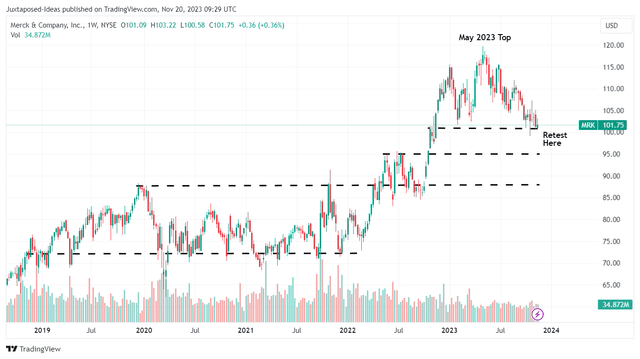

MRK 5Y Stock Price

A similar trend has also been observed in MRK’s prices, with the stock failing to break out of its May 2023 top and currently retesting its critical support levels of $100s.

We can understand why the management has grown desperate and engaged on aggressive M&A activities, with its latest partnership with Japanese pharma Daiichi Sankyo (DSKYF) costing up to $22B in payments.

The expensive deal has already impacted MRK’s FY2023 adj EPS guidance to $1.35 (non-comparable YoY), thanks to the impact of the staggered R&D expenses. It remains to be seen if the three new candidates may imitate the success reported by Keytruda, especially since two are only in Phase 2 clinical trials and one in Phase 2.

For now, the TAM for DSKYF’s Patritumab Deruxtecan, the candidate for Non-Small Cell Lung Cancer, seems to be promising at $36.9B by 2031, as with Ifinatamab Deruxtecan for the Small Cell Lung Cancer at $21.44B by 2029, though extremely underwhelming for Raludotatug Deruxtecan for the Ovarian Cancer at $11.18B by 2028.

MRK has also recently acquired Caraway Therapeutics for $610M, likely attributed to its Parkinson’s Disease pipeline with a supposed market size of $10.4B by 2031. However, based on the pharmaceutical industry’s actual success rate from clinical trials to the eventual approval of only ~8%, investors may want to temper their expectations, since these candidates are only in pre-clinical stage.

This expensive M&A trend seems to be prevalent in the pharmaceutical/ biotech industry, as that of Pfizer (PFE) and Amgen Inc. (AMGN), attributed to the need to bolster pipelines as their existing assets undergo the natural course of patent expiry.

However, we are uncertain about the timing of MRK’s over-sized deal, attributed to the uncertain macroeconomic outlook. Most importantly, its elevated debt levels of $33.98B (inline QoQ/ +19.3% YoY) already triggers a notable increase in its annualized interest expenses of $1.26B (+14.4% QoQ/ +29.9% YoY) by the latest quarter.

While the sum may appear to be reasonable compared to its outsized annualized operating incomes of $23.28B (+15.7% YoY), investors may want to temper their near-term expectations indeed.

This is because the MRK management may continue to expand their pipeline aggressively, with more M&A activities and debt reliance more likely than not, potentially eroding its balance sheet.

So, Is MRK Stock A Buy, Sell, or Hold?

MRK YTD Stock Price

For now, it appears that market sentiments surrounding MRK’s partnership with DSKYF have been mixed, attributed to the drastic plunge post news release.

Based on its lower lows and lower highs since the May 2023 top, we may also see the stock continue trading sideways at these levels, if not breach its support levels of $100 if bullish support fails to materialize.

With the inherent risks of Keytruda’s upcoming patent expiry, we believe that the sell-off may continue for a little longer, before MRK achieves successful commercialization from the DSKYF partnership and/ or its growing pipeline of over 110 candidates.

While MRK may still be a viable dividend play, the forward yield of 2.87% may not be tempting enough, due to the improved returns offered by the US Treasury Yields of between 4.47% and 5.41%.

As a result, we prefer to prudently rate the MRK stock as a Hold (Neutral) here, since it remains to be seen how sentiments may develop surrounding its long-term prospects.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.