Summary:

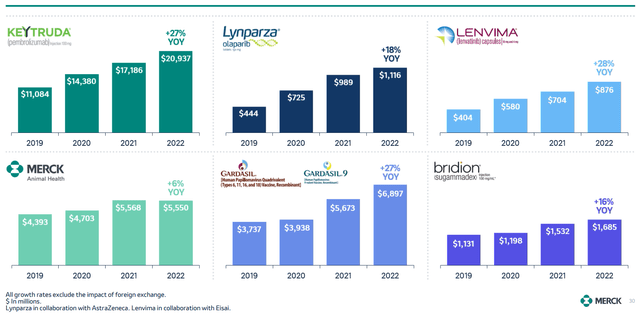

- In 2022, Merck’s KEYTRUDA and GARDASIL worldwide sales increased by 27% YoY.

- The immunotherapy and HPV vaccines markets are expected to grow in the following years.

- The company’s cash and capital structures show a significant improvement in 2022.

- MRK stock is a buy.

anilakkus/iStock via Getty Images

Merck & Co. (NYSE:MRK) stock price increased by 20% in the past six months. Year-to-date, the stock’s price has been relatively stable. The company reported full-year 2022 sales and net income of $59.3 billion and $14.5 billion, respectively, compared to full-year 2021 sales and net income of $48.7 billion and $12.3 billion, respectively. KEYTRUDA and GARDASIL sales increased significantly in 2022 and based on the strong market outlook for immunotherapy cancer treatment and HPV vaccines, MRK’s KEYTRUDA and GARDASIL sales are expected to continue increasing in the following years. The stock is a buy.

Quarterly results

In its 4Q 2022 financial results, Merck reported sales of $13.8 billion, compared with 4Q 2021 sales of $13.5 billion, up 2% YoY. “Growth excluding the impact of foreign exchange was 8%,” the company stated. MRK’s worldwide sales increased by 22% (26% excluding the impact of foreign exchange) from $48.7 billion in 2021 to $59.3 billion in 2022. The company expects its full-year 2023 worldwide sales to be between $57.2 and $58.7 billion.

MRK’s net income decreased from $3.8 billion, or $1.51 per share in 4Q 2021 to $3.0 billion, or $1.18 per share in 4Q 2022. Merck reported a 2022 net income of $14.5 billion, or $5.71 per share, compared with $12.3 billion, or $4.86 per share in 2021. Merck anticipates its full-year 2023 EPS to be between $5.86 and $6.01. The R&D expenditures of the company increased from $3.1 billion in 4Q 2021 to $3.8 billion in 4Q 2022. Its full-year 2022 R&D expenditures increased by 11% YoY to $13.5 billion.

“2022 was an exceptional year for Merck, which is a testament to the profound impact our medicines and vaccines are having on patients globally,” the CEO commented. “Our science-led strategy is working as we continue to build a sustainable engine that will drive innovation and generate long-term value for patients and shareholders well into the next decade,” he continued.

The market outlook

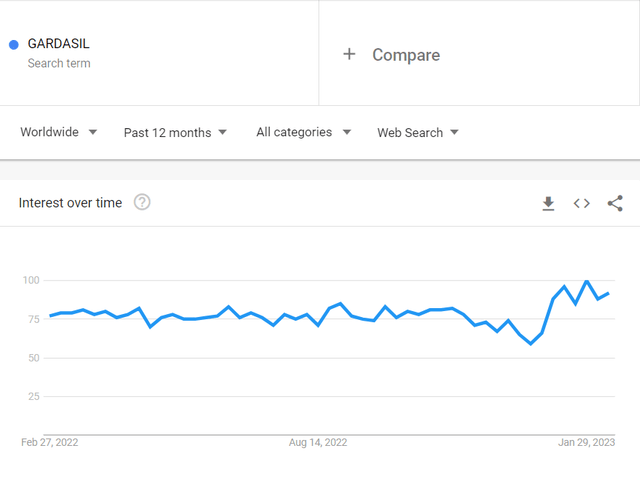

Figure 1 shows that Merck’s sales related to its oncology and vaccine products were the pillars of its growth in the past few years. Among MRK’s products, KEYTRUDA and GARDASIL sales accounted for 47% of the company’s worldwide sales in 2022. Also, in 2021, KEYTRUDA and GARDASIL sales accounted for 47% of Merck’s worldwide sales. In 2022 KEYTRUDA sales increased by 27% YoY (excluding the impact of foreign exchange) to $20.9 billion, driven by strong global demand. KEYTRUDA is a humanized antibody used in cancer immunotherapy. The immunotherapy market size is projected to grow at a CAGR of 14% by 2030 to reach $310 billion, from $86 billion in 2020. The company’s GARDASIL sales increased by 27% YoY to $6.9 billion, driven by strong underlying demand outside the U.S., particularly in China. Figure 2 shows that according to Google Trends, the worldwide search interest in GARDASIL in the past two months increased. GARDASIL is a known vaccine against HPV, which is a sexually transmitted infection (STI). According to Healthline, HPV is the most common STI in the United States, and around 80% of people who are sexually active will have HPV by the time they are 45. The HPV vaccine market is expected to grow at a CAGR of 5% by 2028. Thus, based on the market outlook and the company’s continuing developments, I expect Merck’s worldwide KEYTRUDA and GARDASIL sales to increase in 2023.

Figure 1 – Key growth pillars of Merck

4Q 2022 presentation

Figure 2 – Worldwide search interest in GARDASIL

Google Trends

MRK performance outlook

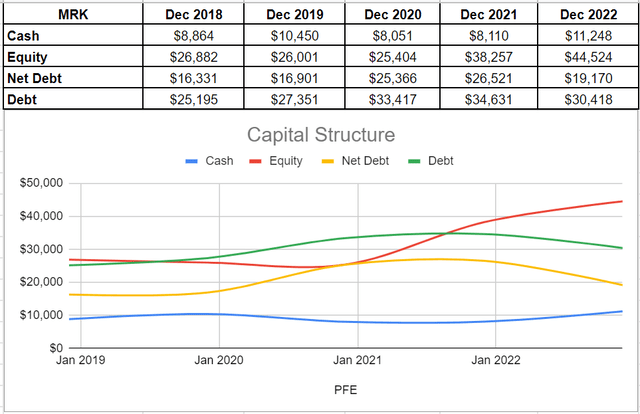

Merck ended 2022 with some valuable wins in trials and approvals, which are clearly observable in its financial structures. In this section, I provided an analysis of cash and capital structures of the company. To be more accurate, I made a comparison between results of recent years. After a downturn of 22% from $10450 million at the end of 2019 to $8050 million in 2020, the company could increase back its cash generation to $11248 million at the end of 2022. Also, its drop in debt amount of $34631 million at the end of 2021 to $30418 million in 2022, combined with cash generations, led to a decline in net debt. In minutiae, MRK’s net debt plunged from $26521 million at the end of 2021 to $19170 million at the end of 2022.

Furthermore, MRK’s total equity improved by 16% and sat at $44524 million in 2022 compared with its previous amount of $38257 million at the end of 2021. Thankfully, the company’s net debt is well beneath its equity level, and the total equity is well enough to tailor a scope of capacity to bring benefits for its shareholders and assimilate upcoming risks. Thus, Merck’s capital structure depicts a healthy position (see Figure 3).

Figure 3 – MRK’s capital structure (in millions)

Author (based on SA data)

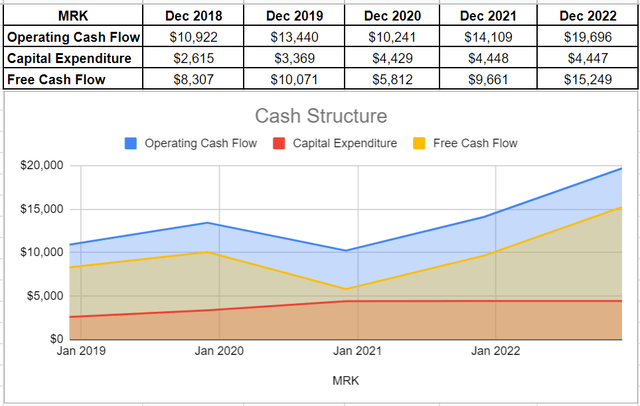

After the downturn of 2020 due to the COVID-19 pandemic, the company has started the recovery process successfully. Its cash operation in 2022 boosted to $19696 million compared with its amount of $14109 million at the end of 2021. Meanwhile, Merck’s capital expenditure was almost constant through these years and was $4447 million in 2022. When all was said and done, the company ultimately generated a considerable amount of $15249 million of free cash flow at the end of 2022, which indicates an amazing rise from its previous amount of $9661 million in 2021. This is the highest amount of free cash flow that Merck corporation has had since 2019, which caters to a scope of capability for more reliable distributions and research expenditures in the future (see Figure 4).

Figure 4 – MRK’s cash structure (in millions)

Author (based on SA data)

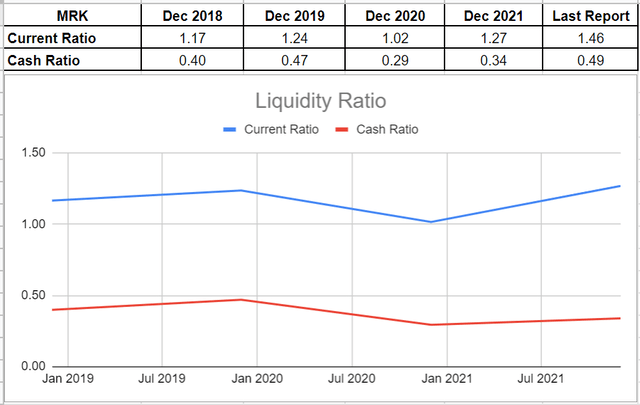

As we assessed Merck’s strong cash and capital structures, it is not unexpected to see their effects on the company’s liquidity condition. Liquidity ratios are worthy for indicating a good picture of the company’s capability to keep its balance between the ability to safely cover its obligations and improper capital allocations. In this regard, I investigated MRK’s liquidity structure across the board of cash and current ratios.

As the liquidity ratios have assets on top and liabilities on the bottom, it is paramount to consider whether their amounts are above 1.0 to analyze if the company is able to face its obligations. According to Figure 5, it is observable that MRK showed an encouraging increase in its cash and current ratios, which indicates that the company can easily face its liquidity problems. Merck’s current ratio increased by 14% at the end of 2022 versus its level of 1.27 in 2021. Also, its current amount is the highest compared with the previous years.

Similarly, the company’s cash ratio, which is a stricter and more conservative measure, improved and sat at 0.49 in 2022. This record indicates that about 50% of the company’s liabilities can be paid off directly by its cash and cash equivalents. As a result, the liquidity condition of Merck Company improved during recent years and depicts an encouraging picture of the 2023 condition.

Figure 5 – MRK’s liquidity ratios

Author (based on SA data)

Summary

Due to the strong financial results in 2022, MRK has been able to improve its capital and cash structures. Also, the company’s current and cash ratios show that Merck is not expected to face severe liquidity challenges and is financially healthy. The market outlook for the company’s products is strong and I expect MRK to continue making huge profits. MRK stock is a buy.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.