Summary:

- Meta’s third quarter results exceeded expectations, but cautious guidance is keeping investors wary.

- Despite a 168% surge, Meta remains the cheapest stock among its peers, with uncertainty surrounding its growth and increasing losses in the Reality Labs segment.

- I expect Meta to answer doubters and come way ahead of 2024 estimates, which are too low and don’t reflect the company’s record high monetization and engagement levels.

- I reiterate a Buy rating for Meta stock, with a price target of $400 a share.

Justin Sullivan/Getty Images News

Meta Platforms (NASDAQ:META) reported third quarter results that exceeded expectations handily, but the conservative guidance that followed has kept investors cautious.

Selling the stock now could be the embodiment of a ‘Cutting Your Flowers And Watering The Weeds’ mistake, as there’s still ample runway for margin improvement as well as topline growth.

I estimate 2024 is going to be better than expected and reiterate a Buy rating with a price target of $400 a share.

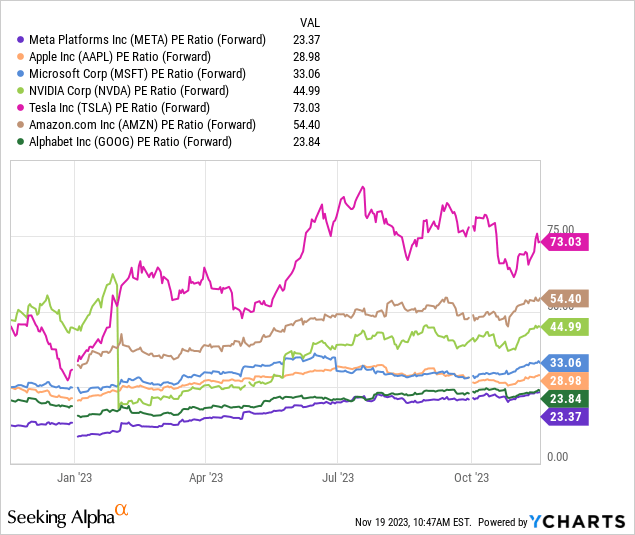

Meta Remains The Cheapest Stock Among The Magnificent Seven, Why?

Despite an exceptional year for the social media giant, Meta is still the cheapest company among the magnificent seven, trading at a 19.4x P/E over expected 2024 earnings.

I believe the main reason for the lower valuation is investors questioning Meta’s steady-state growth pace, as the story of easy comparisons and efficiency initiatives that characterized 2023 approaches an end. In addition, it’s safe to say the increasing losses in the Reality Labs segment aren’t of any help.

So far this year, it’s clear that the top and bottom line growth of Meta’s core advertising businesses had more than offset any negativity about Meta’s value-destructive projects, as evident by the 168% surge in stock price.

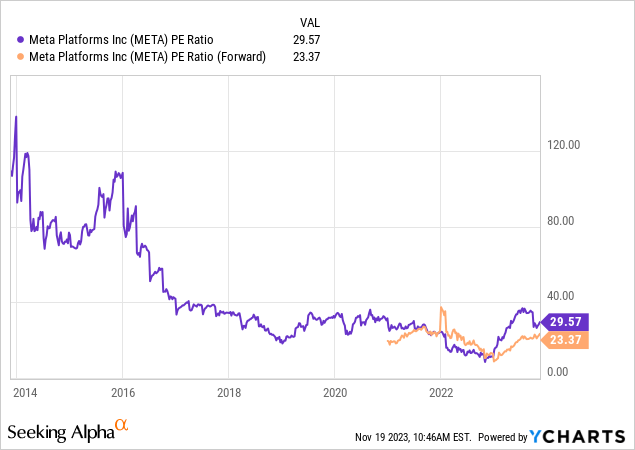

Still, despite the year-to-date surge, Meta is cheap based on any traditional metric, relative to other big tech names but also relative to Meta’s own historical valuations.

So, in order to understand whether or not there’s still room for upside, we need to weigh in on the company’s growth drivers for 2024. In order to do that, let’s begin with the recently announced third-quarter numbers.

Financial Overview

Meta reported consolidated revenues of $34.1 billion, a 23.2% increase Y/Y, beating expectations by nearly $750 million. Growth was primarily driven by an increase in the number of ads delivered and was partially offset by a decrease in the average price per ad.

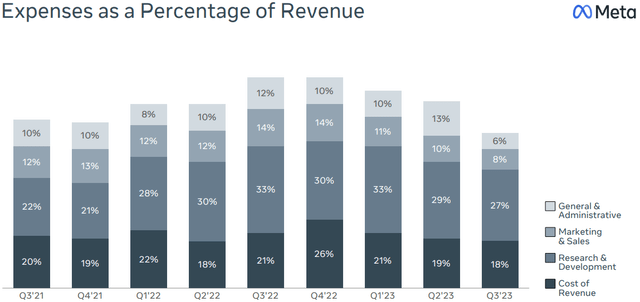

Operating profit came in at $13.7 billion, reflecting a 40.3% operating margin, an astounding 20 percentage points improvement from the prior year period, fueled by a higher gross margin, significant reduction in headcount all across the company, lower marketing spend, and a sharp decline in R&D as a percentage of sales.

Net income was $11.6 billion, more than 2.6x growth Y/Y, resulting in EPS of $4.39, a $0.76 beat.

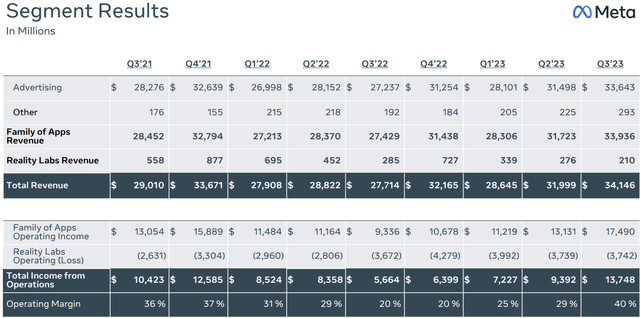

Looking at a segment breakdown, we can see that the Family of Apps segment is solely responsible for the great results, contributing nearly 99% of total revenues and more than 100% of total operating profit.

The segment’s operating margin reached 51.5%, which is the highest level since Q1-21. After stating in my second quarter that I see meaningful room for further margin improvement, at least to 2021 levels, we can see that Meta has already reached that threshold.

It’s important to note that Family of Apps achieved this high profitability despite Reels not yet being neutral to monetization, and a lower price per ad. Therefore, there’s a high probability for further improvement in Q4, and almost a certain improvement on a year-over-year comparative basis, when we look ahead to 2024.

On the flip side, Reality Labs saw a 26% revenue decline Y/Y, and the segment’s operating loss grew by an additional $100 million. So despite approaching record-high profitability in Family of Apps, the consolidated margin is still significantly below 2021 levels, and management said the operating loss in the Reality Labs segment is expected to increase meaningfully in 2024, without providing further clarity about what exactly meaningfully means.

Another area where Meta is highly scrutinized is its capital expenditures, which similarly to the operating expenses, saw a significant improvement Y/Y. However, management attributed a portion of the decline to delayed projects, which is why they are now expecting 2024 capex to be an all-time high for the company, guiding for $32.5 billion at the mid-point, as compared to the updated 2023 guide which stands at $28 billion.

Operational Overview

The strength of Meta’s operations is really a story of two components. The first is the number of users and the second is the revenue the company generates per user. Those parameters provide a reflection of the level of engagement with Meta’s platforms, and equally important, Meta’s ability to monetize that engagement.

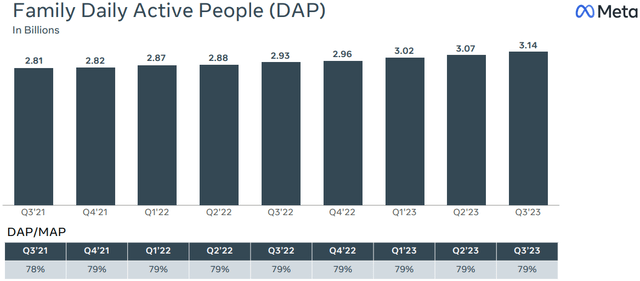

Beginning with the number of users, Meta somehow finds a way to continue to grow its vast user base, which is now amounting to nearly 40% of the world’s population. Daily Active users grew to 3.14 billion, a 7.2% increase Y/Y. Daily active users as a percentage of monthly active users remained steady at 79%, which seems to be a solid ceiling.

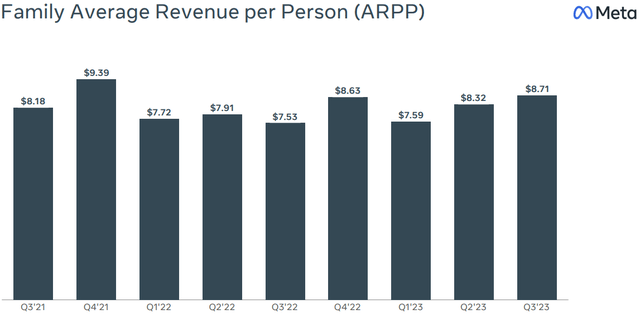

Average revenue per user came in at $8.71, a third-quarter record, and reached levels we haven’t seen since Q4-21. Seasonally, the fourth quarter is the highest for Meta in terms of total revenues and ARPP, as advertising spend and shopping accelerate during the holiday season.

Typically, Q4 comes nearly 15% higher than Q3, and there’s no reason to expect otherwise for the upcoming fourth quarter. If indeed the historical ratio is maintained, this will mark an all-time for Meta, and the first time the company surpasses the $10 threshold.

Remember, this is the same company that as recently as a year ago was seen as unable to deal with Apple’s app-tracking transparency changes.

What’s Going To Drive Continued Momentum In 2024?

Following what can only be described as an amazing third quarter, management gave guidance that kept investors skeptical. On the one hand, there are clear signs suggesting Meta is heading into record highs in its core business. On the other hand, meaningful increases in Reality Labs losses and a non-ambitious guidance for Q4 are in fact a legitimate cause for concern.

Trading at a historically low valuation as we saw above, what investors ought to do is find answers to the following two questions. One, what would drive further multiple expansion, and two, can Meta beat expectations for 2024?

Luckily, I believe the answer to both these questions is similar. If Meta beats next year’s expectations, which currently stand at revenues of $150.6 billion and EPS of $17.3, it’ll probably result in a multiple expansion.

In my opinion, Meta is going to handily beat 2024 expectations. Allow me to explain. The current revenue estimate reflects revenue growth of 12.9%, meaning a significant slowdown from the second half of 2023.

With very high certainty, we can expect that the above-twenties growth rate of H2-23 will continue to H1-24, due to easy comparisons. The second half will be a tougher task, but with Reels only becoming revenue-neutral at the end of 2023, advertising budgets normalizing amid softening recession fears, and continued improvements in targeting which should continue driving higher ARPP, I believe there’s a high chance for high-teens growth in 2024.

Switching gears to profitability, the current estimates reflect a profit margin of 29.4%, which is a 190 bps improvement over expected 2023 margins. Here’s where the consensus estimates are widely missing in my view. In 2023, Meta incurred non-recurring charges related to its restructuring, as well as significant legal costs. Adjusting for those, Meta is already operating at a higher margin than what the consensus estimates reflect for 2024.

This means that on a comparable basis, consensus is projecting a margin decline. While management is expecting an increase in operations loss of the Reality Labs segment, and they do plan to make up for the backlog of hiring with has halted in 2023, I find it hard to believe profit margins will again go in the wrong direction. I expect the growth in Family of Apps to more than offset higher expenses.

So to sum this all up, I expect Meta to beat consensus estimates handily in 2024, which will lead to further multiple expansion, and expect continued momentum in the stock.

Valuation

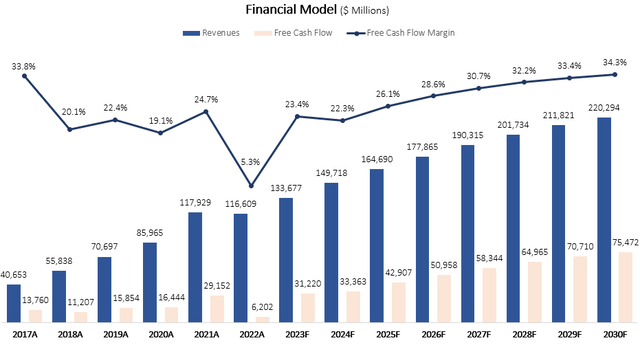

In my financial model, I forecast Meta will grow revenues at a CAGR of 7.4% between 2023-2030, which is significantly lower than its historical pace. I expect growth will be driven by higher engagement over time in the core business, and increasingly better monetization through targeting optimization and improvements in Reels. In addition, I expect the WhatsApp platform will become a larger contributor to revenues, specifically in WhatsApp for businesses, which surpassed 200 million users just recently.

I expect free cash flow margins to improve gradually to 34.3%, reflecting a very significant improvement, which I project will be driven by sustained operating cash flow margins, and operational leverage on the capex and stock-based compensation front.

Created and calculated by the author based on Meta’s financial reports and the author’s projections.

Taking a WACC of 9.1%, I estimate Meta’s fair value at $400 per share, reflecting a 22.5x P/E multiple over my projection for 2024 earnings, which is 3% higher than the consensus.

As we saw in the graphs above, a 22.5x P/E is still a relatively low multiple for Meta, both historically, and compared to the rest of the magnificent seven, including the most relevant comparison in Alphabet (GOOG).

Conclusion

Meta delivered third quarter results that crushed expectations, but management made sure to turn down the excitement with its usual prudence.

While Meta isn’t trading at a single-digit P/E anymore, the company is still trading at a historically low valuation.

I expect the social media empire to deliver better-than-expected results in 2024, which will lead to continued multiple expansion. Therefore, I reiterate a Buy rating and upgrade my price target to $400 a share.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.