Meta: A Raging Buy Even As Core Business Approaches Maturity

Summary:

- Meta’s core business is approaching a mature phase in its life cycle but is still highly cash generative.

- Apart from its core business, Meta is trying to reinvent itself and is creating business options by investing in the Metaverse. They can also develop WhatsApp Pay further.

- Given the current weakness in the share price, our scenario analysis points to a significant upside. We assign a Buy rating on META stock.

- We examine companies using our affiliate ROCGA Research’s Cash Flow Returns On Investment based DCF tools.

Justin Sullivan

Meta (NASDAQ:META) has had a turbulent year or so. Revenue growth has stalled, margins squeezed, and the share price had crashed over 75% from its peak.

That’s the bad news. Looking at Meta from a slightly different angle, over the next 4 years, they are expected to make a total net income of about $100 billion. That is after investing (or spending) billions in Reality Labs (RL) , Mark Zuckerberg’s vision for the Metaverse. Meta still has an expected income margin of 17% for FY2023.

They hold $42 billion in cash and marketable securities and have spent over $65.5 billion over the last 7 quarters in share buybacks. Solvency or liquidity is not a concern.

The concern investors have is the lack of revenue growth and spending increase in RL. Revenue decline has come from multiple angles, a slowdown in revenue growth post-COVID, increasing competition (mainly from TikTok), and Apple’s (AAPL) iOS privacy change. Meta will have to be more agile, adapting and innovating more readily, like its adaption of short-form videos. This is to keep the existing and new users glued to Meta’s platforms.

The plan is to be ahead of the curve with its investments in the metaverse. They will have to invest billions to potentially hundreds of billions before any meaningful returns on investments will be seen. The metaverse may be the next big thing and Meta is gambling big.

On November 9, 2022, Mark Zuckerberg took the decision to reduce the team size by 13% and take additional steps to become a leaner and more efficient company. This should help elevate some of the spending concerns by investors. However, as reported in Q3 results, out October 26, 2020:

We do anticipate that Reality Labs operating losses in 2023 will grow significantly year-over-year. Beyond 2023, we expect to pace Reality Labs investments such that we can achieve our goal of growing overall company operating income in the long run.

Till Q3 of this year, losses from RL amounted to $10.193 billion and if the trend continues, the total for the year ending 2022 should be around $13 billion. Total losses from RL since 2020 are approximately $26 billion, and revenues so far of just under $5 billion. The company acknowledges:

Our costs are continuing to grow, and some of our investments, particularly our investments in virtual and augmented reality, have the effect of reducing our operating margin and profitability. If our investments are not successful longer-term, our business and financial performance will be harmed.

It is too early to make assessments regarding the metaverse, the technology is in its infancy in terms of adoption, software, and hardware. The next-generation Meta’s Quest headset is expected to launch later in 2023. As with the adoption of the VCR and the internet, that one ingredient may still be missing.

Financial Analysis

Meta and social media platforms in general are approaching a more mature phase and the rate of growth can be expected to slow. However, we think this current slowdown is partially transitory given the challenging economic environment. Growth will return, but nothing equivalent to what Meta’s social media platform has enjoyed over the past decade or so.

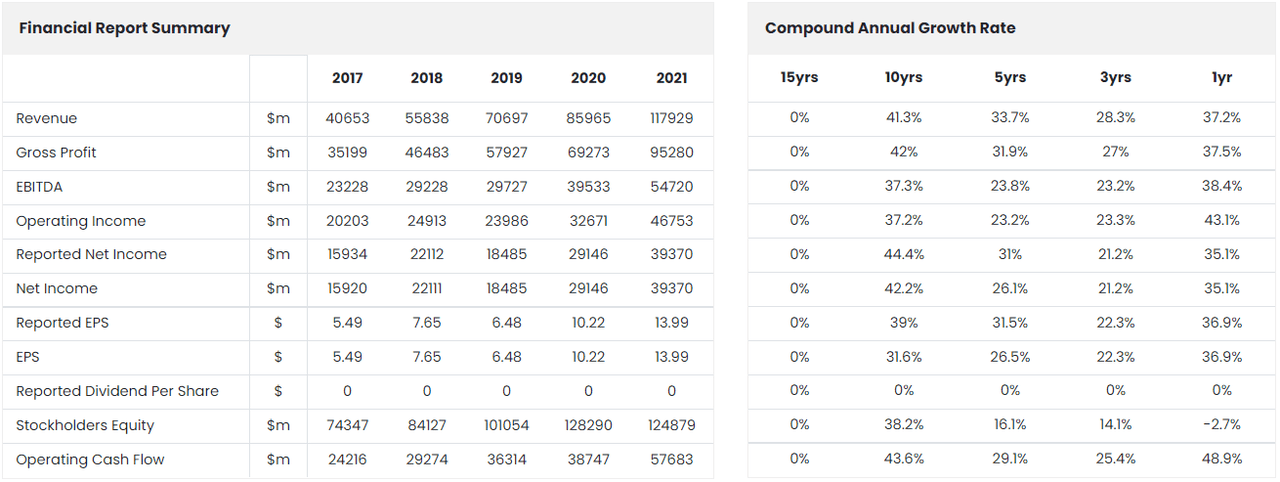

Top-line as well as the bottom-line growth has been stellar, with a 10-yr CAGR in revenue of 41% and net income of 42%.

META Financial Summary (ROCGA Research)

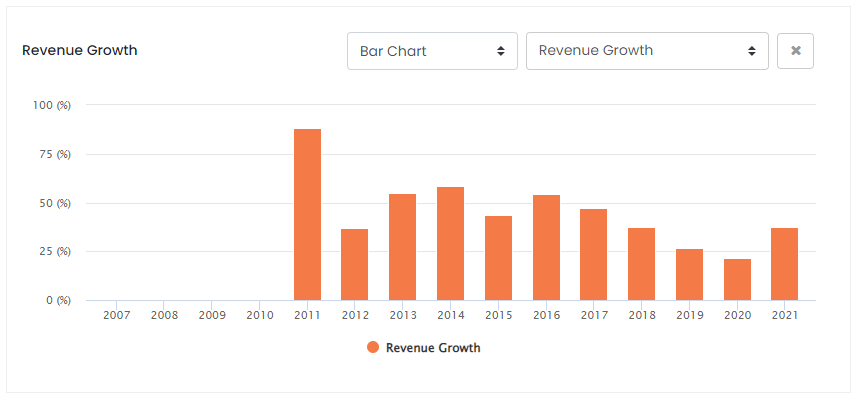

Apart from the post-COVID bounce, revenue growth has been declining and this will stall for 2023. Growth is expected to return again in 2024.

META Revenue Growth (ROCGA Research)

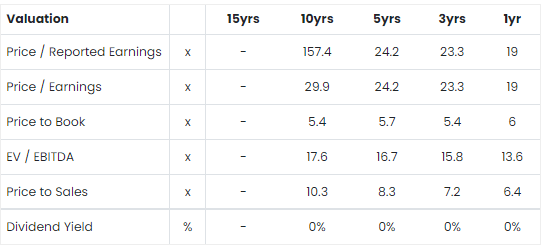

With the weakness in the share price, the forecast estimates FY2023 PE is currently 17. This is considerably lower than the long-run averages. The FY2023 P/S is 2.9, again significantly lower than the long-run averages. Meta was enjoying the higher valuation ratios because higher growth was baked into the share prices. The lower estimated forecast ratios we are now seeing are because growth is expected to be slower.

META Valuation Ratios (ROCGA Research)

We will attempt to derive a valuation based on ROCGA Research, our affiliate company’s Cash Flow Returns On Investment based DCF tools.

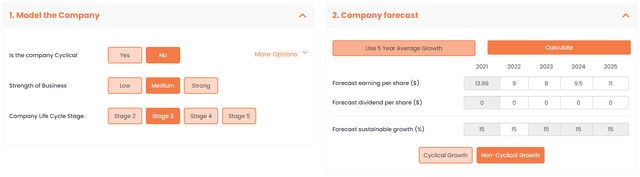

To value the company, we model the company, back-test the valuation with the historical prices, and then forecast forward using the same model. More detail on how the modeling components work can be found here. We use non-cyclical, with medium strength and a life cycle stage of 3.

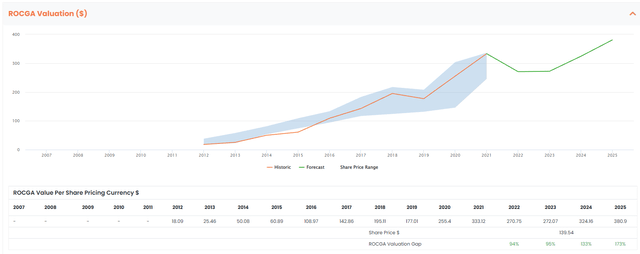

META Default Valuation Model (Model created by the author on ROCGA Research platform)

With forecast EPS estimates and a default model, we see Meta as significantly undervalued.

Meta Default Valuation (Created by the author on ROCGA Research platform)

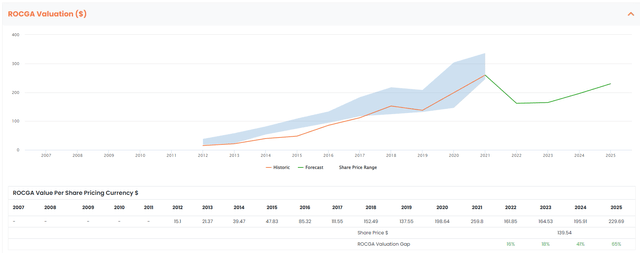

This model works extremely well historically where the model-derived valuation falls within the share price highs and lows. However, as mentioned earlier, the dynamics have changed and the model for the forecast years needs adjusting. Taking into account the transition that is expected in the social media sector, we reduce the forecast growth to 10% in the DCF model and change the life cycle stage to 4. We need to remember that Meta is still profitable and will continue to generate a significant amount of free cash. This excess cash can be used to either reinvest, buy back its own shares, or for making bolt-on acquisitions.

Meta Adjusted Valuation, LCS4, lower growth (Created by the author on ROCGA Research platform)

This is our preferred scenario. For FY2023 we see Meta undervalued by about 18%, increasing further to 41% for FY2024 and 65% for FY2025.

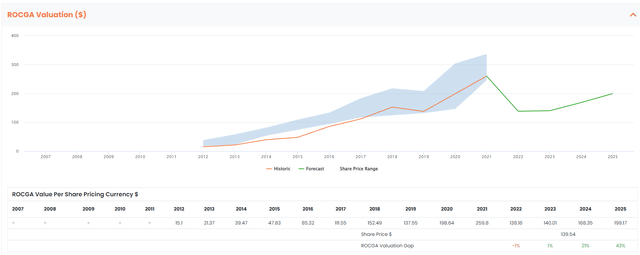

To be prudent some stress testing is warranted. With our preferred scenario above, we add 1% to the weighted cost of capital, increasing this from 5.2% to 6.2%. We see FY2022 and FY2023 as fair value and upside from FY2024 onwards.

Meta Adjusted Valuation, stress testing (Created by the author on ROCGA Research platform)

Q4 results are to be announced on 1st February 2023. We need to keep an eye out for further slowdown in revenue or significant increases in losses from RL. With the recently announced cost-cutting program, we should expect a little more control over the bottom-line numbers. Unless something significant is revealed, any post-result weakness in prices should be transitory.

Our preferred scenario from above for FY2024 indicates Meta is undervalued by about 40%. Using a more conventional valuation method, the PE ratio of 18-20 for FY2024 gives us a share price range of $180-$200, again undervalued between 25% and 40%.

In our opinion, Meta is approaching a mature company stage and is becoming a cash cow, and we value it accordingly. It is going to be hard to value RL as a business (or even the monetization of WhatsApp). The investments required for RL are high, the risks are high, and so are the potential rewards. These investments (costs) are covered using the internally generated cash flows and we are valuing Meta standalone, including losses from RL, but excluding potential future benefits.

Conclusion

We are simply valuing Meta as a mature cash cow and it looks undervalued using ROCGA’s proprietary Cash Flow Returns On Investments based valuation tool. The stock looks undervalued using more conventional PE ratios as well. Taking into account that the company is also incubating options in RL and, to a lesser extent, in the possibility of monetizing WhatsApp, these make Meta a more compelling investment. We therefore assign a BUY rating.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.